In this Placer Bytes, we dive into Best Buy and Costco as they kick-off 2022.

Best Buy’s Return to Growth

Best Buy has always been a very Black Friday-centered brand, so the heavy impact on the day’s strength in 2021 was always going to have repercussions. However, once again, Best Buy has proven to be one of the retailers most capable of strategically adapting to new challenges and concerns.

In 2020, Best Buy was incredibly effective at maximizing the retail reopening with tactics like appointment shopping improving efficiency. And in 2021, the brand continued to show strength with a powerful visit recovery driven by unique campaigns and a keen understanding of how to maximize the wider retail recovery. However, it’s most effective move may end up being the strength it showed in extending the holiday season. Normally a brand that sees an outsized surge on Thanksgiving and Black Friday, the retailer needed to cope without the former and with a limited latter.

And cope it did.

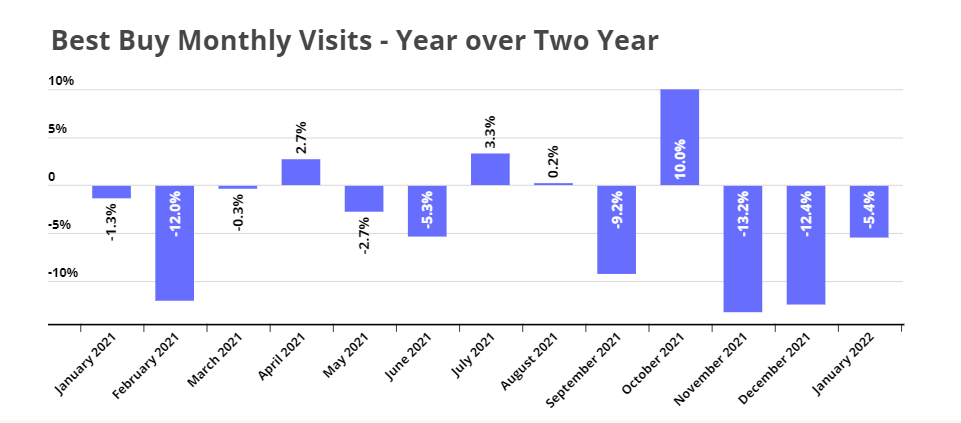

Best Buy visits surged 10.0% in October compared to the same month in 2019 as the brand incentivized visits based on product availability. This was critical in a season where urgency would be far less driven by major price cuts. Visits then declined 13.2% and 12.4% in November and December, respectively, as the aforementioned challenges presented unique obstacles alongside record COVID cases, labor shortages, and supply chain concerns. But the bounceback has been swift, even during an especially challenging January. Visits were down just 5.4% in January, a massive shift considering the wider struggles that the brick and mortar retail space faced.

The brand’s continued ingenuity in overcoming challenges alongside its unmatched brand appeal should give immense confidence in its ability to thrive as the effects of COVID and other related challenges continue to dissipate.

Costco’s Continued Dominance

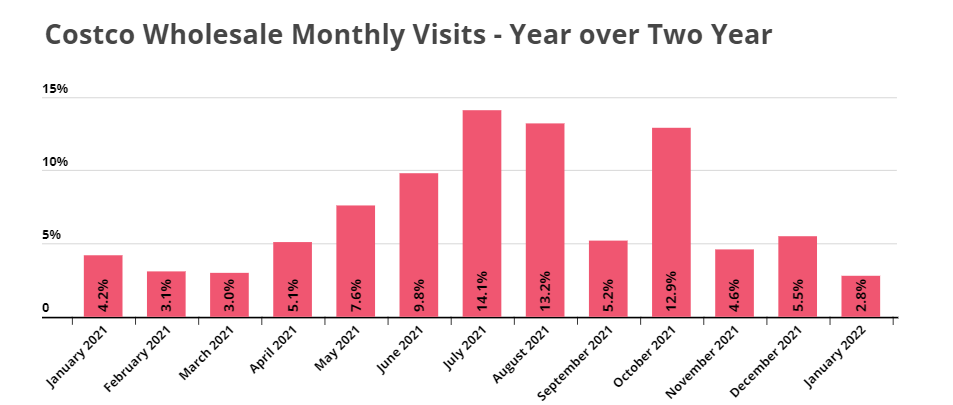

For years, Costco had proven to be one of the most reliable growth stories in retail, with visits growing year over year each month like clockwork. The pandemic changed that pattern, driving year-over-year visit declines in much of 2020 which led to concern that the market shifts caused by COVID may not be beneficial to Costco’s future. Yet, by late 2020, memberships were on the rise which would create a foundation for massive growth in 2021.

This proved to be a key asset for Costco in 2021 when the retailer saw visit growth every month when compared to pre-pandemic 2019. And the stickiness factor for Costco is incredibly important, as the membership club model incentivizes future visits once a customer takes the plunge. In addition, the wider shift to suburban living – which means more space at home – also added a new customer base to enjoy Costco’s offerings.

This led us to include Costco as one of the retailers we expect to win 2022, and January already indicated that this decision is proving to be a smart one. Visits for the retailer were up 2.8% on pre-pandemic January 2020.

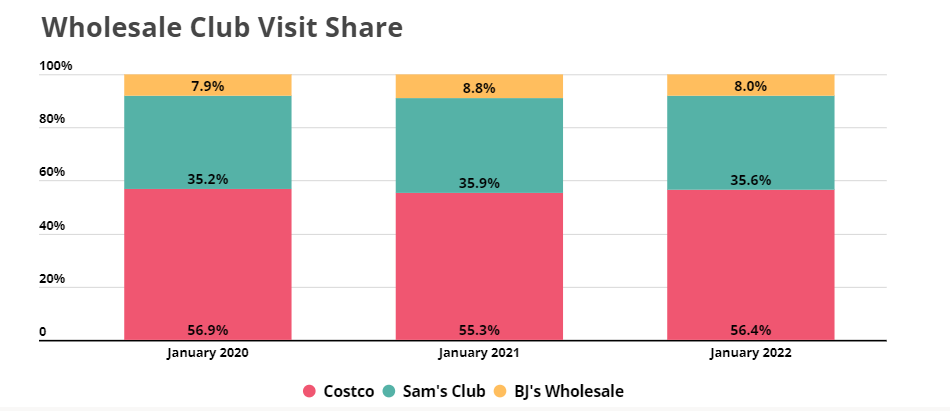

And though this growth is impressive in its own right, the fact that it is coming as competition heats up is even more important. Costco lost some its visit share to a surging BJ’s Wholesale Club and Sam’s Club in January 2021, but by January 2022 those numbers were pushing closer to 2020 levels. This indicates that while all players have seen a boost, Costco’s strong position has remained.

Will Best Buy’s recovery continue? Can Costco continue to thrive in an increasingly competitive environment?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.