Following a strong 2021, the impact of inflation and rising prices have now reached the home improvement sector. We dove into location analytics data for leading retailers to understand whether the pandemic-induced surge has finally come to an end and what lies ahead for these categories.

Home Depot and Lowe’s Visit Growth Stalls

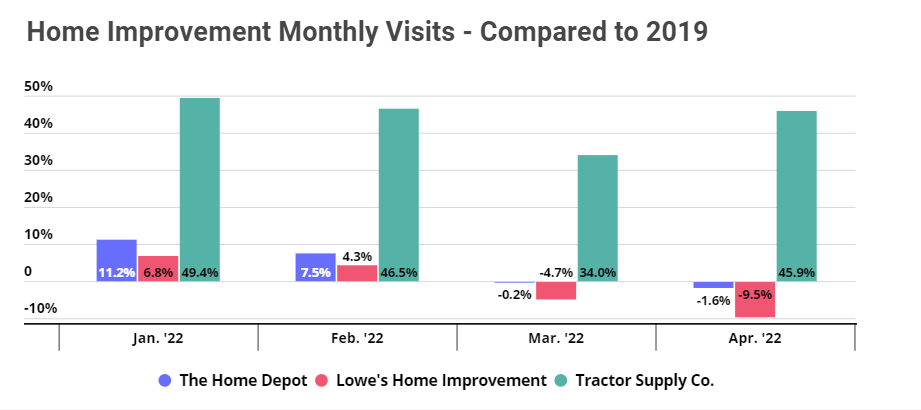

The home improvement sector was one of the biggest retail winners of 2020 and 2021, as consumers stuck at home – or moving home – invested heavily in their living space. This year also started off strong, with January and February visits to Home Depot, Lowe’s Home Improvement, and Tractor Supply Co. still above pre-pandemic levels. But going into spring, visits fell relative to 2019, with April 2022 visits to Home Depot and Lowe’s 1.6% and 9.5% lower, respectively, compared to April 2019.

Meanwhile, Tractor Supply’s impressive gains continued, with visits up 45.9% in April 2022 compared to April 2019. The Tennessee-based retailer’s success can be partially attributed to its aggressive store fleet expansion, but it’s worth noting that average visits per Tractor Supply store have also been significantly higher than they were pre-pandemic. In April 2022, average visits per venue were up by 36.0% compared to April 2019 – indicating that this home improvement up-and-comer still has serious growth potential ahead.

Seasonal Trends Continue

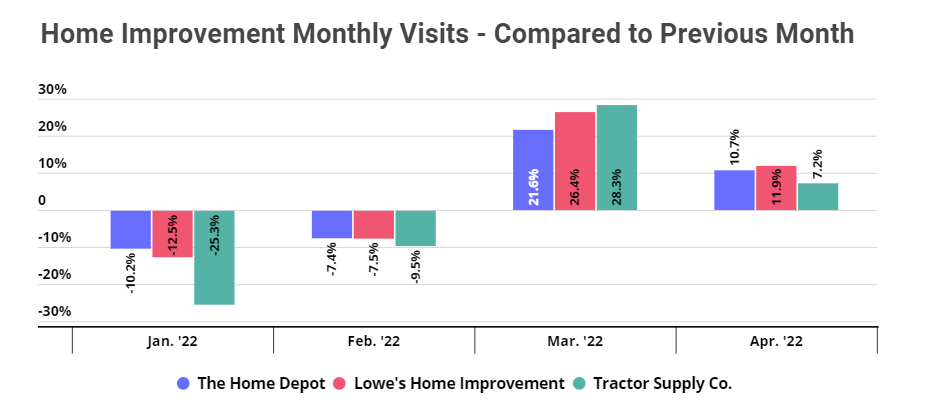

While the recent economic challenges likely impacted Lowe’s and Home Depot’s recent performance, the Yo3Y drop was amplified by normal seasonality. Spring is typically home improvement’s strongest season, as the warmer weather lets contractors take on a wider range of projects and motivates homeowners to get their outdoor spaces ready for the summer months. This year too, all major home improvement retailers analyzed saw month-over-month growth in visits in both March and April, indicating that seasonal trends continued in 2022.

Even though home improvement players did experience a seasonal boost this year, the recent economic challenges likely limited the heights these retailers could reach. And since the sector sees a yearly rise in March and April visits, recent visit numbers are being compared to a particularly strong pre-pandemic and pre-inflation retail period. This means that the Yo3Y visit gaps are not necessarily cause for concern and may be more indicative of the confluence of normal seasonality along with the short-term impact of rising prices.

The Rise of Tractor Supply

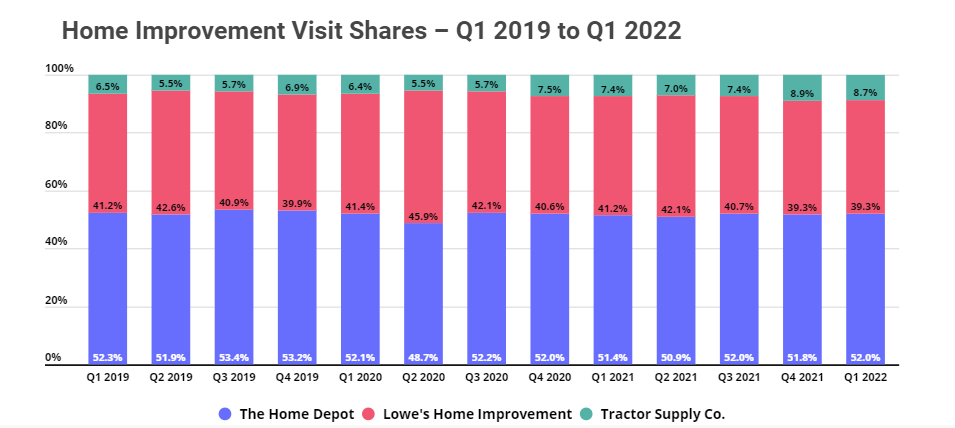

Today, Tractor Supply occupies a different spot in the home improvement retail landscape than it did in 2019. Its visits, loyalty, and visits per venue numbers have been steadily increasing, and the brand plans to continue its current trajectory with 75 to 80 new stores planned for 2022.

Location analytics data shows that Tractor Supply’s massive growth is slowly but surely encroaching on the visit shares of the two home improvement giants. Tractor Supply’s share of total visits remained relatively steady in Q1 2019 and Q1 2020, with the brand receiving 6.5% and 6.4%, respectively, of total visits to Lowe’s, Home Depot, and Tractor Supply. In Q1 2021, however, Tractor Supply’s visit share climbed by 7.4%, and by Q1 2022 it had reached 8.7%. So, while Lowe’s and Home Depot are still the undisputed category leaders, Tractor Supply’s rapid and significant growth may soon pose a real threat to these two legacy brands.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.