UK shoppers over the years have taken advantage of ordering online to save themselves the time and effort of going to stores. Yet, the joy of cooking is one effort they’re still willing to make. Grocery delivery services like Ocado and meal kit purveyors like HelloFresh and Gousto have managed to take advantage of both sides of the coin to give consumers fresh foods delivered straight to their homes. In today’s Insight Flash, we use our newly launched UK Cohort dashboards to compare how these companies have fared when it comes to repeat purchases both before and during the pandemic, what has happened to average ticket, and what a more nuanced view into the number of transactions at different ticket buckets shows.

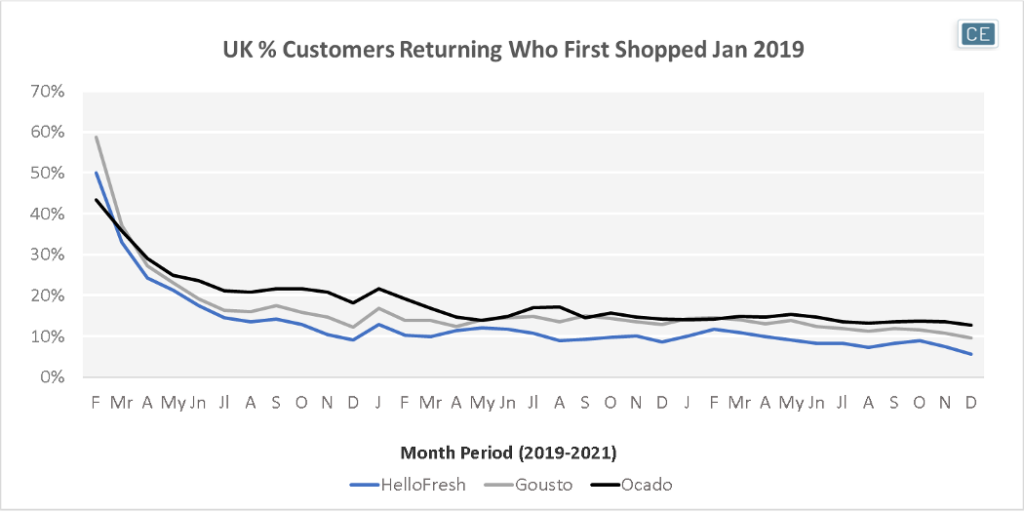

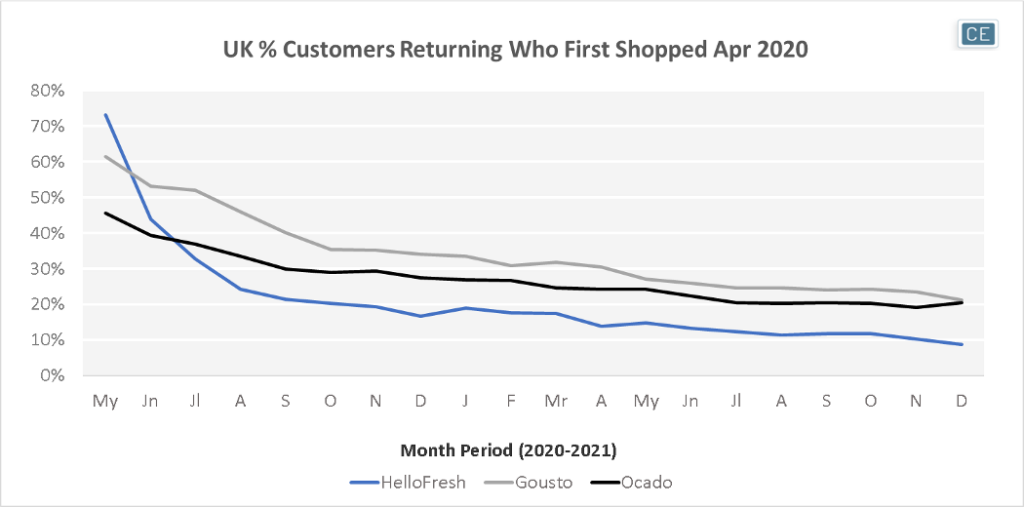

Among customers who first shopped fresh food delivery back in January 2019, Gousto held the highest retention one month later at 58.6%, compared to 50.1% for HelloFresh and slightly above 43.5% for Ocado. 20 months later, Gousto’s return customer percentage was down to 15.1% while Ocado’s was 14.5% and HelloFresh’s was 9.3%. This is interesting to compare to new customers who started shopping each brand at the beginning of the pandemic in April 2020. For these customers, HelloFresh took the lead in return purchasing one month later at 73.2%, followed by 61.4% for Gousto and only 45.6% for Ocado. 20 months later, however, return purchasing was still higher than for the January 2019 cohort for Gousto at 21.2% and Ocado at 20.4%. HelloFresh, in contrast, actually saw a worse return percentage of 8.6%.

Customer Loyalty

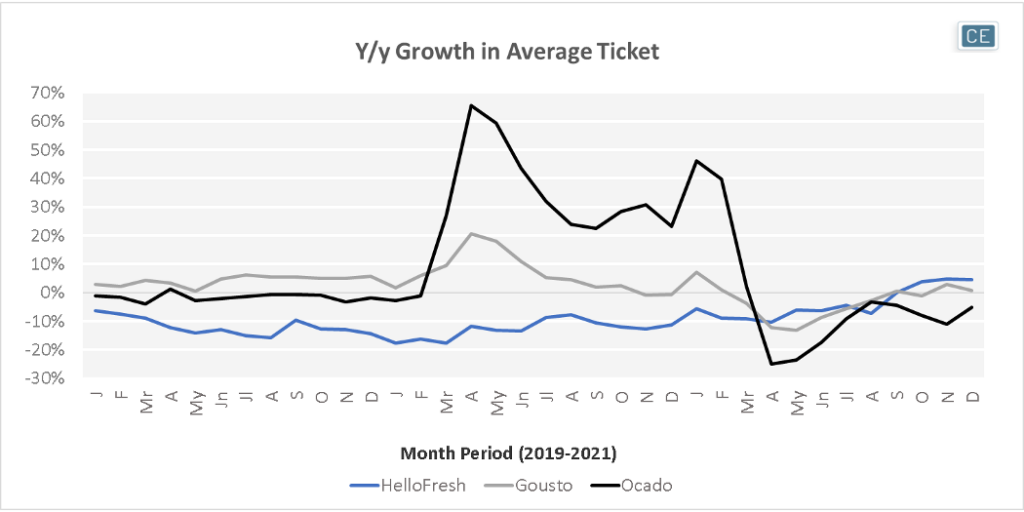

Since 2019, the average ticket for all of these services has shown change. Ocado saw an extremely large spike in average ticket at the beginning of the pandemic, up 65.4%. Gousto saw more muted but still substantial ticket growth at 20.6%. HelloFresh, on the other hand, has seen declining average ticket y/y from January 2019 through August 2021 – only in the last three months of 2021 has the company seen an increase in purchase size in the UK.

Average Ticket

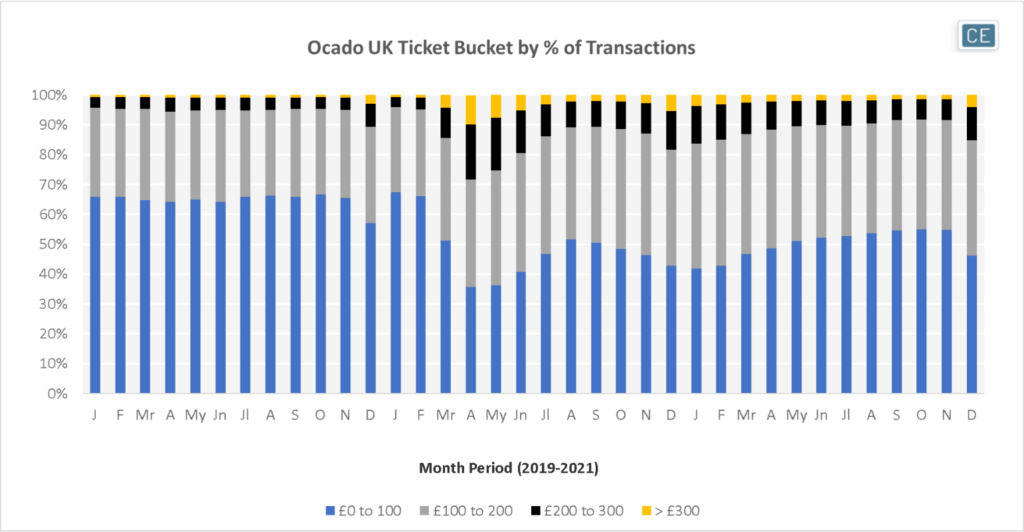

Our Ticket Buckets analysis allows a more granular look into which transaction sizes are driving the average. For Ocado, the pandemic brought not only an increase in the average order size, but brought the percentage of orders over £300 as high as 10% of total transactions. Pre-pandemic, orders £0 to 100 had made up about two-thirds of total transactions. Since April 2020, however, those orders have only been about half of the total and in no month have they made up more than 55% of transactions. This shift to larger orders may help bottom-line results as it allows economies of scale for delivery costs.

Ticket Buckets

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.