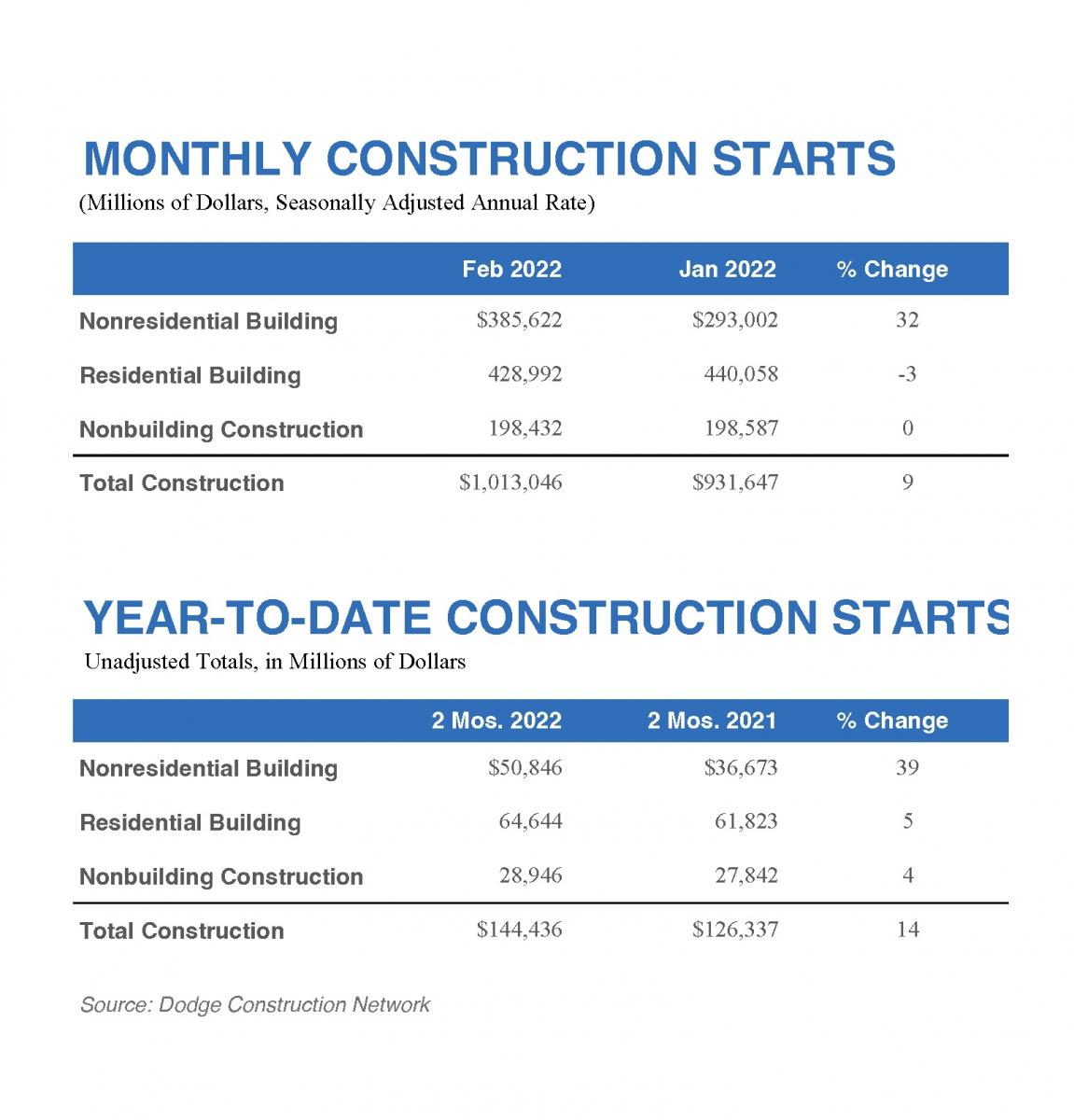

Total construction starts rose 9% in February to a seasonally adjusted annual rate of $1.013 trillion, according to Dodge Construction Network. Nonresidential building starts swelled 32% due to the start of three large manufacturing facilities. By contrast, residential starts fell 3%, and nonbuilding starts fell by less than 1%. Without the three large manufacturing projects, total construction would have declined 6% in February.

Year-to-date, total construction was 14% higher in the first two months of 2022 than in the same period of 2021. Nonresidential building starts jumped 39%, nonbuilding starts rose 4% and residential starts gained 5%. For the 12 months ending February 2022, total construction starts were 16% above the 12 months ending February 2021. Nonresidential starts were 23% higher, residential starts gained 19% and nonbuilding starts were up 1%.

“The manufacturing sector has been an important success story for construction since the pandemic began,” stated Richard Branch, chief economist for Dodge Construction Network. “Domestic producers are expected to seek more control over their supply chains in the future, so that aspect of construction should continue to flourish. However, as evident in February’s data, other sectors are struggling to gain traction in the face of high material prices and worker shortages. The conflict in Ukraine will continue to put upward pressure on costs, making the sector’s recovery more tenuous in 2022.”

Below is the breakdown for construction starts:

For the 12 months ending February 2022, total nonbuilding starts were 1% higher than in the 12 months ending February 2021. Environmental public works starts were up 16% and utility/gas plant starts rose 7%. Highway and bridge starts were up 2% on a 12-month rolling sum basis, while miscellaneous nonbuilding starts were 26% lower.

The largest nonbuilding projects to break ground in February were the $492 million Cardinal-Hickory Creek transmission line in Middleton, WI, a $385 million solar farm in Ventress, LA, and the $350 million Sapphire Sky wind farm in Farmer City, IL.

For the 12 months ending February 2022, nonresidential building starts were 23% higher than in the 12 months ending February 2021. Commercial starts were up 17%, institutional starts rose 12% and manufacturing starts advanced 143% on a 12-month rolling sum basis.

The largest nonresidential building projects to break ground in February were the $10 billion Intel chip fabrication plants in Chandler, AZ, U.S. Steel’s $1.5 billion steel mill in Osceola, LA, and Intel’s $550 million renovation of the Rio Rancho, NM, semiconductor facility.

For the 12 months ending February 2022, residential starts improved 19% from the 12 months ending February 2021. Single family starts were 14% higher, while multifamily starts were 31% stronger on a 12-month rolling sum basis.

The largest multifamily structures to break ground in February were the $400 million 400 Central condos in St. Petersburg, FL, the $220 million Journal Squared apartments in Jersey City, NJ, and the $147 million Miami World Tower building in Miami, FL.

Regionally, total construction starts in February rose in the Midwest, South Atlantic and West regions, but fell in the Northeast and South Central.

February 2022 Construction Starts

To learn more about the data behind this article and what Dodge Analytics has to offer, visit https://www.construction.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.