In April 2022, Chinese ecommerce giant Shein closed a funding round that valued the company at $100 billion. Shein has experienced a meteoric rise in the U.S. fast fashion market, with its sales overtaking established competitors such as H&M and Zara during the COVID-19 pandemic. Using U.S. consumer spending data, we analyzed how Shein sales have boomed over the past few years, as well as how other fast fashion companies have fared.

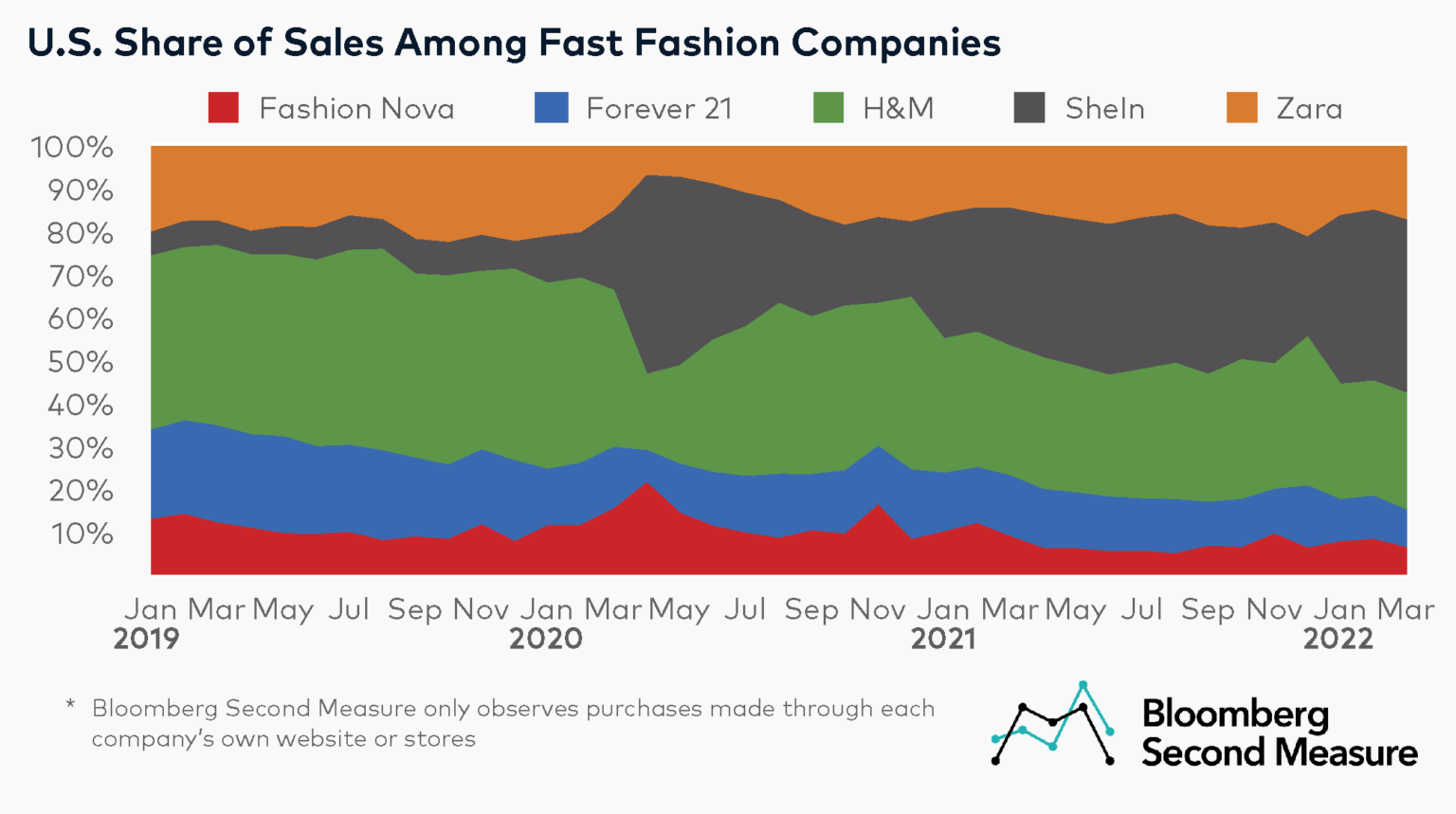

Shein has accounted for a growing percentage of fast fashion market share in the U.S.

Among the fast fashion competitors in our analysis—Fashion Nova, Forever 21, H&M, Shein, and Zara—H&M had the highest market share prior to the pandemic. In February 2020, the month before shelter-in-place orders went into effect, H&M accounted for 43 percent of sales, while Shein had the lowest share, at 11 percent.

Throughout the pandemic, market share among these fast fashion companies changed, with Shein experiencing the most market share growth. In March 2022, Shein accounted for 40 percent of sales, compared to 32 percent in March 2021 and 18 percent in March 2020. Zara also experienced some growth during this time; its share of sales in March 2022 was 17 percent, a two percentage point increase from both March 2021 and March 2020.

The other three fast fashion companies lost market share since the start of the pandemic. H&M’s share of sales in March 2022 was 27 percent, compared to 37 percent two years earlier. For Fashion Nova, market share decreased from 15 percent to 6 percent in the same time period, while Forever 21 decreased from 14 percent to 9 percent.

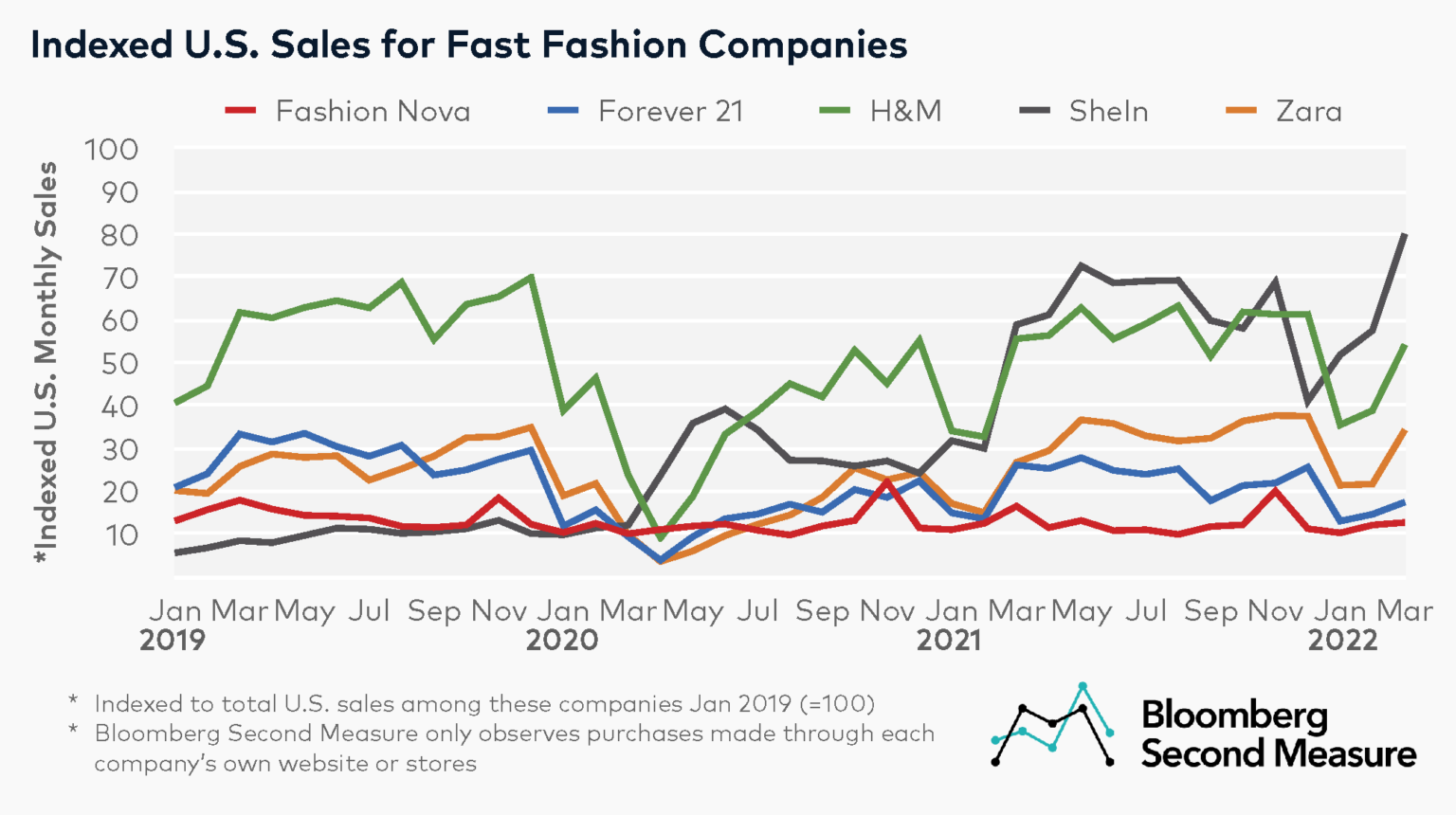

Shein’s U.S. sales have skyrocketed since the start of the pandemic

Most of the change in fast fashion market share can be attributed to Shein’s strong sales growth over the past two years. Shein’s sales growth was kickstarted at the beginning of the pandemic, following the trend of increased ecommerce spending. The company’s U.S. sales roughly doubled between March and April of 2020. By contrast, sales at H&M, Zara, and Forever 21 declined as shelter-in-place orders went into effect.

Between March 2020 and March 2022, Shein’s U.S. sales grew 568 percent. The ecommerce company’s primary audience is Gen Z consumers, and it has focused much of its marketing efforts on social media influencers on platforms such as Instagram and TikTok. Sales at Fashion Nova—the other digitally native fast fashion company in our analysis—grew 26 percent between March 2020 and March 2022.

Among the companies in our analysis, only Shein and Zara experienced positive year-over-year sales growth in March 2022, with 36 percent and 28 percent, respectively. H&M’s sales declined 3 percent year-over-year, while Fashion Nova sales decreased 23 percent and Forever 21 sales decreased 33 percent. It is worth noting that Bloomberg Second Measure only observes U.S. consumer spending data through each company’s own website or stores, so purchases made through other retailers (such as Forever 21 sales made through J.C. Penney) are excluded from this analysis.

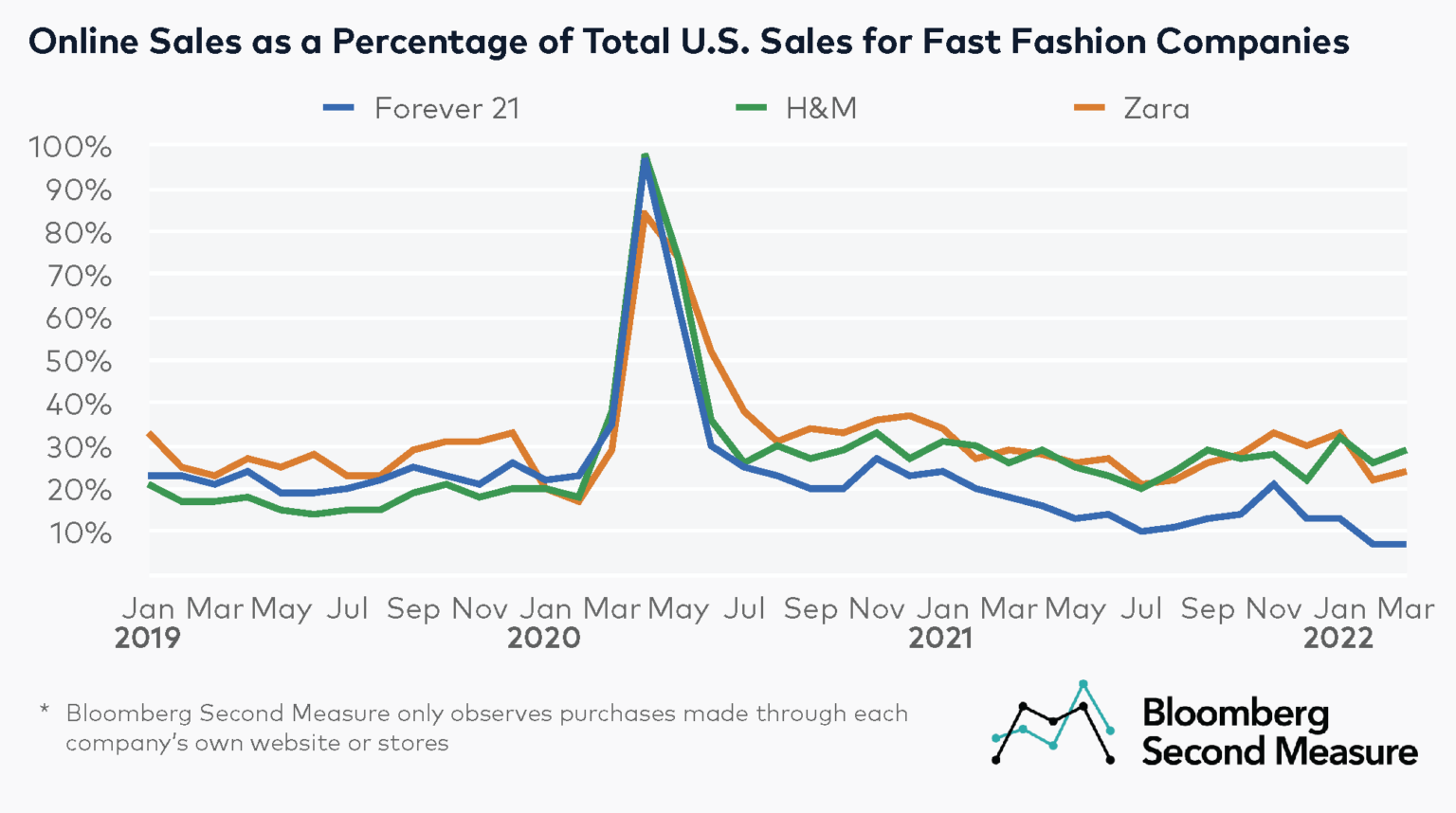

Most sales at H&M, Zara, and Forever 21 still come from the retail channel

While Shein operates entirely online and Fashion Nova has a very limited retail presence, the other fast fashion competitors in our analysis continue to see a mix of online and retail sales. For H&M, Zara, and Forever 21, most sales took place online at the height of pandemic lockdowns, but then primarily returned to retail by that summer.

For Forever 21, the percentage of online sales as a percentage of total sales has continued to decrease and is currently lower than pre-pandemic levels. In March 2022, 7 percent of Forever 21 sales took place online, compared to 18 percent in March 2021 and 35 percent in March 2020. In March 2022, the percentage of online sales as a percentage of total sales was 29 percent at H&M and 24 percent at Zara.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.