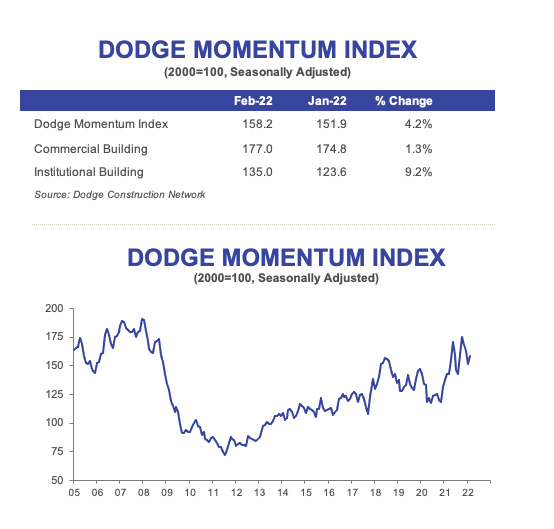

The Dodge Momentum Index increased 4% in February to 158.2 (2000=100), from the revised January reading of 151.9. The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. In February, institutional planning rose 9%, and commercial planning moved 1% higher.

The Dodge Momentum Index rebounded from three consecutive monthly declines that followed a 14-year high in October 2021. Much of February’s gain was due to a sizeable jump in the institutional component, as more education and healthcare projects entered planning. Commerical planning remained solid thanks to office and warehouse projects. When compared to February 2021, the overall Momentum Index was 11% higher in February 2022. The institutional component was up 37%, while the commercial component was down 1% on a year-over-year basis.

A total of 22 projects with a value of $100 million or more entered planning in February. The leading institutional projects were a $500 million first phase of the OC Vibe recreation and mixed-use space in Anaheim, CA, and the $299 million Kaiser Roseville Medical Center in Roseville, CA. The leading commercial projects were the $500 million Potomac Technology Park data center in Manassas, VA, and a $175 million Chick-fil-A refrigerated warehouse in Hutchins, TX.

February’s increase in the Dodge Momentum Index suggests that the construction sector continues to weather the storm of higher material prices and labor scarcity and is looking past the pandemic’s unique issues for projects like schools and offices. As the pipeline of projects awaiting groundbreaking fills, a more even and pronounced recovery in construction starts will take hold.

February 2022 Dodge Momentum Index

To learn more about the data behind this article and what Dodge Analytics has to offer, visit https://www.construction.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.