Manhattan and Brooklyn’s Pandemic Recovery

In the early days of the pandemic, amidst the lockdowns, population exodus, and mounting daily COVID cases, many predicted that New York City was finished. But as it turns out, it takes more than a global pandemic to destroy the city that never sleeps. Using foot traffic data, we dove into recent retail, tourism, and migration patterns for Manhattan and Brooklyn to understand how the past two years have impacted these iconic urban hubs.

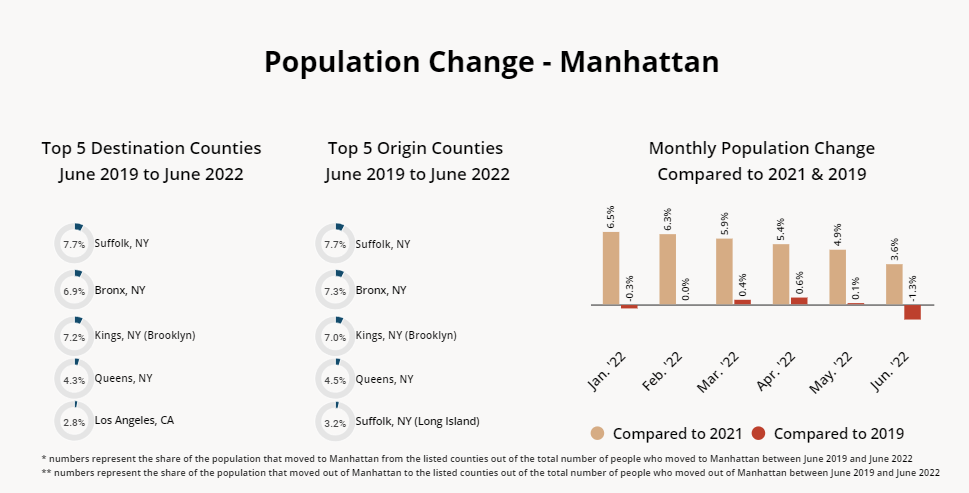

Manhattan’s Population Change

Manhattan was often compared to a ghost town at the start of the pandemic. New Yorkers practiced social distancing and commuters stayed away while embracing the work-from-home lifestyle (WFH). By September 2020, the residential vacancy rate in Manhattan had reached nearly 6% – more than double the typical 2% to 3%. But even as Manhattan was emptying out in 2020, big tech was betting on the city’s long-term health and snapping up millions of square feet of office space. And Manhattan made headlines recently when a report found that the average apartment rent in the borough for June 2022 exceeded $5,000 for the first time ever, indicating that demand for housing in Manhattan has returned with a vengeance.

Foot traffic data confirms that Manhattan’s residents have returned home. Year-over-year (YoY) monthly population numbers have been consistently elevated, bringing the population in line with pre-pandemic levels – in the first half of 2022, Manhattan’s population was essentially the same as it was in the first half of 2019. And while some Manhattan residents have chosen to leave over the past three years and move to suburban Long Island (Suffolk County) or neighboring boroughs of Brooklyn, Queens, or the Bronx, just as many people have moved into Manhattan from these surrounding counties – indicating that despite the staying power of remote and hybrid work, living in Manhattan still has serious appeal.

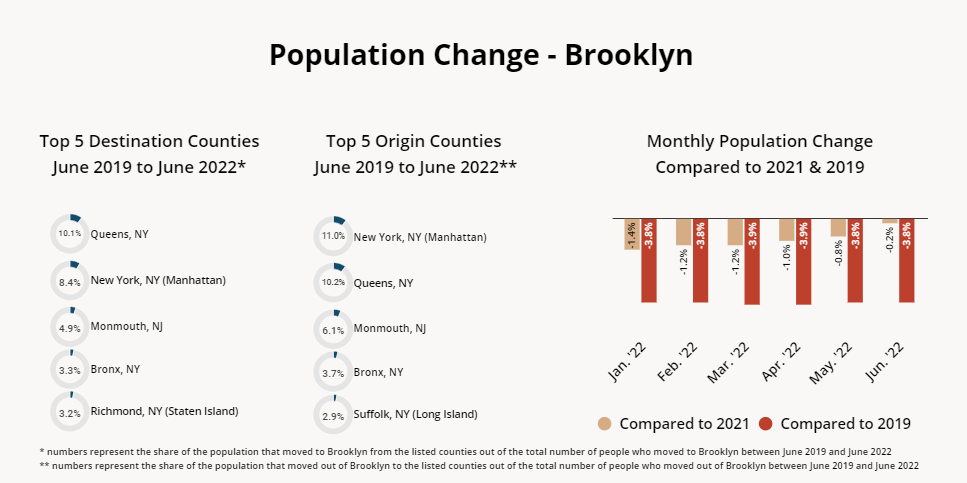

Brooklyn’s Population Change

While Manhattan’s population has essentially returned to pre-pandemic levels, Brooklyn still has fewer residents than it did in 2019, with the year-over-three-year (Yo3Y) monthly population gap hovering at a little less than 4% for the first half of 2022. And unlike Manhattan that saw monthly YoY population increases between January 2022 and June 2022, Brooklyn’s population continued decreasing (albeit slightly) between 2021 and 2022 – indicating that many of those who left the borough during the first two years of COVID have yet to return.

Like with Manhattan, most of those leaving Brooklyn remained nearby. Queens was the most popular relocation destination, followed by Manhattan, which means that not everyone left Brooklyn in search of open spaces. Some did move to the suburbs – 4.9% of those who left King’s County between June 2019 and June 2022 moved across the bay to Monmouth County, NJ. But 6.1% of those who moved to Brooklyn arrived from Monmouth County – so more people moved into Brooklyn from Monmouth than moved from Monmouth to Brooklyn.

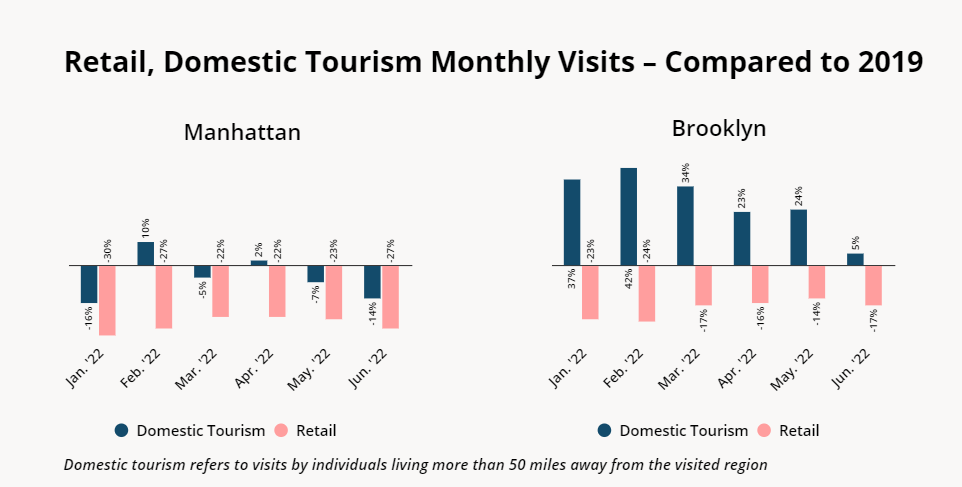

Brooklyn Domestic Tourism Recovery Beating Manhattan

Manhattan’s population may be returning faster than Brooklyn’s, but the data indicates that Brooklyn has the upper hand in terms of retail traffic and domestic tourism visits. Using Placer.ai’s COVID-19 Recovery Dashboard, we analyzed differences in retail and domestic foot traffic to Manhattan and Brooklyn between 2019 and 2022. We found that while Manhattan is struggling to maintain its pre-pandemic levels of domestic tourism, Brooklyn has experienced Yo3Y domestic tourism growth every month this year.

Manhattan’s domestic tourism took a hit in January as Omicron kept would-be travelers home, but visits climbed to 10% Yo3Y growth in February – only to fall again in March as inflation caused many to think twice before booking such an expensive vacation. And although tourism foot traffic recovered slightly in April, visits fell again in May – and fell even further to 14% domestic tourism visit gap in June 2022. Inflation may actually be hurting Manhattan tourism in two ways – first, by leading some potential tourists to forego their vacation altogether, and second, by making it relatively cheap for those Americans who can afford a trip to travel to Europe instead.

Meanwhile, domestic tourism to Brooklyn skyrocketed between January 2022 and May 2022, with double-digit increases in foot traffic every month relative to the equivalent month in 2019. And while visit growth did slow down in June 2022, domestic tourism was still 5% higher than in June 2019. Brooklyn is a much more affordable destination than Manhattan, which could explain some of the disparity. But the increase in domestic tourism to Brooklyn can also be attributed to former residents who are now regularly returning to their old haunts to shop, eat, or visit friends.

Brooklyn’s Smaller Yo3Y Retail Visit Gap

And even though Brooklyn lost a fair number of permanent residents while Manhattan’s population has recovered, Brooklyn is seeing smaller retail visit gaps than Manhattan – in June 2022, retail foot traffic in Manhattan and Brooklyn was 27% and 17% below June 2019 levels, respectively. This could indicate that – at least in popular tourist hubs – domestic tourism is just as important a driver of offline retail as are residents.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.