Source: https://insights.consumer-edge.com/2022/05/chipotle-shows-rising-prices-not-slowing-down-fast-food/

As rising input costs threaten margins, several Limited-Service restaurants have been forced to hike prices. Chipotle noted on its recent earnings call that a 10% y/y increase in prices had resulted in minimal impact on demand, with same-store sales growing 9%. In today’s Insight Flash, we look at how Chipotle compares to the broader industry, focusing on how its demographics have responded to more expensive meals.

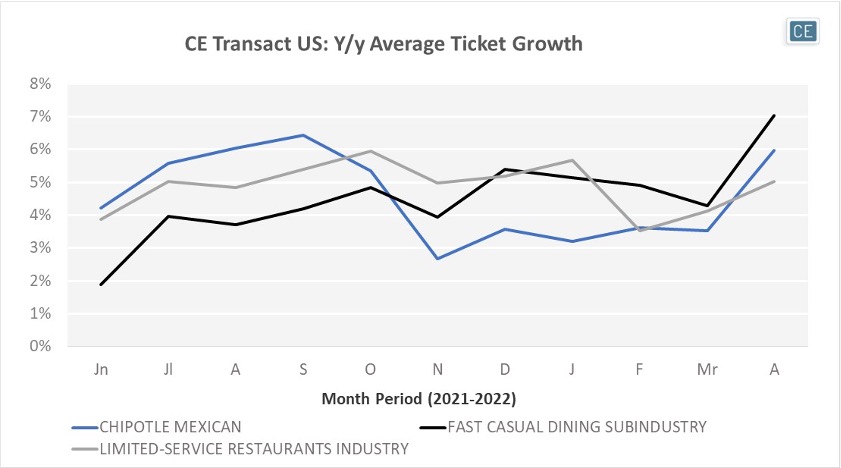

From the end of 2021 through March, Chipotle average ticket growth has actually lagged the Fast Casual Dining subindustry and the Limited-Service Restaurants industry. Average ticket growth would capture not only price increases, but also any changes to ordering if customers were trading down to lower-priced foods. However, April average ticket did shoot up by 6%, matching last summer’s growth which outpaced the industry and subindustry.

Average Ticket

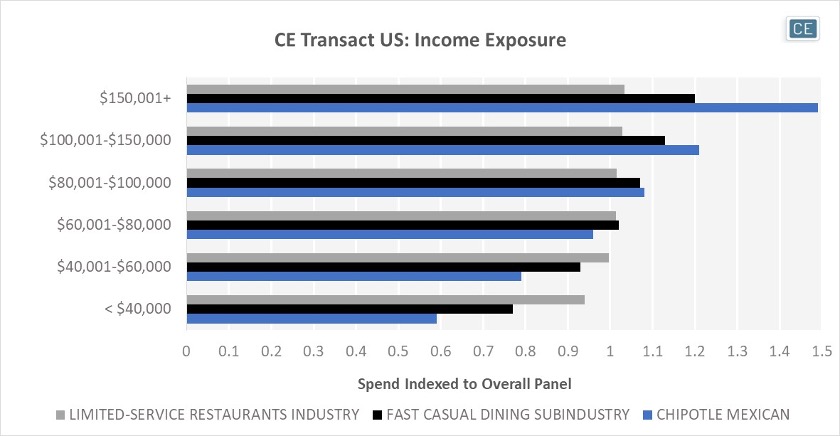

Part of the reason Chipotle may be seeing “very little resistance” to its price increases could be because its customers skew much higher income than the typical Limited-Service Restaurant diner. While overall the Limited-Service Restaurant industry has only a 1.03 overindex to the highest income shoppers, those making over $150,000 per year are 1.49 times more likely to eat at Chipotle than our panel average. This is higher than even the overall Fast Casual segment, which the highest income individuals are 1.20 times more likely to dine in.

Income Exposure

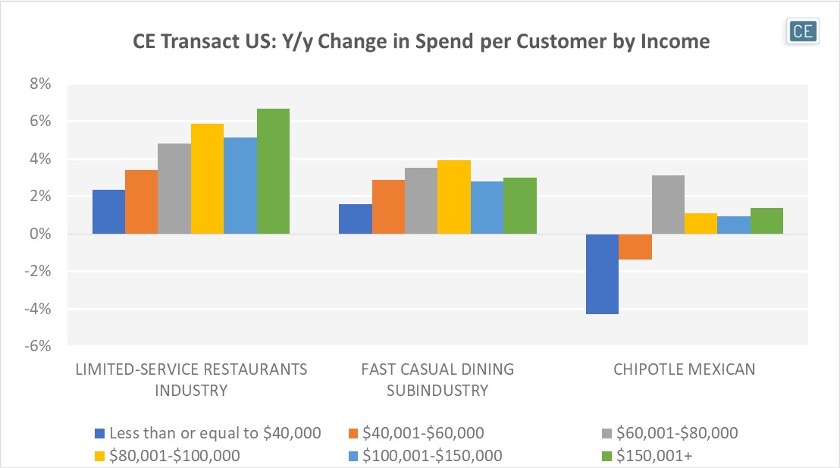

However, Chipotle’s price increases have had some negative consequences among other income groups. Although the highest income groups all spent more per individual at Chipotle in 1Q22, the same could not be said for those making under $60,000 per year. Those making $40,000 – $60,000 spent -1.4% less, and those making under $40,000 spent -4.3% less. Although these groups did have higher overall spend, this was driven largely by more lower income individuals visiting Chipotle, while the high prices may have led individuals who did visit to make fewer trips.

Spend per Individual

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.