In this Placer Bytes, we look at recent foot traffic patterns for David’s Bridal, the go-to destination for many brides-to-be across the nation, and for Bed Bath & Beyond, a popular choice for wedding registries.

David’s Bridal Benefits from 2022 Wedding Bump

As life returns to normal in states across the nation, 2022 is shaping up to be a huge year for weddings. Gradually waning cases of COVID mean that couples can plan their big day with a lot more certainty than in 2020 and 2021. Enter David’s Bridal, the nation’s leading bridal dress retailer. The wedding sector’s comeback has meant big things for the brand. In January, David’s Bridal announced the expansion of its retail footprint with plans to open two new stores during Q1 2022. What’s more, the company is staying on top of retail trends by announcing a “Guaranteed in Stock and Ready to Ship” bridesmaids collection as well as a comprehensive wedding mobile planning app.

According to analysis from The Knot, as many as 2.6 million weddings are expected to take place in 2022, up from 2019 pre-pandemic levels of 2.2 million. Furthermore, to support the planning of the growing number of ceremonies, the demand for wedding planners and vendors has skyrocketed throughout late 2021 and 2022.

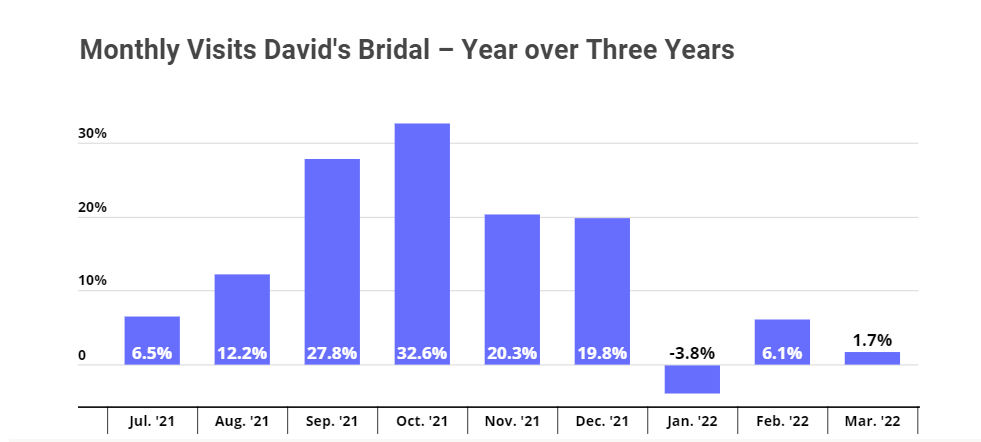

The Yo3Y growth in foot traffic at David’s Bridal is a testament to the resurgence of the wedding sector this year and to the retailer’s strong position in the category. Visits in February and March were up by 6.1% and 1.7%, respectively, compared to the same months in 2019. As this year’s wedding season is just getting started, there’s large potential to see even more growth in foot traffic at David’s Bridal as we look ahead further into 2022.

Bed Bath & Beyond Visits Per Venue Are On The Rise

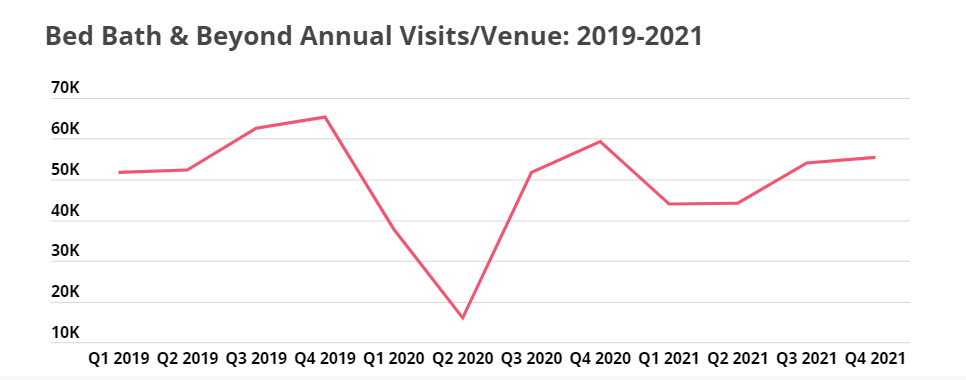

In 2021, Bed Bath & Beyond launched several strategic initiatives, including an expanded assortment of owned brands, expanded same-day delivery partnerships with Uber Eats and DoorDash, the opening of several new regional fulfillment centers, and a new store-in-store partnership with Kroger. And although Bed Bath and Beyond has yet to close its Yo3Y foot visit gap, the brand’s visits per venue have been slowly but steadily rising back up from a 2020 low.

Remodeled Stores Overperforming

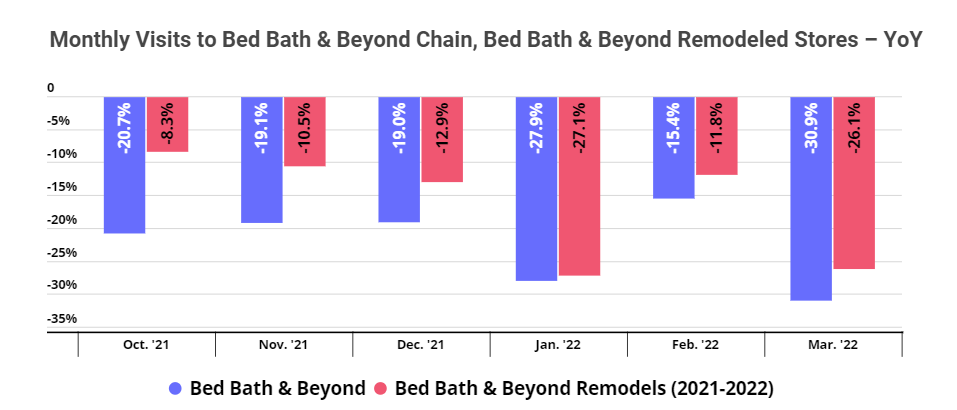

Aside from the gradual visits per venue recovery, Bed Bath & Beyond recent remodel efforts offer another bright spot in the home goods retailer’s performance. In 2020, Bed Bath & Beyond announced plans to remodel around 450 stores over the following three years as part of a wider store fleet optimization strategy, which also included closing 200 locations over 2021 and 2022.

In 2021, the brand initiated 131 store remodels and completed around 80. To see how these remodeled stores are performing relative to the legacy Bed Bath & Beyond venues, we’ve isolated the performance of the first 50 stores the company remodeled, and compared visit numbers to foot traffic to the brand as a whole. As the graph below shows, the remodeled stores outperformed foot traffic to legacy stores every month between October 2021 and March 2022. So, as Bed Bath & Beyond continues its remodeling program, we can expect to see a positive impact on overall visitation trends to its stores.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.