Visits to pet supply shops have seen significant growth over the past two years. We took a closer look at foot traffic trends for Petco and PetSmart to see how the pet supply visit leaders fared over the past two years.

Trending Upward

Demand for pet supplies skyrocketed for the last two years. As work from home became widespread, homebound pet owners and first-time pet parents drove significant and lasting visit growth to brick and mortar pet supply stores.

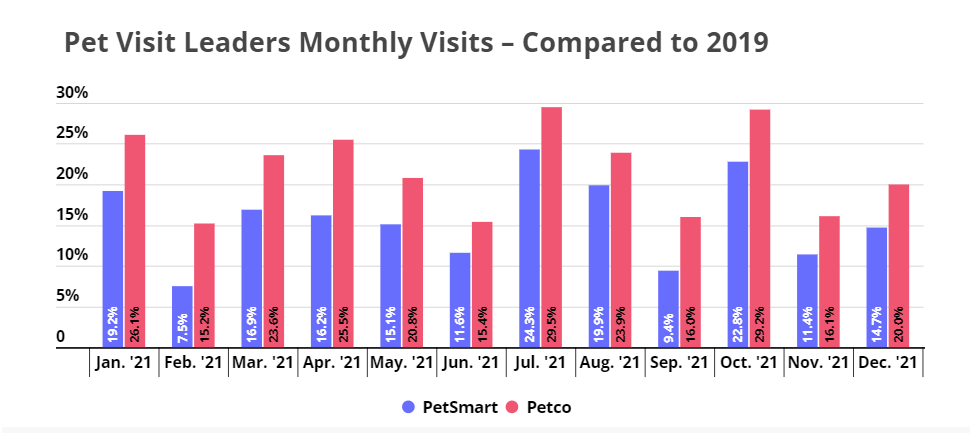

Petco and PetSmart dominate the US market, and both experienced significant increases in their foot traffic over the past two years. In 2021, PetSmart and Petco saw their average monthly visits increase by 15.7% and 21.7% respectively compared to 2019 – the two retailers are showing record visits and remarkable growth.

Continued Growth

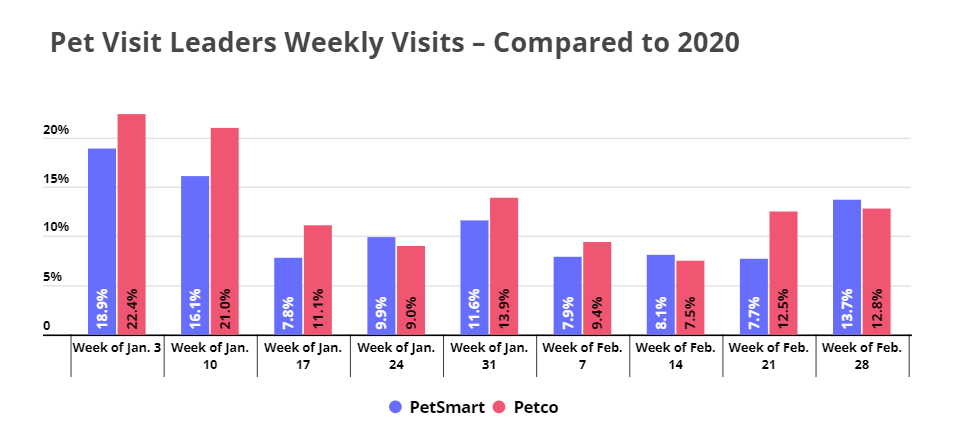

Early 2022 data shows that foot traffic isn’t slowing down in the new year. Year-over-two-year (Yo2Y) visits have been up every week this year, with visits the week of February 28th up 12.8% for PetSmart and 13.7% for Petco compared to the equivalent week in 2020. It looks like the increase in pet ownership over the pandemic is driving a long-lasting visit surge to offline pet store retailers.

Petco vs. PetSmart

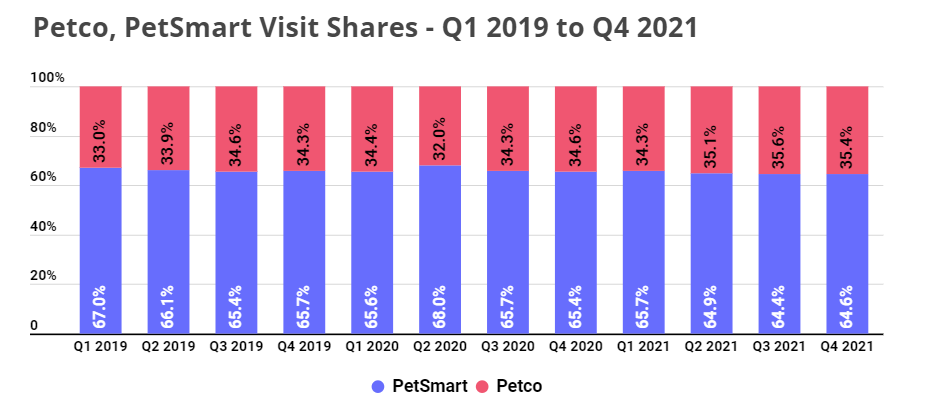

PetSmart is currently the visit leader in this sector. To maintain its edge, PetSmart has launched a number of brand partnerships, including a relationship with payment service provider Afterpay, and delivery service DoorDash in 2021.

Recently, however, Petco has also launched several programs and partnerships to help draw customers to stores and to build its brand. This includes PetCo’s Vital Care program, a wellness plan that offers grooming and unlimited veterinary exams, as well as the expansion of their pet hospital network by purchasing a stake in Thrive Pet Health. Petco has also joined forces with Lowe’s Home Improvement to open shop-in-shops in Lowe’s stores – a decision that seems particularly strategic and forward-thinking given the recent success of the home improvement sector.

So far, Petco’s initiatives have been paying off. The brand posted record visits and sales in 2021, and visit share data indicates that the balance of power between the two category leaders may be starting to shift. In Q1 2019, PetSmart received 67.0% of visits while Petco obtained 33.0% of visits out of the total visits for the two brands. By Q4 2021, PetSmart’s visit share had dropped 64.6% while Petco’s visit share climbed to 35.4%.

Still, while Petco may be gaining some ground, the continued growth of the pet care market shows that the space has plenty of room for multiple retailers to grow and thrive.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.