What are America’s favorite pastimes?

Baseball.

Apple pie.

Rearranging furniture.

That’s right—home furnishing and furniture rearranging is on the rise. Pinterest’s popularity continues to climb; in Q1 2022, Pinterest reported 433mm monthly active users (MAUs). The TV channel HGTV (which focuses solely on home design, redecorating, and remodeling) also was the 9th most-watched TV network in 2021.

There’s even an article on Psychology Today explaining why people love moving furniture around (hint: it lifts your mood, provides concrete satisfaction, and instills a sense of effectiveness!)

Add to that the rapid acceleration of eCommerce in the wake of the pandemic that continues to impact the Home Furnishing industry and it’s easy to see why now is both an exciting and intimidating time to be an advertiser.

So, how have these advertisers responded?

Let’s find out.

Digital Ads Incoming

Ask most industry advertisers—except maybe those in pharma—where they’re putting their ad dollars and the majority will say Digital.

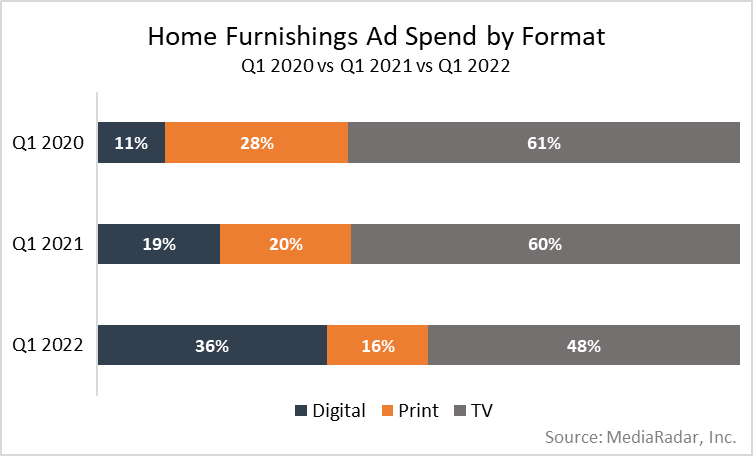

The same is true for advertisers in the Home Furnishing industry—although at a slower pace than others. TV remains the go-to format, while Digital formats are gaining ground.

In Q1 of this year, Digital accounted for 36% of total spending, representing a 111% increase YoY.

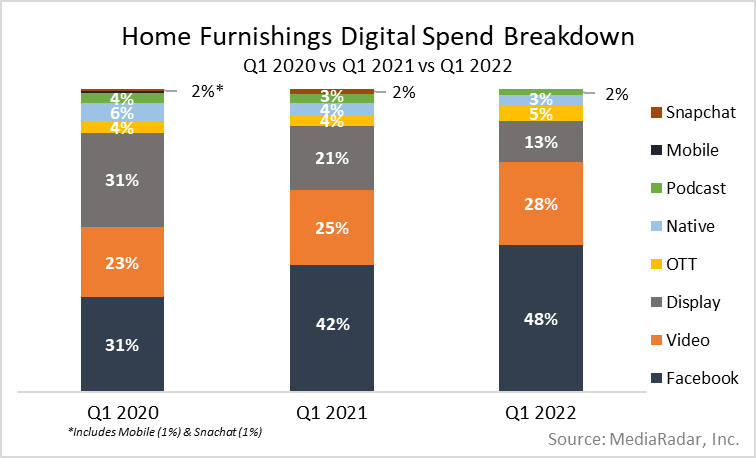

At the heart of this growth were increased investments in Facebook and Video, which grew by 14% and 12% from Q1 of last year.

The move to both Facebook and YouTube aligns with pushes from both of these platforms into digital commerce.

In 2020, Facebook introduced Facebook Shops as a way for businesses to create online stores on its platform (Instagram, too).

In 2021, YouTube hosted a live-streaming event called “Holiday Stream and Shop” that allowed select social media influencers to sell merchandise and products on the platform.

While Facebook and YouTube’s investment in digital commerce has wooed advertisers, we can’t say the same for Snapchat.

Despite Snapchat’s heavy push into digital commerce in recent years, spending decreased by 99% in Q1 2022.

As companies and consumers alike figure out the best way to buy and sell home furnishings online, spending on Digital will gain ground on Print and TV, which have historically accounted for more than 80% of spending. (Print decreased by 12% YoY ($207mm) and TV was down by 10% from the same quarter last year.)

Barring something totally unforeseen, Digital will surpass Print and TV in 2023 (if not sooner) as the format attracting the majority of ad dollars from these advertisers.

Retail Media is Here

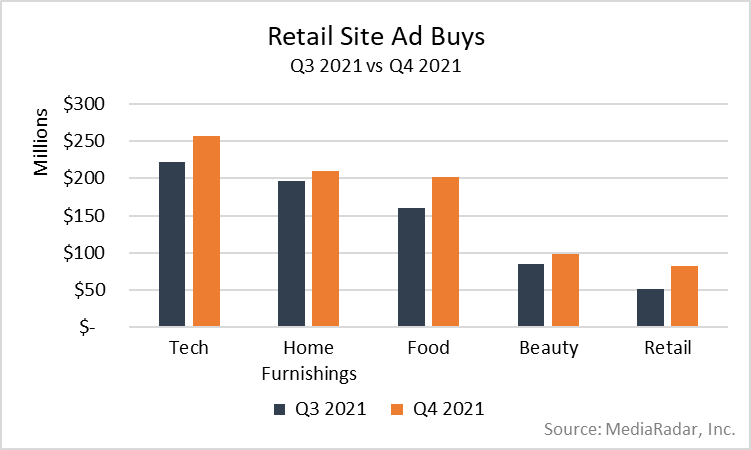

Home Furnishing advertisers aren’t shying away from retail media.

In Q3 and Q4 2021, Home Furnishings was the second biggest spending category on Amazon, Walmart and Target.

In Q1 of this year, Home Furnishings accounted for 20% of the $250mm spent on retail media.

As society dives deeper into eCommerce, the benefits of retail media will be impossible to ignore.

Why?

The more purchases people make on these retail sites, the more data they can collect—the same data Home Furnishings advertisers can use to target consumers.

For example, The Clorox Company could tap into Amazon’s data to show ads to people on Amazon.com who bought a competing product sold by Proctor & Gamble.

Similarly, it could target past purchasers who haven’t bought one of its products in 6-12 months.

The ability to get in front of consumers who’ve shown clear purchase intent is an unprecedented opportunity no advertiser will be able to pass up and should eat into more of their Digital spending as it establishes itself.

More Time at Home Calls for More Furniture

Some reports on the state of remote working point to its mass adoption, while others signal a return to the office as companies like Google call employees back.

Nevertheless, we can agree that remote working in some capacity is here to stay, and that people are spending more time at home (even if most of them are currently going through a post-pandemic phase of doing anything but staying inside).

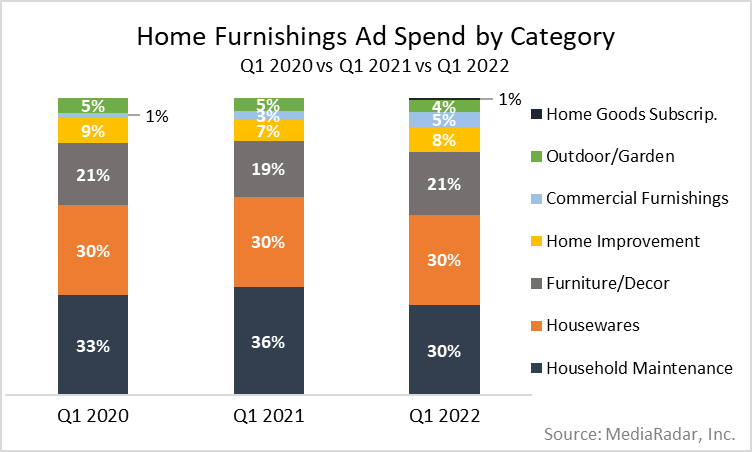

Given the increased time at home, Furniture/Decor advertisers, a subcategory of Home Furnishings, increased their ad spending by 8% QoQ in Q1.

Top spenders in this subcategory included Sleep Number and Tempur Sealy, both of which were top spenders in Q1 2021.

Castlery, La-Z-Boy and Lovesac also invested significant ad dollars in Q1.

Collectively, these brands accounted for 33% of the category’s ad spend in the first quarter of the year.

Advertisers Welcome the Honey Do Lists

More time at home hasn’t just translated into more furniture purchases.

It’s also meant more time to work around the house.

During the last two years, homeowners spent more time and money on their homes than ever before and the home improvement market has reaped the rewards.

Between 2019 and 2021, the home improvement market size in the United States increased by 32%.

Similarly, hardware stores total sales in 2021 totaled $63b, which is $4b more than the year before.

To ride this wave, advertisers promoting Home Improvement/Building Materials increased spending by 34% QoQ in 2022.

Top spenders in this subcategory included Product Bliss (Ruggable rugs), which increased spending by 410% and E. Mishan and Sons (Granitestone Nutriblade Knives), which increased its investment by 32x.

Additionally, Stihl and Chevron increased their spending by almost 850% and 900% QoQ, respectively.

In a similar vein, Household Maintenance—think laundry products, home fragrances/air fresheners, cleaning products and dishwashing detergents—has been a top category in Q1 for the past 3 years.

In Q1 of this year, these advertisers spent more than $398mm on ads. (That said, spending for this subcategory is down by 20% QoQ in Q1 2022, but still exceeded $398mm.)

Home Furnishing Brands Are Adjusting to Post-pandemic Advertising

As the world continues to adjust to home investment and remote work trends kicked off during the pandemic, home furnishing brands are clearly doing the same as reflected in their ad strategies. The increase in digital and focus on home furnishing projects (yes, including the recreational activity of rearranging furniture!) sets them up well for successful campaigns far into the future.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.