Our latest white paper dives into the spectacular return of the offline fitness industry. We looked at overall fitness visit patterns, regional variance trends, and changes in gym-goer behavior to analyze how consumers’ relationships with health clubs have evolved as a result of the pandemic. We also explored the impact inflation has on the sector to understand how fitness consumer behavior is adapting to changing economic circumstances. Below is a taste of our findings – for the full report, read the white paper here.

Following a Slow January, Gyms Are Now Thriving

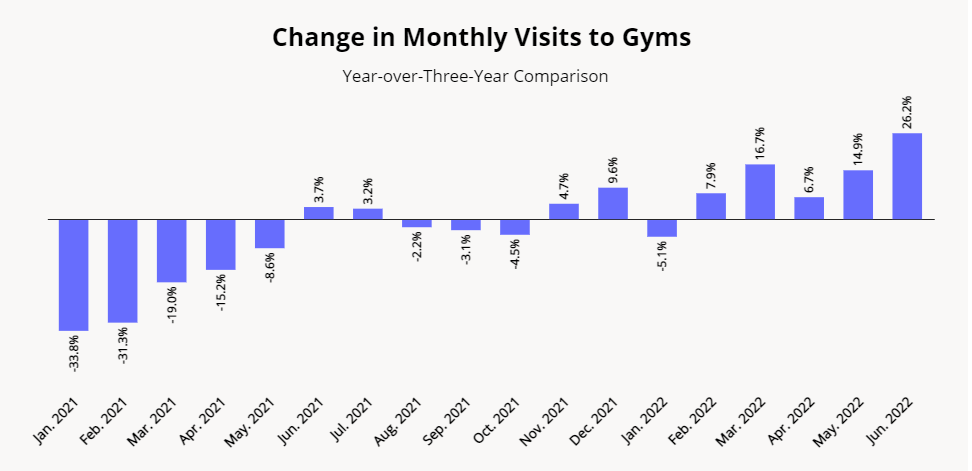

January is usually offline fitness’ biggest month, with New Year’s resolutions driving a significant increase in membership sign-ups and foot traffic relative to the rest of the year. And although this year’s January gym rush was hampered by the spread of Omicron – the sector showed incredible resilience and bounced back as soon as the wave ended, with February visits already seeing an increase of 7.9% relative to February 2019.

The growth in nationwide fitness visits is all the more impressive given the gloom and doom predictions regarding the end of gyms at the height of the pandemic – and the fact that, according to some estimates, 15% of gyms permanently closed in 2020 alone. Even historic inflation rates haven’t slowed this growth rate down, with June 2022 gym visits outperforming June 2019 foot traffic levels by 26.2%.

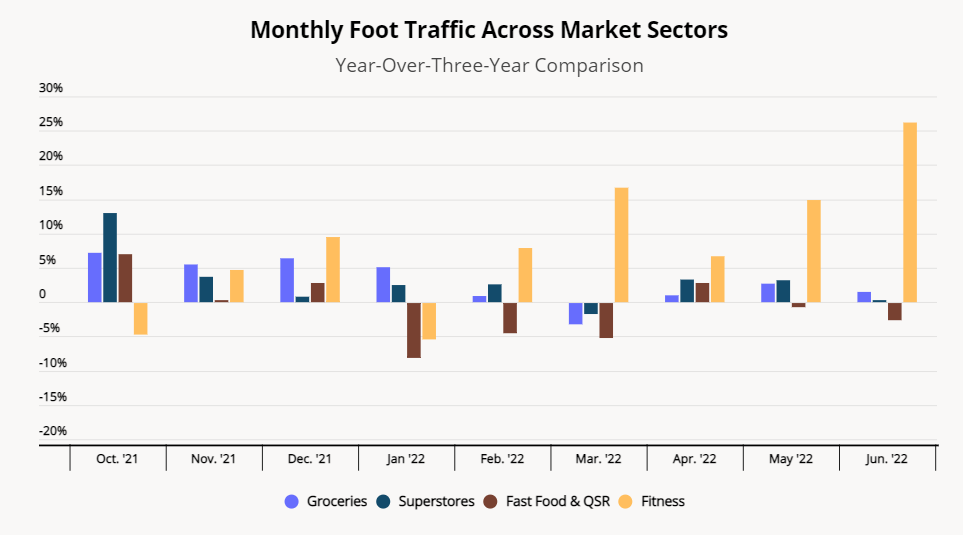

Fitness Growth Beats Other High-Performing Sectors

Fitness is not only beating its own 2019 and 2021 numbers – the growth in fitness foot traffic is also significantly higher than year-over-three-year (Yo3Y) visit increases in other high-performing sectors. In June 2022, Yo3Y visits to groceries and superstores grew 1.5% and 0.3%, respectively, while fast food & QSR remained close to 2019 levels with only a 2.5% visit gap – still an impressive feat given the current economic climate. Meanwhile, fitness foot traffic grew a whopping 26.2% Yo3Y.

Some of the increase in gym visits may actually be driven by inflation. Partaking in most other activities, from dining out to shopping, leads to a new expense each time the activity is experienced. But gyms usually charge a flat fee – which can be as low as $10 – for monthly access, and the membership also often includes more than just entrance to a weight room or access to an elliptical. Many health clubs offer app access to workouts, online nutrition programs, and other omnichannel services, which lets gym-goers get quite a bang for their buck. And for many gym-goers, having a space to enjoy the community of like-minded people is enough of a reason to keep their membership even when trying to cut back on their spending.

Offline Fitness Has Made a Comeback

The benefits of exercise are innumerable, from lowering stress levels to increased longevity to fewer COVID complications – but another significant aspect of offline fitness is the community created around gyms and exercise. People seek community and interaction, and the gym is one of the best ways to cultivate those relationships. As pandemic restrictions isolated many, people are now ready and eager to take advantage of fun, positive, face-to-face interactions – and a class at the gym or session with a trainer fits that bill.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.