The Omicron wave drove record numbers of COVID cases throughout the country. And the impact the variant had on retail was also unique, creating some of the most notable COVID related side effects since the early stage of the pandemic.

We dug into the effects of the Omicron wave, and what the early recovery data shows.

Retail

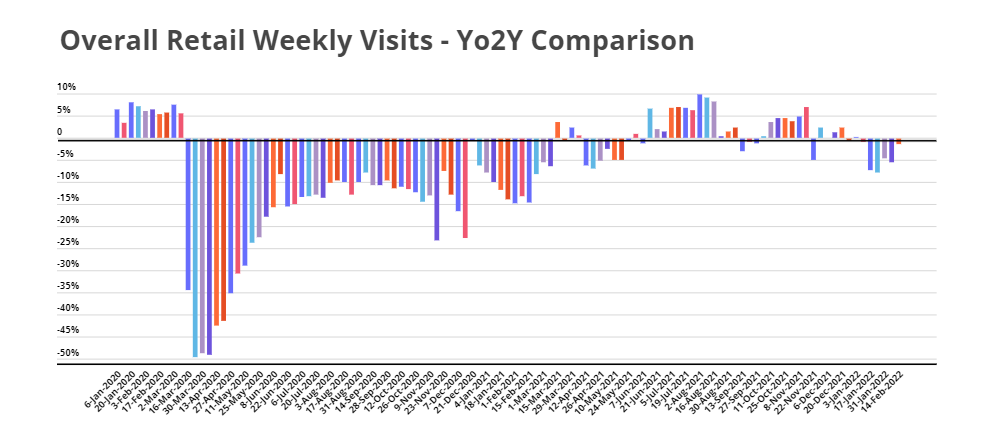

The wider brick-and-mortar retail sector had seen a steady recovery through the summer with the combination of declining cases, renewed demand and vaccination driven confidence driving visits. This created a summer peak that generated significant visit strength throughout July and early August. Yet, the Delta variant’s impact quickly limited that surge pushing visits back to year over two year (Yo2Y) declines by late August and through September.

However, retail foot traffic trends show just how much more significant the Omicron period has been compared to the earlier Delta wave. During Delta, the period of impact lasted around a month and the actual declines were fairly limited, with weekly visits quickly bouncing back by October. But Omicron has been impacting visit rates since the end of the holiday season, and the visit declines in January and February have been far larger than anything seen during Delta.

Dining

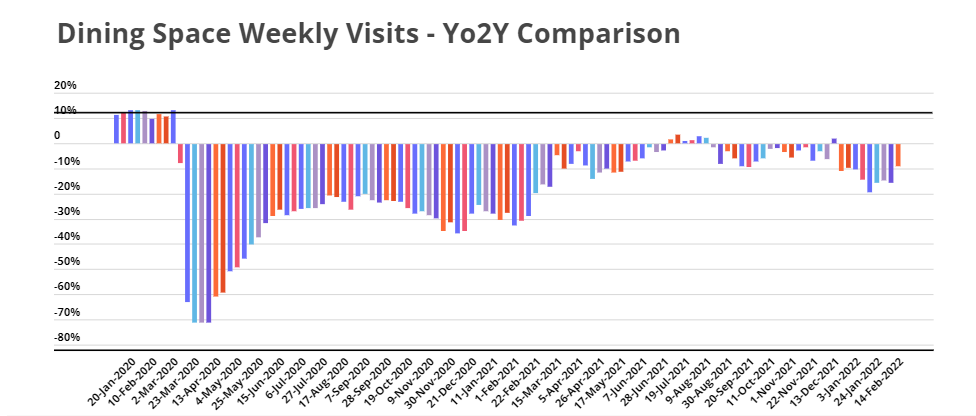

The effect on the dining sector, where in-person visits are directly impacted by rising case numbers, is even more substantial. For this sector, the Omicron-induced downturn caused the Yo2Y visit gap to revert back to rates not seen since early Spring 2021 – indicating that Omicron has been harder on the dining sector than the Delta variant or any other setback in 2021.

Office

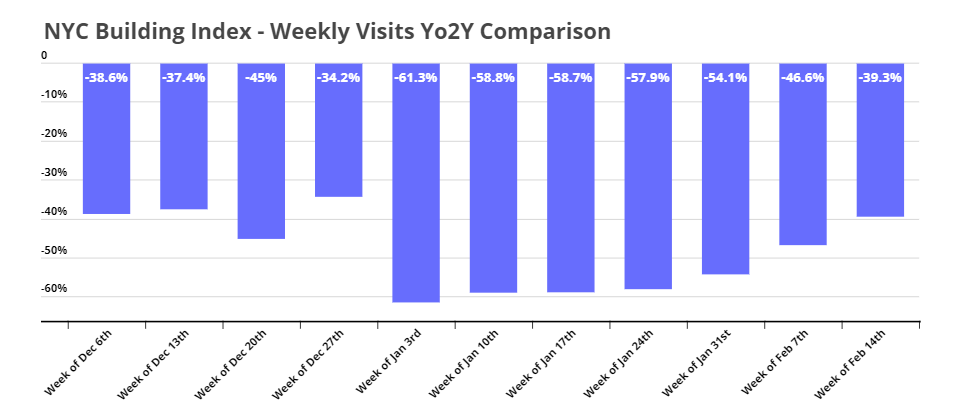

The office recovery was also heavily impacted, with months of progress decimated in January when weekly Yo2Y visit gaps exceeded 50% throughout the month. This came after a late 2021 push that saw Yo2Y visit gaps lower than they had been all year, even during a COVID affected holiday season.

The clear conclusion is that this particular COVID wave had driven a major setback in the overall recovery process for retail and office visits. However, as the graphs above indicate, mid-February of this year was already showing a significant recovery in visits across different retail segments, including the NYC Office Index.

The takeaway? The spread of the Omicron variant created a unique challenge at this stage of the recovery and drove major visit declines. However, brick-and-mortar retail, restaurants and even offices once again showed resilience and continued their recovery trajectory as soon as case numbers declined.

So, while this particular variant may be remembered for causing one of the bigger challenges, the clear, fast and significant recovery being seen is the latest and perhaps greatest testament toward ongoing consumer demand for in-store experiences.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.