While some video streaming platforms have been in the news recently for implementing ad-supported tiers or experiencing declining subscriber counts, an analysis based on Bloomberg Second Measure’s alternative dataset shows that as of March 2022, major music streaming subscription services like Spotify (NYSE: SPOT) and Amazon Music continued seeing subscriber growth in the U.S. for their paid subscription plans. Between these two music streaming companies, Spotify also had the higher customer retention rate.

Alternative data shows that Spotify (NYSE: SPOT) and Amazon Music have seen strong year-over-year subscriber growth

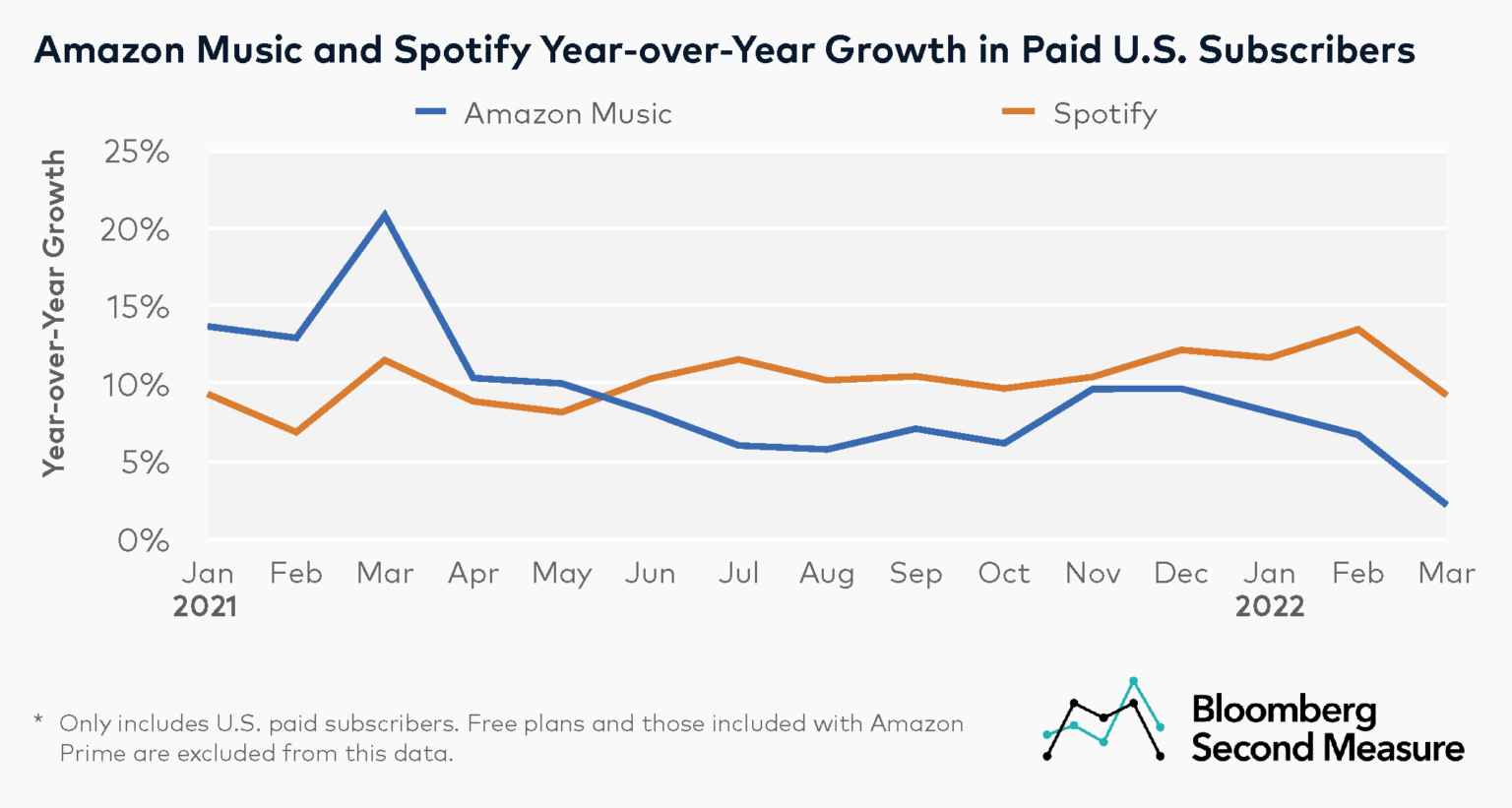

For both Spotify and Amazon Music, the average monthly year-over-year growth rate for paid U.S. subscribers was 10 percent in 2021. Subscriber growth has continued for these music streaming subscription services into 2022. In March 2022, the number of paid Spotify subscribers in the U.S. increased 9 percent year-over-year, while customer counts at Amazon Music grew 2 percent.

Interestingly, Spotify sustained double-digit year-over-year growth in its U.S. paid subscribers for nine of the previous twelve months, while year-over-year growth at Amazon Music generally slowed down during the same time period.

Both Amazon Music and Spotify offer multiple subscription plans. Amazon Music Prime is a limited music streaming subscription service included with Amazon Prime (and therefore excluded from our dataset), while Amazon Music Unlimited offers a much larger content library for an additional subscription fee. Amazon Music Unlimited offers individual plans at different price points for Prime and non-Prime members, as well as a family plan and a single-device plan for streaming music exclusively from an Echo device or Fire TV. In May 2022, Amazon Music raised its subscription prices for the single-device plan and for the individual plan for Prime members.

Spotify is known for offering a free plan with ads and limited features, as well as premium plans for individuals, couples, and families. Both Amazon Music and Spotify also offer a student plan at a discounted rate.

Notably, our alternative dataset only includes U.S. paid subscriptions. Free plans (such as music subscriptions already included with Amazon Prime), free trials, and international subscriptions are excluded from this analysis.

Spotify has a higher customer retention rate than Amazon Music

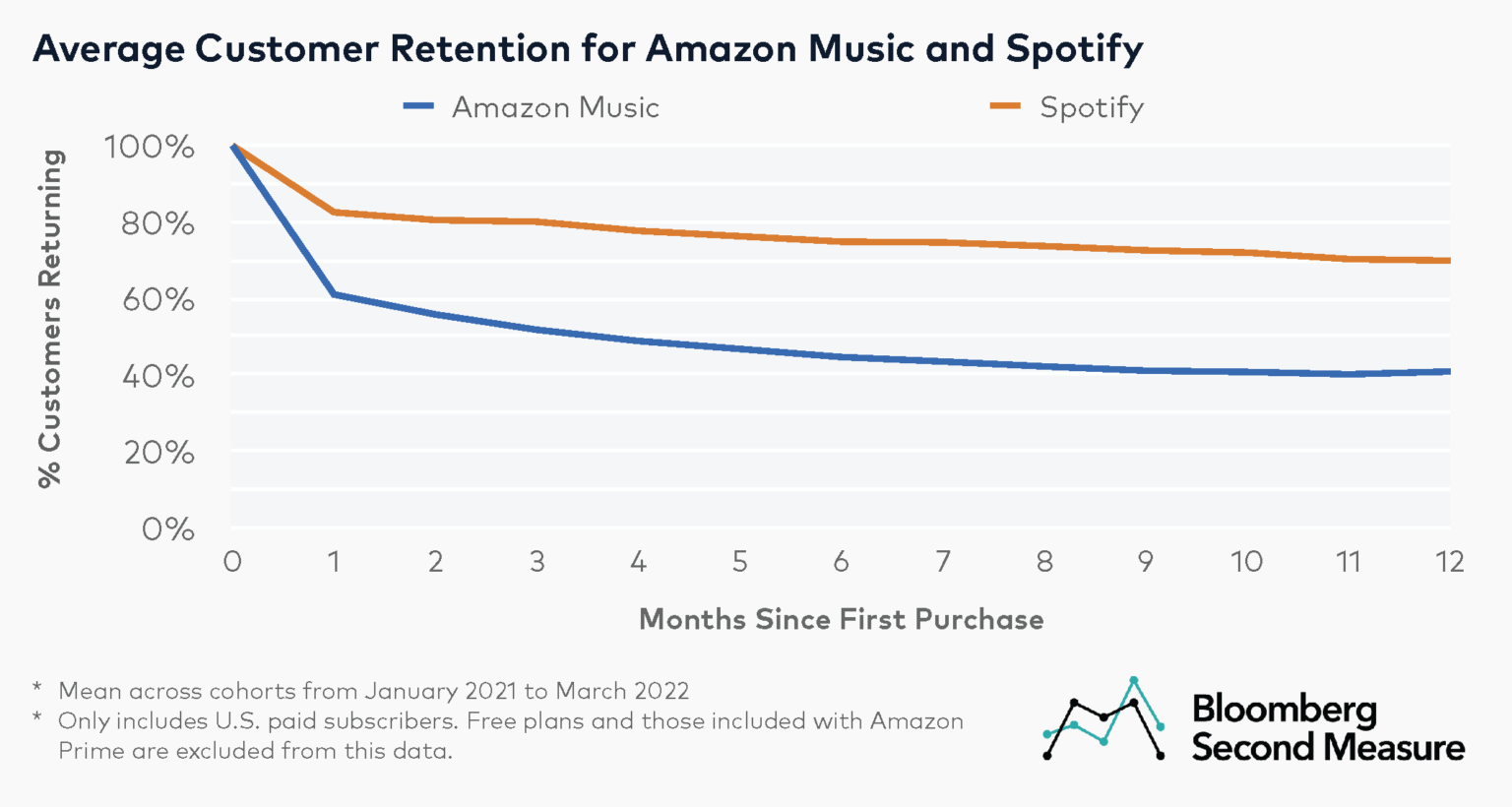

While subscribers are continuing to grow for both music streaming companies, our data reveals that Spotify customers are more likely than Amazon Music customers to stay with the service. Among consumers who made their first Spotify purchase between January 2021 and March 2022, 75 percent on average were retained after six months and 70 percent remained subscribers after twelve months.

On the other hand, the average customer retention rate for Amazon Music during this time frame was 45 percent after six months and 41 percent after twelve months. One potential factor that may affect customer retention rates at Amazon Music is that subscribers can choose to purchase monthly plans or annual plans. By contrast, Spotify only offers monthly subscriptions.

Streaming companies are branching out beyond music

While both services originated as music platforms, they have since expanded to include other types of audio content. More specifically, both Spotify and Amazon Music have ventured into podcasts, though in some cases this decision has led to controversy. In addition, Spotify announced earlier this month that it will launch “Spotify Island” within the online game platform Roblox, marking its foray into the “metaverse” and expanding its reach outside of its own platform.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.