In this Placer Spotlight, we dive into the visit data for Ulta Beauty to understand how the variety of its brick and mortar offerings is impacting retail foot traffic to the brand.

Ulta Beauty’s Winning Streak Continues

Ulta is one of the non-essential retail brands that recovered the fastest from the COVID lockdowns and store closures, with retail foot traffic reaching 2019 levels in early 2021. As the country continued to open up and people began socializing again, Ulta’s visit surge continued, with foot traffic throughout most of 2021 higher than it was pre-pandemic.

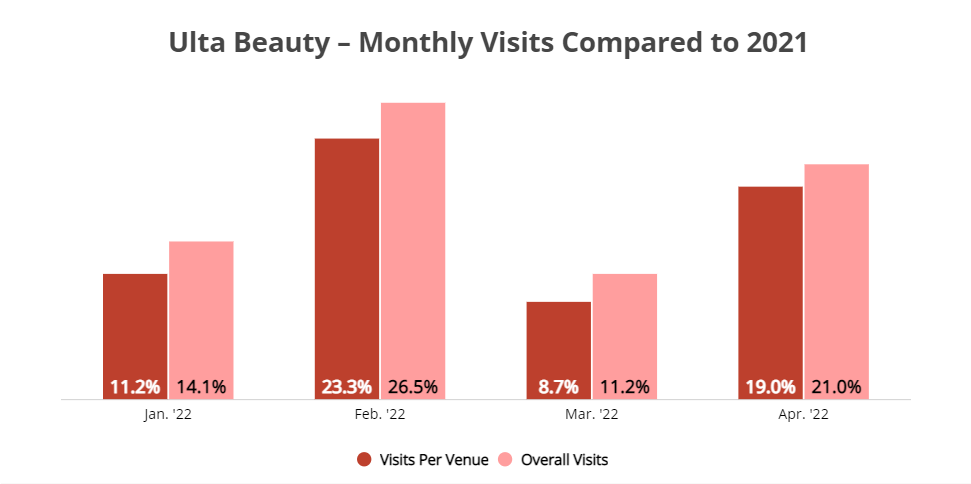

And despite the Omicron wave in January and February 2022 and the more recent impact of inflation and rising gas prices, Ulta’s foot traffic is still going strong. In April 2022, overall foot traffic for the brand and visits per venue were up 21.0% and 19.0%, respectively, relative to 2021, following a first quarter of consistent year-over-year (YoY) growth.

Ulta’s success despite the wider retail challenges may be attributed to the brand’s diverse product selection, which includes high-end beauty brands alongside more affordable options. Ulta also regularly offers coupons, appealing more to discount shoppers. This focus on providing value and higher-cost products under one roof could be helping the brand attract customers looking for a prestige-inspired shopping experience on a tighter budget.

Ulta’s Long-Term Gains

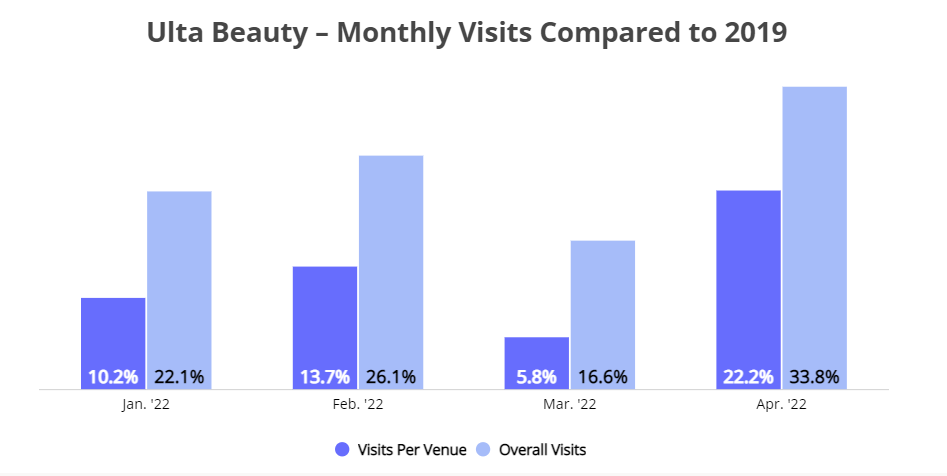

Ulta’s strength in 2022 becomes even more apparent when comparing its current foot traffic to pre-pandemic 2019. Overall year-over-three-year (Yo3Y) visits to the brand increased by double-digits for the first four months of the year, in part due to the brand’s rapid brick and mortar expansion. But visits per venue also increased in January through April 2022, culminating with a 22.2% Yo3Y increase in April visits per Ulta venue – which means that the brand’s new stores are already attracting a healthy customer base.

The increase in visits to stand-alone Ulta stores is all the more impressive given the success of its Ulta at Target collaboration. There are now over 100 Ulta at Target shop-in-shops with plans to open 250 Ulta at Target locations in 2022 – but the availability of Ulta at Target does not seem to be negatively impacting customer demand for trips to stand-alone Ulta stores.

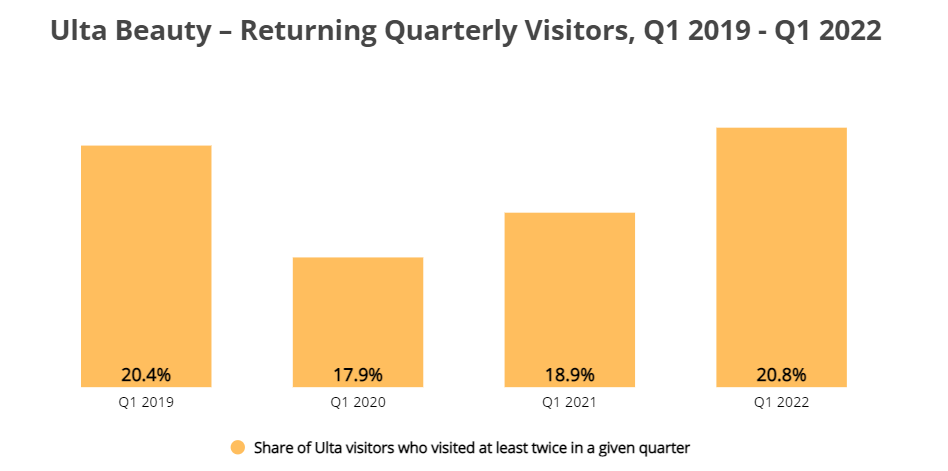

Ulta’s Visitor Loyalty Back to Pre-Pandemic Levels

Although, as mentioned above, foot traffic to Ulta has been up for a while, visitor loyalty did take a hit over COVID. The share of returning quarterly visitors dropped to 17.9% and 18.9% in Q1 2020 and Q1 2021, respectively, compared to a 20.4% share of returning visitors in pre-pandemic Q1 2019. But now, not only is overall and visit-per-venue foot traffic up at Ulta, the share of returning quarterly visitors has also increased to 20.8%, a slightly higher percentage than in Q1 2019.

The fact that Ulta’s stand-alone shops are successfully attracting both new and returning customers speaks to the brand’s successful omnichannel brick and mortar strategy.

While we often talk about omnichannel as the integration of offline and online channels, omnichannel also means making use of a variety of platforms within the digital and brick and mortar space.

Online, this can mean implementing a multichannel sales strategy and selling a product or promoting a brand across various websites and social media outlets. Offline, a full omnichannel strategy can look like operating owned stores alongside shop-in-shops and pop-up stores to increase brand awareness and customer access to the products.

The strong visitation trends to Ulta’s owned stores despite the rise of alternative offline channels demonstrates that offering several different brick and mortar sales channels does not necessarily mean that these channels will cannibalize each other. In the same way that offline and online channels can be strategically integrated to boost traffic across both mediums, operating diverse offline channels can also help a company build its brand and reach a wider array of customers.

As retailers continue experimenting with new brick and mortar formats, companies worried that multiplying offline channels will lead to self-competition can learn from Ulta that a comprehensive approach to omnichannel is a rising tide that can lift all boats.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.