Our Quarterly Index Reports analyze the Q2 2022 performance of five key retail sectors – grocery, QSR, fitness, superstores, and dollar stores – from a location data perspective. The reports provide insights into the Q2 2022 performance of each category by diving into foot traffic patterns of each sector as a whole and evaluating visit metrics for leading brands. Below is a taste of the findings.

Superstores

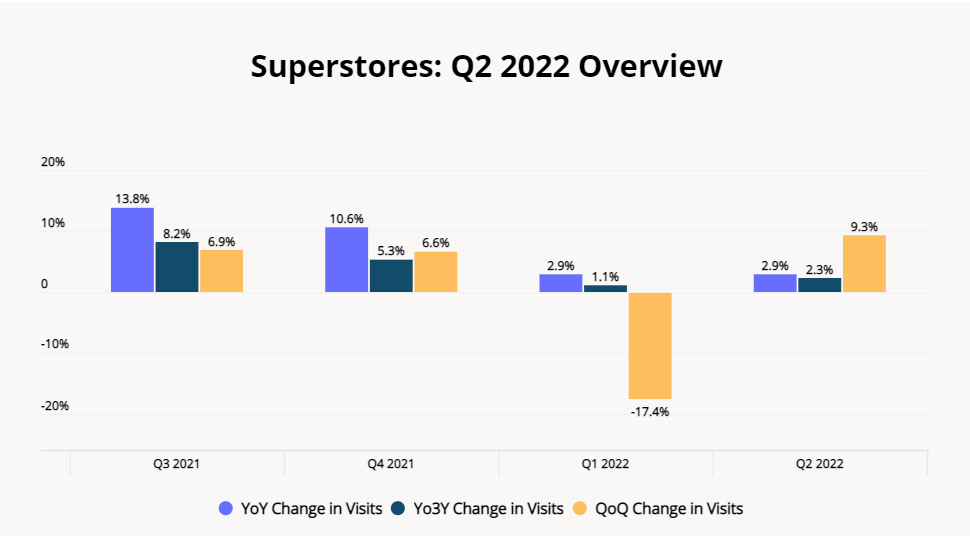

In Q2 2022, foot traffic to superstores jumped in Q1 and increased relative to both Q2 2021 and Q2 2019. Brands in this space include retail giants such as Walmart and Target and wholesale clubs like Costco and BJ’s Wholesale Club, and appear to be benefiting from the inflation and high gas prices of Q2 2022 by catering to consumers looking to consolidate shopping trips and buy value-priced items in bulk. So, while rising costs and supply chain issues did have an impact on some retailers’ bottom lines, foot traffic data indicates that superstores were one of the major beneficiaries of Q2 2022.

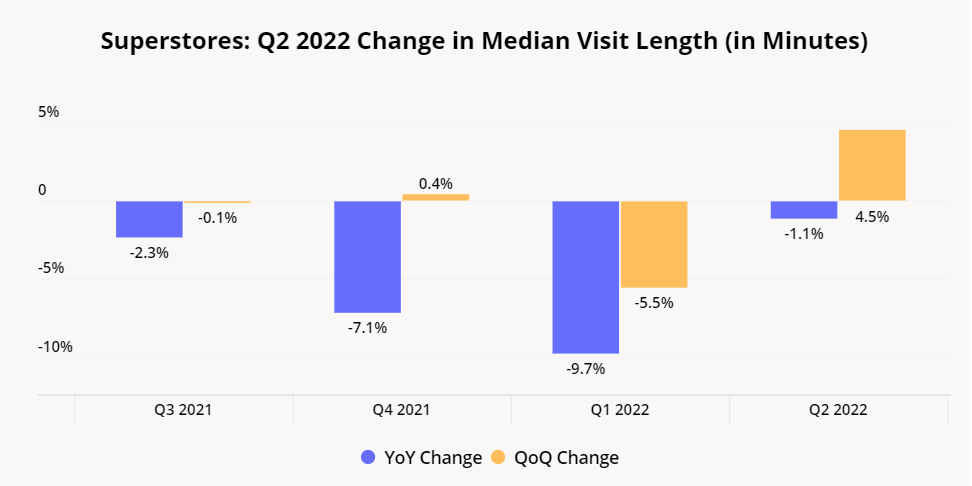

Median visit length to superstores increased by 4.5% between Q1 and Q2 2022 as consumers took more time in stores filling up their carts in an effort to avoid multiplying trips. So while the median visit length did not quite reach the heights it did in Q2 2021, the rising cost of a tank of gas does seem to be impacting brick-and- mortar consumer habits and leading some shoppers to adopt the mission-shopping behavior seen earlier in the pandemic.

QSR and Fast Food

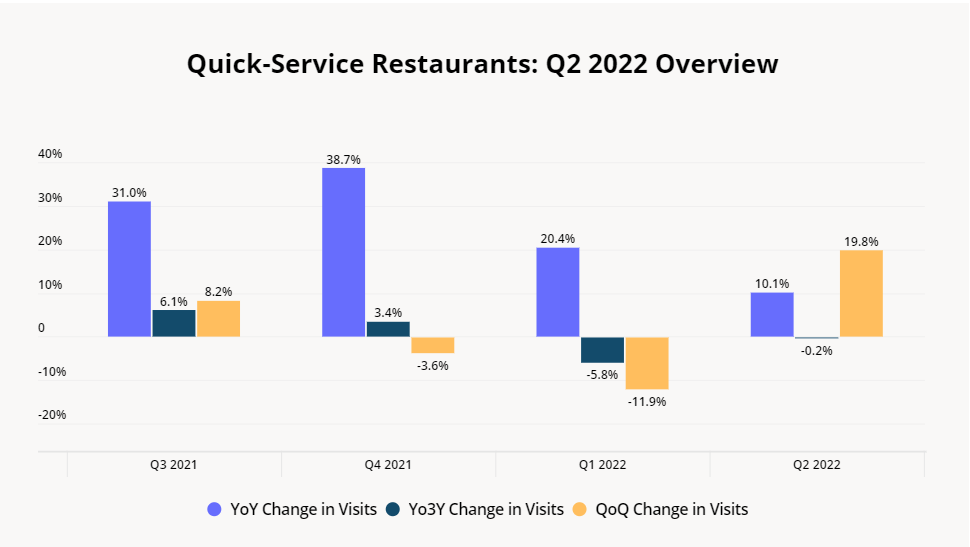

Offline Quick-Service Restaurants (QSR) foot traffic in Q2 2022 was essentially on par with pre-pandemic levels, and foot traffic increased significantly on both a year-over-year (YoY) and quarter-over-quarter (QoQ) basis. And as the COVID impact continues to wane and consumers trade down from full-service restaurants to fast-food, several QSR brands are seeing their visits increase – not only compared to 2021, but compared to pre-pandemic as well. So while the current economic challenges, and perhaps a lingering COVID effect, may be somewhat inhibiting Yo3Y growth, the general trend seems to be positive – and is even more impressive in the context of the wider contraction in discretionary spending.

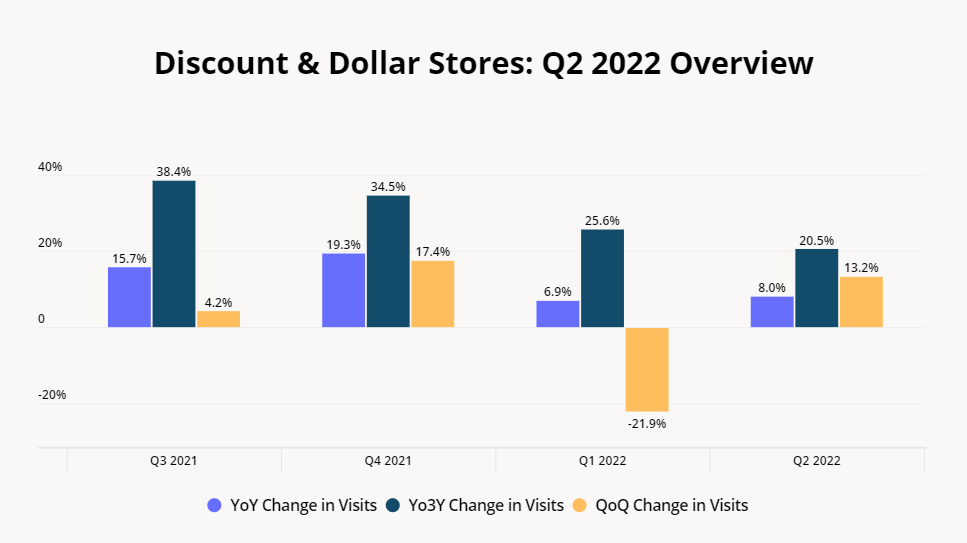

Foot traffic to dollar and discount stores increased over the pandemic, and Q2 2022 data indicates that visits to dollar and discount stores are still growing on all fronts – QoQ as well as year-over-year (YoY) and year-over-three-years (Yo3Y). And as consumers look to stretch their budgets, dollar and discount stores are likely to continue seeing elevated traffic numbers in H2 2022. To respond to the heightened demand, many brands are expanding their store fleet – which is setting the category up for even greater long-term success.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.