Athleisure surged in 2020 as the pandemic pushed many to re-evaluate their apparel priorities, and sporting goods retailers also thrived as people stocked up on exercise equipment to make up for the absence of fitness centers. Now that gyms and offices are opening back up, we analyzed Nike, Lululemon, and Athleta’s recent visit patterns to understand how these brands performed in 2021 and where the athleisure and athletic wear recovery is heading in 2022.

Nike’s Consumer Direct Acceleration Strategy Pays Off in 2021

Last year, Nike announced its new plan of “Consumer Direct Acceleration” (CDA) – a strategy in the making since 2017 – with the goal of creating “a more premium, consistent and seamless consumer experience across Nike’s owned and strategic partner ecosystem.” A major element of the strategy involved pruning its network of wholesale distributors to funnel more customer demand to Nike owned stores.

Increasing DTC sales is not just good for profit margins. By ensuring that most customers interact with the brand through Nike-owned channels – whether physical stores or brick and mortar – the company gains more control and creative freedom in building and maintaining its brand. This also allows Nike to use its digital and offline data collected from its DTC channels to provide customers with the best possible experience – for example, by opening 150 to 200 small-format digital centric stores that offer services through the Nike app and curate the product selection based on what is popular with consumers in each store’s neighborhood.

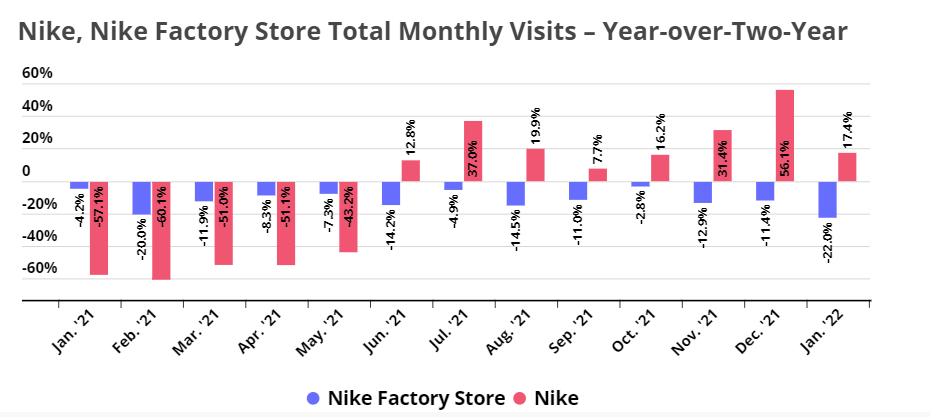

Now, foot traffic data from the past thirteen months shows this strategy is bearing fruit. Nike Factory Stores started 2021 far ahead of the retail stores, with year-over-two-years (Yo2Y) visit gaps of 4.2% vs. 57.1%. But the year ended with December Yo2Y visits to Nike retail stores up 56.1%, while visits to Nike Factory Stores were down 11.4%.

Nike Visits per Venue Affirm Draw of Nike Retail Stores

Some of the visit increase is driven by new store openings. But drilling down into visits-per-venue data confirms that the visit recovery for Nike retail stores is now consistently outperforming the recovery at the brand’s factory stores. Nike retail stores registered impressive Yo2Y visit gains over the 2021 holiday season, with visits 11.2% and 27.4% higher in November and December, respectively, than they were in 2019. Meanwhile, foot traffic to Nike Factory stores fell by 4.5% and 3.3% in the same months.

Nike Factory Stores’ end of year Yo2Y visit numbers are not necessarily cause for concern, given the confluence of adverse circumstances that plagued this year’s holiday shopping season. But the contrast with Nike retail stores’ performance does seem to vindicate Nike’s current strategy.

Athleta’s Expansion Leads to Visit Growth

Athleta and Lululemon both started off the year with a 9.7% increase in visits compared to January 2019. And both continued growing their store fleet throughout the year, but while Lululemon is building out its global footprint, Athleta has been staying focussed on North America – including encroaching on Lululemon’s home turf and expanding into Canada.

Athleta’s North American expansion is reflected in the past 13 months’ visit numbers. The brand has posted Yo2Y visit growth every single month since January 2021, with holiday visits up 7.6%, and 5.0% in November and December, respectively. Meanwhile, Lululemon’s November-December visits were down by 0.6% and 2.8%, respectively.

Lululemon is a pioneer at building a global athleisure brand through community-focused marketing initiatives that have earned the brand a large community of loyal customers. But Athleta is now catching up. The Gap-owned brand recently launched a wellness platform that will offer workout content and supervised chat rooms on topics ranging from mental health to body positivity. And unlike Lululemon, which has a robust menswear line, Athleta caters almost exclusively to women – including plus size women – and has committed to offer extended sizing for every Athleta category by the end of 2022. As these two brands continue to grow their reach, it looks like they are succeeding in carving out separate niches in the expanding athleisure space.

Want to stay up to date on the performance of leading retailers?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.