Amazon reported disappointing earnings last week, noting overcapacity in its supply chain as online retail sales fell and the company issued disappointing guidance for next quarter. In today’s Insight Flash, we dig into some of the dynamics behind the report, including looking at return purchase behavior for those who started shopping for products sold by Amazon.com during the COVID-19 pandemic versus earlier cohorts, where Amazon.com shoppers have been spending instead, and what US trends look like by income and age demographics.

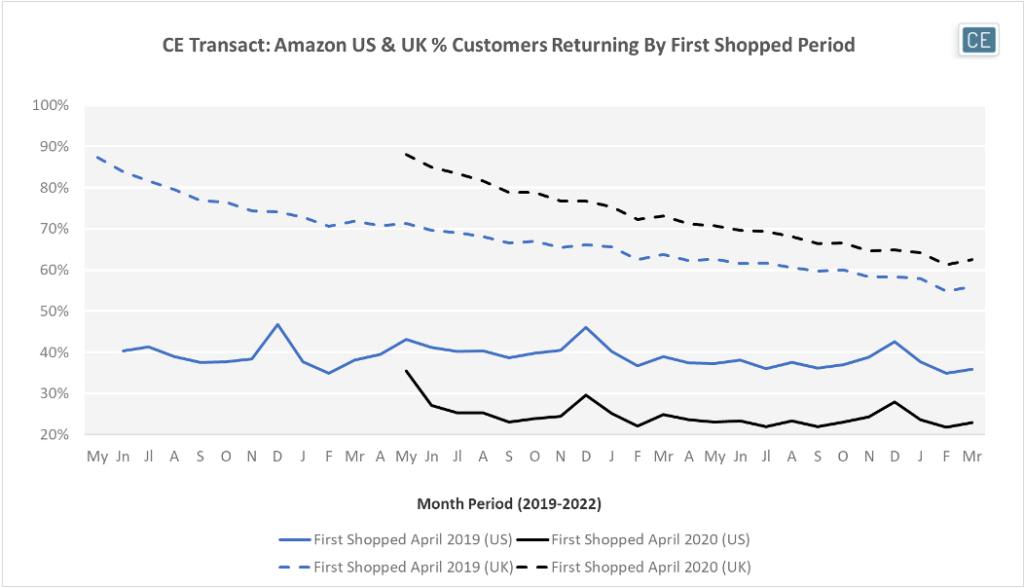

Some of the slowdown may be due to shoppers who turned to Amazon during the pandemic, but have since moved back to their previous shopping habits. For this analysis, we take advantage of our ability to separate Amazon.com product sales from third-party sales and focus on the Amazon-owned inventory (repeat purchases would likely be higher if both owned inventory and marketplace were included). In the US, only 36% of those who first shopped Amazon.com in April 2020 made another purchase in May. A year earlier, retention had been much higher with 40% of those who made their first purchase in May 2019 coming back in June. By March of 2022, 36% of those in the 2019 cohort were continuing to come back to Amazon versus only 23% of the 2020 cohort – much higher churn in a shorter time period. In the UK, the cohort who first started shopping during the pandemic is behaving more similarly to the year-earlier group. 63% of those who started shopping in April 2020 returned to Amazon.com in March 2022, on par with 64% of those who started shopping in April 2019 returning in March 2021. However, the older cohort has seen some deterioration in repeat shopping rates in the last year, with only 56% shopping in March 2022.

Customer Loyalty

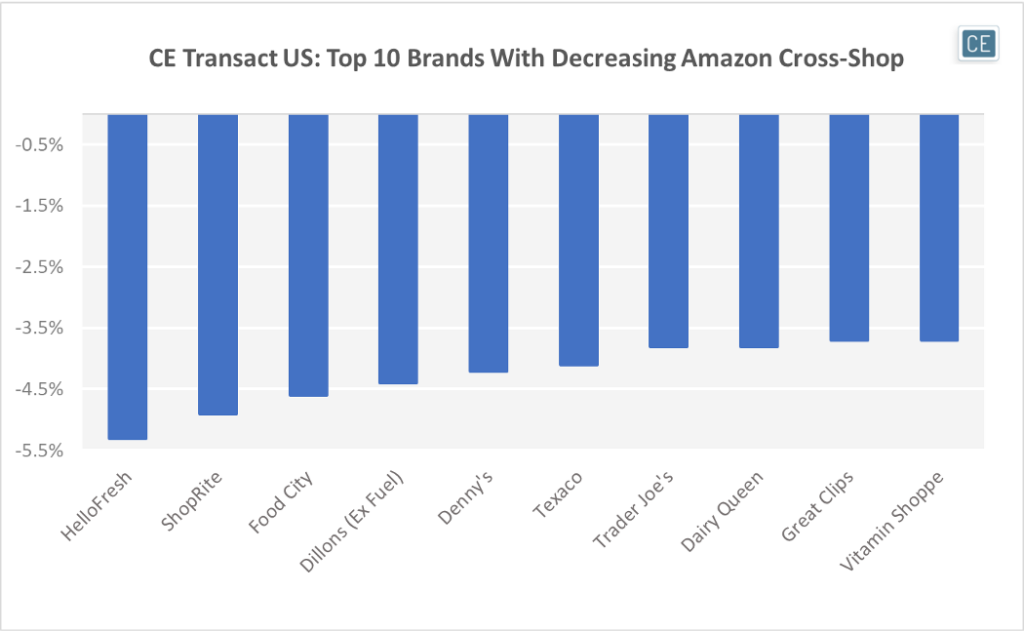

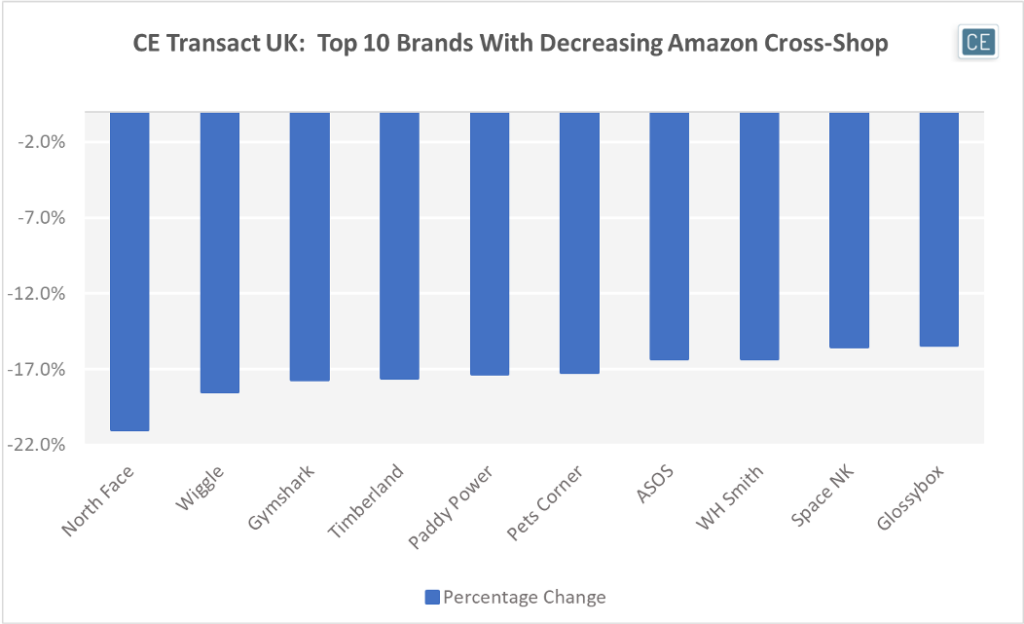

One common question is that if Amazon.com growth is slowing, which other companies might be benefitting? Looking at cross-shop rates, it seems like Amazon may be losing out on some of its share of groceries and household essentials. In the US, HelloFresh customers saw the largest decrease in Amazon cross-shop rates, followed by several grocers. This might imply that shoppers are filling their baskets and pantries with meal kits or grocery items purchased in-person instead of buying from Amazon.com. In the UK, shoppers of outdoor and athletic brands like North Face, Wiggle, Gymshark, and Timberland saw the largest decrease in Amazon.com cross-shop versus last year. These active customers may be more predisposed to going back out into the world and adventuring to brick and mortar stores.

Cross-Shop

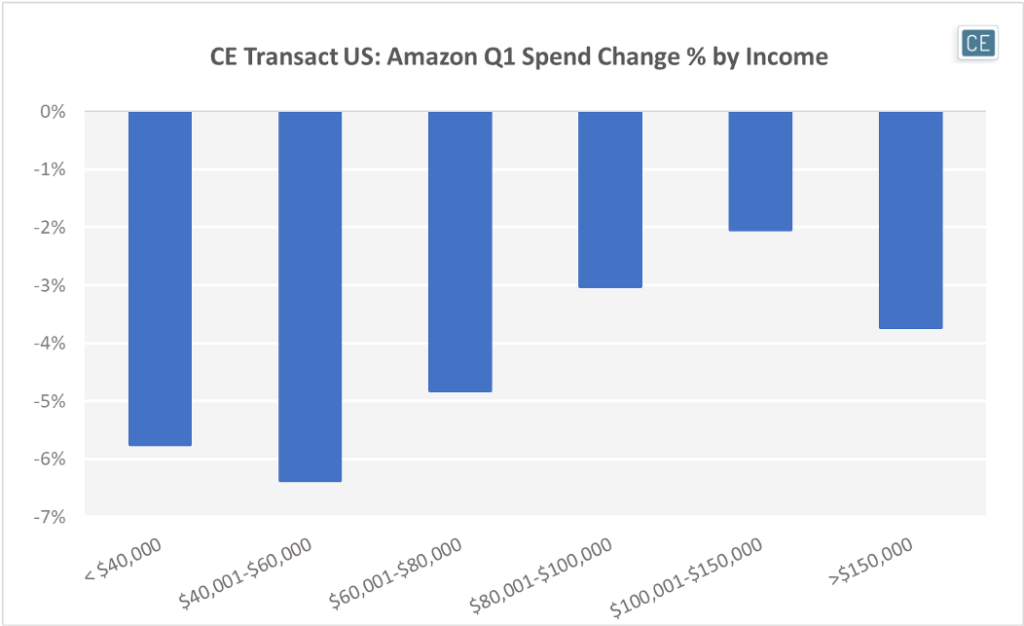

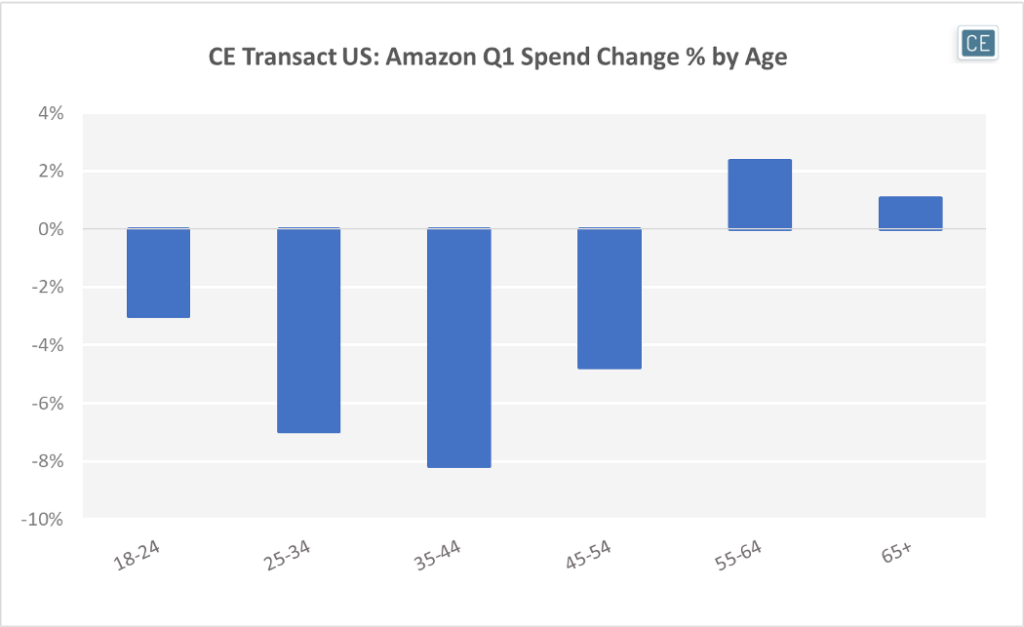

CE Transact US allows users to also see where Amazon spend is declining by demographic. In 1Q22, all income groups in the panel spent less on Amazon.com than in 1Q21. However, perhaps due to overall rising prices forcing shoppers to concentrate more spend on necessities like gas and fresh food, lower income groups showed a larger decline in spend than higher income groups. Interestingly, older age groups did spend more on Amazon.com in 1Q than they did last year. This may be due to some shoppers in this category feeling more wary about going out due to omicron, or because this group’s slower Amazon.com adoption in earlier years moves current customers closer into the “early adopter” profile within their age group now.

Demographics

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.