From Omicron in January to the impact of rising inflation and the systemwide shock driven by rising gas prices, 2022 kicked off with anything but an easy start. Yet, industry-level analysis provides powerful insights into the segments that have been more resistant to these negative effects and the wider trends that could be driving a more significant retail-wide recovery.

The Strong Getting Stronger

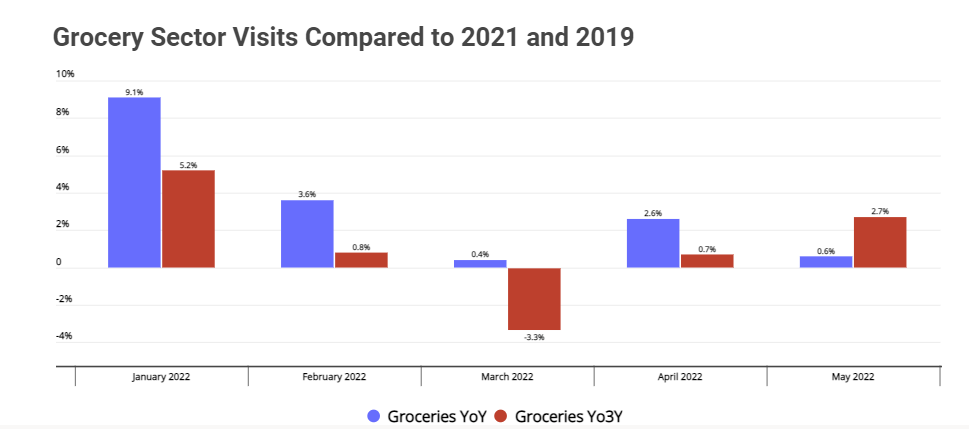

At this stage, there are some segments that are seemingly immune to the wider impacts on the retail landscape. The grocery segment, one of the stronger performers since the onset of the pandemic, has continued to see strength both in terms of comparisons to pre-pandemic levels and in a year-over-year comparison. After seeing monthly visits down 3.3% compared to 2019 in March, April and May visits were up 0.7% and 2.7%, respectively.

This indicates that the heaviest impact on grocery spending came in March, driven by the combination of rising gas prices and inflation. But as the initial shock of these forces wears off, visits are rebounding in a substantial way. Even if headwinds like inflation persist, there’s a high likelihood that the grocery sector will continue to thrive as it still offers a more cost-effective avenue to food, and as the sector continues to benefit from the shift to cooking and the wider segment’s success in delighting customers during the pandemic.

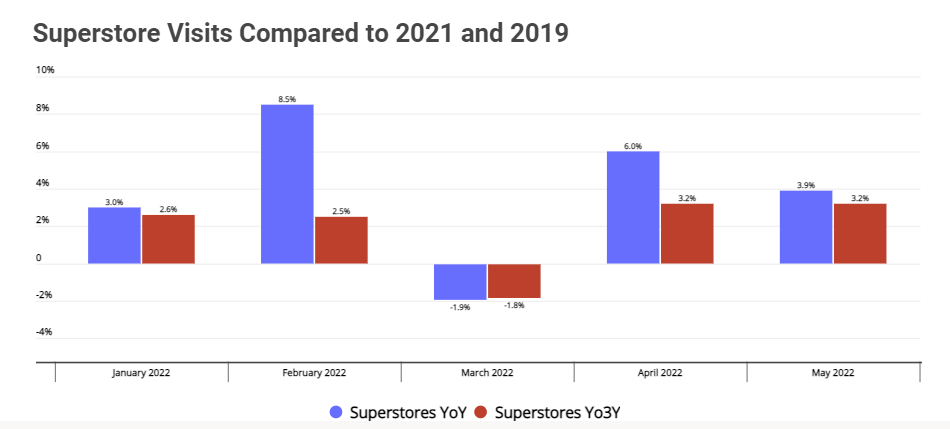

A similar trend impacted the superstore segment with visits declining in March from both a year-over-year (YoY) and year-over-three-year (Yo3Y) perspective. And, like grocery, this segment bounced back with significant visit strength in both April and May. Visits were up 6.0% and 3.9% respectively compared to the same period in 2021 and up 3.2% for both months compared to the equivalent months in 2019.

The clear strength compared to both 2021 and pre-pandemic standards indicates that the segment’s unique offering presents a specific draw. And, like grocery again, there is ample reason to believe that this trend will continue. The ‘one-stop shop’ appeal of superstores is especially powerful in an environment where visitors are looking to limit the amount of time behind the wheel while also seeking out value. And leaders in this segment actively pursuing ways to offset prices only deepens this reality. The continued innovation alongside the effective trend alignment, and steps being taken to build greater loyalty, only increase the conviction that this segment should be well-positioned for an extended period.

2022’s Surprise Continues to Impress

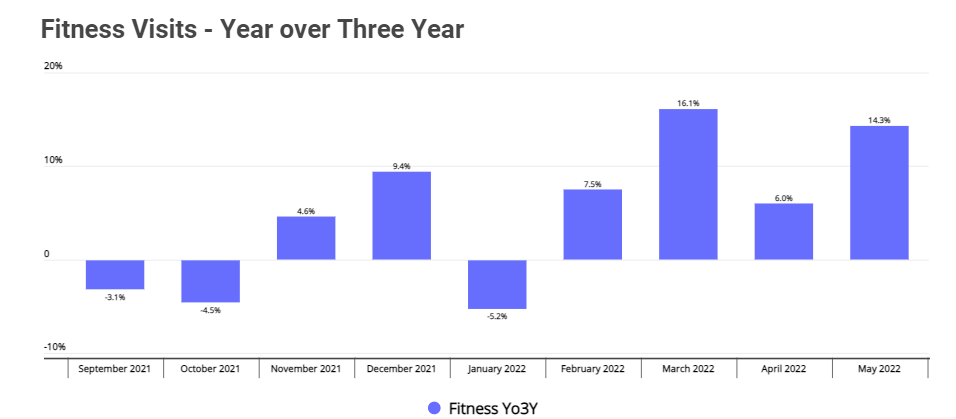

The wider fitness segment was one of the most impressive performers in late 2021 with year-over-three-year visits showing growth by the end of the year. Yet, January, with the rise of Omicron, saw visits down 5.2%. However, the decline was short-lived and the segment has experienced four straight months of growth compared to the equivalent months in 2019, with May seeing a 14.3% increase compared to May 2019. The impact of pent-up demand is likely playing a significant role here, as is the renewed understanding of the critical importance of community within the fitness sector.

End of the Decline?

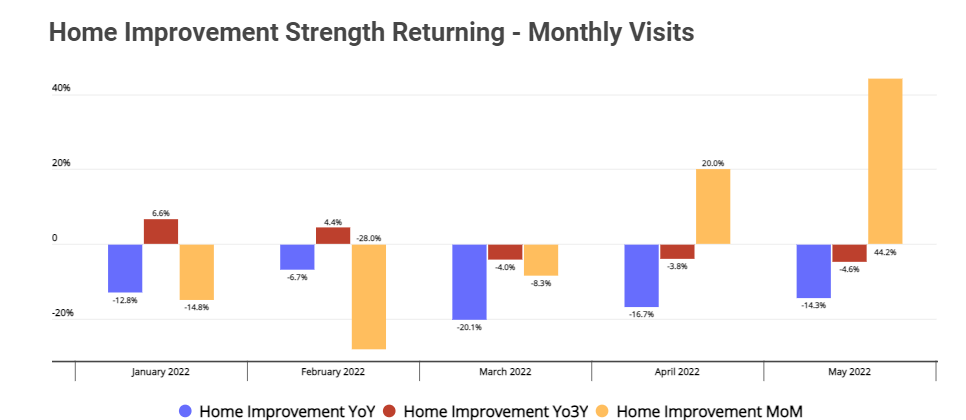

The home improvement segment, one of the strongest performers throughout the pandemic, has recently seen a more difficult period. Comparisons to the unique peaks of the pandemic period have created a difficult standard to match, especially considering the impact of inflation and rising gas prices on discretionary spending. And all of this taking place during the segment’s normal seasonal peak between March and May was anything but ideal.

Yet, there does appear to be a rebound brewing. After multiple months of month-over-month visits declines, the home improvement space saw visits grow by 20.0% in April and another 44.2% in May. While this still amounted to year over three year declines of 3.8% and 4.6% respectively in those months, the potential for a bounceback in the second half of the year is very promising.

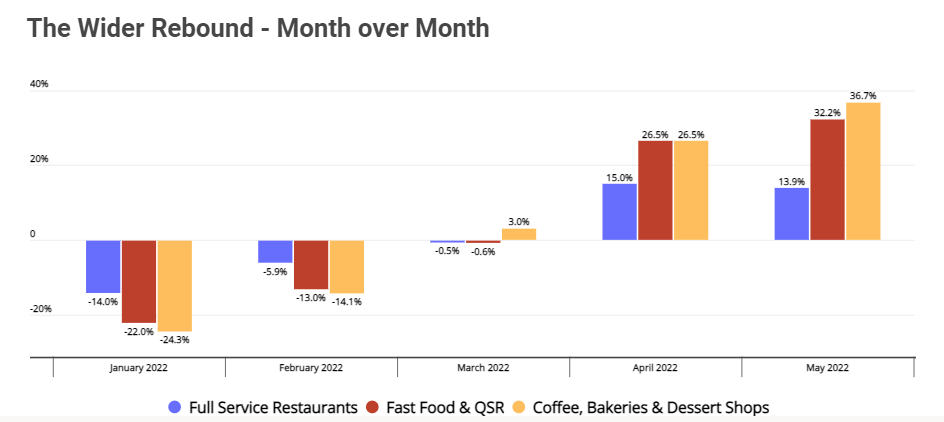

And this wider month-over-month growth was felt across other segments as well. Full-Service restaurants, and even QSR leaders all have seen a similar swell of visits in recent months. For all these segments, month-over-month visits jumped in April and surged even further in May.

This wider rebound indicates that the initial shock of inflation and rising gas prices is dissipating and consumers are identifying a new balance. This is bringing visits back to sectors that had been disproportionately impacted, and though spending changes are likely to persist as these economic headwinds remain, the impact could be significantly diluted.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.