Used cars stand out among the many categories seeing unprecedented demand recently, with many cars being sold even before they hit dealer websites. In today’s Insight Flash, we focus in on trends for CVNA and KMX, two of our most strongly correlated auto names, looking at inventory growth, average value of inventory versus units sold, and trends in model year sales.

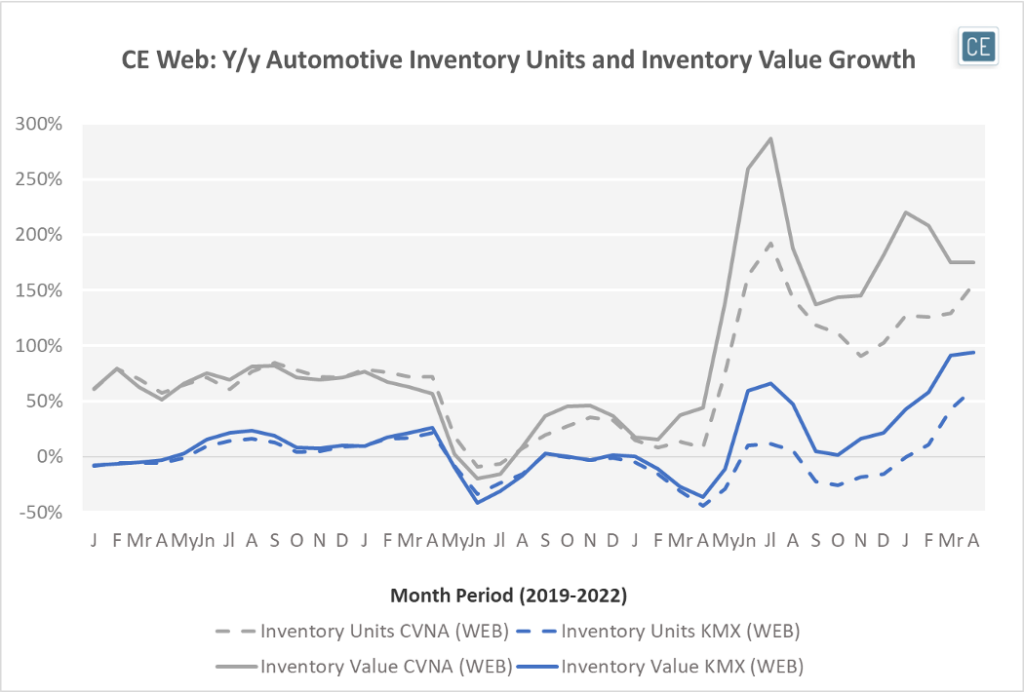

Over the winter and early spring, inventory growth has accelerated for both CVNA and KMX. KMX saw a 60% y/y growth in vehicle inventory in April, while CVNA saw almost 160%. As quickly as unit growth is accelerating, however, the value of the vehicles has been climbing even more. KMX inventory value was almost double in April versus the year-ago period, while CVNA inventory value grew 175%.

Inventory Trends

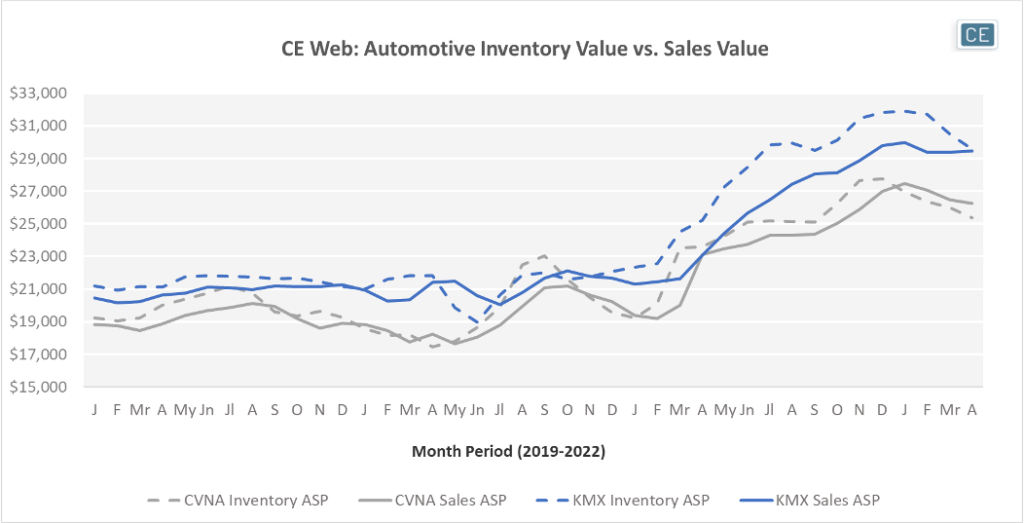

But can sales keep up with increasingly expensive inventory? Both KMX and CVNA have seen strong average sales value growth to match the inventory trends. For both, however, through the end of last year inventory pricing outpaced monthly sales pricing. For KMX, which sells higher value vehicles than CVNA, the two have recently begun to converge. For CVNA, average sales value ticked above inventory value in January of this year, with April’s average inventory value having fallen 9% since the beginning of the year.

Average Price

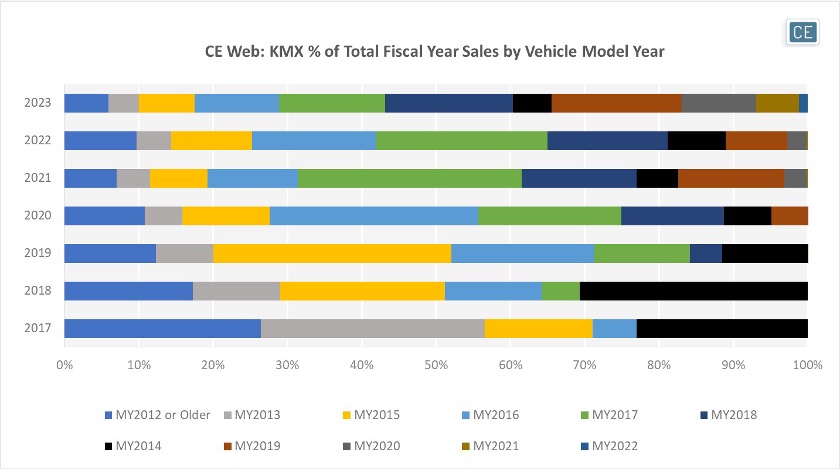

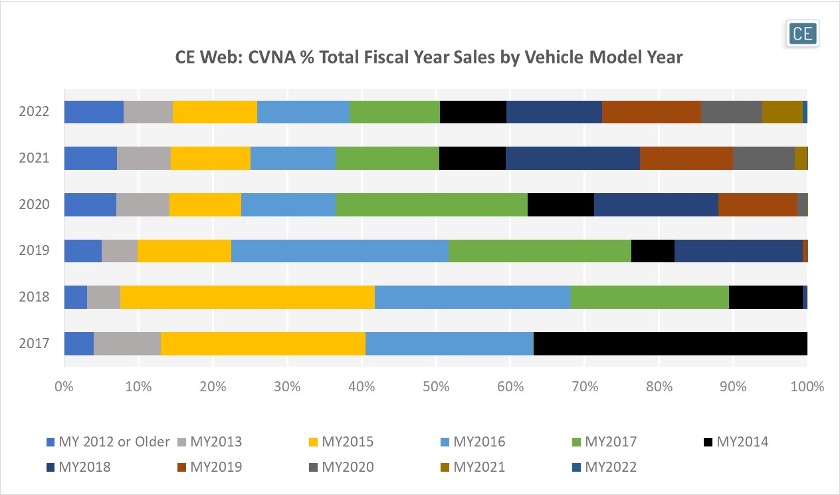

How old the vehicles are may be playing a large part in the pricing trends. For KMX, 20-25% of the vehicles sold in fiscal 2019-2021 were over five years old. However, in fiscal 2022 that percentage dropped to only 7%. For CVNA, however, the vehicles sold have been getting older over time.

Model Year Trends

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.