Over the past couple of years, buying second-hand clothes has become mainstream – and the pandemic seems to have given the sector a further boost. We dove into foot traffic of several leading brick and mortar apparel resellers to find out how the rise in thrifting is impacting visits to second-hand stores.

The Rise of Thrifting

The second-hand apparel market in the United States has been growing for quite some time, with consumers citing ethical, financial, and environmental concerns as their motivation for visiting thrift shopping. As more customers became comfortable purchasing or renting pre-owned, pre-worn clothes, even established brands – including luxury labels such as Stella McCartney and mainstream fashion houses such as Express – began entering the resale and rental apparel market as well.

The second-hand apparel revival has boosted traffic to established chains of thrift and consignment stores, including Goodwill, which has been around since the early 20th century, Crossroads Trading and Plato’s Closet, which have both been around since the ‘90s. And although these brands also suffered a pandemic-induced setback, they quickly returned to growth.

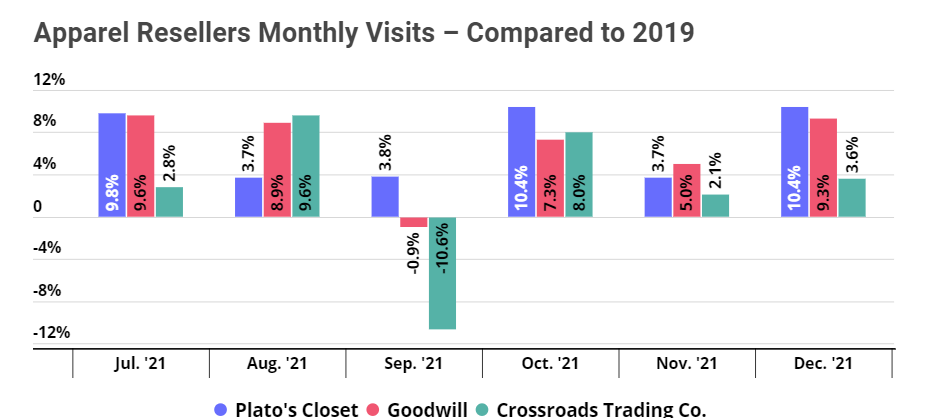

Throughout the second half of 2021 – except for September, where retail visits as a whole took a dip due to the spread of the Delta variant – all three chains saw steady year-over-two-year (Yo2Y) growth, culminating in a 10.4%, 9.3%, and 3.6% Yo2Y increase in December visits for Plato’s Closet, Goodwill, and Crossroads Trading Co., respectively.

Growth continuing in 2022

While thrifting was already on the rise pre-COVID, it seems that the pandemic has given the sector an additional boost. People spending more time at home finally got the chance to purge their closets, which increased the supply of high quality second-hand clothing in thrift stores. And this increased supply may continue in 2022, as people working from home continue to declutter their spaces.

On the demand side, some consumers who got into the habit of purchasing second-hand clothing during the period of economic uncertainty decided to stick with the habit now that their situations have somewhat stabilized. Others, who took the pandemic as an opportunity to move towards more sustainable consumption habits, have incorporated trips to the thrift stores into their “new normal” routine.

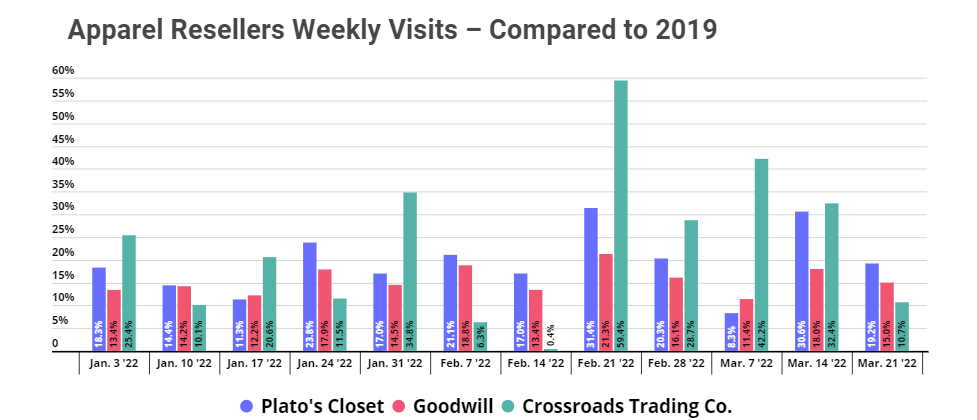

Foot traffic data shows that the growth in visits to second-hand apparel retailers has indeed continued into 2022. Despite the Omicron-induced nationwide lull in retail visits in early January, visits to the three brands have been up every week this year when compared to pre-pandemic 2019. The last full week of March saw visits up by 19.2%, 15.0%, and 10.7%, for Plato’s Closet, Goodwill, and Crossroads Trading Co., respectively, compared to the equivalent week in 2019.

Second-hand vs. Traditional apparel

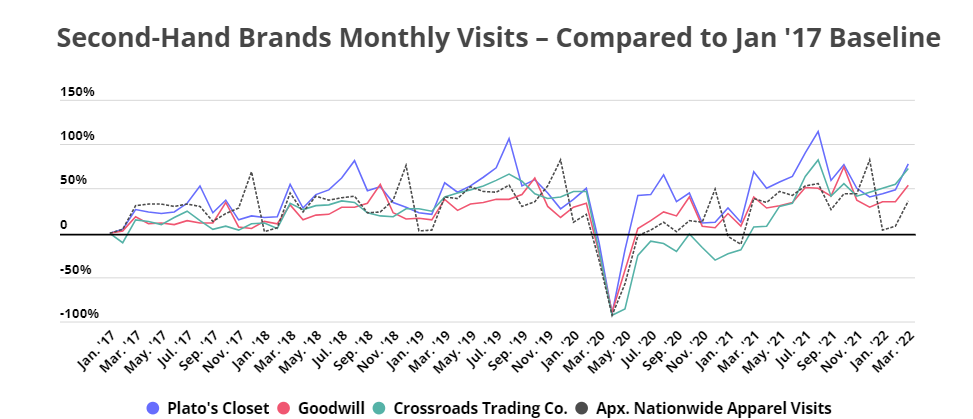

Although some consumers now prefer second-hand clothing stores to traditional apparel retailers, most consumers do not seem to treat the two categories as mutually exclusive. The chart below represents the approximate baseline change in foot traffic to Goodwill, Plato’s Closet, and Crossroads Trading alongside the change in nationwide apparel visits since January 2017.

In addition to confirming the slow and steady rise of apparel resellers over the last five years, the chart reveals an interesting insight about the seasonality of the second-hand apparel category. Whereas regular apparel visits tend to peak in December, foot traffic to thrift stores peaks in August and October. While the October peak is likely due to Halloween and costume shopping, the reasons for the August peak are less evident – perhaps parents facing back to school season look to buy second-hand clothes for their quickly growing kids, or maybe the surge is driven by consumers who enjoy thrift store shopping as part of their vacation routine.

Whatever the reason, the difference in seasonality trends between second-hand and traditional apparel visits seems to indicate that second-hand apparel chains are not necessarily in direct competition with stores that sell new clothing. Instead, consumers visit each category based on the specific need they are looking to fill.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.