We last looked at the impact of inflation and increased gas costs on retail foot traffic in late March 2022. With another month of data in, we dove into the numbers to find out if retail visits have recovered from the shock of rising prices and what categories are proving particularly resilient.

Retail Visits Bounce Back from High Gas Prices

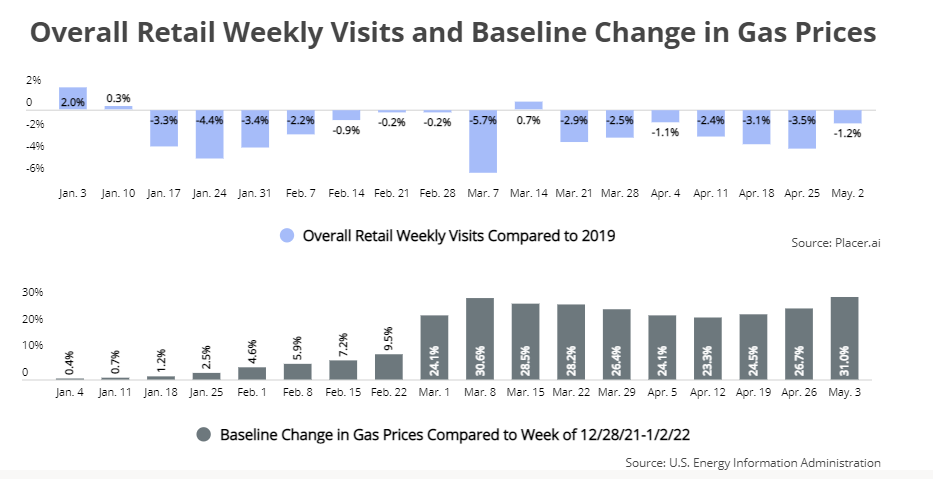

Gas prices increased gradually in January and February 2022, but the beginning of March saw a dramatic spike relative to an end of 2020 baseline. But although gas prices first jumped the week of March 1st, it was only the following week (March 7 to 13, 2022) that major news outlets such as CNBC, The Washington Post, and CNN began warning consumers that they would likely pay more at the pump for the foreseeable future.

Seemingly impacted by the increase in focus and prices, nationwide retail visits for the week of March 7th took a dive, with weekly visits falling by 5.7% relative to 2019 – the biggest year-over-three-year (Yo3Y) weekly gap seen since the start of 2022.

Although gas prices have remained high since, retail foot traffic seems to have mostly recovered. Visits in early May were almost back to pre-pandemic levels, with foot traffic the week of May 2nd down only 1.2% relative to the equivalent week in 2019. This indicates that while rising costs did provide an initial shock, behavior is normalizing. As consumers became accustomed to paying more at the pump and were no longer constantly reminded of the increase in gas prices, they returned to their pre-gas hike habits.

Dollar Store Foot Traffic Booming, Grocery Visits Recovering

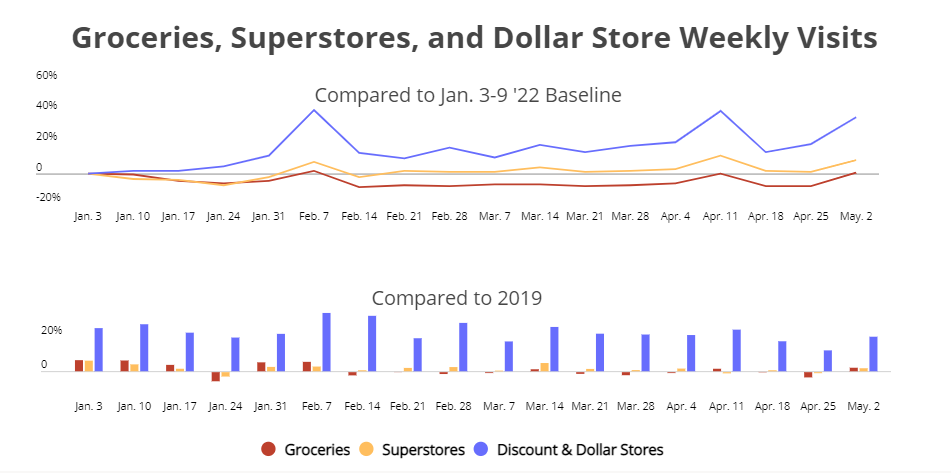

Unlike gas prices that only began spiking in March 2022, inflation has been on the rise for a more extended period. And grocery stores, which were relatively COVID-resistant in 2021, proved more vulnerable to inflation in 2022. So while grocery stores outperformed superstores last year, the trend reversed in 2022 with grocery foot traffic lagging behind superstores. Between mid-February and the end of April, superstore foot traffic has stayed relatively close to where it was in the first week of the year, while grocery visits have fallen significantly.

Some of the success of the superstore category (including Walmart, Target, and Costco) could be due to the sector’s diverse offerings under one roof. Consumers trying to reduce their driving time may be buying groceries at superstores as a way to consolidate their shopping trips.

More recently, however, the grocery category has also seen an uptick, with visits the week of May 2nd to 8th 2022 up by 0.5% relative to the first week of the year and up 2.1% relative to the equivalent week in 2019 – another indication that consumers are getting over the shock of high prices and returning to their pre-decline habits.

Meanwhile, dollar and discount stores, including Dollar General and Five Below, are seeing some major foot traffic gains, with weekly visits up all year relative to the equivalent week in 2019. Of course, dollar and discount stores were already strongly positioned, with visits relative to pre-pandemic up for much of 2021. But what’s truly impressive is that visits have been rising significantly even relative to the already strong January 3-9 2022 baseline – and the visit increase since the beginning of the year is much greater than for superstores.

So, while inflation is also beginning to impact dollar store prices, foot traffic data indicates that dollar store prices are likely still low enough to attract shoppers looking to stretch their paycheck.

QSR & Fast Food Leading Dining Foot Traffic

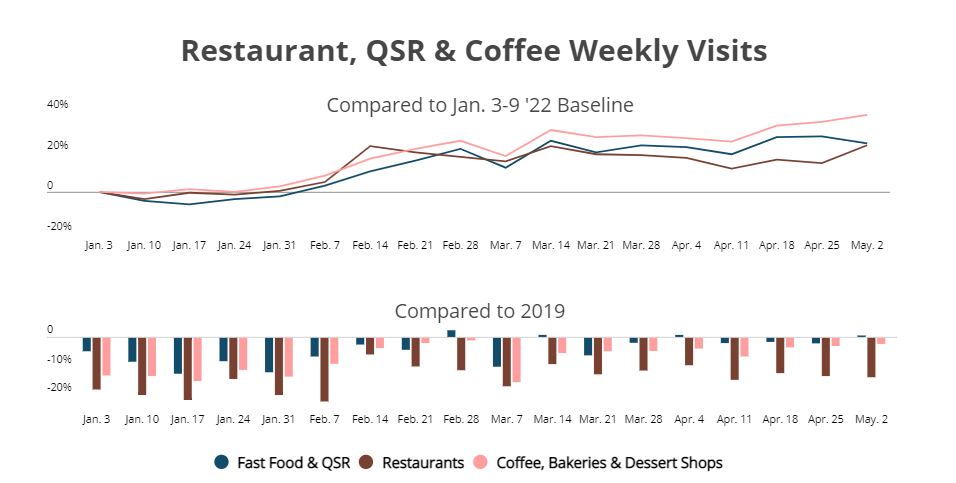

So far, we looked at overall retail trends and dove into various retail categories where consumers can purchase essential goods. But location analytics tools can also shed light on inflation’s impact on discretionary spending. We analyzed three dining categories – full service restaurants, QSR and fast food, and coffee shops, sweet shops and bakeries – to understand how rising prices are impacting nationwide dining visits.

As the chart below shows, visits to all three dining categories are increasing relative to a January 3rd to 9th 2022 baseline, and even full service restaurants have been seeing rising visit levels after suffering a heavy blow over COVID. So while many restaurants may still have a way to go before reaching pre-pandemic occupancy, visits are moving in the right direction. And, Yo3Y foot traffic data shows that the coffee and bakery category has also almost returned to pre-pandemic levels after seeing gas and inflation-related visit declines in March and early April.

But the current dining visit leader is QSR and fast food. Aside from a Yo3Y 9.9% drop in visits the week of March 7th to 13 2022 – in line with the drop in overall retail visits that same week – QSR visits have stayed relatively close to pre-pandemic levels, with visits the week of May 2nd to 8th up 0.5% relative to the equivalent week in 2019. Perhaps consumers feel justified buying prepared fast food now that grocery prices are on the rise anyways; or maybe spending money on QSR is a cost-effective way to indulge in today’s economic climate. Whatever the reason – fast food’s consistently strong visit performance over the past weeks shows that, despite inflation and high gas costs, the category is definitively out of its COVID slump.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.