Despite some airports capping airline capacity without consultation in the last week - and the sad, if inevitable, decision of one UK airport to begin the closing process - it has been another week of capacity reaching above 102 million seats, and we should probably enjoy that heat whilst we can.

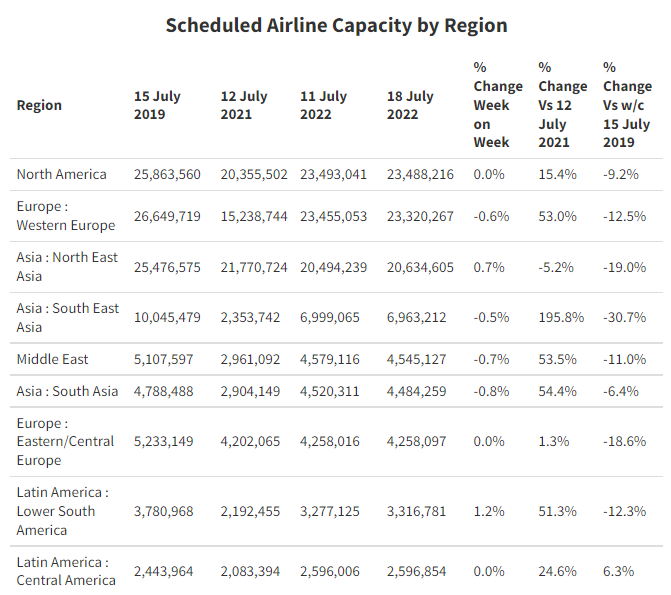

Unsurprisingly, it is only the larger airports that are capping airline capacity for the peak holiday season, this inevitably means we will see capacity fall in the coming weeks in some key locations. Nevertheless, who would have thought that global airline capacity would be 28% up on last year and in Western Europe some 53% or 8 million seats forward; it seems that the airlines did and the airports didn’t!

Autumn Airline Capacity Strong

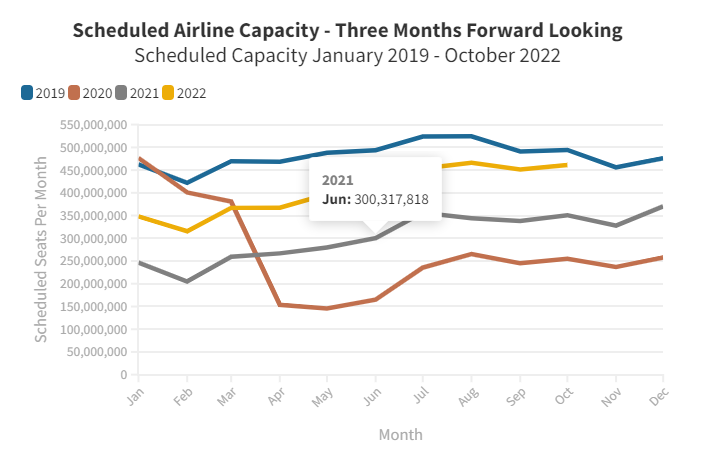

It may be the hottest week of the Northern Hemisphere, but it is also time to start looking a bit further forward to the autumn and we have now added October to our forward-looking capacity analysis - by which time of course we all hope that the current resource challenges will be behind us. Indications continue to suggest that September and October - at least from a planned capacity perspective - will be strong. Yes, there will be capacity adjustments, but October is currently holding at 93% of the 2019 level, so allowing for the normal adjustment factors it will finish at around 85-86% of 2019 levels.

With just a 0.1% move in weekly airline capacity, and in absolute terms just “some” 93,000 fewer seats this week, there is not much movement of interest across the major regions of the world and perhaps the focus this week should be on the travel recovery compared to this time last year. In that context South East Asia leads the way with a near doubling of capacity – but, of course, we need to remember that many parts of the region this time last year were still in lockdown, whereas Europe and North America (well the United States at least) were on their third recovery phase and had never heard of Omicron

Southern Africa is another region where capacity has doubled year-on-year despite the demise of Comair and South African Airways being half the carrier they were some time back. On a recent trip to Cape Town people were complaining about the increased costs of air travel since some carriers had left the market, that may be the case but those airlines operating need to cover the increasing cost of operation, after all not every airline is state-owned.

Central Asia Ahead of 2019 Levels

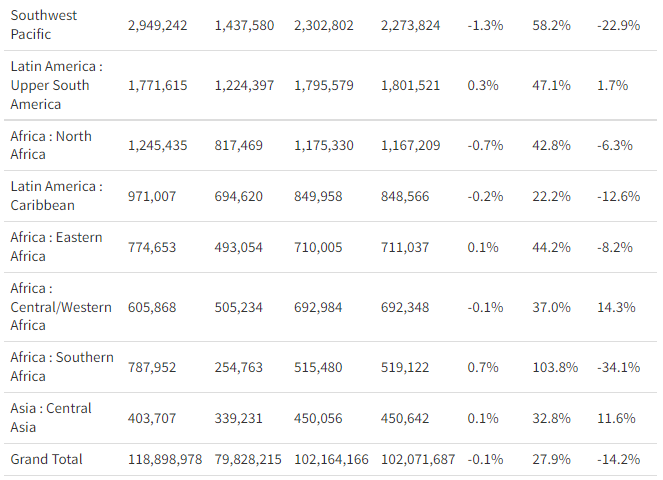

Looking at 2019 flight data, four of the seventeen regions now offer more weekly airline capacity than in 2019, and many of them we have highlighted in the past. None of the four regions will on their own make a huge difference to the global picture, but this week we are shouting out the smallest of them all, Central Asia, which is nearly 12% ahead of 2019 levels. Kazakhstan is the region’s largest market with an 18% increase on 2019 levels and 248,000 seats a week. However, in growth terms, the leader over the last three years is Kyrgyzstan with an impressive 47% growth. Air Astana are by far the largest regionally based carrier with 161,000 seats a week but very quietly Turkish Airlines have been building their presence in all country markets and now offer over 20,000 seats to the region compared to 12,000 in 2019; as my wife reminds me frequently, you have to watch out for the quiet ones…

There is nothing significant happening across the top twenty country markets and if the highlight of the week is Japan adding some 4% more seats week-on-week, then it is a very quiet week. After last week’s election result, there are hopes rising of Japan allowing more international visitors, but in truth, the summer season has been missed for a market that in 2019 was hoping for some ambitious increases in tourism after hosting the 2020 (well 2021) Olympics.

Vietnam Doubles Capacity

Vietnam in seventeenth position takes this week’s prize for the largest capacity growth year-on-year as it doubles capacity to 1.6 million, but the United Kingdom is not far behind with a 175% increase and a much larger base of 3.2 million. Greece is the strongest performing country market, with a 13% increase in capacity over 2019, in what will be one of the busiest weeks for the Islands.

The next two weeks will see many airlines reporting their second-quarter earnings which should be a positive set of results for the US-based carriers and an improving situation for the European carriers; all of course ahead of the issues now being faced and subsequent capacity cuts. The top twenty carrier list also (and perhaps not surprisingly) includes airlines that between them probably account for 80% of the industry’s profit in normal times; this week 800 active carrier schedules were adjusted across the OAG data platform. It doesn’t take a genius or indeed me to wonder how the 780 that contribute around 20% of the industry profitability in a normal year survive, but survive they do!

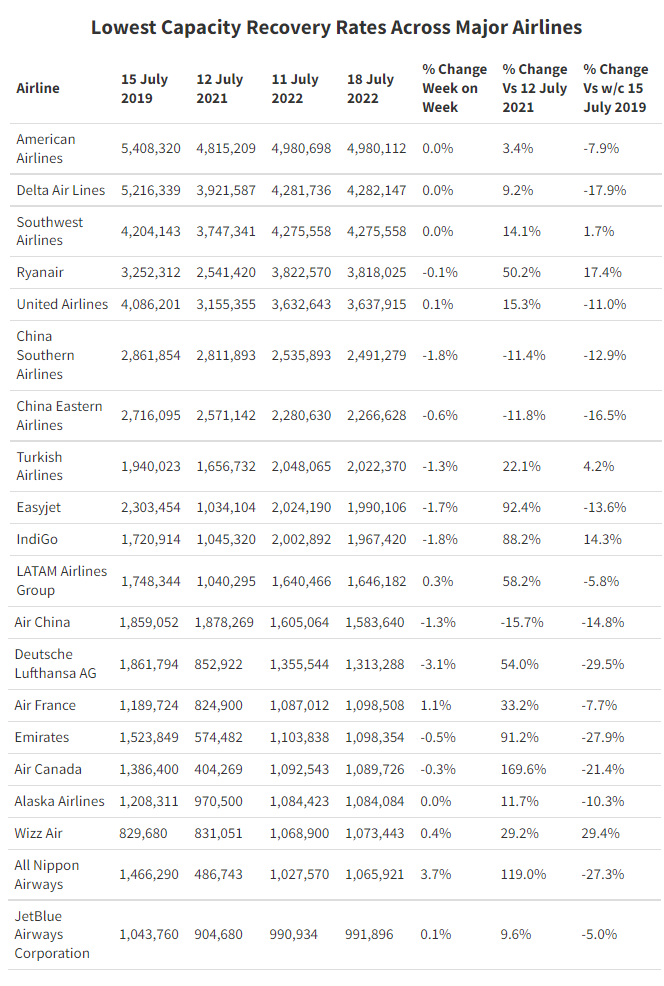

Standing on a platform at Luton Parkway last week, I noticed the “mind the gap” message on the platform just as an easyJet aircraft headed off to somewhere sunny. The irony of the message can be applied to the ever-increasing gap in capacity between the tangerine dream and the Irish machine; with Ryanair having added an incredible 17% more capacity versus 2019 whilst easyJet remain at -13%; an ever-widening gap of some 1.9 million seats a week. Still, profitability is the key factor so let’s see who’s doing best on that front in the next few weeks, any ideas anyone?

Flight Cancellations: Are Things Getting Better?

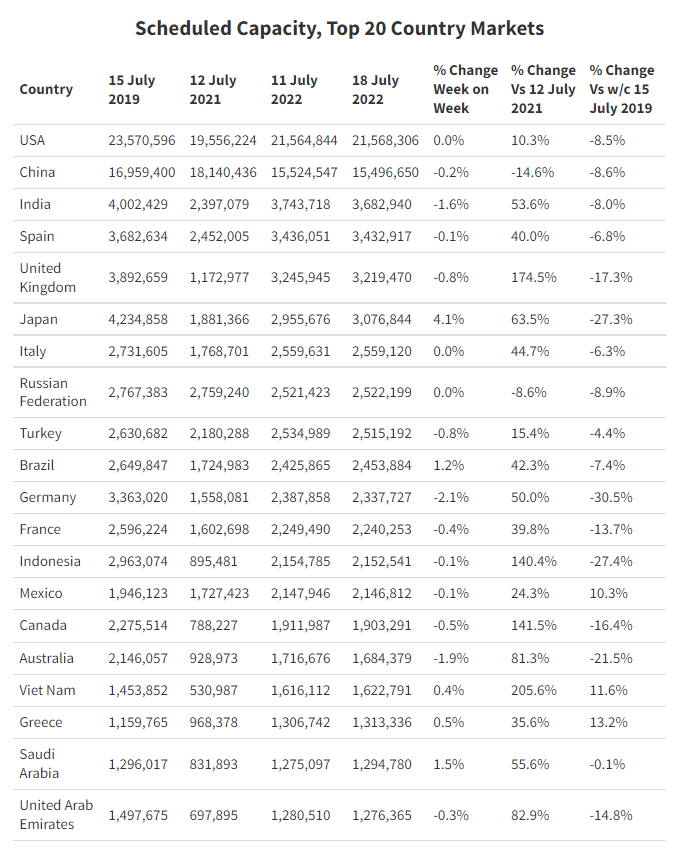

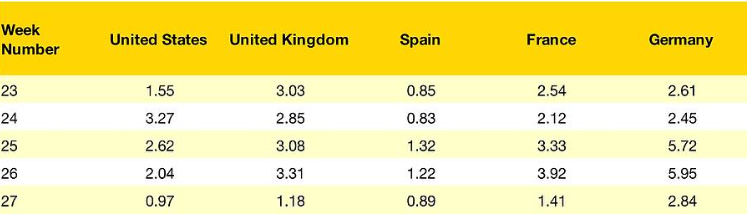

The subject of cancellations is a red-hot topic at the moment with OAG inundated with media requests from around the world for the freshest data. So, this week we are reporting on the last five weeks’ cancellation rates for a selection of the top country markets and airlines.

In summary, things appear to be getting a bit better over the last few weeks, although it may be that delay rates are creeping up at the expense of straight cancellations. In percentage terms, it seems that you are still over three times more likely to have your flight cancelled in Germany than in the United Kingdom but things appear to be getting better.

Percentage Scheduled Flight Cancellation Rates 2022

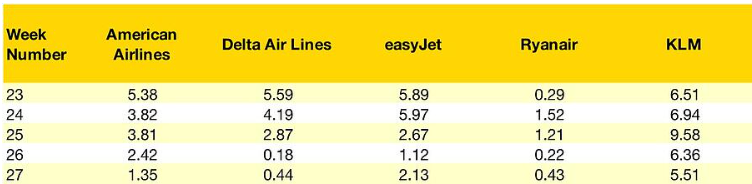

Amongst some of the major airlines, there are some ups and downs. Both easyJet and Ryanair saw their flight cancellation rates increase, although for Ryanair perhaps a 0.43% rate isn’t too shabby in the current conditions but again in percentage terms you were five times more likely to get a CX with easyJet than their biggest competitor. And of course, Delta Air Lines continues to be ahead of their major legacy peers in the US market.

Percentage Scheduled Flight Cancellation Rates 2022

And in closing, it is of course Farnborough this week so expect lots of big aircraft deals to be made, apparently India will be a market with some headlines early in the week and someone in Saudi Arabia needs to wake up and place a huge order if they expect to hit their vision 2030 targets before 2050!

To learn more about the data behind this article and what OAG has to offer, visit https://www.oag.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.