After months of pressure from activist hedge funds, national department store chain Kohl’s Corporation (NYSE: KSS) announced in May 2022 that it was exploring a potential buyout. The announcement came amid a shifting retail industry in which several big-box retailers like Walmart and Target reported disappointing first quarter results, while some department store companies such as Macy’s Inc (NYSE: M) and Nordstrom Inc (NYSE: JWN) posted strong first quarter earnings and raised their profit outlook. Consumer transaction data reveals that Kohl’s sales in May 2022 were lower year-over-year, but higher than pre-pandemic levels. At the same time, Kohl’s had the highest share of national sales among major department store competitors—Kohl’s Corporation, Nordstrom Inc, Macy’s Inc, Hudson’s Bay Company, Dillard’s, and J.C. Penney—as of May 2022.

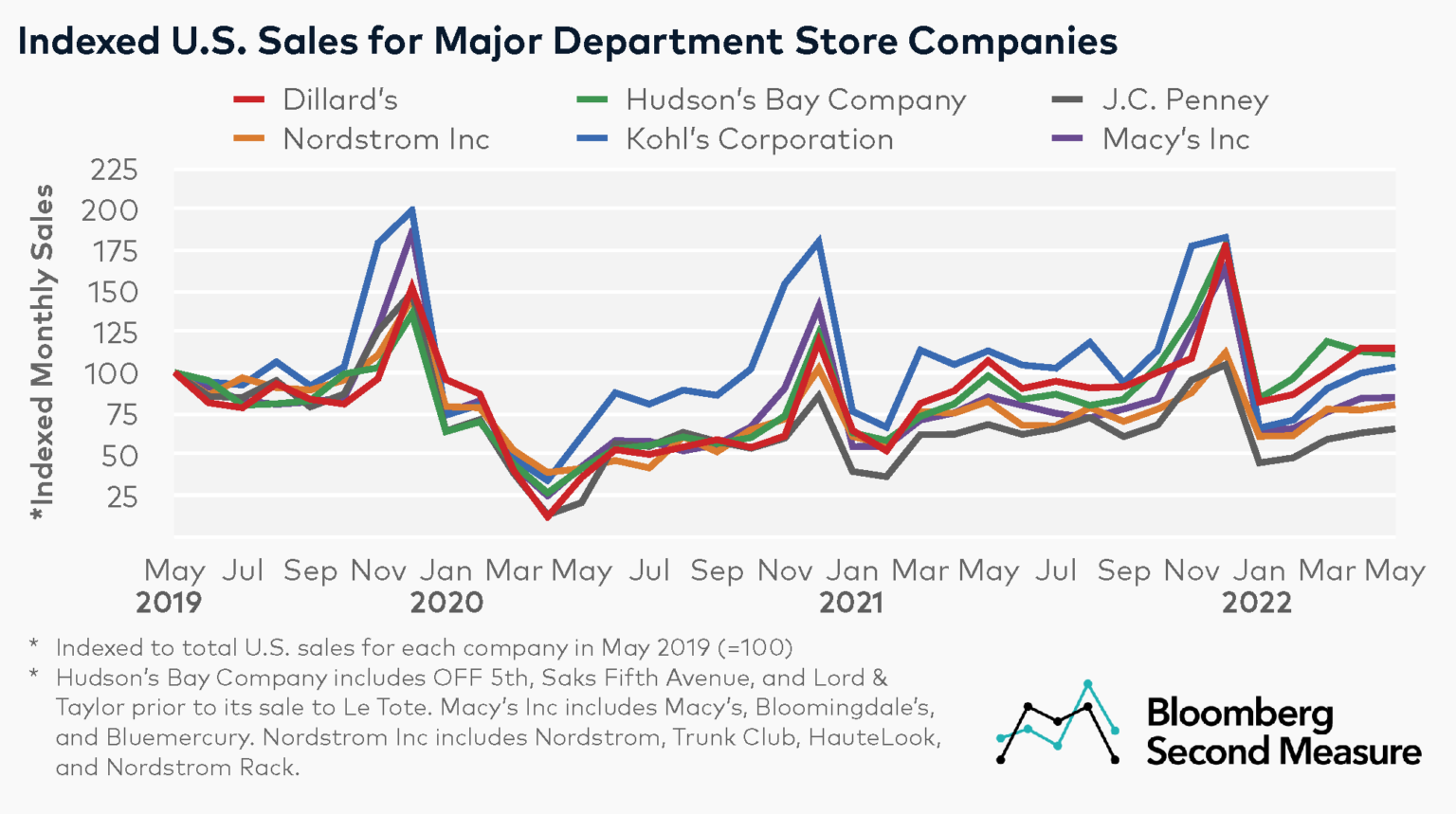

How does Kohl’s Corporation (NYSE: KSS) sales growth compare to other department store competitors?

National department store companies have varied in their sales recovery during the pandemic. In May 2022, half of the companies in our analysis—Dillard’s (NYSE: DDS), Hudson’s Bay Company, and Kohl’s—had higher sales than the same month in 2019, with increases of 15 percent, 11 percent, and 3 percent, respectively.

In the same time frame, sales declined 15 percent at Macy’s Inc, 20 percent at Nordstrom Inc, and 34 percent at J.C. Penney. Notably, J.C. Penney filed for bankruptcy in May 2020 and closed 175 stores throughout 2020 and 2021, which may partially account for its lower sales. Last month, Nordstrom Inc also announced that it would sunset Trunk Club, the clothing subscription service it acquired back in 2014.

All of the companies in our analysis also experienced a spike in sales each holiday season, even during the pandemic. For example, between October and November of 2021, Kohl’s sales grew 56 percent.

On a year-over-year basis, Kohl’s had the biggest decrease in sales among these companies, with a 9 percent decline in May 2022. Hudson’s Bay Company saw the biggest increase in sales year-over-year, with 14 percent. In late 2019, Hudson’s Bay Company sold its Lord & Taylor chain to the clothing rental company Le Tote. Hudson’s Bay Company, which now includes the brands Saks Fifth Avenue and Saks OFF 5th, went private in early 2020 and subsequently split its ecommerce unit Saks.com into a separate business entity that is reportedly planning for an IPO in 2022. Prior to Kohl’s buyout bids, the department store faced pressure from activist investors to undergo a similar move as Saks.com and spin off its ecommerce business.

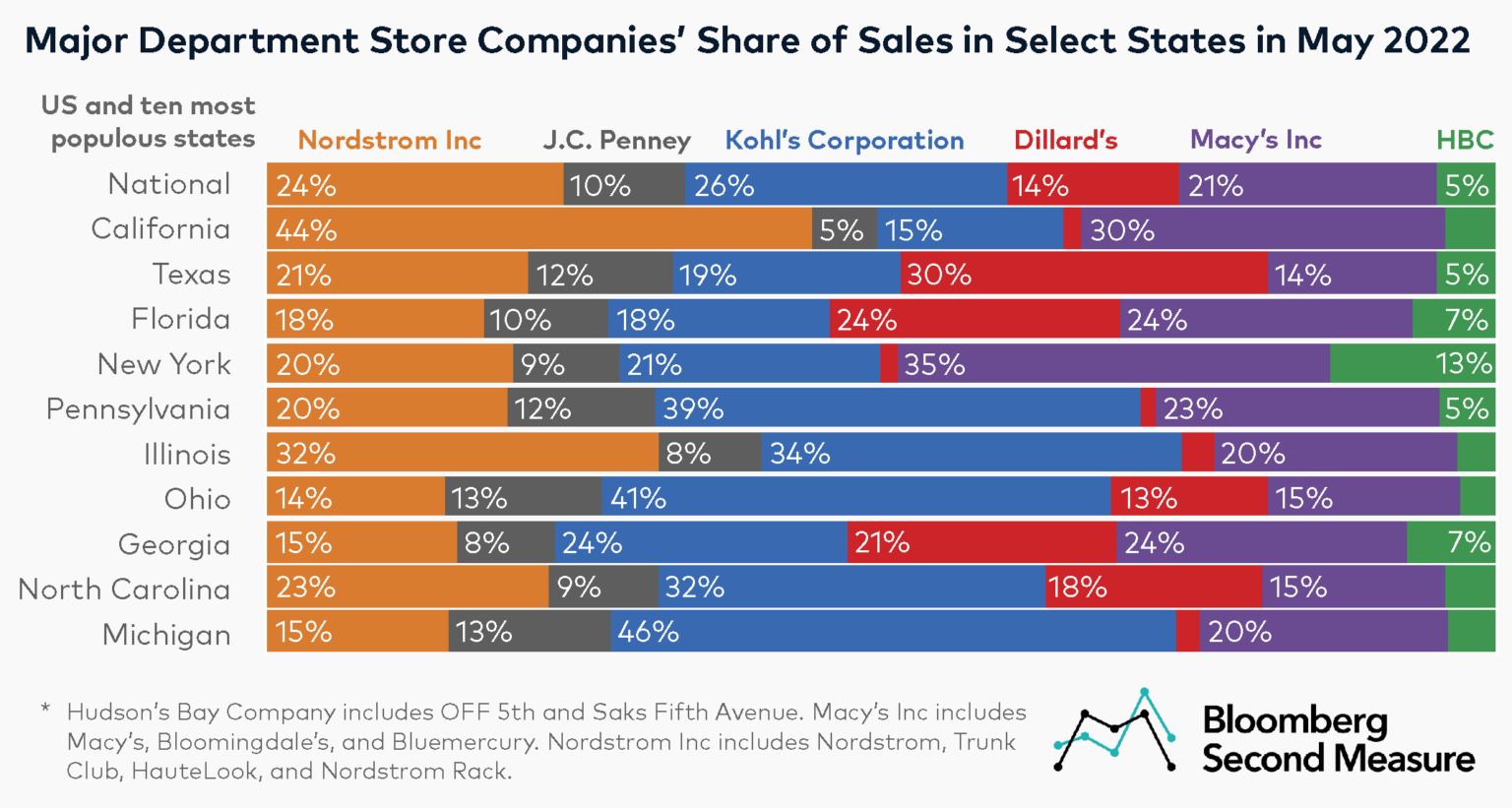

Kohl’s has the highest share of sales among major department stores nationally, but market share varies by state

Nationwide, 26 percent of sales among these major department stores went to Kohl’s in May 2022. Nordstrom Inc was a close second with 24 percent, followed by Macy’s Inc with 21 percent. Dillard’s earned 14 percent of national sales, while J.C. Penney earned 10 percent and Hudson’s Bay Company earned 5 percent.

Comparing department store market share in the ten most populous states, Kohl’s had the highest share of sales among these companies in six of the states. Kohl’s is especially popular in the Midwest, accounting for 46 percent of sales in Michigan and 41 percent in Ohio. On the other hand, Kohl’s earned only 15 percent of sales in California.

Among states in the South, Dillard’s is one of the most popular department stores, accounting for 30 percent of sales in Texas, 24 percent in Florida, and 22 percent in Georgia. The chain has a minimal presence in the Northeast, accounting for only 1 percent of sales in New York and Pennsylvania.

Nordstrom was the most popular department store among these competitors in California, with 44 percent of sales, while Macy’s earned the highest department store market share in New York, with 35 percent of sales in May 2022. J.C. Penney and Hudson’s Bay Company did not earn the highest market share in any of the ten most populous states. J.C. Penney earned 13 percent of sales among these companies in Michigan and Ohio, while Hudson’s Bay Company earned 13 percent of sales in New York.

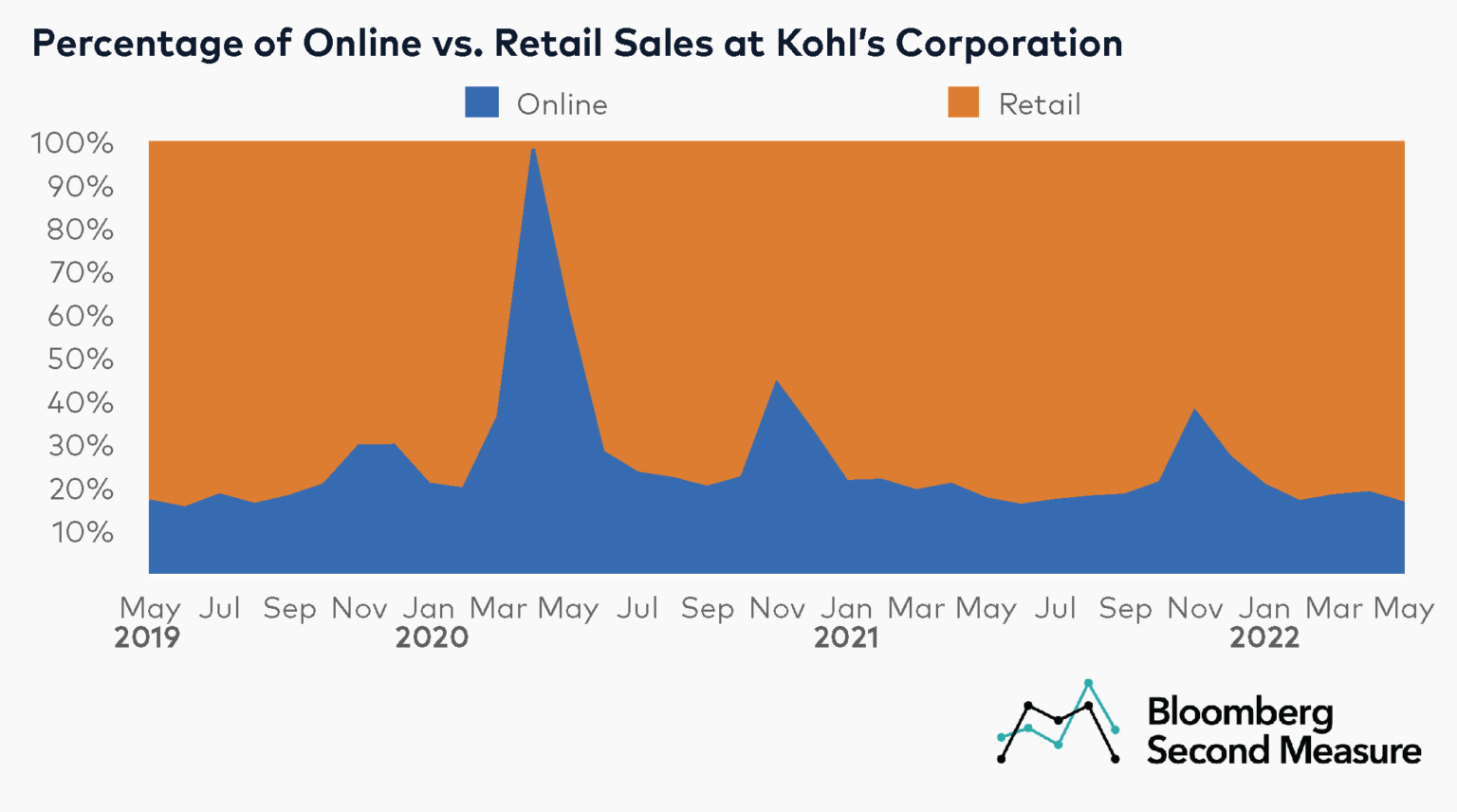

Most of Kohl’s sales come from the retail channel

Despite the pandemic causing a shift to ecommerce for many retailers, Kohl’s continues to see most of its sales come from stores. Like many other retailers, most of Kohl’s sales in April 2020 took place online as shelter-in-place orders went into effect. However, consumers began returning to stores by the summer of 2020. In May 2022, 16 percent of Kohl’s sales came from online shopping. During the same month in 2019 and 2021, 17 percent of sales were ecommerce-based.

Another notable trend is that Kohl’s sees a higher percentage of its sales coming from the online channel during November. Holiday sales events like Black Friday and Cyber Monday are a likely factor in the shift to online sales during this period. In November 2021, 37 percent of Kohl’s sales were online.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.