It’s not TV. It’s HBO.

The retired slogan still rings in our ears.

HBO elevated original content before it was cool.

But for years, brands couldn’t take advantage of the company’s massive audiences. This changed last year.

HBO Max entered the advertising-based video on demand (AVOD) landscape.

With its content, limited advertising and affordable pricing, HBO is trying to take on the biggest players: Netflix and Disney+.

But unlike these other leading OTT platforms, HBO Max has advertising spots that can help media planners and brands get in front of targeted audiences.

Which industries are taking advantage of this advertising channel? And which brands leverage the platform most?

HBO Max wants to be favorite among consumers and brands

In June of 2021, HBO Max released an ad-supported video on demand (AVOD) tier that allows users to access the full library of HBO content, DC Films, Warner Bros movies and more for $10 per month.

The platform is home to popular shows like Friends, Doctor Who, Rick and Morty and Watchmen.

In an even more unconventional move, Warner Bros, belonging to WarnerMedia, which is part of AT&T, released their films like Wonder Woman 1984 and Dune on the same day they were released in theaters. (Ad-tier subscribers had to wait over the following months to stream the films.)

This upset the entertainment industry—but was great for consumers and HBO Max.

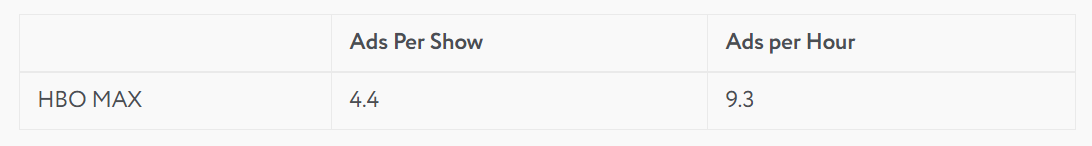

Plus, with only four minutes of ads per hour, HBO Max promised to keep ads to a minimum.

Unlike other key AVOD platforms, HBO Max didn’t limit its inventory to select partners. It opened up spots to the entire marketplace.

HBO Max subscriber numbers are obscure due to the fact that cable subscribers with traditional HBO have access to HBO Max for free, as well as AT&T customers with select plans. Currently, there are about 73.8 million global users with access to HBO and HBO Max. This number will surely grow as WarnerMedia completes its merger with Discovery.

What does HBO Max promise advertisers?

Viewers have long loved HBO, but what about advertisers?

After all, the channel is new to advertising sales.

“HBO has previously been a walled-off garden for the last 50 years,” said Julian Franco, vice president of product management at HBO Max. “Stories are better received if you limit the disruptions during them.”

In line with its history of fan-obsession, HBO promises to “put consumers at the center—where every ad product is designed to lean into their interests and behaviors and drive engagement for your brand.”

HBO does this with a proprietary ad model that allows brands to optimize engagement with relevant audiences.

The platform offers brands a “brand block,” in which “brands own a block of content and consumers delight in a limited commercial experience.” This is also referred to as a brand takeover.

The company offers brands access to their in-house studio for custom creative assets. Having the genius talent behind HBO as a creative partner could be a great investment for certain brands.

HBO Max is determined to find the right balance between consumer desire for less ads and brands’ desire for maximum engagement. It has significantly less ad space than competitors—roughly half that of Hulu.

But less time doesn’t necessarily translate to less impact. True to tradition, HBO is seeking to capture quality over quantity.

Which brands have already started experimenting with this premium channel?

MediaRadar Insights on HBO Max

MediaRadar started tracking* HBO Max advertising soon after its launch, on July 1, 2021.

In 2021, after its launch, the platform had over 410 advertisers.

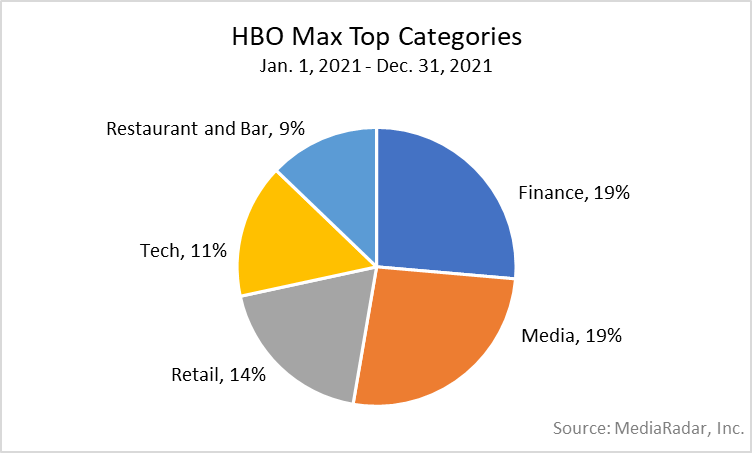

Financial & Insurance brands represent 19% of HBO Max advertising volume. This is around 2-3 times more than other leading OTT platforms.

Media also makes up a significant 19%, while Retail spending isn’t too far behind. Retail brands made up 14% of advertising dollars on this channel.

Top Advertisers:

Ad Analysis

Though the inventory is small—HBO Max partners with brands to make sure it is an effective use of their investment with the brand block strategy.

Is HBO Max the right fit for your ad dollars?

AVOD is still a new channel—and HBO Max is one of the youngest competitors. But with its rich tradition of award-winning content and a dedicated fan following, it’s arguably one of the strongest contenders for a brand’s ad dollars.

The platform trails behind ad-free Netflix and Disney+ in number of subscribers, but is ahead of other AVOD platforms like Hulu and Peacock. (The caveat being that the current number of customers watching ads on the platform hasn’t been announced publicly.)

When we zoom out, OTT spending still pales in comparison to TV ad dollars even though time spent streaming is on the rise.

Americans spend nearly half of their total viewing hours on streaming, but by 2024, PwC analysts predict that U.S. advertisers will only be spending 8% of their budgets on the channel. Put another way, AdAge says that only $5.6 billion of the $71.6 billion TV dollars would be put towards OTT.

This means that brands have a great opportunity to become some of the leading partners in OTT. MediaRadar can give you insights on which brands are already jumping in—and where.

See where your competitors are spending, how much and what creative they are using. Use these insights to build your next campaign strategy. HBO Max might be at the top of your list.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.