The streaming market has grown increasingly saturated during the pandemic, as TV networks like NBCUniversal and Discovery launched their own streaming platforms to compete with more established streaming services like Netflix (NASDAQ: NFLX) and Hulu. At the same time, several streaming services—especially those launched by TV networks—have been experimenting with lower-priced plans that are supported by ad revenue. Bloomberg Second Measure’s transaction data reveals that even as new competitors have entered the streaming wars, Netflix and the Disney+ bundle had the highest overall average customer retention rates in 2021. A further breakdown of streaming services’ customer retention by acquisition price point shows that most ad-free streaming plans also had higher customer retention rates than their ad-supported counterparts.

Netflix (NASDAQ: NFLX) and the Disney+ bundle had the highest customer retention rates among streaming services in 2021

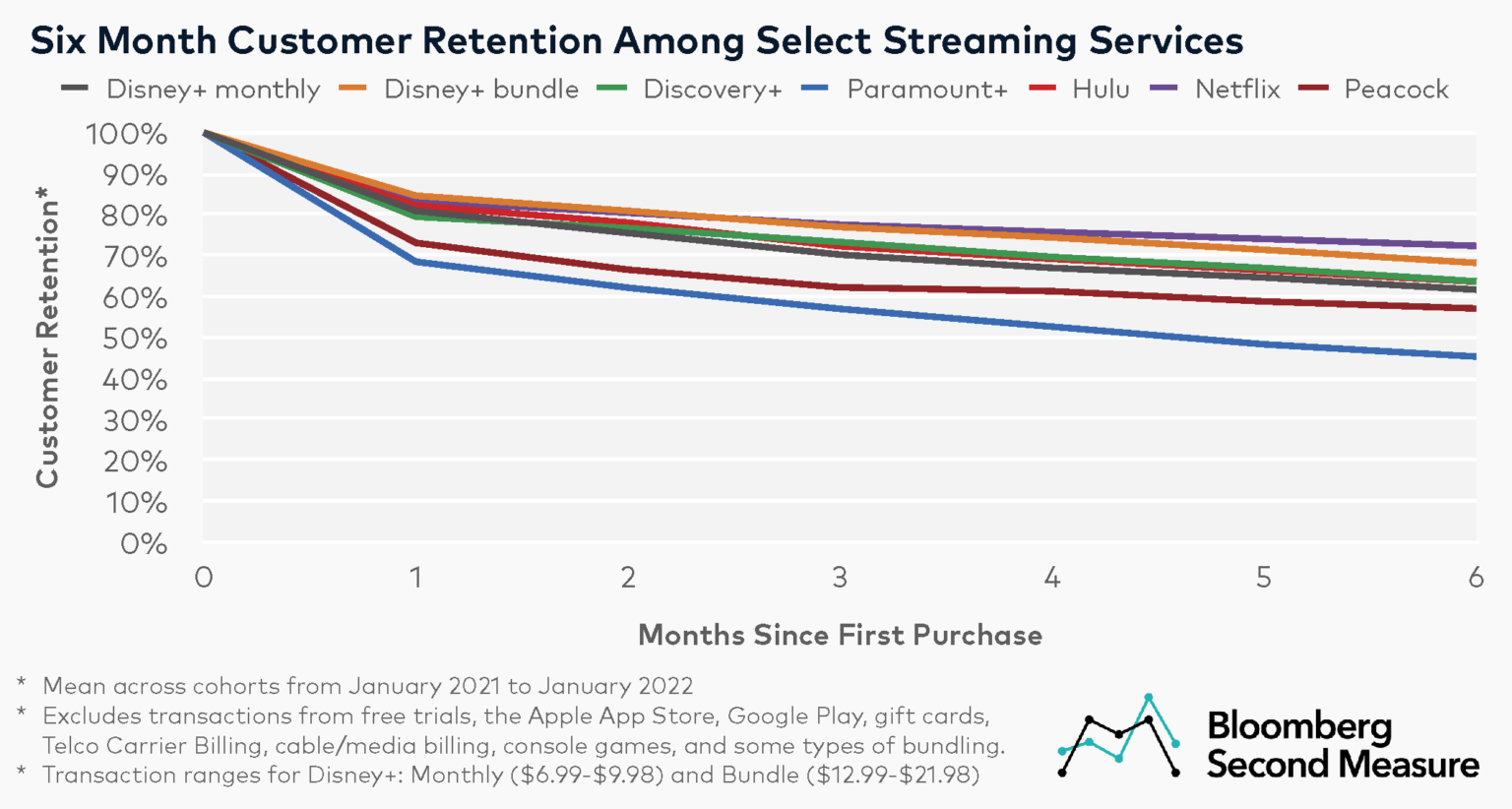

Among a group of major streaming services, Netflix and the Disney+ bundle—which includes Disney+, Hulu, and ESPN+—had the highest average customer retention in 2021. For cohorts who made their first purchase between January 2021 and January 2022, 85 percent of Disney+ bundle subscribers (represented in our data by U.S. customers for Disney+ acquired at the $12.99-$21.98 price point) were retained the following month. At Netflix, 83 percent of subscribers were retained after one month. However, customer retention at Netflix was stronger in the long-term. After six months, Netflix had an average customer retention rate of 72 percent, compared to the Disney+ bundle retention rate of 68 percent.

Within the same time frame, customer retention for the Disney+ monthly plan (represented by U.S. customers who made their first purchase at the $6.99-$9.98 price point) was lower than the Disney+ bundle, with an average of 62 percent of customers remaining subscribed after six months. Notably, this cohort excludes annual subscribers and those who made their initial purchase with Premier Access, the Disney+ plan for select new movie releases.

Discovery+, which launched in January 2021, is one of the newest entrants in the crowded streaming industry and marks a continuation of TV networks creating streaming platforms in addition to their cable offerings. Even though Discovery+ has been around for just over one year, its customer retention rates have outpaced several of its competitors in the same time period. Among cohorts that made a purchase in 2021, the average six-month customer retention rate for Discovery+ was 64 percent, behind Netflix and the Disney+ bundle, but at the same level as Hulu, and ahead of other TV-network platforms Peacock and Paramount+.

In 2021, the average six-month retention rate for Peacock was 57 percent. Notably, Peacock offers a free subscription tier, which is not captured in Bloomberg Second Measure’s data. Peacock is also one of the newer streaming services in the analysis, having launched in July 2020. Paramount+ had the lowest customer retention among the analyzed group in 2021, with an average of 45 percent of customers remaining subscribed after six months.

Notably, Bloomberg Second Measure data only includes paid U.S. subscribers. Our data also excludes free trials, as well as promotions such as free access through partnerships with Verizon. It also does not include transactions from the Apple App Store, Google Play, gift cards, Telco Carrier Billing, transactions through gaming consoles, and some types of bundling including cable and media bundles. Amazon Video has been excluded from this analysis because transactions include movie purchases and rentals made through the service in addition to subscriptions, and exclude complimentary Video subscriptions associated with Amazon Prime membership.

Ad-free streaming plans generally have higher customer retention rates than ad-supported plans

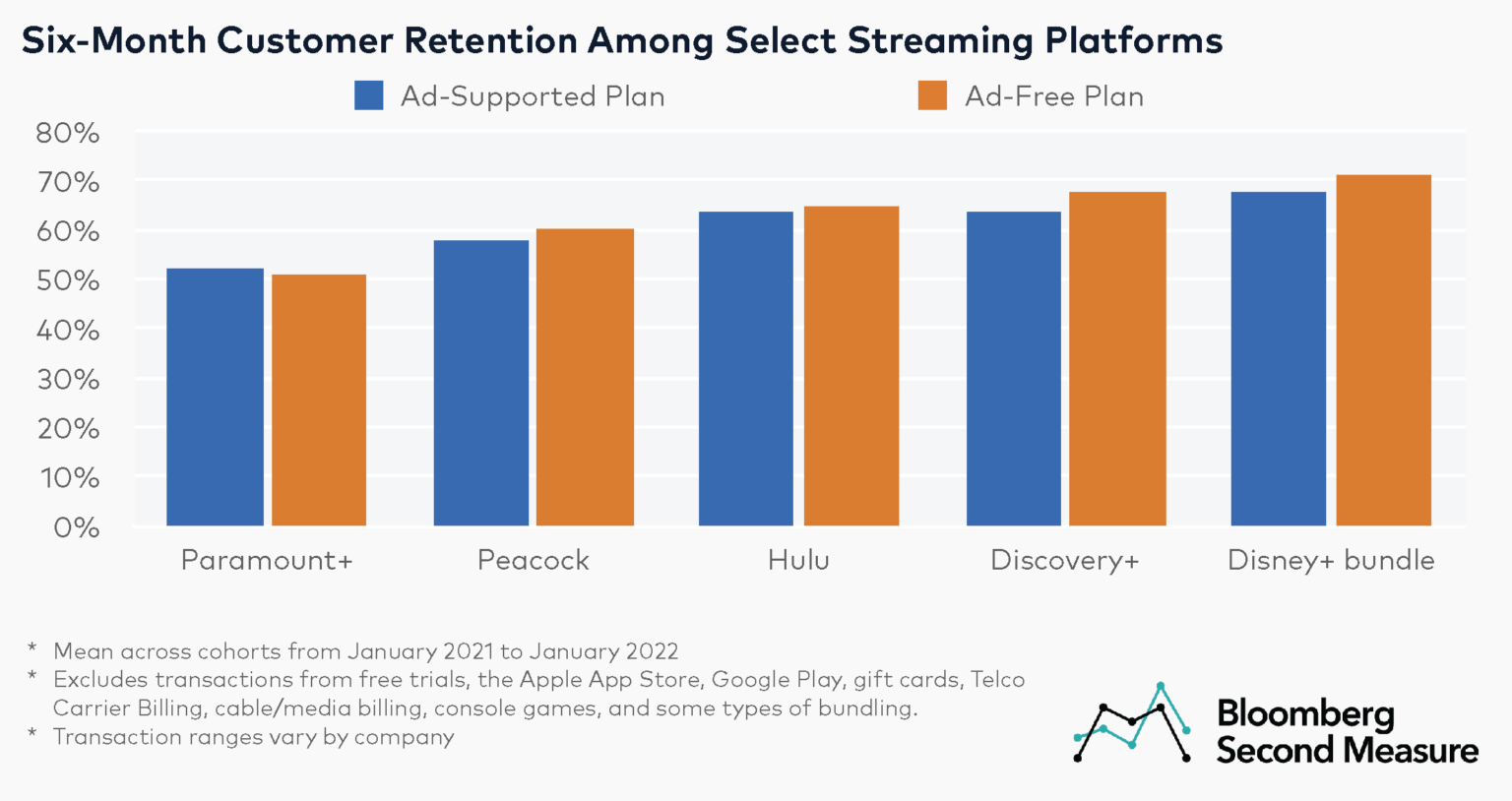

Disney+ recently announced its intention to launch an ad-supported tier in 2022, following in the footsteps of many of its streaming competitors. Among the streaming services in our analysis that offer both an ad-supported tier and an ad-free plan, most of them saw slightly higher customer retention rates with the ad-free version in 2021.

The Disney+ bundle that includes Hulu and ESPN+ currently offers an ad-free plan (identified in our data as U.S. transactions between $12.99 and $15.98) and an ad-supported plan (U.S. transactions between $18.99 and $21.98). The ad-free bundle plan had a retention rate of 71 percent after six months, compared to 68 percent for the ad-supported plan.

A similar pattern emerged for Discovery+, Hulu, and Peacock. For Discovery+, customer retention was 68 percent for the ad-free version (U.S. transactions from $6.99-$8.98) and 64 percent for the ad-supported service (U.S. transactions from $4.99-$6.98). Likewise, Hulu’s monthly plan without ads (U.S. transactions from $11.99-$14.98) had an average six-month retention rate of 65 percent, while the retention rate for the monthly plan with ads (U.S. transactions from $5.99-$8.98) was 63 percent. For Peacock, the average six-month customer retention rates were 60 percent for the ad-free plan (U.S. transactions from $9.99-$11.98) and 58 percent for the ad-supported plan (U.S. transactions from $4.99-$6.98).

Paramount+ is the only service in the analysis for which the ad-supported tier had a higher customer retention rate after six months. The six-month customer retention rate for the ad-free tier (U.S. transactions between $9.99-$11.98) was 51 percent, while the retention rate for the ad-supported tier (U.S. transactions between $4.99-$6.98) was 52 percent.

Netflix, the largest streaming service by U.S. subscriber count, currently does not plan to launch an ad-supported tier. However, the company’s CEO has not entirely ruled it out for the future.

How are streaming services standing out in a crowded market?

The pandemic led to increased demand for streaming services. As new players have entered the market and the industry competes for more eyeballs, streaming services are seeking ways to stand out. In 2021, movie studios including Disney and Warner Bros simultaneously released new features to movie theaters and to streaming platforms (Disney+ and HBO Max, respectively). In fact, Disney+ launched Premier Access fees for select new movie releases, starting with Mulan in late 2020. More recently, Amazon finalized its deal to acquire MGM and add thousands of movies and TV shows to its Prime Video streaming service.

Other streaming services have sought revenue opportunities beyond streaming. Last summer, Netflix began selling branded merchandise through its new e-commerce shop and also expanded its offerings to include video games.

As part of Discovery’s upcoming merger with WarnerMedia, Discovery+ and HBO Max will reportedly be combined into one streaming platform in the future. HBO Max also announced that it will continue to stream new Warner Bros movies in 2022, but after an exclusive theatrical release period.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.