Source: https://www.reveliolabs.com/news/business/want-to-know-where-revenue-is-headed-look-at-this-metric/

It stands to reason that salespeople leaving a company in droves is a bad sign, especially if that company depends heavily on selling products or services. But what does the data actually say about the consequences of high or low sales turnover? This week, we look at how company revenues and employee sentiment are actually affected when sales attrition varies.

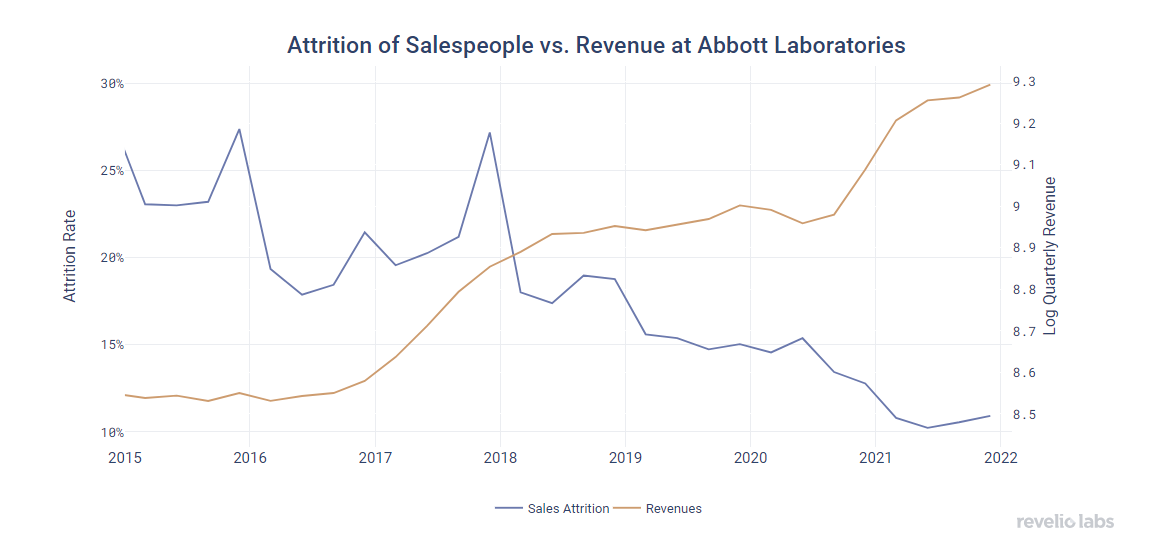

Pharmaceutical and medical device companies specifically depend heavily on sales. By looking at Abbott Laboratories as an example, we can see what happens to revenue when a company manages to reduce sales attrition:

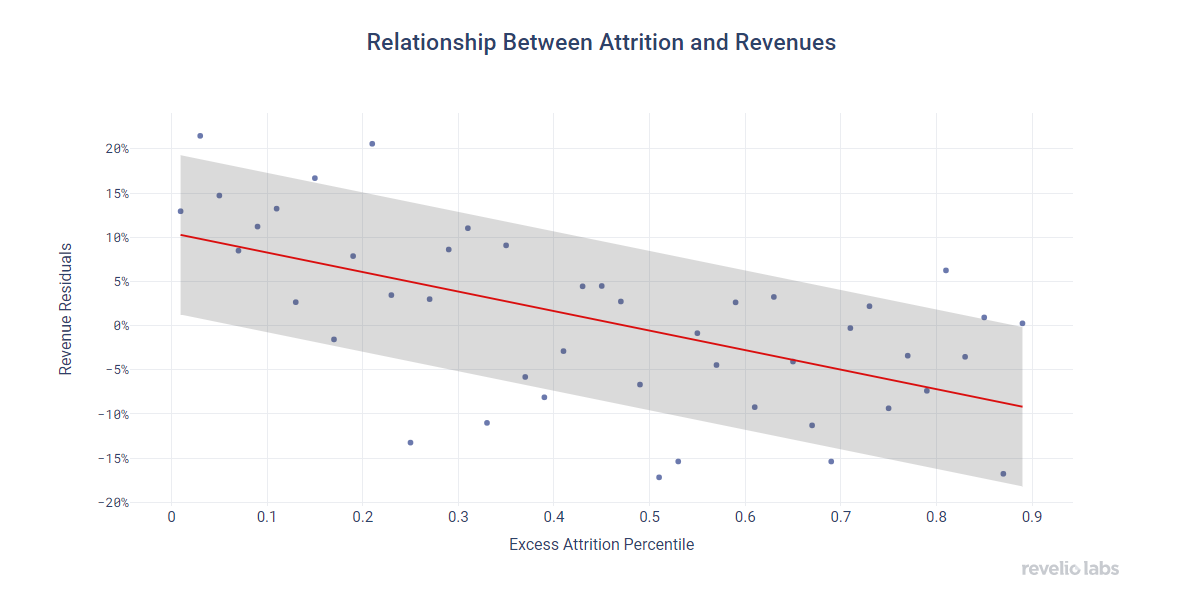

Quite notably, it wasn’t until Abbott Laboratories reduced sales attrition that revenues started rising. Similarly, when controlling for company and time effects, we see that a 10% decrease of sales attrition leads to 7% higher revenues 6 months later. While the effect of lower sales attrition takes time to come into full force, it ultimately appears to help companies meet their sales targets and improve revenues.

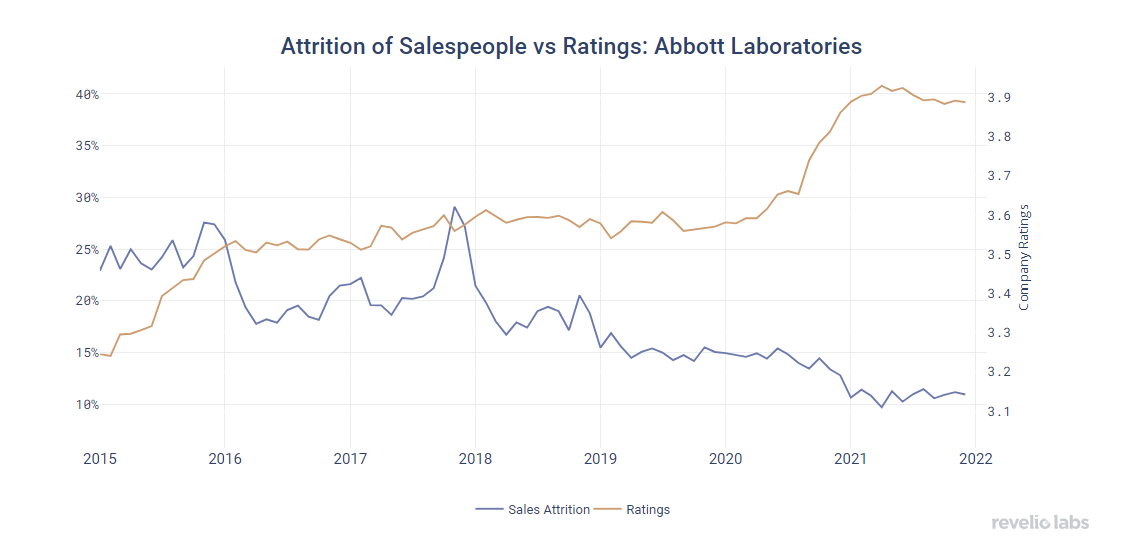

But what about employee morale? Wouldn’t we expect variations in sales attrition to have an impact on how all employees feel about the company? In the case of Abbott Laboratories, there is another distinctly negative relationship between the two measures: when attrition falls, ratings increase.

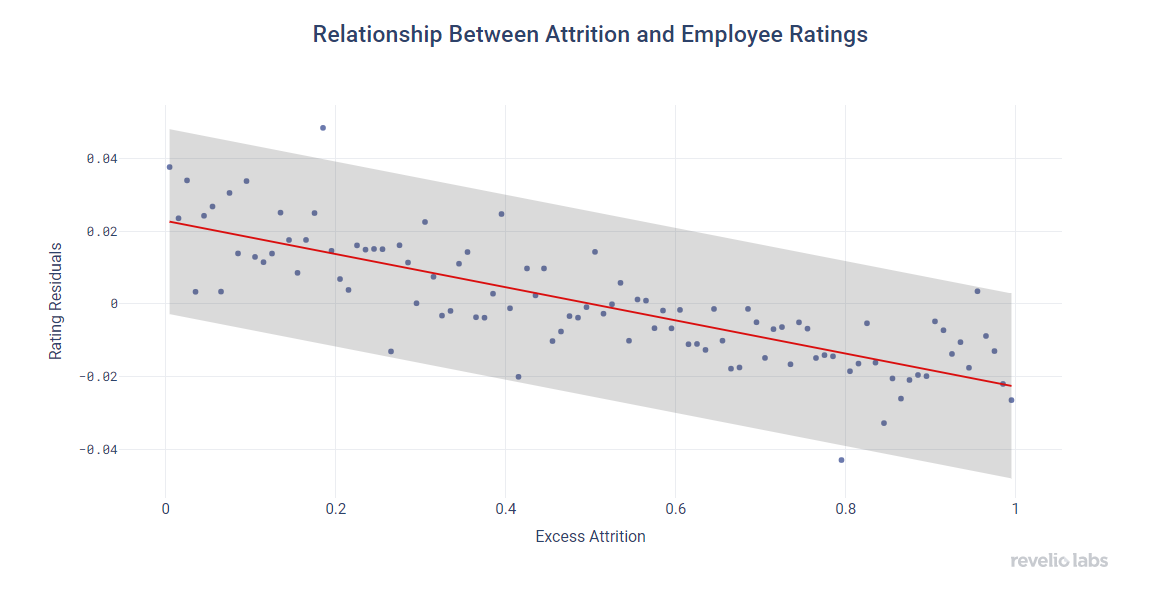

This relationship also holds for other firms. Low attrition rates are associated with higher overall employee ratings. We find that on average, a 10 percent decrease in attrition, leads to 6 percent higher employee satisfaction ratings after six months. This could possibly be due to a mix of good company performance leading to positive employee outlooks, and a lower burden on the sales teams when attrition is low and work can be more evenly distributed among more employees.

Key Takeaways:

To learn more about the data behind this article and what Revelio Labs has to offer, visit https://www.reveliolabs.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.