What do the COVID-19 pandemic, a looming recession, rising interest rates and global conflicts have in common?

They all impact nearly every aspect of life, including how brands spend their ad dollars.

While the lasting impact of these events remains to be seen, we are starting to see how advertisers are responding to the shifting sands.

Hint: Most of them are spending less.

Still, there are opportunities to convince them to open their wallets.

Recently, MediaRadar looked at a sampling of advertising on over 215 digital content companies like BBC News, ABC, and USA Today. Large media brands were included and together, have an audience of 257 million unique visitors. Here’s what the data shows, and what it means for your strategy.

Advertisers Are Bracing Themselves

Walk down the street and ask any number of people if we’re in a recession and you’ll get different responses – likely a mix of “absolutely,” “heck yeah,” “no, but we’re getting there,” and “nah, this is the normal.”

If you asked TD Securities, you’d hear that there’s more than a 50% chance we’ll enter a recession in the next 18 months.

If you asked Bloomberg Economics, you’d hear there’s about a three-in-four chance that the US will enter a recession by the start of 2024.

The New York Times would tell you it’s “hard to say.”

Although there’s no consensus on a recession, the overwhelming majority of businesses—and advertisers—would agree on this: when times get tough, spend less.

In MediaRadar’s sample, we saw more than 30k companies (46k brands) buying ads on digital media channels through May 2022 are following suit.

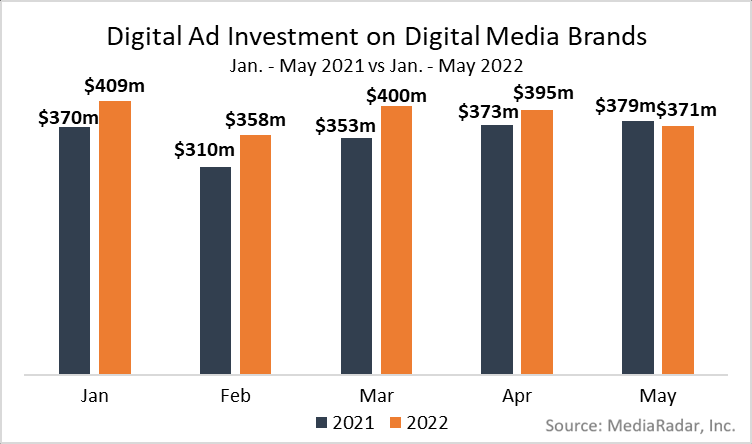

After spending increased by 4% YoY through the first four months of the year, it dropped by 2% YoY in May, the first time it’s dipped below 2021 levels.

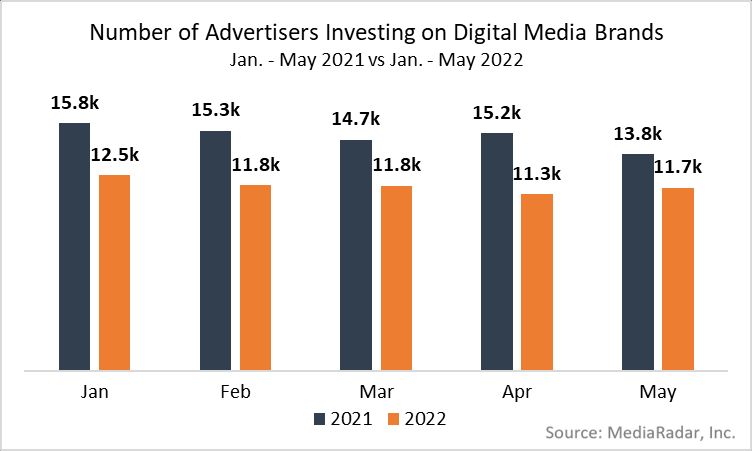

The number of advertisers buying ads on these channels dropped by 15% YoY as well.

While it’s normal to see ad spending on these channels fluctuate, the decrease during the peak summer months could indicate that the brief increase we saw at the end of the pandemic will be quickly followed by a recession-fueled dip.

Will the decrease continue?

It’s hard to say, but given the state of the world, don’t be surprised if some advertisers, especially those hit harder by current events, adopt more reserved spending habits as they hunker down.

Video Ads Are Losing Their Luster

We live in a video-first world.

So much so that Instagram’s CEO, Adam Mosseri, recently said, “I do believe that more and more of Instagram is going to become video over time.”

When you have an app like Instagram—one founded on photo sharing—going all-in on video, you know it’s here to stay. (TikTok and OTT platforms agree.)

With so much interest in video, it might be surprising to learn that video advertising on our sampling of digital media channels is declining. (Note: Sample doesn’t include social platforms like Instagram or video platforms like YouTube)

But for digital media brands, that’s what’s happening – albeit slowly.

After spending at least $90mm on video ads in each of the first four months of the year, advertisers decreased video spending by 8% MoM in April, bringing the total spend below $90mm for the first time in 2022.

There’s no denying that any diminishing activity around video will cause heads to turn, but even giants can hit the ceiling.

Here’s proof: Facebook’s user base increased by less than 1% between Q2 2021 and Q4 2021.

Even video consumption among US adults is expected to decrease.

This isn’t to take away from video’s spotlight – it’ll always be a big part of spending on digital media channels. However, the slight decrease and potential plateauing are worth noting – especially as other channels, like OTT, are on the rise.

This could be a signal that video spending on these channels is approaching its ceiling, not because advertisers are losing interest, but because new ecosystems are popping up and they’re testing the water.

Birds of a Feather Flock Together

This saying doesn’t typically apply to digital media channels, but it felt right when we looked at how advertisers are spending on them.

Why?

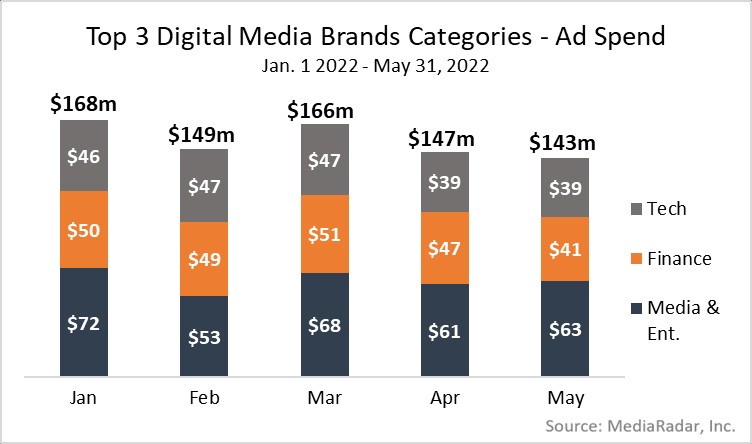

Because the biggest industry players are all buying ads on digital media channels – Media & Entertainment, Financial & Real Estate, and Technology.

These are the categories you’d expect to muster through a downturn and find a silver lining.

Combined, the companies in these categories accounted for 40% of the total digital ad investment in these channels.

That said, it’s worth noting that some of them are flying lower than normal.

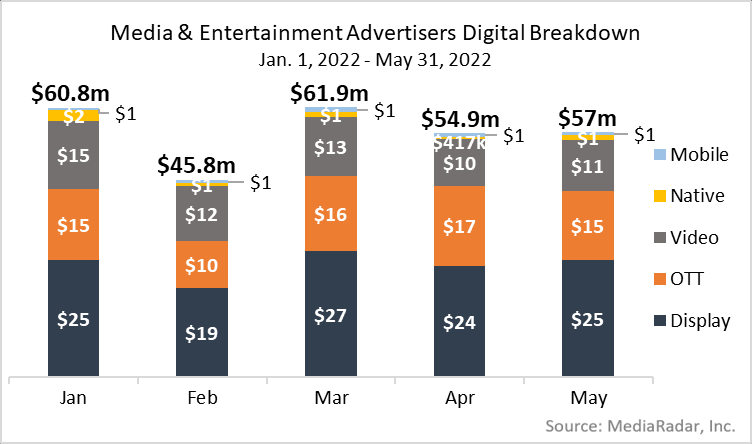

Media & Entertainment companies, including Amazon, Meta, and Microsoft, don’t fall into this “low-flying” category.

Instead, they’re increasing their spending.

Through May, there have been nearly 4k Media & Entertainment companies leveraging these digital media sites, with more than half of this investment coming from the promotion of films, mobile media (like the DraftKings’ Sportsbook,) and websites (such as eBay, Facebook and LinkedIn.)

For these companies and others like them, their spending habits put them in rarified air.

As other industry advertisers weather the storm by tightening their belts, these more “recession-proof” companies will continue to spend.

Ad teams should note this trend as they look for sweet spots and those showing resilience when others are pumping the brakes.

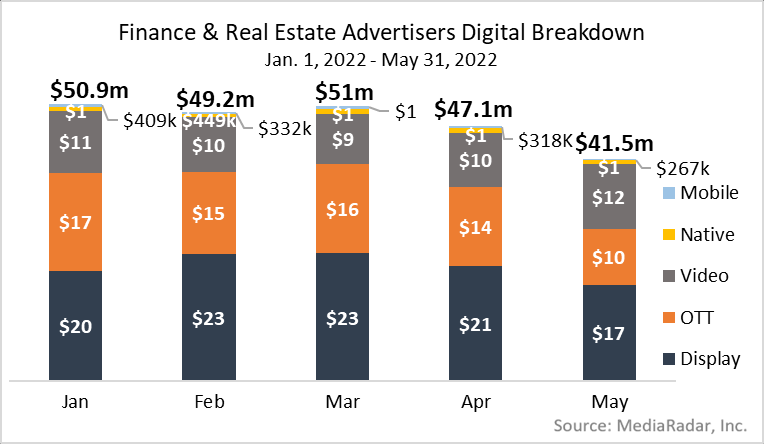

While Media & Entertainment advertisers appear to be less concerned about the future, those in Finance & Real Estate are showing some apprehension.

After a modest increase in spending through the first few months of the year, spending from these companies on digital media channels decreased by 12% MoM from April.

This is important to note, given that this category is often a true economic indicator and reflects overall market trends; rising interest rates and widespread layoffs in Real Estate are strong signals as well.

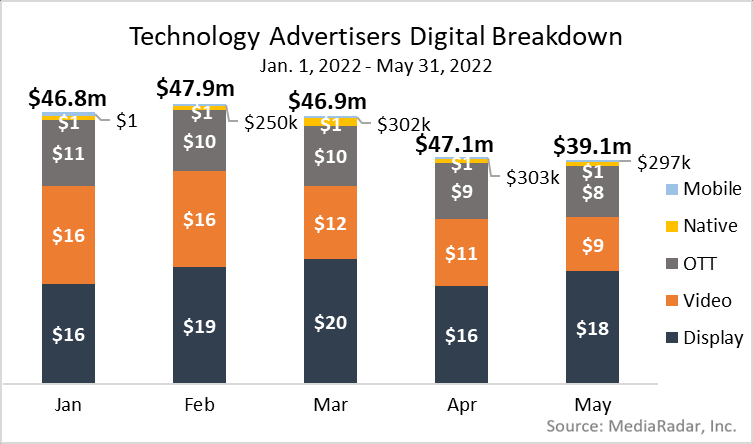

Technology advertisers – think consumer electronics, software companies, and telecommunication companies – also pulled back spending, decreasing it by 5% from January through May.

Again, the pullback from these companies reflects current market conditions; when times get tough, people spend less on material goods.

When that happens, ad budgets go down.

The writing is on the wall: spending habits are shifting and many advertisers are decreasing their budgets.

That said, some brands are “recession-proof,” like Media & Entertainment, Pets, Childcare, and Groceries.

For those lucky few, expect their wallets to remain open and for their spending to remain flat or increase slightly in the months ahead.

You Can Have One without the Other

Given the size of the digital media world, one would think that brands would be spreading their wealth to take advantage of all it has to offer.

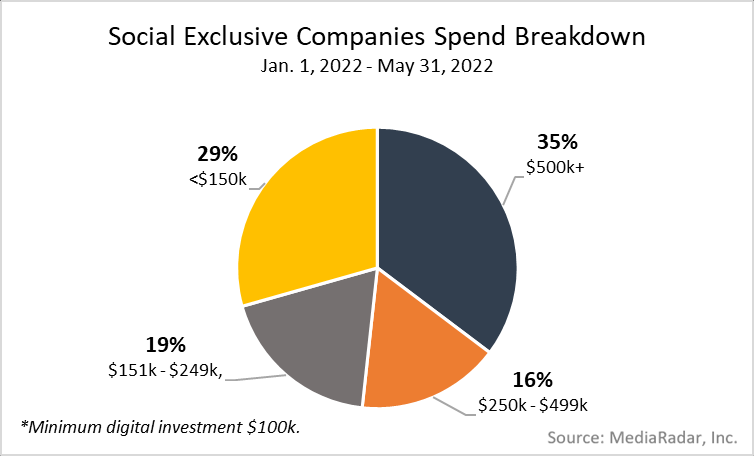

That said, of the nearly 9k advertisers who invested over $100k in digital advertising through May, about 2k of them only bought social ads.

While there’s a reason they’re only buying on social media – likely because they’re in their comfort zone – they could be convinced to expand their advertising investment outside of social’s hallowed walls.

Target the top 35% of the social-exclusive club and nearly 700 companies that have already spent more than $500k come into view. These companies are primed to buy – just show them what’s outside of social’s hallowed walls.

The you-can-only-pick-one attitude extends to digital media channels as well.

Out of the more than 7k advertisers who bought more than $100k on digital ads (not social exclusive), more than 2.5k of them, including those in Media & Entertainment, Finance & Real Estate, and Technology, aren’t investing in digital media brands.

Again, this is an opportunity to start a conversation with advertisers who are spending right now, who aren’t taking advantage of all the inventory available.

So, while the outlook looks grim, there are opportunities – it’s just a matter of looking for the sweet spots and low-hanging fruit.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.