Grocery and Superstores Make a Comeback

U.S. job growth soared in July, as the pandemic-impacted categories of leisure and hospitality bounced back to meet consumers’ continued demand for out-of-the-house experiences. But inflation continues to cut into spending power, with food inflation in particular remaining stubbornly high. We dove into retail foot traffic data to understand how the current dynamics are impacting key consumer-facing industries.

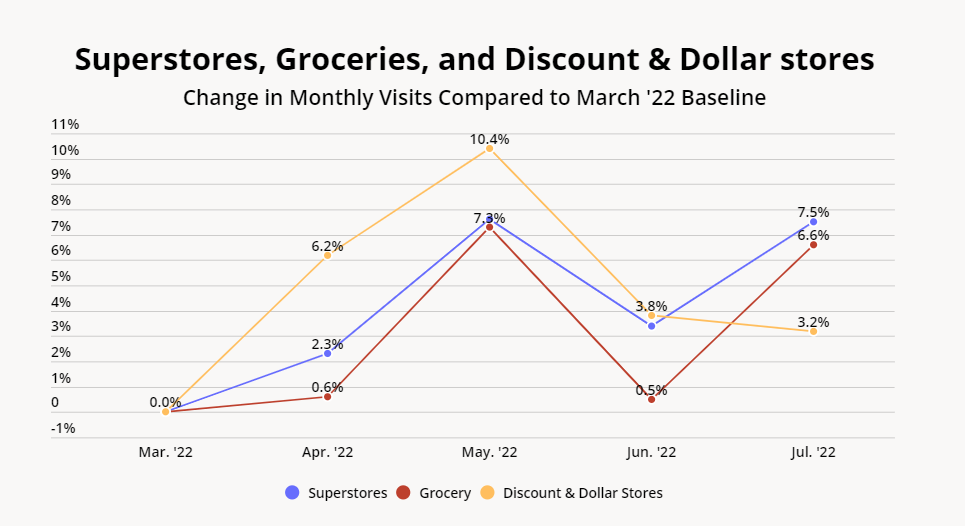

Dollar Store Visit Growth Continues to Outpace Grocery, Superstore Sector

Food prices are rising, and since most households buy groceries at least once a week, consumers are noticing the price increases at the grocery store. As a result, some consumers may have shifted their food and beverage shopping from supermarkets and superstores to discount and dollar stores – although the trend appears to be slowing.

Following March 2022, when gas prices surged and the year-over-year (YoY) inflation rate crossed 8%, visit growth to discount and dollar stores outpaced foot traffic increases to superstores and grocery stores. April 2022 dollar store visits were 6.2% higher than visits in March 2022, compared to the 2.3% and 0.6% increase in visits for superstores and grocery stores, respectively. May 2022 continued the pattern, with dollar store visits up 10.4% and superstores and grocery stores up 7.6% and 7.3%, respectively, when compared to a March 2022 baseline.

But data from June and July shows that superstores and grocery stores are beginning to come back. June 2022 foot traffic growth to superstores and dollar stores was essentially equal when compared to a March 2022 baseline. And in July, grocery stores and superstores saw a 7.5% and 6.6% increase in visits compared to a March 2022 baseline, while foot traffic to dollar stores grew just 3.2%.

The return of superstore and grocery store visits may be driven by the differences in product offerings between the three retail categories. While some dollar stores, including select Dollar General locations, do sell produce, most discount and dollar stores do not carry the variety of food and beverage items typically associated with grocery retailers or superstores. Consumers who shifted their grocery shopping to dollar stores following the initial gas hikes and inflation reports may now be returning to superstores and grocery stores to purchase fresh fruits, vegetables, and other items that are harder to find at discount stores.

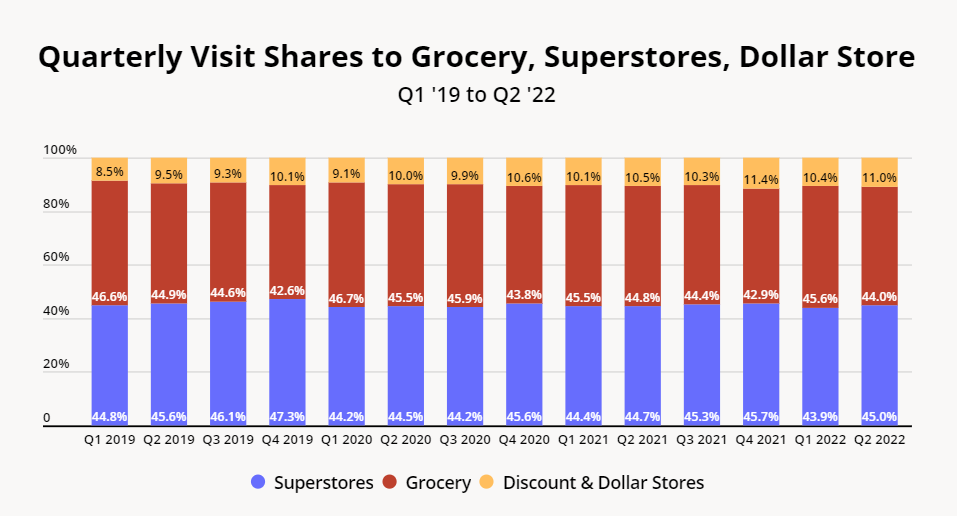

Dollar Stores Already Strengthened by Pandemic

Just because consumers are returning to grocery and superstores does not mean that dollar and discount stores are losing steam. Comparing the visit shares of superstores, grocery stores, and discount stores over the three-and-a-half years reveals how much stronger dollar stores are today compared to pre-pandemic.

Visit share represents the share of visits to each category out of the total number of visits to all three sectors. In 2019, before COVID hit the U.S.,the visit share to discount and dollar stores hovered between 8.5% and 9.5% in Q1, Q2, and Q3, and barely passed the 10% mark in Q4 – traditionally the sector’s strongest quarter. But throughout the pandemic, many dollar chains continued massive offline expansions, and since 2021, the visit share to discount stores has consistently exceeded 10%, even reaching 11.4% in Q4 2021. In Q2 2022, as inflation and gas prices impacted consumer shopping habits, the dollar store visit share climbed to 11.0%, compared to just 9.5% in Q2 2019.

Still, the chart below also shows that grocery and superstores are still by far the biggest food and beverage retailers, controlling almost 90% of the visit share. But as dollar stores continue to expand, and especially if more dollar stores follow Dollar General’s lead and begin stocking fresh produce, competition in this already competitive space may well heat up even further.

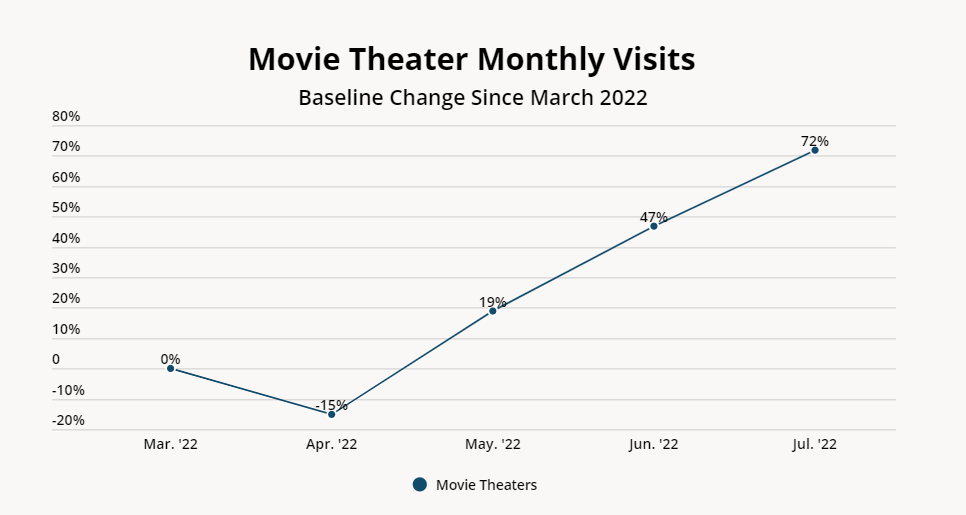

Increased Demand for Experiences

Consumers may be looking to save on recurring essential purchases, but the current economic challenges also appear to be boosting certain categories of discretionary spending. Foot traffic to movie theaters suffered an initial hit in April, but visits have since skyrocketed, with July 2022 visits up 72% compared to a March 2022 baseline.

May, June, and July 2022 saw a slew of particularly successful film releases, which likely played an important role in driving visits to cinemas – and thanks to falling gas prices, consumers may no longer think twice before driving to the cinema. And even though movie tickets (like almost everything else) are more expensive now than they were last year, the price increases are much lower than in other categories, which may make an in-theater movie night an attractive outing option.

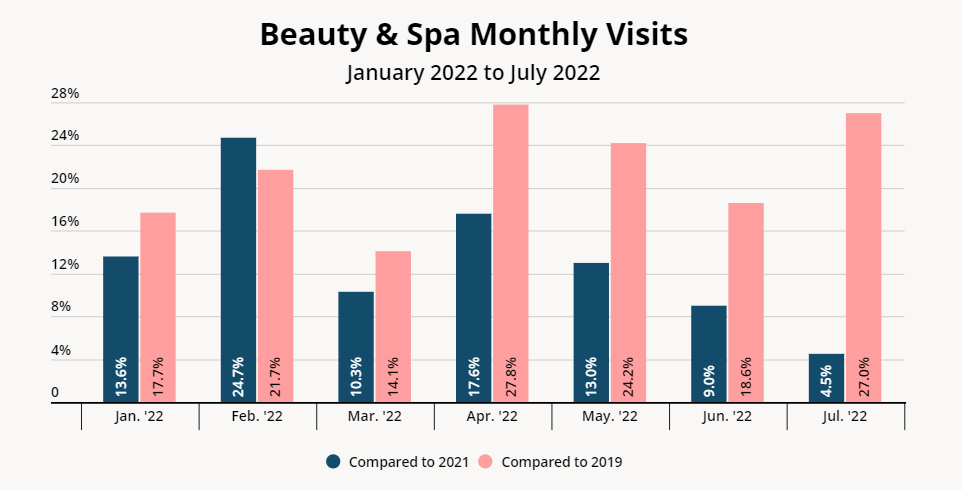

Beauty Foot Traffic Up

The beauty and spa industry is also seeing heightened foot traffic. Visits to the category – which includes beauty retailers such as Ulta Beauty, personal care providers such as Massage Envy, and specialty retailers such as Buff City Soap – have been up every month this year, not only compared to COVID-ridden 2021 but also compared to pre-pandemic 2019. And while some of the visit growth is driven by brick-and-mortar expansions, the increase in foot traffic also reflects a strong demand for beauty products that has – so far – remained relatively unaffected by the wider downturn in consumer spending.

The success of movie theaters and of the beauty and spa category indicates that, despite the challenges, consumers are still willing to spend money on non-essential goods and services. So while overall spending may be slowing down, people still want to treat themselves – and businesses that can provide consumers with gratifying entertainment, services, or products at an inflation-friendly price point can reap the rewards.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.