In 1946, studio executive Darryl F. Zanuck said, “Television won’t be able to hold on to any market it captures after the first six months…People will soon get tired of staring at a plywood box every night.”

Boy, was he wrong. If anything, the reason people get tired these days is because they’ve been starting at the “plywood box” too much.

To say TV and related technology, like OTT (or “over-the-top”/streaming services) is popular would be an understatement.

This year, 1.88b people will use OTT services like Netflix, Peacock, Discovery+ and Paramount+.

It’s no wonder with this big of an addressable audience that OTT has become so attractive to brands.

In 2021, OTT ad spending reached $1.3b.

Recently, however, some of these OTT providers have reported a decrease in subscribers, leading to new creative investments in advertising and a drive to stand out from (rising) competition.

Here are a few key storylines that came out of our Q1 data on OTT advertising.

Netflix Fights Back Against the Competition (and a Declining Subscriber Base) with Print Ads

Um, what?

Netflix has long since ruled the roost in the OTT world. However, the crown may be slipping; Netflix reported it lost 2k subscribers in Q1—the first time it’s lost subscribers in a decade—and expects to lose another 2mm in Q2 as people cancel their subscriptions following a price hike, show cancellations and the possibility of ads.

In the past, Netflix could weather these storms with its market dominance; if people wanted OTT, it was Netflix or one of the few other options.

That’s not the case anymore.

Today, the abundance of OTT services makes it harder for Netflix and its competitors to gain market share—just ask Quibi.

Despite declining numbers, Netflix still has more than 220mm paying subscribers. But the likes of Amazon Prime Video, Hulu and a host of others, namely those from big media companies—think Peacock, Discovery+ and Paramount+—are forcing it to fight back for the first time in its history.

One of the ways Netflix is fighting back is with ads—and their Q1 strategy shows they’re not going for the typical route.

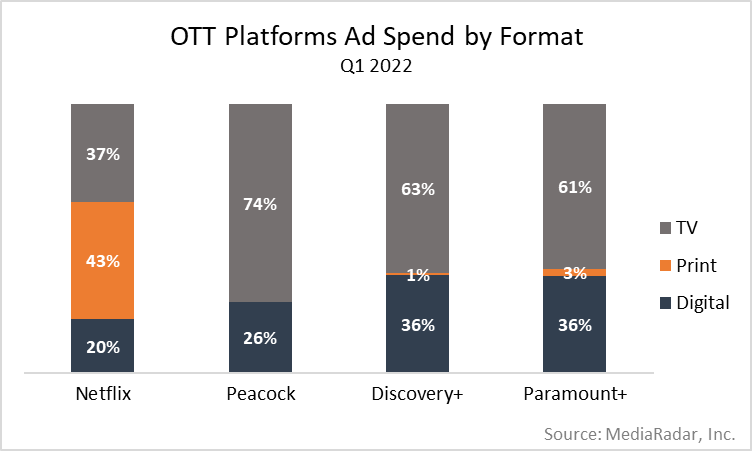

In Q1, Netflix spent 43% of its ad dollars on Print and another 37% on TV, making it by far the biggest spender on traditional formats.

Why does this matter?

For starters, Netflix is significantly more popular with younger generations than it is with older ones, so a traditional-first ad strategy that leans heavily on Print misses the mark in every sense, given that younger people overwhelming prefer digital devices.

While Netflix appears to be opening its eyes to Digital (more on that below), its fondness for ad formats of the past, especially Print, likely has to do with its desire to get those from older generations to open their wallets.

According to a survey in mid-2021, just 44% of Netflix’s subscribers are above the age of 65, while 75% are between 18 and 34.

In Netflix’s eyes, more Print ads are the answer to go after people who aren’t paying for its service.

On the surface, that seems like a logical approach but only financial reports in the coming quarters will decide if it was the right way to allocate its ad dollars.

Digital is coming

Despite a big investment in Print and TV, Netflix still had money lying around—20% of its budget in Q1—to spend on Digital.

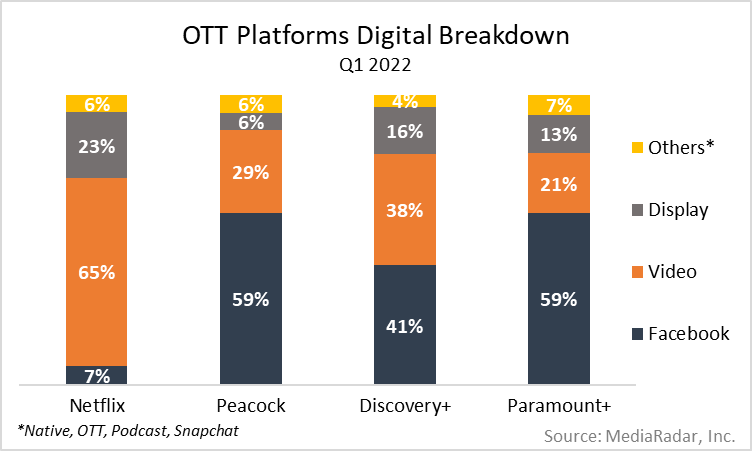

Of those digital dollars, 65% went to Video, while Display and Facebook got 23% and 7%, respectively. The remaining 5% went to Native, OTT, Podcasts and Snapchat.

The most notable change from Q1 2021 was its investment in Facebook ads, which represented 30% of its budget during the first three months last year.

So, if one’s to believe that its traditional-heavy strategy is about going after older generations, the sizable decrease in Facebook goes against that given that Facebook is the social platform of choice for older generations.

Instead, Netflix appears to be banking on Video, in combination with Print and TV, to help it rebound.

While it’s strange to see Netflix in this position, it’s hard to question its strategy.

Does Netflix have a plan?

Almost certainly, but it’s unlikely that a revamped ad strategy will be the answer to its woes.

For Netflix, rekindling its subscriber base will likely require a big investment in content, an effort to stabilize prices and a renewed commitment to staying free of ads (something that’s looking less likely).

Come One, Come All

OTT accounts for just 3% of total digital ad spend per month.

While that may be surprising given the popularity of OTT, it’s likely because OTT’s historically been dominated by subscription services with no ads or light ad loads.

It’s also likely has something to do with OTT’s nascent status in the advertising world and relatively unproven capabilities compared to more mature alternatives.

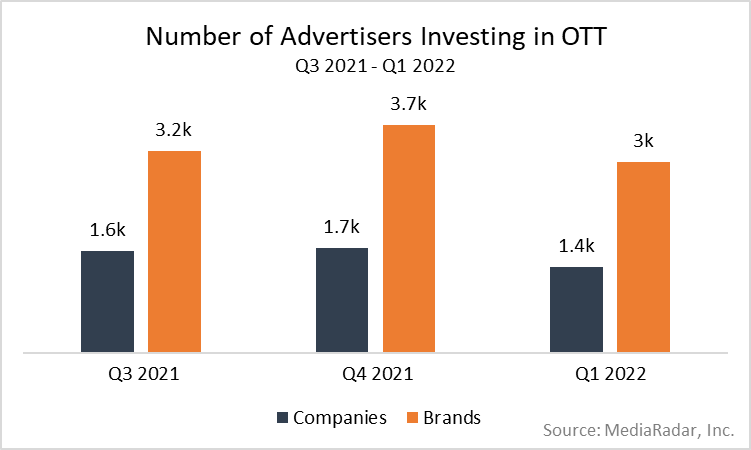

Still, during Q1, nearly 1.4k companies, including Berkshire Hathaway, Capital One and Microsoft, bought OTT ads for more than 3k brands.

In Q1, these companies combined to spend more than $369mm.

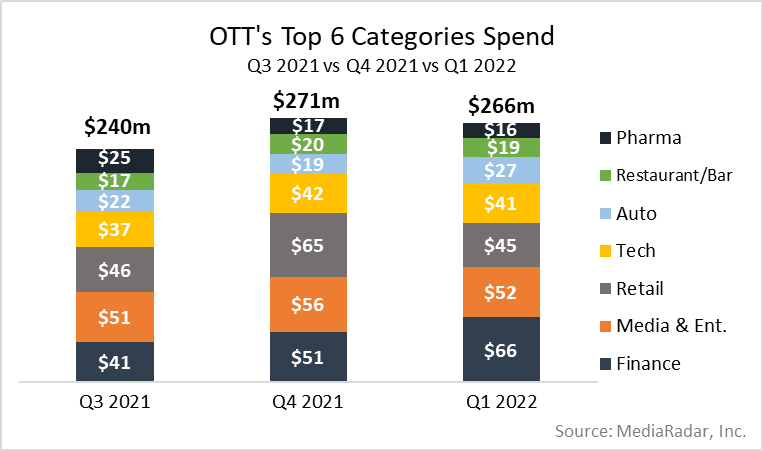

Looking deeper into the data, we see that 6 categories, including Pharma, Restaurant/Bar, Auto, Tech, Retail, Media & Ent, and Finance, accounted for 72% of ad spending. (These are the same categories that have been top spenders the past 3 quarters.)

The fact that advertisers in a variety of industries are investing in OTT demonstrates the widespread appeal of this advertising ecosystem, which bodes well for the OTT services as it tries to convince advertisers to move some of their budgets to their way.

Paramount+: The OTT Service of Choice for People Who Love Ads

There’s more that goes into the longevity of these OTT services than pricing and content.

Ad loads play a role, too.

On the one hand, more ads mean more revenue.

On the other hand, more ads mean a worse experience for subscribers.

For this reason, most of the OTT services take a relatively similar approach to ad loads:

Paramount+ does things differently:

The difference between Paramount+ and others is surprising given the intense competition for subscribers.

With all else being equal, a poor experience with a ton of ads could easily be enough to turn someone away.

So, why’s Paramount+ taking this approach?

It likely has to do with its attempt to attract more advertisers and improve sales.

Despite all the ads, however, Paramount+ is growing, adding almost 7mm subscribers in Q1.

The continued growth of the platform could signal that OTT subscribers will put up with more ads in exchange for better content and lower prices.

The success of Paramount+’s approach could also be a message to other services that more ads are acceptable, which could lead to ad loads rising in the future.

OTT Advertising: A Huge Opportunity for All

Don’t mistake the fact that OTT accounts for 3% of total advertising spend as a sign of weakness.

While it may be hard to remember, there was a time when advertisers were just dipping their toes into Facebook.

OTT advertising is here to stay.

For OTT services, ads will continue to be a tool they use to grow.

For brands, ads will be a way to get in front of a growing addressable audience with immersive experiences on the big screen.

For these reasons, don’t be surprised if we’re looking back in a few years and asking ourselves, “Can you believe OTT accounted for such a small percentage of total ad spending in the early 2020s?”

(And maybe, also, “Can you believe there was a time when I didn’t have to see 30 ads while streaming a movie?”)

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.