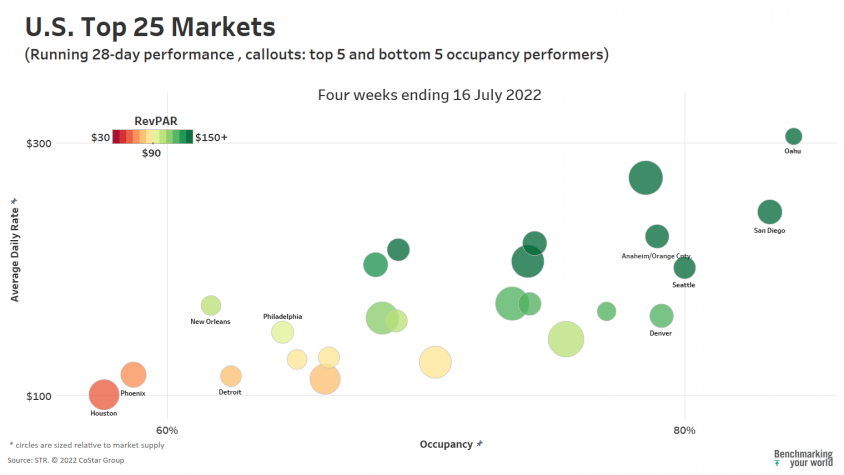

While the calendar shows that the summer of 2022 is pushing toward its conclusion, travel season remains in high gear around the U.S. Aligned with that season, the latest four-week “bubble” charts from STR show that leisure-oriented travel remains the predominant force behind the top performing U.S. hotel markets.

For the four-week period ending with 16 July, Oahu led the Top 25 Markets in average occupancy (84.2%) with a conspicuous boost during the Fourth of July holiday—the same period when most markets saw expected and significant demand declines. Oahu’s recent four-week occupancy also gained 9.3 percentage points over the prior four weeks.

San Diego placed second on the occupancy leaderboard by filling 83.3% of rooms, while Seattle appears to have found some footing with the third highest occupancy at 80.0%.

Despite appreciable occupancy numbers, the top five performers among the Top 25 Markets moderately underperformed their occupancy levels from 2019. Denver, for example, filled 79.1% of its rooms as compared with 87.2% during the comparable period in 2019. Only one Top 25 Market, New Orleans, showed higher occupancy (61.7%) than its 2019 match—during the usual low season for the market.

In terms of recent average daily rate (ADR), all but a single Top 25 Market (San Francisco) reported higher nominal (non-inflation adjusted) levels than 2019.

On an indexed revenue-per-available-room (RevPAR) basis, which collectively combines occupancy and pricing benchmarks, there are positive signs for a range of large markets, including some of those near the bottom of the current month’s occupancy board. For instance, Phoenix’s recent average occupancy (58.7%) was down two-plus percentage points from the same period in 2019. However, Phoenix’s matched ADR increased 28% for a collective RevPAR index of 123 (or 23 % above 2019). With a 15.7% inflation rate from June 2019, Phoenix easily outpaced its RevPAR recovery benchmark in real terms. Other large markets that met or beat their inflation-adjusted RevPAR indices included New Orleans (120), Anaheim (116) and San Diego (115).

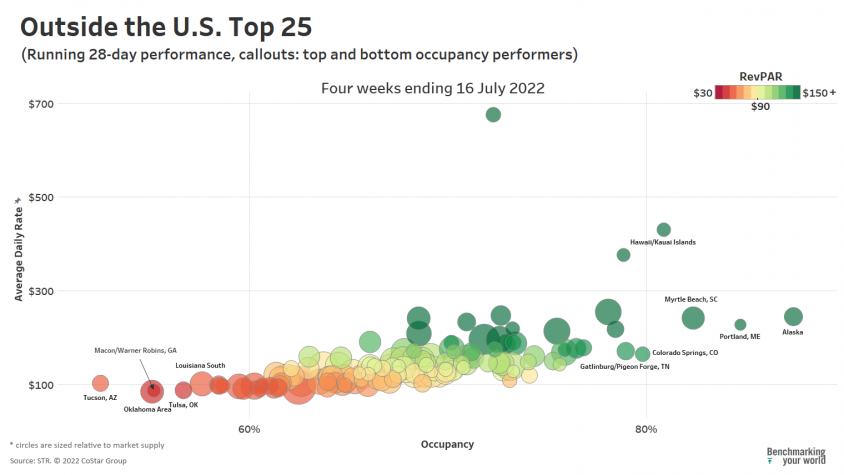

As we look beyond the largest markets, there is sharp evidence that warm-season, “play-oriented” destinations continue to fill rooms albeit at a slightly slower pace than last summer. Alaska was in first position with occupancy of 87.4%, coming in ahead of last year (86.4%) and right at the pre-pandemic comparable (87.4%). Portland, ME also showed a high occupancy level (84.7%) as a leisure-based destination in its warm season.

Further, among the 30 best occupancy markets outside of the major cities, a vast majority are oriented toward leisure travel. Still, only six of those 30 markets have had occupancies higher than the same period last year. This suggests that many of these leisure-dependent markets may have already seen a short-term peak.

To the degree that there may be some deficit in occupancy levels, a clear majority of non-large markets have closed benchmark shortfalls through increased ADR. Since our last monthly update, all leader markets increased ADR by at least double digits. Myrtle Beach had the largest ADR gain, up $36 to $241, followed by Portland (+$33 to $228), Hawaii/Kauai (+$32 to $431) and Alaska (+$23 to $244). Indexed RevPAR among smaller market leaders was highest in Hawaii/Kauai Islands (151), Portland (129), Alaska (125) and Myrtle Beach (116) – all outpacing their 2019 RevPAR indices on an inflation adjusted basis.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.