Which apps – and which publishers – were 2021’s biggest hits by downloads, monthly active users (MAU) and consumer spend? The answers are revealed in App Annie’s State of Mobile 2022 ranking charts.

2021 was another momentous year for mobile app publishers and developers. Over a year after the first pandemic-induced growth, the app industry rocket ship was still on an upwards trajectory. But against that, there were new operational challenges to navigate. For example, Apple ‘deprecated’ its identifier (IDFA), which meant most advertisers were no longer able to track and measure their users’ actions without an informed opt-in.

However, despite IDFA hurdles, as App Annie’s State of Mobile 2022 report makes clear, the collective numbers were all up. Global downloads rose 5% to 230 billion, and users spent $320,000 on in-app purchases and subscriptions every minute.

So What Apps Were Users Downloading? And Which Publishers Were Coming Out on Top?

In a new addition to the State of Mobile annual review (and by popular demand) we have included a collection of top 10 charts. These lists reveal the year’s biggest winners by downloads, monthly active users (MAU) and consumer spend.

TikTok Dances to #1 in Downloads in 2021

In terms of apps, the leading product won’t surprise anyone. ByteDance’s TikTok is #1 for downloads. And it leads a line-up of all the social and messaging giants in mobile: Instagram, Facebook, WhatsApp Messenger, Telegram and SnapChat. The outliers include ZOOM Cloud Meetings at #8, its presence indicates the lingering influence of the new work-from-home dynamic on the app space.

And then there’s CapCut at #9, after a successful global rollout in April 2020. CapCut is a free editing tool for TikTok (the two apps are made by ByteDance), and its success is a further illustration of Tiktok‘s relentless march across the cultural landscape. It also illustrates just how popular video editing – once the preserve of professional specialists – has become extremely accessible among the wider audience.

Meta Tops the Global Monthly Active User Chart in 2021

The top apps by MAU rankings of 2021 share some similarities to apps that made it to the top 10 by downloads. Meta is the publisher of the top four products, while TikTok is at #6. However, we expect the latter to rise up the chart by the end of this year. We have projected Tiktok will surpass 1.5 billion users by the end of 2022.

Elsewhere on the chart it’s worth noting Amazon and #5 and Netflix at #10 – among apps that saw spikes in usage as the result of pandemic-related restrictions and increased demand.

We Want Video: Streaming Pulls in the App Dollars

TikTok aside, the top apps by global consumer spend chart for 2021 looks very different from the other two lists. It skews heavily towards video streaming and content-based services. Hence the presence of YouTube, Disney+, Tencent Video, HBO Max, Twitch and BIGO LIVE.

Piccoma, at #6, stands out. The ‘webtoon’ comic app run by Kakao piccoma Corp (the Japanese subsidiary of Korea’s Kakao) has become a phenomenon across South east Asia. Its business model breaks down comic books into episodes and offers them for free, with a paid option for customers who can’t wait for the next instalment.

Needless to say the above apps loom large across the regional charts too. But there are many notable local successes. LATAM seems to be undergoing a mobile payments and commerce boom. This is exemplified by the presence of Mercado Pago at #6 in both the download and active user charts for Argentina.

Mercado Pago is a payment product that was originally designed for the Mercado Libre e-commerce auction site, but expanded to be a generic payment instrument. It has 60 million active customers across LATAM.

Google and Microsoft Mean Business in the Company Download Chart

Turning to the State of Mobile 2022 rankings for app-publishing companies, the download chart reflects the sense that mobile is very much a productivity medium. Google tops the list with Google Meet, while Microsoft is at #4 driven by the success of its Business enablement apps Microsoft Teams due to the increase of remote-based working environments.

Also note the presence of four China-Headquartered companies in the top 10 by downloads: ByteDance, InShot Inc, Alibaba Group, and Tencent. Inshot, a free tool that helps its users get their video and images ready for sharing on TikTok and other sharing products, passed the half a billion downloads in September 2021 as user generated content reigns supreme on mobile.

Tinder Proves the Enduring Spending Power in Mobile Dating

Turning to consumer spend, we can see again the dominance of live streaming. The top 10 comprises 9 companies that sell premium subscriptions for access to their video content. The exception is Match Group at #2, driven by Tinder. It continues to lead a flourishing online dating sector, for which spending is up 95% on pre-pandemic levels. Tinder itself captured $1.35 billion in consumer spend in 2021.

Free Fire is the Year’s Most Downloaded Mobile Game

From its earliest days, the app industry was driven by consumer demand for games. This is still the case. In 2021, games generated $116 billion out of the total $170 billion in mobile app consumer spend. That’s around 68%. Meanwhile, of the 233 apps that generated more than $100 million in 2021, 174 were games.

So which were the successful titles, and who were the companies behind them?

The most downloaded game of the year was Free Fire, published by Singapore’s Garena Online, a subsidiary of Sea. It proved to be the pre-eminent title in the hugely popular Battle Royale (Shooting) sub-genre – which further demonstrates the power of mobile devices in providing highly engaging core game experiences akin to consoles or PC. Meanwhile, the other huge Battle Royale product – PUBG MOBILE – remained the No #1 game in terms of monthly average users globally.

In an article we published last year, we explored the secret of Free Fire‘s success. We highlighted how Garena Online optimized its game for low-end mobile devices, designed short game missions to fit with ‘on the go’ mobile time frames, and created a character and universe (Chrono) around the footballer Ronaldo.

It’s also worth noting the presence of Hypercasual games in the State of Mobile 2022 download top 10. It remains one of the most successful segment in mobile gaming, with Bridge Race charting at #4, Hair Challenge at #8 and Join Clash 3D at #10.

ROBLOX Crowns an Incredible Year at the Top of the Consumer Spend Top 10

Inevitably, the chart for top games by consumer spend looks very different from the download and MAU charts. Games that fall within the more casual genres tend to prioritize ad-monetization. Therefore, the app store consumer spend rankings chart skewed towards the more core genres which relied on in-app purchase monetization. ROBLOX sits on top. The world-building game enjoyed a stellar year, with over 48 million users playing on a daily basis across all devices (mobile, PC and home consoles) as reported in the company’s recent earnings call. We believe world building games like ROBLOX are heading towards a new trend and that metaverse related mobile games are on target for $3.1 billion in annual spend.

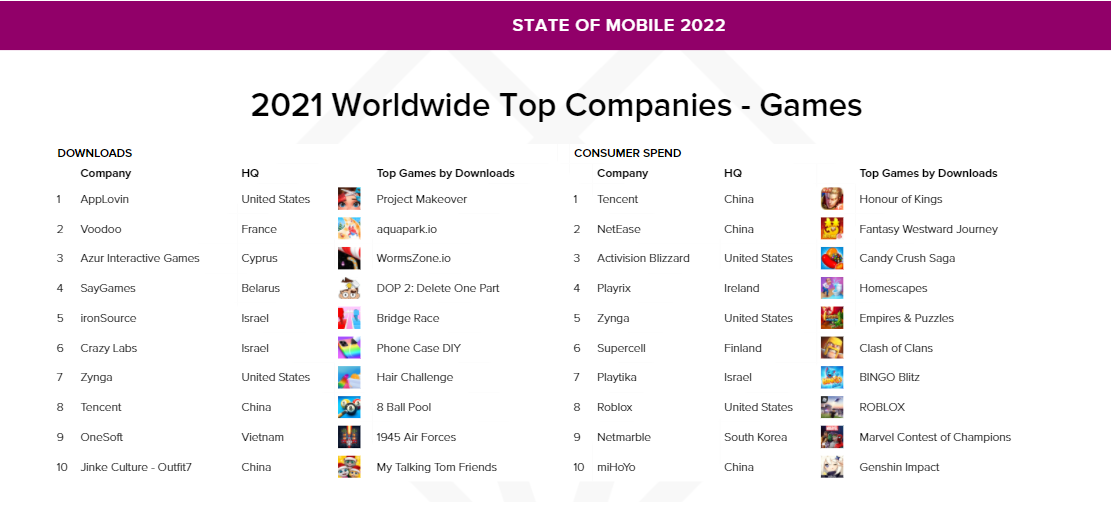

The Most Successful Games Developers of 2021 are Spread all Over the World

The publishers leading the mobile games market – at least in terms of downloads – are a very multinational cohort. US-based AppLovin tops the list thanks largely to its roster of Hypercasual games such as Project Makeover (and its suite of user acquisition tools).

But elsewhere there are companies present from Cyprus, Belarus, Israel and Vietnam. Their success proves that mobile games development can be done anywhere.

The 2021 Top Mobile Game Companies Rankings by Consumer Spend however showed less spread in headquarter locations that lead in monetization. This is a list dominated by more established companies – Tencent, Activision, Zynga, Supercell, Roblox – that curate long running franchises. Case in point: Candy Crush Saga. This game launched in 2012 but its latest incarnation Candy Crush Saga remained #3 on the MAU chart nine years later. In Activision Blizzard‘s company’s Q3 2021 earnings report, it revealed that King (developer of Candy Crush Saga) grew its revenues by 20% YoY to Q3 2021 – a new quarterly record of $652 million.

To learn more about the data behind this article and what AppAnnie has to offer, visit www.appannie.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.