Home Improvement boomed in 2020 as Americans got started on DIY projects that had been on the back burner for years. Now that routines are (almost) back in full swing, we dove into recent foot traffic to Lowe’s Home Improvement, The Home Depot, and Tractor Supply to see how the sector performed in 2021 and what lies ahead for 2022. We also looked at Lowe’s new collaboration with Petco to understand how this expansion fit into the larger home improvement landscape.

Home Improvement Growth Spurt Comes to and End

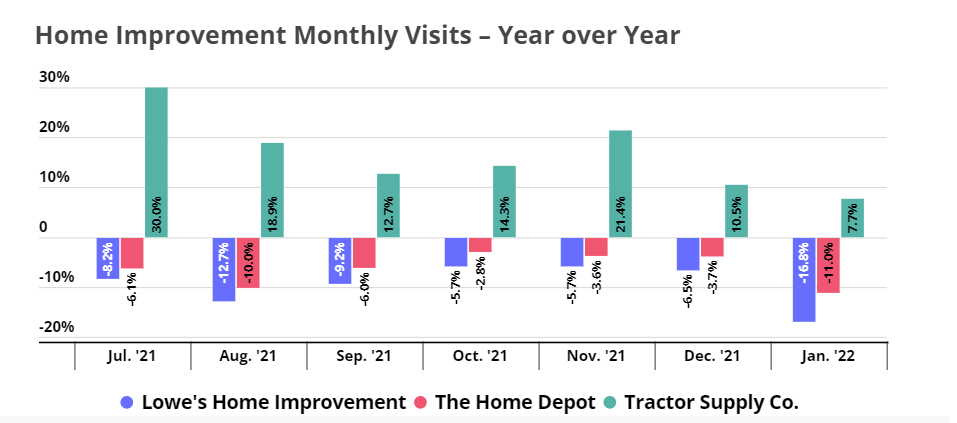

When looking at home improvement sector visits year over year, it is clear that the growth spurt that defined 2020 came to end. Over the past seven months, year over year (YoY) visits were down every month for both Home Depot and Lowe’s. Tractor Supply is continuing to see impressive growth, but it is likely that the brand’s massive store fleet expansion is playing a major role in the visit increases.

But the fact that foot traffic is down compared to the 2020 sky-high visit numbers does not mean that the sector is in trouble – it just means that the uniquely impressive traffic heights hit at the peak of the pandemic were impossible to sustain. As a result, the only way to truly assess whether the sector will derive any long-term benefit from COVID’s home improvement craze is to compare current foot traffic to 2019 numbers.

And indeed, when looking at monthly visits on a year-over-two-year (Yo2Y) basis, the picture looks much rosier. Yo2Y visits over the past seven months were up every single month for all the brands analyzed. And going into 2022, January visits were still strong, with Lowe’s, Home Depot, and Tractor supply posting 8.5%, 9.3%, and 56.2% visit gains compared to January 2020.

This is an incredibly promising sign for the sector, and shows that a significant portion of the customers who were introduced to these brands over the pandemic have become regular shoppers.

How Much of a Threat is Tractor Supply?

When looking at the YoY and Yo2Y home improvement visit numbers in the graphs above, it’s hard to miss the significant disparity between Tractor Supply and the other two brands. So how much of a threat is Tractor Supply to Lowe’s and Home Depot?

First, it’s important to remember Home Depot and Lowe’s are still the clear home improvement visit leaders. Even with Tractor Supply’s massive expansion, analyzing the visit share between the three brands shows that in January ‘22, Tractor Supply received 8.8% of total visits, while Lowe’s and Home Depot received respectively 39.0% and 52.3% of visits.

Second, loyalty trends reveal that Lowe’s and Home Depot customers are more loyal than Tractor Supply ones. The graph below shows the share of visitors who visited each brand at least twice in a given quarter. In 2019, around half of Lowe’s and Home Depot customers are categorized as loyal visitors, compared to only around a third of Tractor Supply customers.

The difference in loyalty numbers may be due to the difference in audiences between the brands – both Home Depot and Lowe’s heavily market to contractors, who visit home improvement stores regularly to stock up on work supplies. In addition, the boost that Tractor Supply sees in overall visits because of the expansion negatively impacts the visits per store metric since it includes more recently opened locations.

And critically, Tractor Supply’s loyalty numbers are on the rise. Whereas customer loyalty for Lowe’s and Home Depot remained relatively consistent between 2019 and 2021, the share of loyal customers to Tractor Supply has seen a Yo2Y increase every quarter of 2021: in Q4 2019, 33.7% of Tractor Supply visits came from loyal customers. By Q4 2021, that share increased to 37.3%. So, while Tractor Supply still has a way to go to reach the visit levels of the two home improvement giants, location data shows that the Tennessee-based brand is on the right track.

Petco at Lowe’s

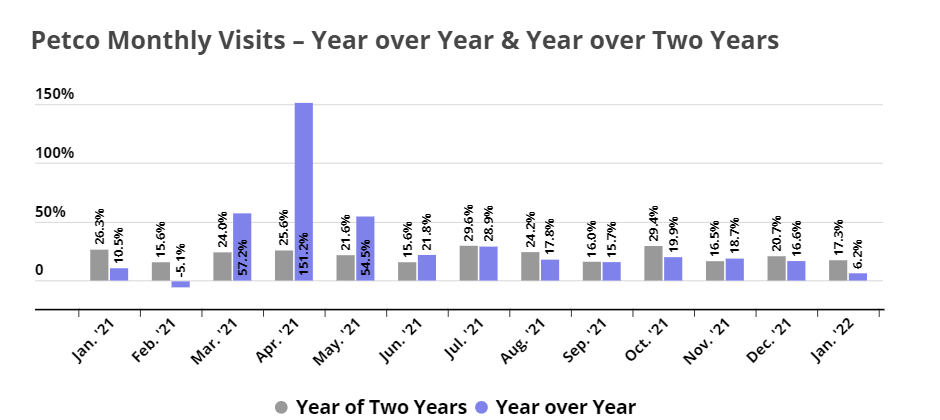

Lowe’s recently announced a partnership with Petco to open Petco shops-in-shop in select Lowe’s locations. Given the strength of the pet-supply sector in general, and of Petco in particular over the past two years, this move makes a lot of sense. For each of the last thirteen months, Petco visits have been up on both a YoY and Yo2Y basis. So by bringing Petco mini shops into Lowe’s, the home improvement leader is showing that it’s not resting on its pandemic laurels and is instead continuing to actively grow its clientele.

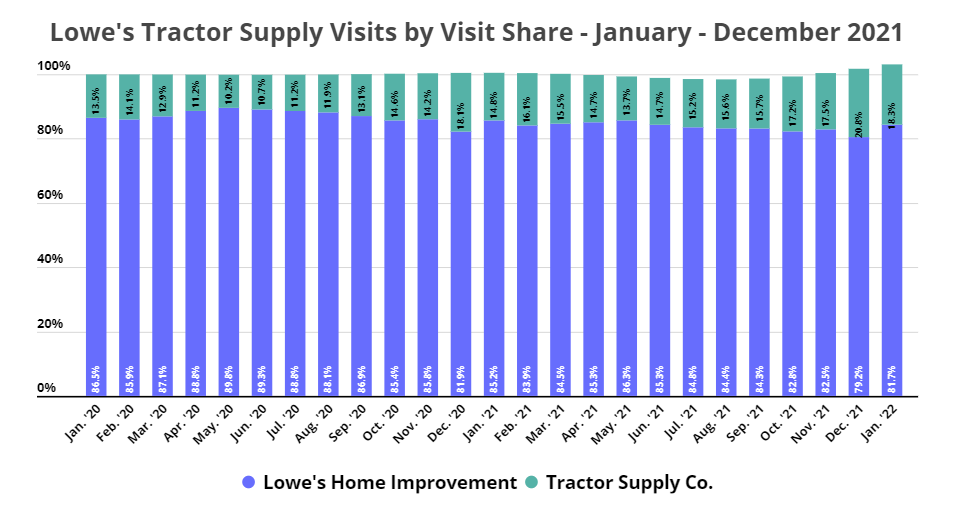

But the Petco-Lowe’s partnership makes even more sense when looking at the wider home improvement picture. While Lowe’s still generates far more foot traffic, Tractor Supply has in fact been slowly eating into Lowe’s visit share. In January 2020, 86.5% of the visit share between the two brands went to Lowe’s while 13.5% went to Tractor Supply. But by January 2022, Lowe’s only received 81.7% of the visit share while Tractor Supply grew its portion to 18.3%.

Tractor Supply has been in the pet supply industry for a while. The home improvement up-and-comer purchased Petsense in 2016, and the brand carries an extensive selection of pets and pet supplies in its Tractor Supply stores. So, Lowe’s partnership with Petco may also help give Lowe’s a leg up in its increasingly hot competition with Tractor Supply.

Want to stay up to date on the performance of leading retailers?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.