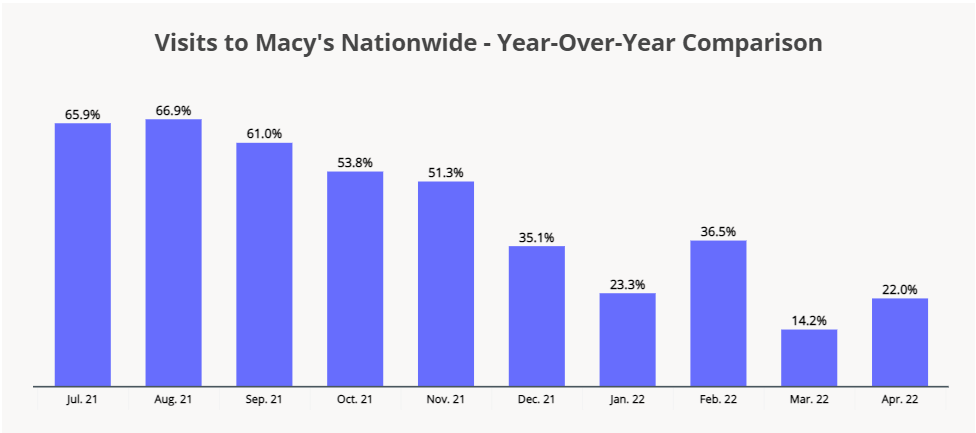

Our latest whitepaper explores five retailers who have stayed relevant over decades of changing shopping habits. The oldest retailer in our report, Macy’s, has consistently kept their finger on the pulse of shifting consumer preferences and adapted their brick and mortar strategy accordingly. We dove into one of the brand’s latest innovations – the off-price shop-in-shop concept Macy’s Backstage – to understand how incorporating Macy’s Backstage into existing Macy’s locations was boosting visits to the department store.

The Secret to Macy’s Longevity

Macy’s, one of the first department stores in the United States, has been around since the mid-nineteenth century. One of the secrets to Macy’s success has been the brand’s ability to tap into the full potential of its stores. As the rise of ecommerce ate into the “one-stop-shop” value proposition, Macy’s has doubled-down on the department store’s role in discovery and focussed on creating an environment where shoppers can easily and efficiently browse for new brands and products.

Over the past couple of years, Macy’s has opened a variety of shop-in-shops in select stores to give people a reason to visit Macy’s locations and provide consumers with a product-discovery experience they cannot access online. To this end, the department store has implemented partnerships with Pandora, Toys “R” Us, and even Wetzel’s Pretzels. These shop-in-shops have helped bring shoppers back to Macy’s following the pandemic-induced brick and mortar retail lull.

The Evolution of Macy’s Backstage

Even before these brand partnerships, Macy’s began experimenting internally with the shop-in-shop concept to give consumers an additional reason to stop by Macy’s locations. In 2015, Macy’s launched its new off-price brand Macy’s Backstage. According to their release, the new brand brings shoppers “the best of the Macy’s department store brand mixed with the fun of bargain shopping at an outlet.”

Although initially established as a stand-alone brand, management quickly shifted to bringing the Backstage brand into existing Macy’s locations. These Backstage shop-in-shops take a page out of the off-price’s playbook, providing customers with a treasure-hunt experience thanks to the constantly changing assortment of products. And following the example of other off-price retailers, Macy’s Backstage products are not available for purchase online – only in-store.

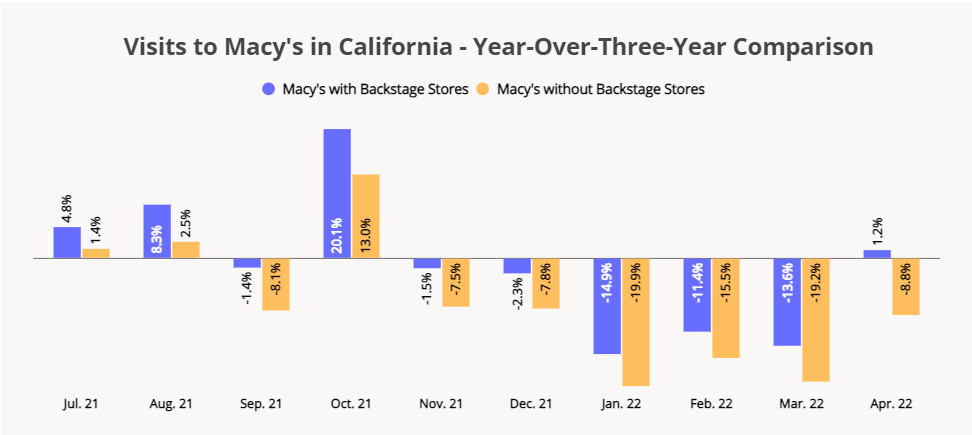

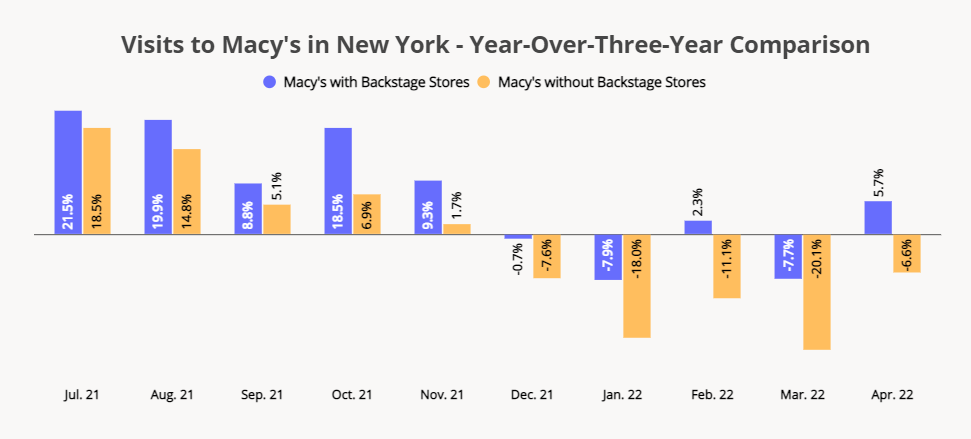

By early 2019, Macy’s management found that adding Backstage to an existing store provided an average sales lift of 5% – and recent foot traffic data supports this claim. Comparing year-over-three-year (Yo3Y) changes in visits for Macy’s stores with and without Backstage shop-in-shops in the states California and New York show that Macy’s with a Backstage section are seeing a much better COVID recovery trajectory than those without.

Macy’s Backstage Expands

Recently, Macy’s announced that it will expand the Backstage brand, with plans to open 37 new Backstage shop-in-shops in existing Macy’s stores. This will bring the off-price concept to nearly 60% of the chain, including the brand’s iconic flagships at Herald Square in New York City and State Street in Chicago, in addition to the nine free-standing Backstage locations that were operating by the end of Q1 2022.

The success of the Backstage concept in drawing more shoppers to Macy’s points to the department store’s continued ability to meet current market demands and answer the needs of today’s consumers. By expanding its Backstage concept, Macy’s is ensuring that its stores offer a unique experience while capitalizing on the growing demand for discount products – especially among high- and mid-income shoppers.

Over a century and a half has passed since the brand opened its first store in New York City in 1858, and the company is still going strong – in 2021, Macy’s venues nationwide collectively received over 370 million visits. As long as Macy’s continues innovating its in-store offerings to give shoppers a reason to visit, the brand will continue serving customers for many years to come.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.