Peloton has been on a wild ride the past three years. When in-person gyms closed due to COVID-19, Peloton capitalized on providing an in-home fitness solution. Peloton’s shares were up 220% in 2020 due to the pandemic causing profits to rise.

But nearly all of those gains were wiped out last year as the brand had a bumpy ride in 2021 with bad press, class action lawsuits, supply problems among their issues.

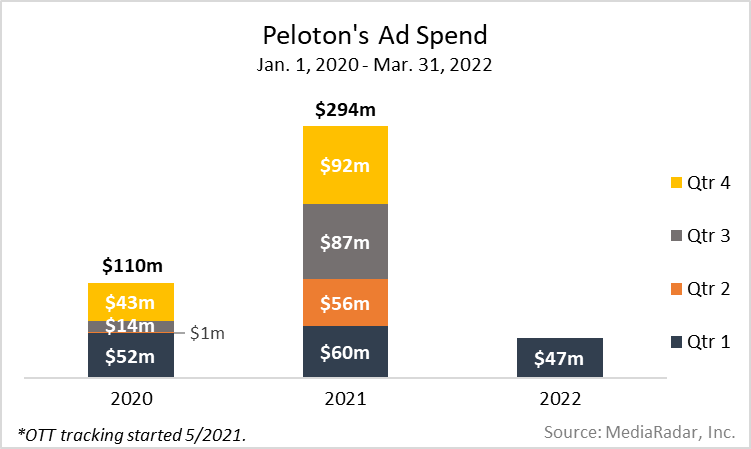

Despite their hurdles, MediaRadar’s analysis of Peloton’s ad spend shows an increase in advertising investment by 300% YoY. It’s estimated that the company spent $294 million advertising across all platforms.

However, Q1 of 2022 data reveals ad investment is down 22% compared to Q1 of 2021. 2022 saw an estimated spend of $47 million based on the sampling (compared to $60mm in 2021).

Why? And where is the ad spend going? Let’s break it down.

Peloton’s Wild Ride

Since its founding in 2012, Peloton’s seen its fair share of ups and downs.

On the heels of a successful Kickstarter campaign that saw it attract more than $300k from thousands of people eager to ride the next wave of fitness, Peloton secured funding in 2014, 2015 and 2017.

In 2018, it raised an additional $550mm at a valuation of more than $4b.

By the following year, it’d sold 577,000 bikes and treadmills.

Then, things started to turn sour.

In Q3 2019, Peloton had one of the worst debuts for a major IPO in more than a decade.

Surely, a sign of things to come, right?

Maybe not.

By May 2020—as people began to adjust to no-gyms-are-open life—sales and subscribers increased by 66% and 94%, respectively.

A year later, Peloton reported its first billion-dollar quarter.

But in March, a child was fatally injured on one of the company’s treadmills.

Combine that with the world—and gyms—reopening, and Peleton started to unravel.

So, yeah, it’s been a wild ride, which may have you wondering: How have these ebbs and flows impacted its advertising strategy?

Less Ad Spend, More Variety

There’s no ignoring the fact that Peloton benefited greatly from the stay-at-home world. During that time, Peloton did what any business would do during a period of massive growth: Spend more on advertising.

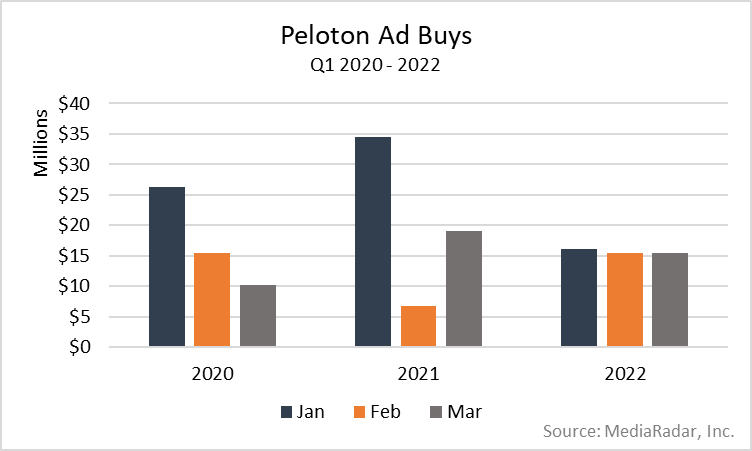

Last year, Peloton increased its ad spending by 300% YoY as it invested more than $56mm in each quarter.

This year, however, ad spend is down 22% in Q1—a number that likely has to do with the bad press and gyms-reopening in 2021. In fact, last year, Peloton announced it expected subscriptions to drop by 6% and sizable financial losses in 2022.

As we enter 2022, Peloton has not just decreased their ad spend—they’ve taken a shift on where those ads are going, too. In fact, while there is a decrease in ad spend in Peloton’s Q1 of 2022, it shows the most variety in their digital breakdown to date.

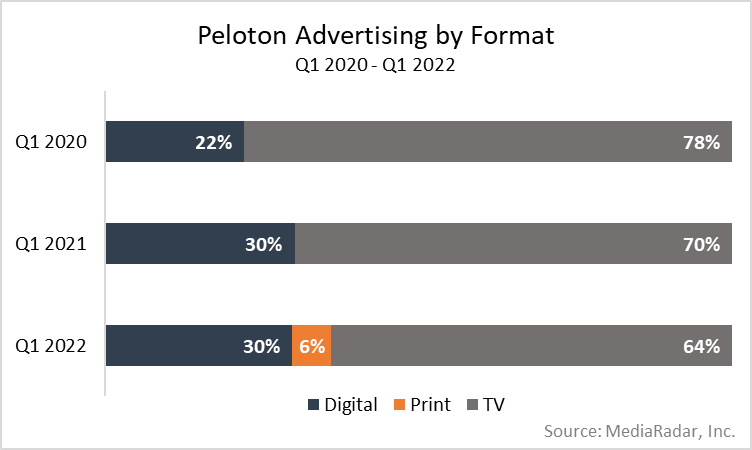

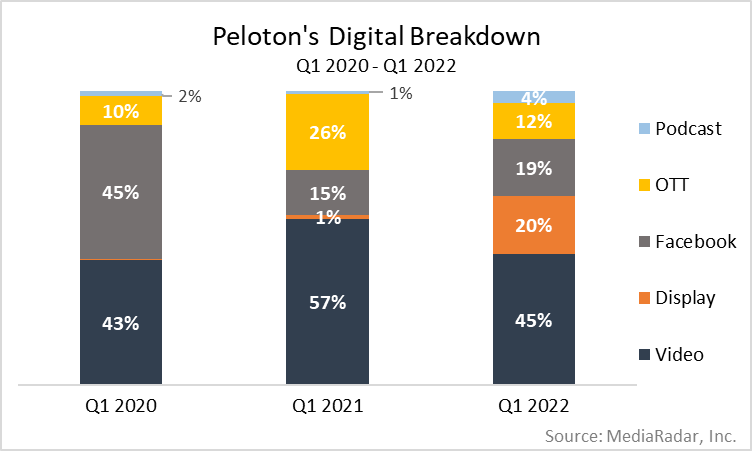

Last year, the company spent the majority of their ad spend (70%) on TV spots and 30% on digital (a 58% decrease from the year prior.) Of this digital spend, 57% went to video, while 26% and 15% went to OTT and Facebook, respectively.

This year, we’re seeing an increase in digital ad spend, as well as the addition of print advertising, which was absent in the past. In Q1 2022, print advertising accounted for 6% of Peloton’s quarterly spending.

Of that investment, 99% came in February as it bought ads in The New York Times (44%), The Wall Street Journal (41%) and Harper’s Bazaar (UK) (12%), with the remaining allocated to D Magazine and GQ (UK).

To make up for the increase in print spending, Peloton decreased its TV buys.

The remaining 30% of Peloton’s budget went to digital ads, the same amount it allocated to digital last year. Yet, while the 30% didn’t change, where these dollars went within the digital world did.

Most of Peleton’s digital dollars went to video (45%), despite being down 39% QoQ from 2021.

YouTube’s Music channels received the most investment from Peloton during Q1 2022 at 7%. FAcebook was closely behind with 6%, then Fox, ION Television, Fox and WE Network all received 4% each.

Outside of video, Peloton spent its remaining budget on display and Facebook ads, the latter of which remained relatively flat in Q1 of 2022 (down by only 1% QoQ), but down significantly from

Q1 2020 when Facebook got 45% of Peloton’s digital investment.

What’s particularly intriguing when looking at this data is that, while TV is 64% of spend, the top two properties are YouTube and Facebook. This means the digital spend is extremely concentrated on those two sites, while TV advertising is spread across many networks.

It’s Sink or Swim (er… Bike) for Peloton

While it’s hard to give an exact reason for Peloton’s stabilized spending in Q1 of 2022, it’s likely due to the fact that it’s seeing a major drop in demand due to price sensitivity and increased competition as well as its strategic pivot that’s emphasizing content and digital offerings.

As Peloton gets its ducks in a row, we expect spending to increase.

Will Peloton ever eclipse the $294mm it spent on ads last year?

Probably not. But with a new CEO leading the charge and a fresh perspective, expect Peloton to pedal faster than ever to make up ground, which will almost certainly include more ads across digital, print, and TV formats.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.