Source: https://www.placer.ai/blog/grocery-update-a-regional-analysis-of-inflation-and-foot-traffic/

As inflation spiked in the first half of 2022, grocery shoppers nationwide felt the pinch at the checkout. We conducted a regional analysis of grocery foot traffic data to examine the effect inflation is having in various markets and recapped Q2 2022 visit data for the category as a whole to offer a forecast for the coming months.

Soaring Inflation: a Regional Grocery Analysis

Inflation remains at the forefront of retail news, with the consumer price index (CPI) jumping 9.1% in June – representing the highest level in almost 40 years. We took a look at the food-at-home CPI (a proxy for grocery store prices) and regional grocery visit data to see if we could identify how rising prices are affecting foot traffic trends.

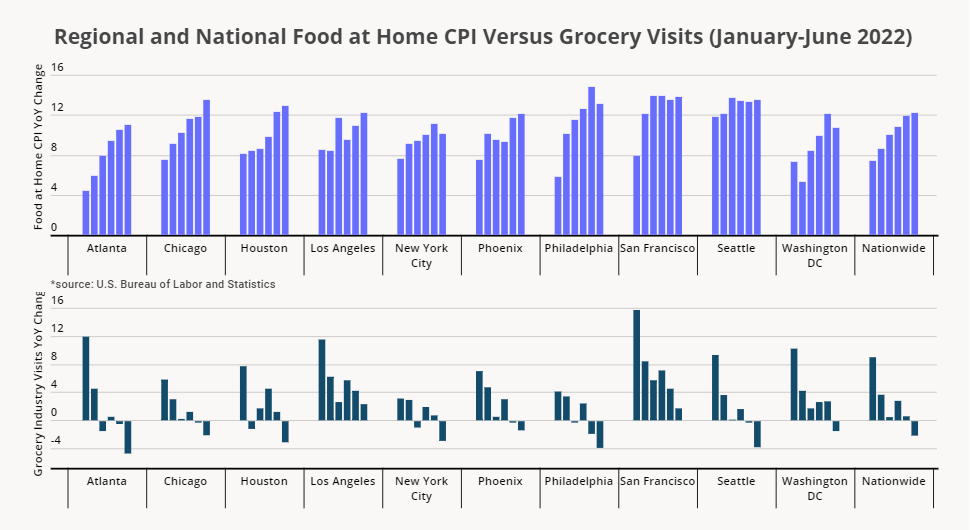

We reviewed food-at-home CPI data for 10 major markets from January 2022 through June 2022 and compared these figures to year-over-year (YoY) grocery store visitation data over the same period. While food-at-home inflation has somewhat influenced grocery store visitation trends across most markets, the magnitude of that inflation doesn’t appear to be a strong indication of grocery store visits: The data shows that grocery visits are decreasing as food-at-home CPI is increasing, but the impact of the increase in food-at-home prices is not consistent across regions.

For example, food-at-home inflation in Atlanta is running slightly below the national average in June – 11.0% versus the national average of 12.2% – yet visit data shows a YoY decline of 4.6% compared to the moderate 2.0% average decline nationally. Other markets such as San Francisco and Los Angeles saw YoY visit growth even as food-at-home CPI climbed above the national average, indicating other factors beyond prices – perhaps the high cost of eating out in these markets– are at play.

While many of these markets saw a dip in YoY visits in June, we don’t expect inflation to ultimately dictate the sector’s foot traffic performance. As mentioned, our analysis showed YoY growth for grocery in Q2 2022 and we expect that trend to continue as consumers look to save money by eating at home.

Consumers Turn to Value-Oriented Grocery Retailers

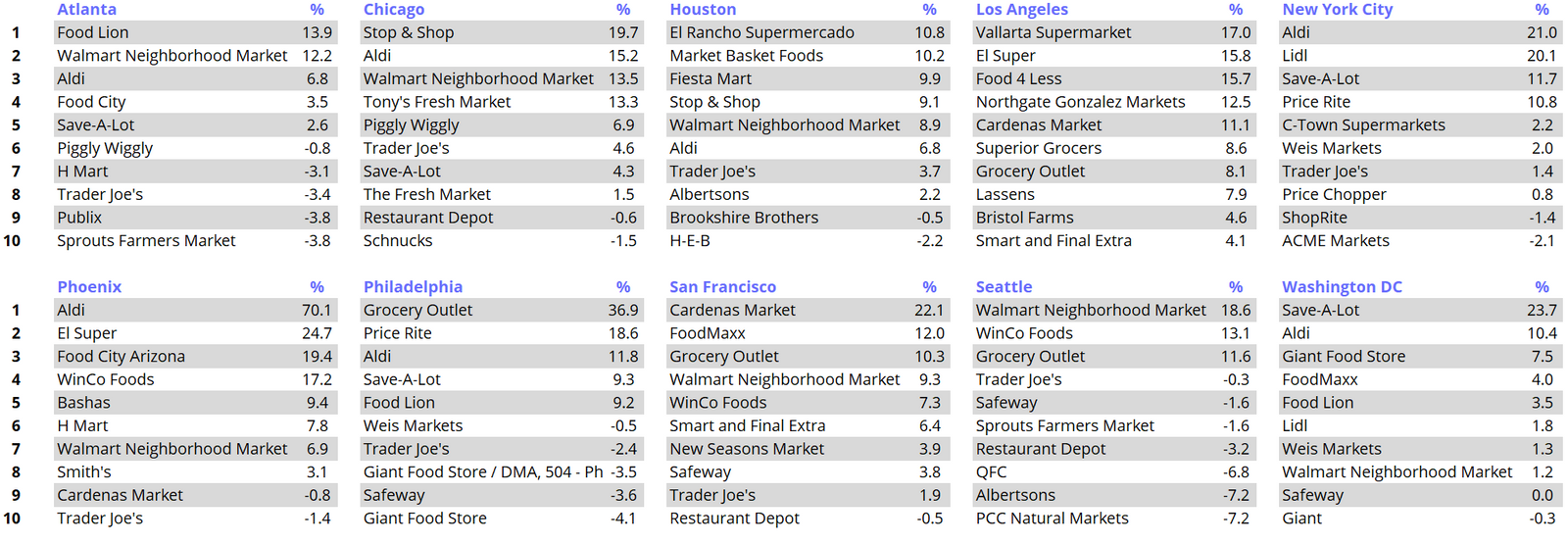

Analysis of visit data in regional markets shows that inflation is perpetuating a consumer trade-down to value-oriented grocers. While June YoY grocery store visitation trends declined in nearly all of the markets we looked at, some value-oriented grocery chains – brands such as Aldi, Lidl, Walmart Neighborhood Market, Save-A-Lot, and Grocery Outlet Bargain Market – have successfully increased their foot traffic.

For example, visit data in June for Walmart Neighborhood Market shows 18.6% YoY growth in Seattle, 13.5.% YoY growth in Chicago, and 8.9% YoY growth in Houston. Grocery Outlet shows YoY growth of 36.9% in Philadelphia, 10.3% in San Francisco, and 8.1% in Los Angeles. These numbers demonstrate a significant opportunity for the value-oriented segment of the grocery category if the nation’s inflation woes continue.

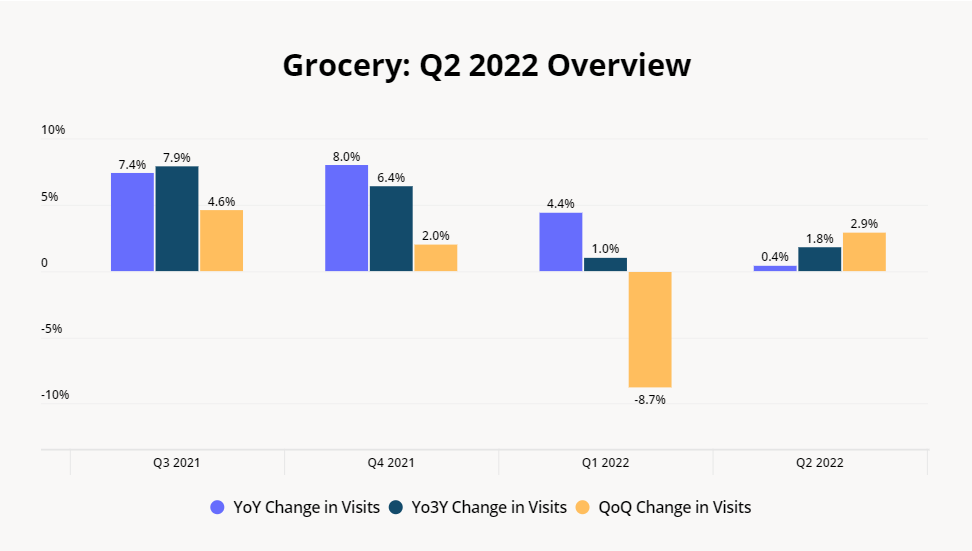

Grocery Still Ahead of 2019 Visit Numbers

Despite the challenges posed by inflation, foot traffic data shows that grocery visits rose in Q2 2022 on a quarter-over-quarter (QoQ) as well as year-over-three-year (Yo3Y) and YoY basis. So while the current inflation may be bringing grocery visits down from their pandemic peaks, the sector is still ahead of where it was in 2019. The continued strength of grocery is a testament to the long-term benefits of the COVID grocery boom and to shoppers’ current value-orientation which could be leading some consumers to choose home-cooked meals over eating out.

The Recap

Though some markets saw a dive in YoY foot traffic in June, our grocery sector visit data showed continued Yo3Y growth in Q2 2022. We expect to see continued positive foot traffic numbers, especially when compared to pre-pandemic data, as consumers turn away from eating out to the more cost-effective approach of home-cooked meals.

Notably, consumers are turning to value-oriented grocers as a result of rising prices. These brands likely have the greatest potential for growth in the coming months.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.