As demand for consumer electronics softens, it’s no surprise that Best Buy saw visits and sales decelerate this quarter. According to the company’s Q1 2022 results, U.S. comparable store sales declined 8.5% year over year (YoY) and U.S. online sales decreased 14.9% YoY. Nevertheless, two things stood out to us from the quarter: (1) the shift to a higher average selling price helping to offset inflationary pressures; and (2) encouraging trends from new retail formats.

Higher Selling Price Insulating Best Buy from Inflation

Like other retailers, Best Buy has experienced cost inflation in areas such as labor, marketing and supply chain. However, as the company’s CEO Corie Barry noted in the company’s Q1 2022 earnings call, the cost inflation was largely in-line with the company’s expectations. Thanks to Best Buy’s planning and execution over the previous two years, the company saw an increase in average selling price over the past two years thanks to growth in appliance sales, increased consumer spending on premium products, lower promotional and markdown activity, and some price increases. Barry also noted that the company was starting to see a pickup in the promotional environment, which is expected to create margin pressure for the remainder of the year.

Promising Results from Best Buy’s Experiential Remodel

Over the past several years, Best Buy has taken steps to optimize its store base, including consolidating its store fleet, allocating more space to fulfilling online orders, and converting legacy stores into experiential formats (which offers a greater number experiential store-in-store partnerships with brands like Samsung, Oculus, and Lego in addition to existing partnerships with Apple, Microsoft, and Amazon). The company has set a target of 300 experiential remodels by 2024.

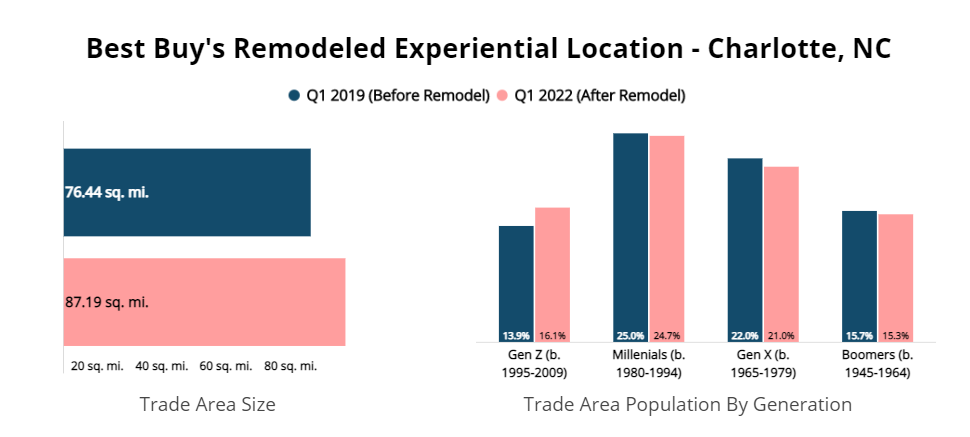

To understand the impact of the experiential remodels, we analyzed visitation data for Best Buy’s experiential store in Charlotte-North Lake, where the remodel completed in November 2021. We compared the store’s performance in Q1 2019 (pre-pandemic and pre-remodel) with its performance in Q1 2022. The data shows the store’s trade area increased by around 14% since the remodel (from 76.44 square miles in Q1 2019 to 87.19 square miles in Q1 2022). And not only are customers coming from farther away to visit the store – the Q1 2022 trade area of the Charlotte Experiential Best Buy also had a higher percentage of Gen Z’ers than it did prior to the remodel.

Best Buy Outlets Attract New Customers

In addition to Best Buy’s experiential stores, the company currently operates 16 outlet locations, with plans to open more this year. According to management, these locations carry “open box, clearance, end-of-life and otherwise distressed large-product inventory in major appliances and televisions that might otherwise be liquidated at significantly lower recovery rates.” Barry also noted that, so far, the company sees “twice the recovery rate of our cost of goods sold…at our outlets versus alternative channels.”

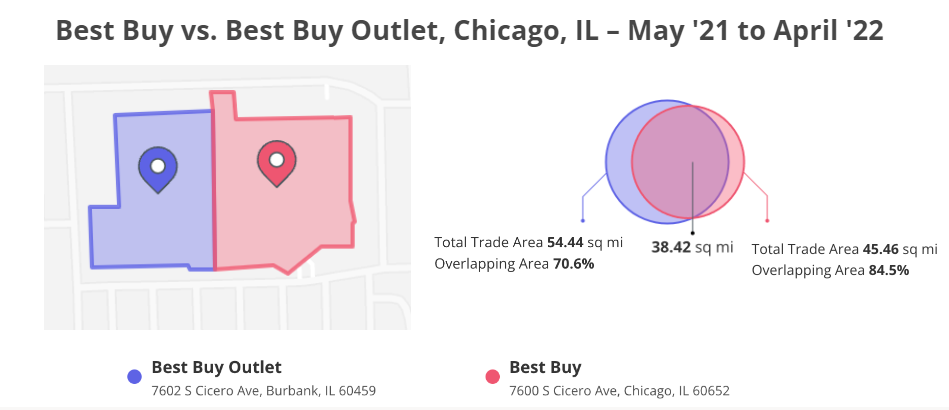

From a customer acquisition standpoint, these locations can attract new and re-engaged customers, with management estimating that approximately 16% of outlet customers were new to Best Buy and 37% were re-engaged Best Buy customers. Placer data corroborates that outlet stores are attracting new customers. We examined side-by-side Best Buy and Best Buy Outlet stores in the Chicago area and found almost 30% of the Best Buy Outlet customers had not visited the adjacent Best Buy location over the past 12 months.

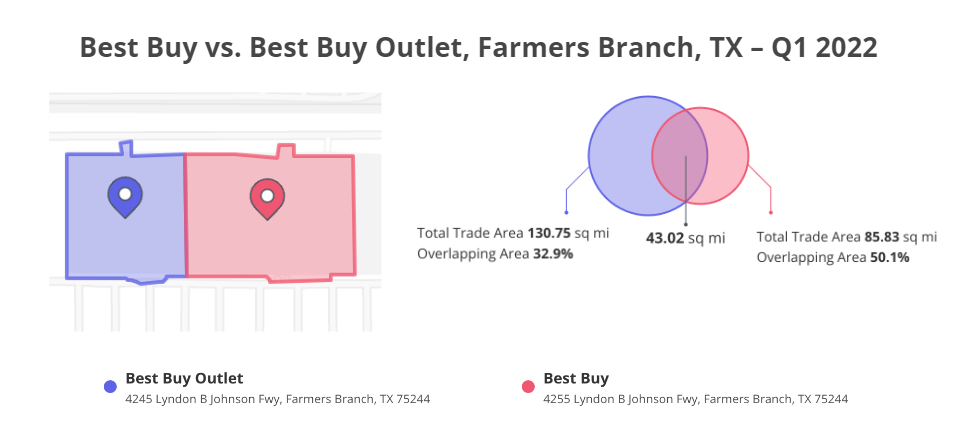

In Farmers Branch, Texas, almost 70% of the Best Buy Outlet customers had not been to the adjacent Best Buy between May 2022 and April 2021.

In fiscal 2023 (calendar 2022), Best Buy plans to double its outlet store count (including new locations in Chicago, Phoenix, and Houston), and expand its assortment at these locations beyond major appliances and large TVs to include computing, gaming and mobile phones.

With its varied projects, Best Buy is the latest retailer to prove that rightsizing doesn’t just mean shutting down stores. Instead, the brand closed some of its legacy locations, remodeled others, and added some new offline concepts to meet different types of customers. As the company continues experimenting with different brick and mortar formats, including opening a new small-format (5,000 sq. ft.) store in Charlotte, NC this summer – the current store fleet diversification may be just the beginning.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.