Put lightly, the last few years have been volatile in the brick-and-mortar retail sector. Yet, Walmart and Target, two of the industry’s heavyweights have consistently overperformed. This included a strong showing in the spring of 2022 that came as COVID’s effects were dissipating, creating the sense that retail could finally enjoy a period of extended normalcy.

Yet, that period barely had time to take off before rising gas prices and inflation began to impact consumer behaviors and spending. This led both Walmart and Target to warn that profit challenges were expected as the year progresses – especially as they looked to keep prices down in an environment of economic uncertainty.

So, where do these giants stand in terms of brick-and-mortar performance, and just how bad are things trending? We dove into the data to find out.

Back-to-School Challenges

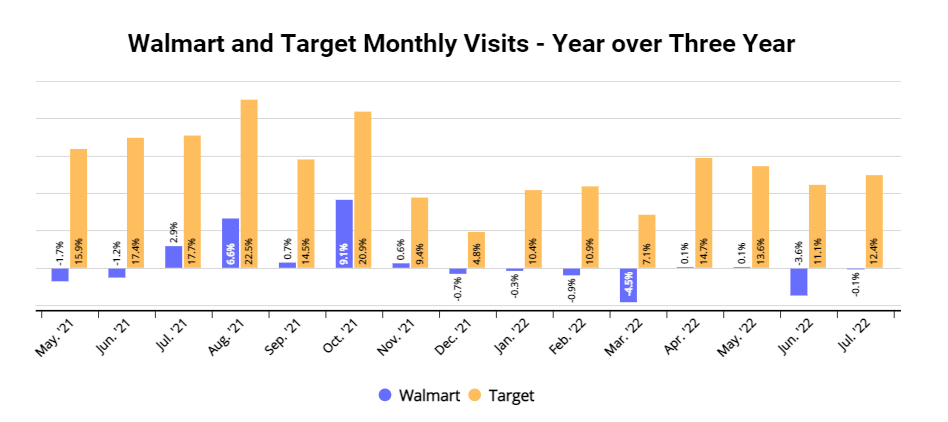

Indeed, visits to both Walmart and Target were down 2.7% and 2.9% respectively in July of 2022 compared to the same month in 2021. But this was only the second such visit decline in year-over-year (YoY) numbers since March of 2021 for Target, and the third for Walmart. And while inflation and high gas prices are clearly playing a role, an additional factor comes from the unique heights hit in July of 2021.

In July of 2021, Walmart and Target were up over 16.0% compared to 2020 and up 2.9% and 15.9%, respectively, compared to July two years prior during the particularly strong 2019 Back-to-School season. So while visits are down, the relatively minor decreases even amid very significant economic challenges are actually quite impressive.

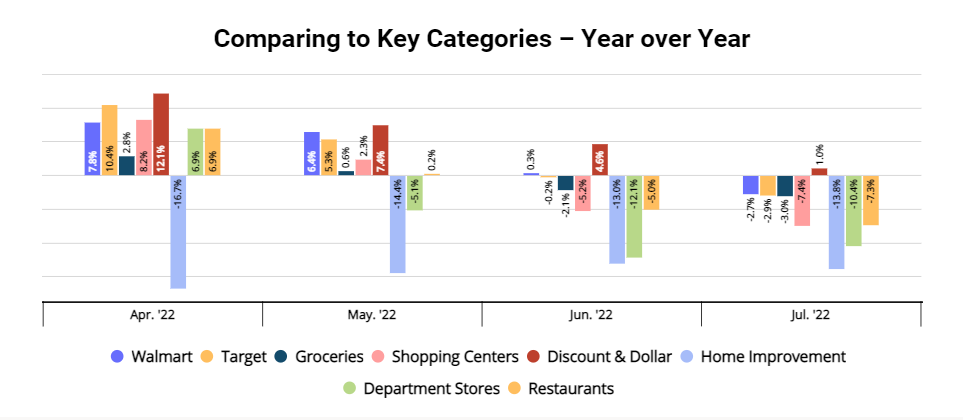

The relative strength of both retailers also comes into heightened view when compared to other categories in the retail sector. Visits have trended closely with, if not above, a high-performing grocery segment and well beyond retail segments like home improvement, restaurants, and department stores. The players are only lagging behind dollar and discount, a segment that is uniquely well-positioned for the current situation and is still benefiting from aggressive expansions over the last year.

2019 Context and Positive Visit Trends

The optimism continues to build when looking at the same monthly data compared to the aforementioned 2019 period directly. From this view, Walmart visits were essentially flat, while Target’s were up significantly.

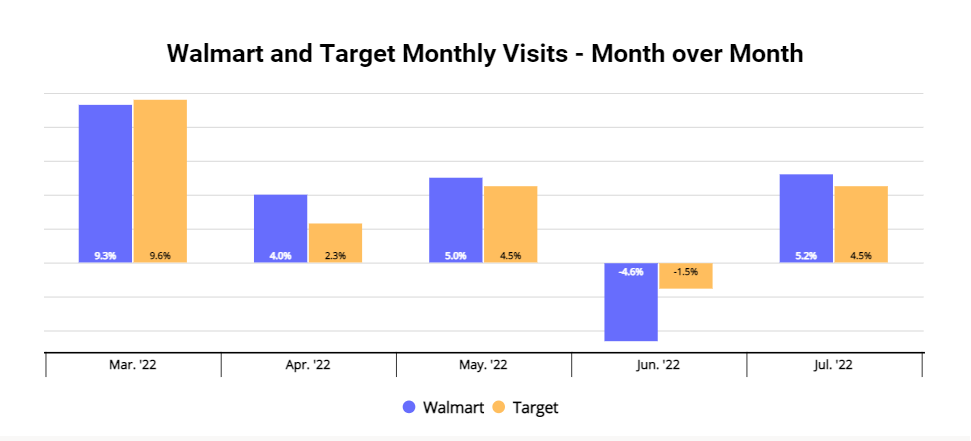

And a month-over-month (MoM) view shows that within those relatively strong comparisons, July marked a strong move forward compared to June. Visits were up 5.2% for Walmart and 4.5% for Target MoM, a sign that while economic headwinds were limiting visits in June, the Back-to-School season still drives urgency and visits.

There is also ample reason to believe that the situation will actually get better. Gas prices are beginning to decline, the pull of superstores has an added value in times of inflation, and even inventory issues could be a short-term blessing as the push to keep prices low for those products aligns well with trading-down behavior. In addition, the YoY comparison in the coming months will be easier as August and September saw the impact of the Delta variant in 2021.

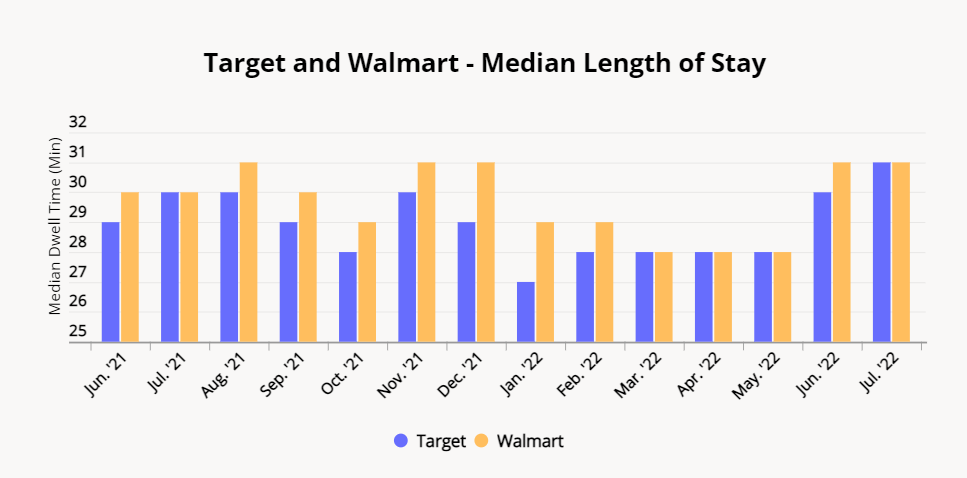

There is still a question of whether basket sizes increase even as visits decline – and indications from visit duration do suggest that consumers had more in-store time to fill their carts in recent months, with visit duration up in June and July. This indicates that some form of mission-driven shopping has returned as a response to the cost of gas leading to the potential for larger basket sizes. Essentially, consumers are looking to avoid the impact of gas prices by preferring visits to stores that have more products under one roof and then spending more time at those locations. If this does align with increased summer basket size, the impact could be very significant.

So where are Target and Walmart heading?

The likeliest conclusion is that the wider economic headwinds will impact profitability and even limit the overall success that the brands could have otherwise had. However, equally likely is continued growth and major relative success when compared to the wider retail environment.

And even the negatives need to be seen in context. While profits might be pinched in the shorter term, that is a direct result of a decision to keep costs lower for customers – something that should only contribute to the incredible customer loyalty both chains already benefit from. In addition, though visits are down, there are very strong signs that mission-driven shopping has returned, adding more weight to each visit. This is critical because it shows the unique power of these brands to turn even difficult circumstances into drivers for longer-term growth.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.