Around this time two years ago, it was becoming clear that COVID wasn’t going away so quickly. Large corporations and smaller companies that a few months before the pandemic would not have dreamed of allowing work-from-home (WFH), were adjusting to managing a fully remote workforce. And, workers were learning that they enjoyed getting back almost an hour a day that was previously spent commuting while being just as productive.

Now that we have officially entered our third pandemic year, it’s becoming increasingly evident that office jobs in the new normal will look radically different than they looked in 2019. To dive deeper, we looked at more than 70 office buildings in Manhattan to see where foot traffic trends today stand compared to one, two, and three years ago.

Return to the Office

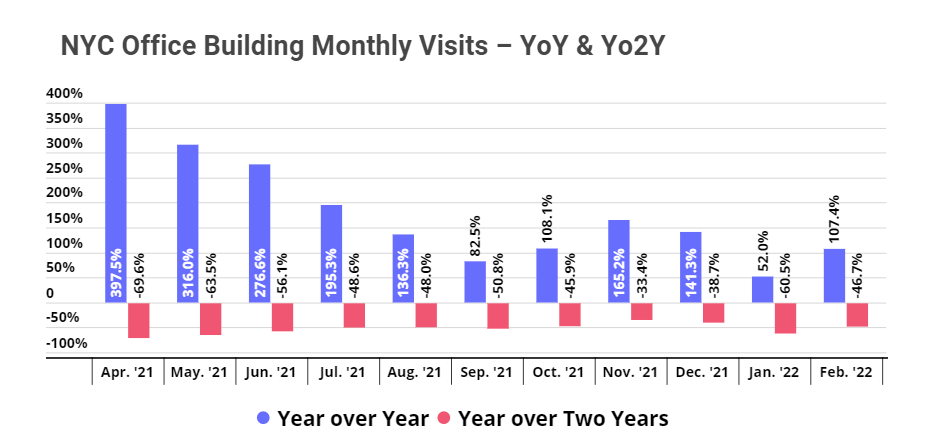

NYC office occupancy still has a long way to go before it returns to its pre-COVID levels. On the one hand, year-over-year (YoY) foot traffic to Manhattan office buildings is significantly up – February ‘22 saw a 107.4% increase – which means that many people have returned to the office in some sort of capacity. But the year-over-two-year (Yo2Y) gap persists. February office foot traffic in Manhattan was down 46.7%, on average, compared to visits in February 2020 on the eve of the pandemic.

The rise in YoY visits coupled with the persistent Yo2Y gap indicates that many are still working according to a hybrid or fully remote model. Some are going into work a couple days a week and working from home the rest of the time, while some employees – especially those who relocated far from their workplace during the lockdowns – are continuing to work completely or almost fully remote. But very few have returned to the pre-pandemic routine of spending every business day in the office.

Even major tech companies that long resisted allowing remote work on a regular basis have come around, with the least-WFH friendly policies still permitting hybrid work, indicating that this shift is here to stay.

Sensitivity to COVID Waves

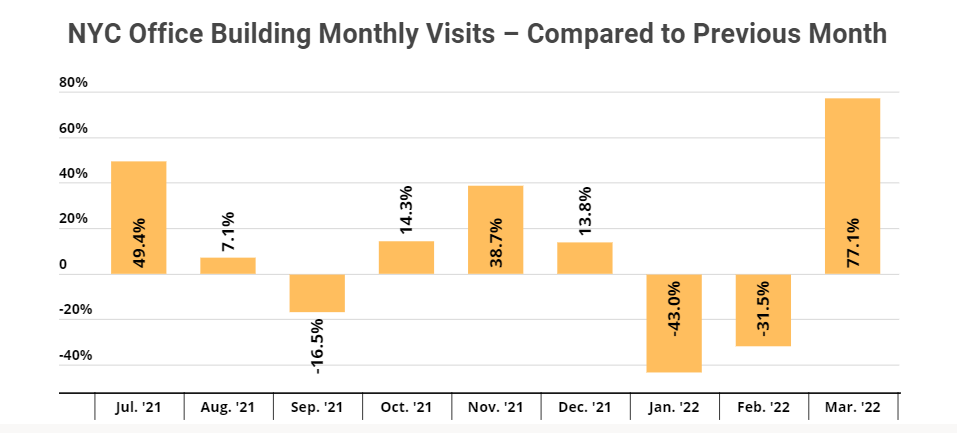

Even though some sort of permanent shift seems to be taking place, it is still too early to assess the full impact of the transition to more flexible work models, since the pandemic is not quite over. Month-over-month (MoM) data shows just how much sensitive office occupancy is to new COVID waves. Monthly visits grew in July and August ‘21 compared to the previous month, only to fall in September as the Delta-induced COVID cases peaked. MoM rose again in October, November, and December, but decreased in January and February as the Omicron wave spread throughout the country. In March, as Omicron abated, MoM visits surged again.

This data shows that the office recovery is still unfolding. People are slowly returning to the office in some capacity, but the workplace recovery is precarious. After such a long period of time working fully remote, the default reaction to a new COVID wave is to revert to WFH until the risks subside, meaning the full extent of the office recovery will likely only emerge once the COVID situation fully stabilizes.

Current State of Affairs

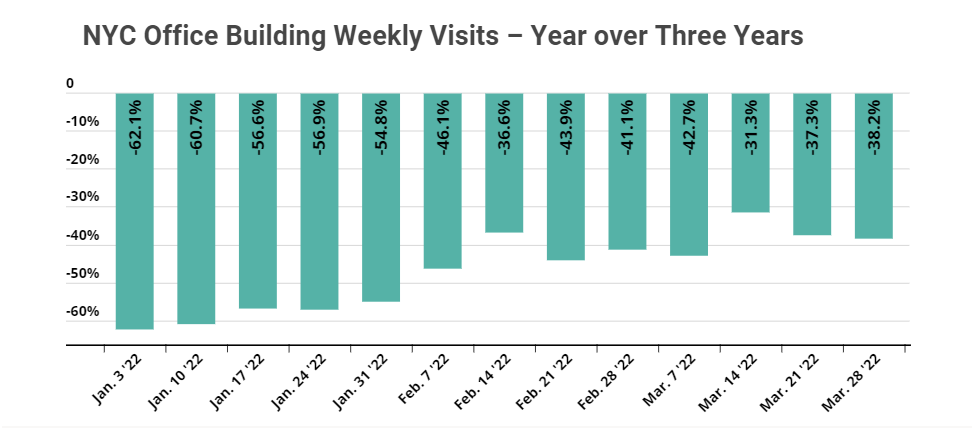

The pandemic hit the United States around around March 2020, so comparing recent foot traffic data to weekly visits three years ago (in February and March 2019) can give us a more accurate picture of the current state of the office recovery. The chart below shows that Yo3Y gap has narrowed since January and early February, and the comparison to 2019 visits is similar now to what it was in November and December ‘21.

The increasing pace of return – even in the face of rising gas prices and other challenges – is yet another indication of the continued draw to the office. While a ‘new normal’ is likely taking place in the professional landscape, that new normal will still consist of a heavy office component. Hybrid work environments will likely play a critical role in the coming years, but the continued pull of office visits speaks to the balance many professional environments are looking to achieve. Elements like in-person collaboration, culture building and new employee onboarding deepen the value of office presence, even in a time where flexibility becomes an ever more important component.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.