In this Placer Bytes, we dive into Planet Fitness to see if the fitness chain can recover from a rough start to 2022 and check in with Dick’s Sporting Goods as it continues to gain strength.

Dick’s Sporting Goods Kicks Off 2022 With Strength

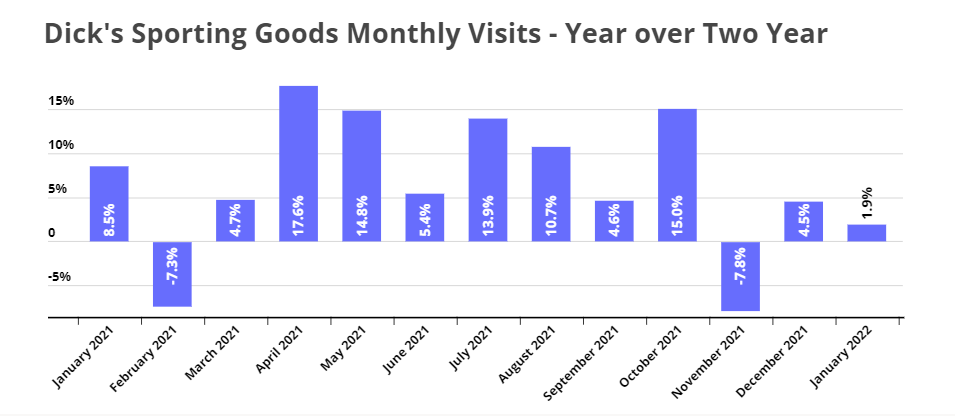

While the wider retail sector saw visits down over 4% in January ‘22 amidst record COVID cases, Dick’s Sporting Goods saw visits rise 1.9% compared to the same month in 2020. This followed a 2021 where all but a weather-affected February and COVID-decimated November saw visit growth.

For a brand that was already showing strength in 2019, the alignment with a range of trends has been a powerful driving force. The continued relative strength of at-home fitness, the rising position of athleisure and athletic wear, and the increased appreciation for time spent participating in athletics have all come together to give this retailer a continued boost. Looking ahead at the year to come, and considering the willingness the retailer has shown to invest in new concepts and ideas, it is hard to expect the growth to slow down anytime soon.

Planet Fitness Recovering

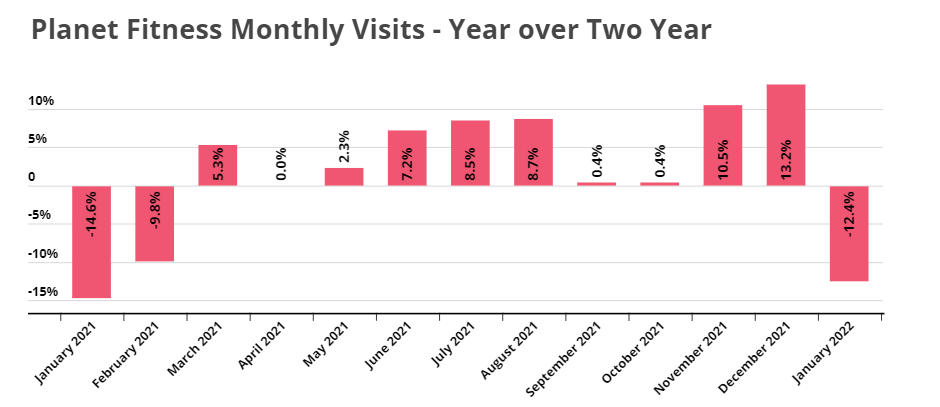

In early 2021, we called out Planet Fitness as a brand that would win the year with a strong recovery – even in the midst of the pandemic’s lingering fitness impact. By midway through the spring of 2021, Planet Fitness was already showing visit strength compared to the same months in 2019.

This trend continued throughout the summer and into the winter before rising Omicron cases sent January visits plunging in a year-over-two year comparison. This dip was especially significant because it came in Q1, normally the strongest period annually for fitness chains – indicating that the timing could present a major setback for the offline fitness recovery.

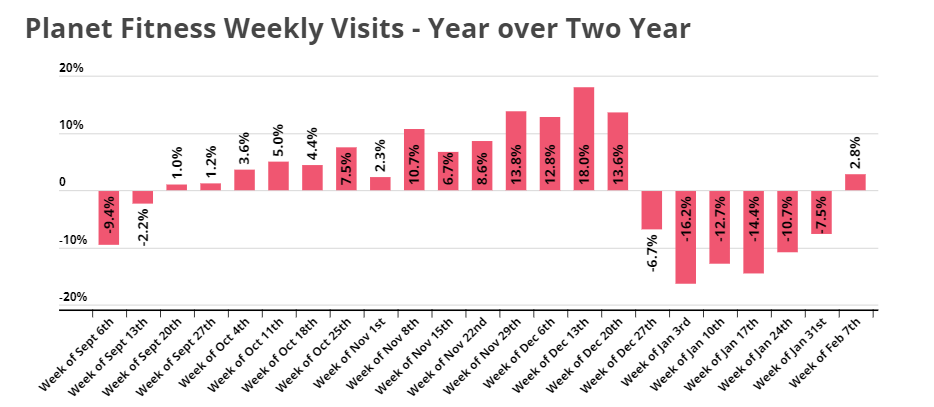

However, early February may be proving to be the greatest testament yet to the resiliency of offline fitness. Visits the week beginning January 31st were down just 7.5% compared to the equivalent week in pre-pandemic 2020 – a far smaller gap than the 16.2% seen the week beginning January 3rd. And the week beginning February 7th saw an even more significant milestone with visits actually up 2.8% compared to the same period in 2020.

While Planet Fitness’s expansion has played a big role in the overall growth, the resilience of consumer demand for fitness chains is an ongoing affirmation of the company’s future potential, especially with many competitors closing. This is even more true considering the value model the brand has always aligned with. This model fits incredibly well for consumers who want a more multichannel fitness regime that includes classes at other chains and at-home components like Peloton. Whichever perspective you take, it’s clear that Planet Fitness has impressively managed to overcome yet another obstacle.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.