Our quarterly indexes track foot traffic patterns for major retail and retail-adjacent sectors, including grocery, superstores, home improvement, fitness, and dining. Below is a taste of our findings. For the full report, visit our Q1 2022 quarterly indexes.

Fitness Foot Traffic up Yo3Y for 2nd Quarter in a Row

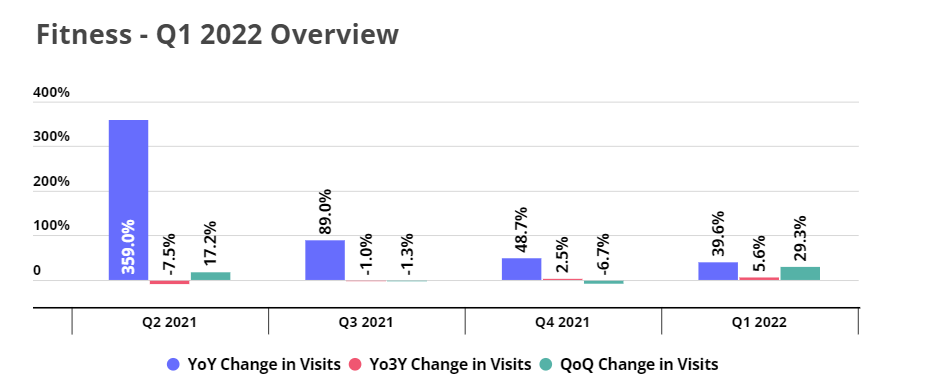

Offline fitness experienced a revival in Q1. After a budding recovery in Q4 followed by an Omicron-induced drop in visits in January, fitness foot traffic rose once more, leading to an overall 5.6% increase in fitness visits in Q1 2022 compared to Q1 2019. This follows a Yo3Y quarterly growth of 2.5% in Q4 2021, meaning that fitness visits over the past two quarters have not only matched pre-pandemic levels, they’ve exceeded them.

The current fitness foot traffic numbers are a testament to the strong demand for offline fitness channels. Much of the foot traffic likely comes from people who were exercising in gyms before the pandemic but had stopped doing so during the COVID era. And for many of these consumers, the novelty of a fitness routine consisting exclusively of home workouts and digital classes has likely worn off after two years.

But some of the visits are also coming from new exercisers. In a survey we conducted in March 2022, almost half of respondents (47.7%) stated that they had taken up or increased their exercising since the pandemic. For those new to working out, exercising in a gym – whether out on the floor under the supervision of trainers or in instructor-led classes – can be invaluable in terms of learning proper form and avoiding injuries. As the pandemic-fueled interest in health and wellness shows no sign of fading, brick and mortar fitness centers are well positioned to continue their growth trajectory.

Fitness Visits Take Off Mid-Q1

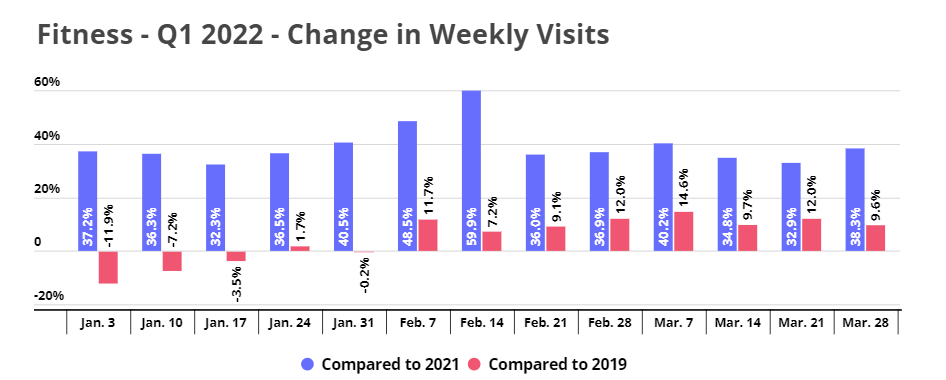

Whereas January is typically one of the strongest months for fitness, as consumers motivated by New Year’s Resolutions hit the gym with gusto for the first couple of weeks of the year, this year’s fitness visits only started taking off mid-February. Due to the spread of Omicron, the fitness category did not see the usual beginning-of-the-year boost – and comparisons to strong January 2019 made the sector seem worse off than it was. As the COVID wave receded, however, the sector revealed its true strength: offline fitness began to climb again, and weekly visits have exceeded 2019 for the entire second half of the quarter.

Notably, this growth in fitness foot traffic took place within the context of large-scale branch closures, which has impacted visits to some of the bigger category leaders. LA Fitness, Gold’s Gym, and 24 Hour Fitness were only some of the major fitness chains that have permanently shuttered a number of locations over the past two years.

But a number of rising stars, including Blink Fitness, Chuze Fitness, EoS Fitness, and Esporta, have seen extraordinary growth recently which has offset the widespread branch closures at some of the legacy brands. And it should also be noted that although LA Fitness, Gold’s Gym, and 24 Hour Fitness had fewer venues in Q1 2022 than they did in 2019, the average visits per venue to the branches that remained were on par with pre-pandemic levels – proving once more that the end of gyms is not coming any time soon.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.