Source: https://secondmeasure.com/datapoints/consumer-spending-wholesale-clubs-costco-sams-club-bjs/

Wholesale clubs experienced a sales boost early in the pandemic, as consumers rushed to stockpile pantry essentials and household goods. But how have wholesale clubs fared two years after the panic-buying rush? We looked at a few of the major wholesale club competitors—Costco Wholesale (NASDAQ: COST), BJ’s Wholesale (NYSE: BJ), and Walmart-owned Sam’s Club—to see how consumer spending has changed at these retailers. In addition to some wholesale clubs continuing to see strong growth in sales and average spend per customer throughout the pandemic, we also found that fuel sales through wholesale clubs skyrocketed in March 2022.

Sales at Costco (NASDAQ: COST) and Sam’s Club have continued to grow since the initial panic-buying phenomenon

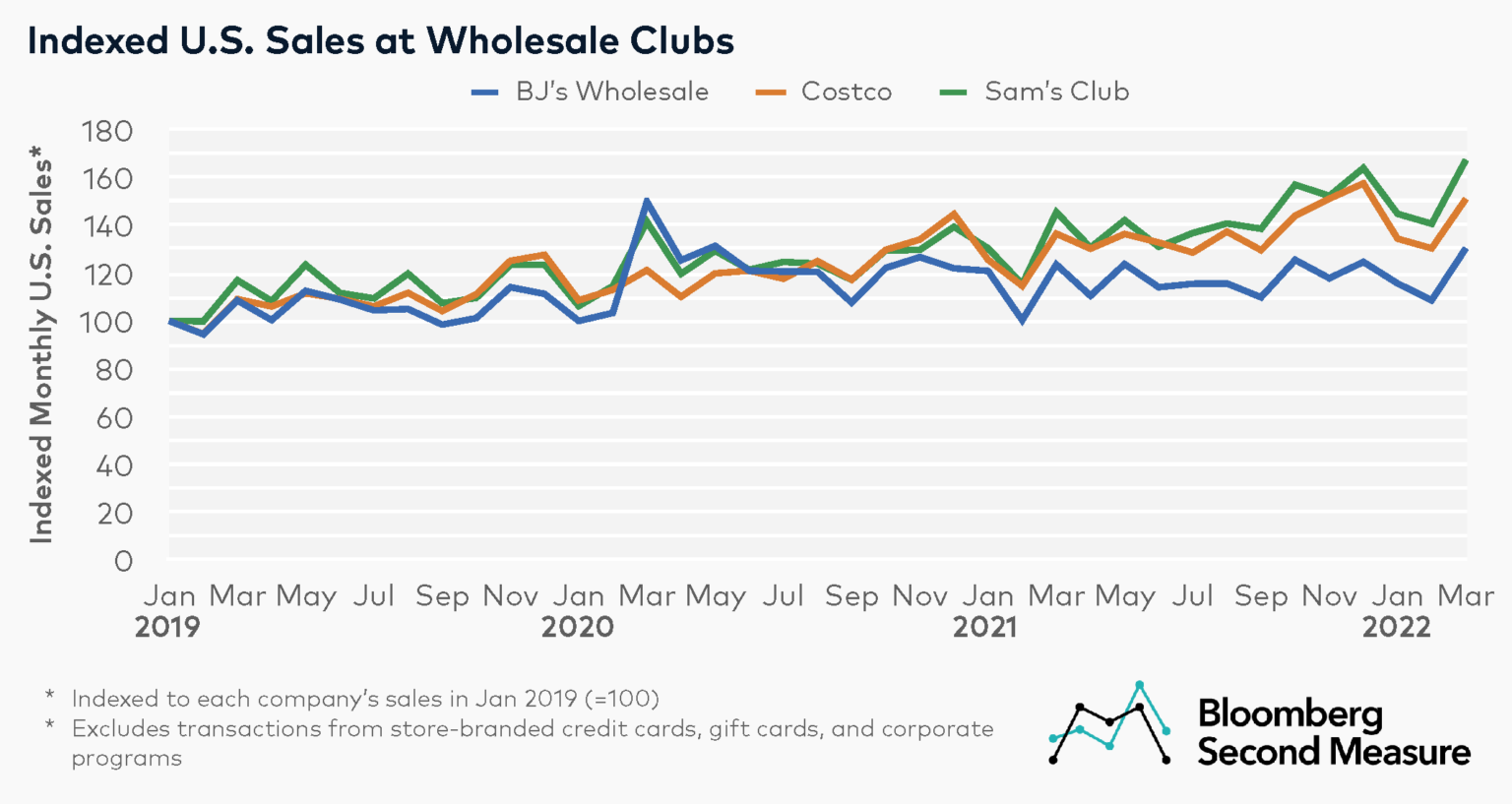

Increased sales at the three major wholesale clubs coincided with the start of the pandemic. In particular, BJ’s Wholesale and Sam’s Club experienced sales growth of 45 percent and 23 percent, respectively, between February and March of 2020. Costco saw a more modest sales increase of 7 percent month-over-month.

Two years after the start of the pandemic, sales at Costco and Sam’s Club reached new heights. In March 2022, Costco sales were up 25 percent compared to March 2020, and Sam’s Club sales grew 18 percent in the same period. On the other hand, BJ’s Wholesale sales were down 13 percent in March 2022 compared to the same month two years earlier. Notably, Bloomberg Second Measure data does not include sales made by gift card, store-branded credit cards, B2B transactions, or corporate programs.

Wholesale clubs charge members an annual fee in order to access their stores, which offer products in bulk and typically at a lower price than at other retailers. In recent years, however, Costco partnered with Instacart and piloted same-day grocery delivery with Uber, enabling consumers to shop without a membership. In March 2022, BJ’s also became the first wholesale club to be listed on DoorDash.

Sales per customer are still increasing at Costco and Sam’s Club, but remain below the pandemic peak for BJ’s Wholesale (NYSE: BJ)

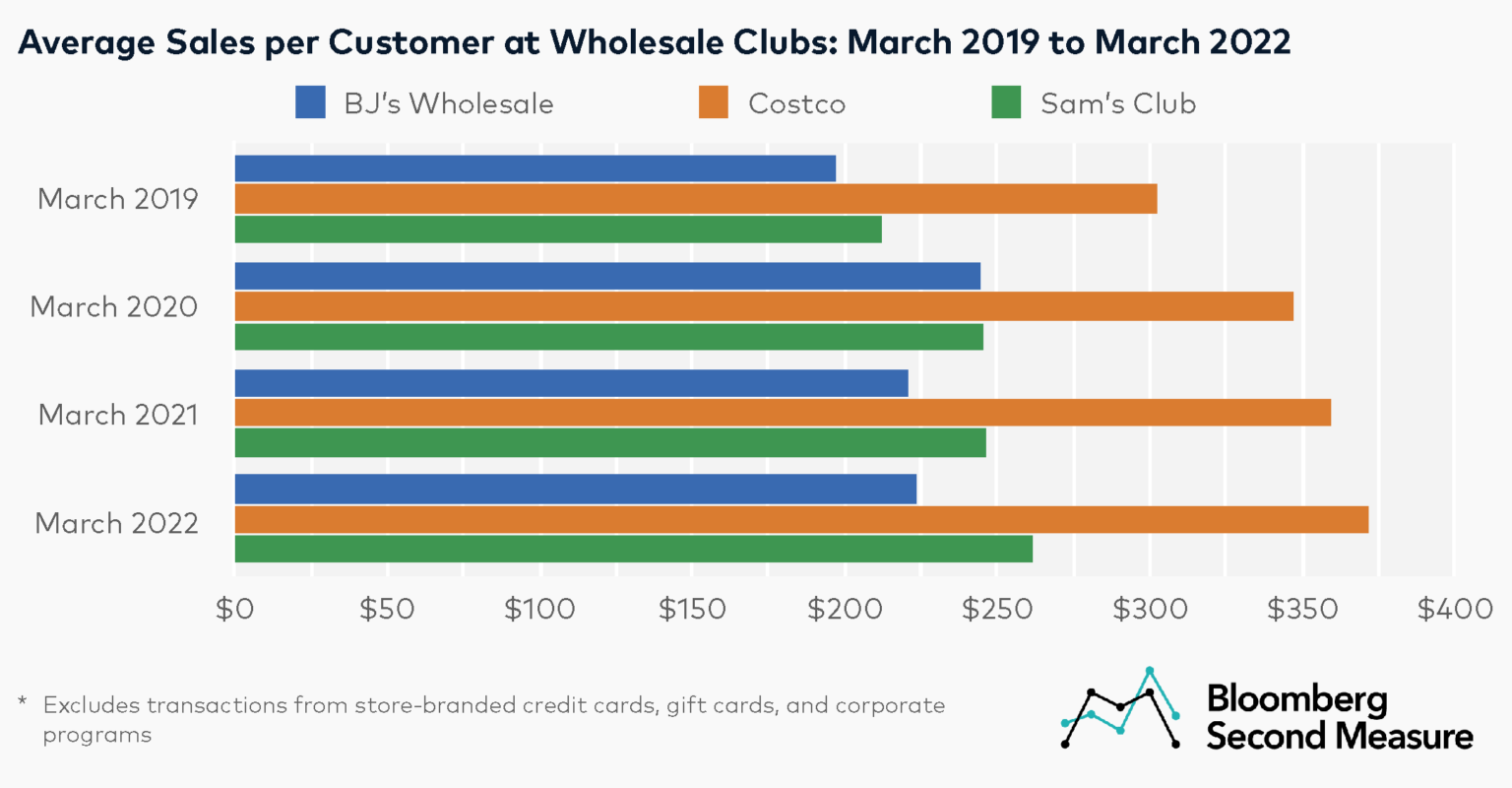

Our data shows that consumer spending trends related to average sales per customer have followed a similar pattern as overall sales growth. For all three wholesale clubs in our analysis, average monthly sales per customer jumped between March 2019 and March 2020, increasing 24 percent for BJ’s, 16 percent for Sam’s Club, and 15 percent for Costco.

At Costco and Sam’s Club, the average monthly sales per customer increased further over the following years, with each company’s sales growing 7 percent between March 2020 and March 2022. Conversely, BJ’s sales decreased 9 percent in the same time frame. In March 2022, the average monthly sales per customer was $371 at Costco, $261 at Sam’s Club, and $224 at BJ’s Wholesale. Consumer spending data also showed that Costco has the highest average transaction values among the three companies, and customers visit Costco more frequently than its competitors—with 3.3 transactions per customer on average at Costco in March 2022, compared to 3.0 transactions at Sam’s Club and 2.6 transactions at BJ’s Wholesale.

All three of these wholesale companies offer a broad mix of products, including groceries, household goods and appliances, electronics, jewelry, clothing, and furniture. Costco also offers travel packages for its members, which may partially contribute to higher spending at Costco compared to its competitors.

Wholesale clubs are seeing higher sales for their fuel offerings

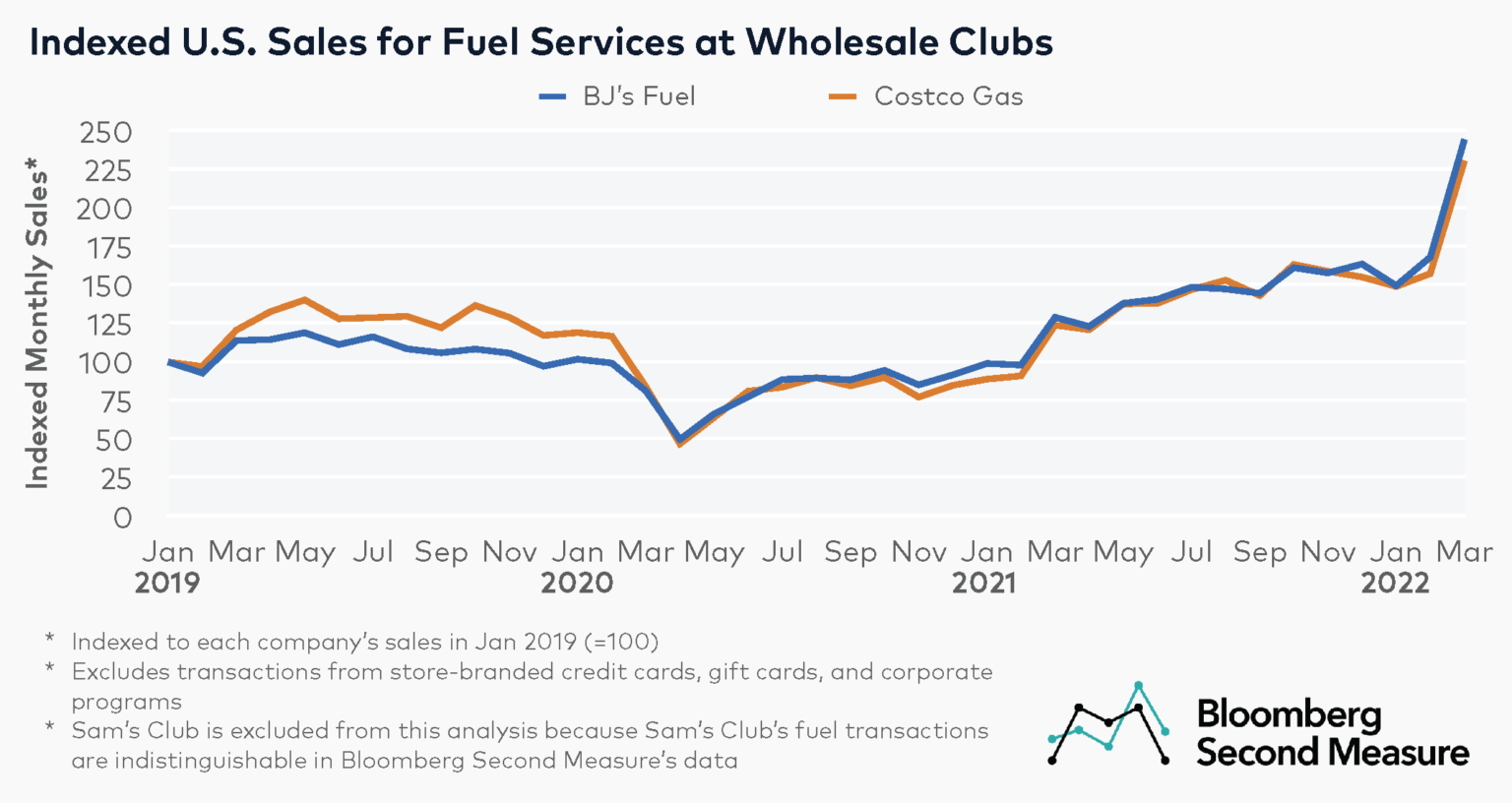

In recent months, wholesale clubs have seen major sales growth for their gas stations. With the cost of fuel rising, some consumers have reportedly been signing up for wholesale club memberships in order to save at the gas pump.

In March 2022, Costco and BJ’s experienced month-over-month consumer sales increases of 46 percent and 45 percent, respectively, for their fuel services. Compared to the same month in 2021, fuel sales were 89 percent higher for BJ’s and 86 percent higher for Costco in March 2022.

A closer look at the data indicates that this March 2022 increase was from a combination of rising customer counts as well as increased spending. Customer counts grew 18 percent month-over-month at BJ’s Fuel and 16 percent at Costco Gas. Likewise, sales per customer at BJ’s Fuel increased 23 percent month-over-month in March 2022, compared to an increase of 26 percent at Costco Gas.

Sam’s Club also offers gas stations for members, but Bloomberg Second Measure’s consumer spending data does not isolate the company’s fuel transactions. Walmart+, which offers access to discounted fuel through Sam’s Club as well as its partnerships with stations such as Exxon and Mobil, has also reportedly been further boosting gas discounts for its members.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.