About the Office Building Indexes: These indexes analyze foot traffic data from nearly 350 office buildings (53 in San Francisco, 72 in Manhattan, 50 in Boston, 48 in Los Angeles, 50 in Atlanta, and 70 in Chicago). They only include commercial office buildings and commercial office buildings on the first floor (like an office building that might include a national coffee chain on the ground floor). They do NOT include mixed-use buildings that are both residential and commercial.

Two years after the first lockdowns, the return to office question still lingers. Cities and companies are anxious for office occupancy to return to pre-pandemic levels. The majority of workers, however, still prefer to work from home, whether fully remote or hybrid.

As we enter the second half of the year, and as the shock of economic shifts brought on by inflation and gas prices levels out, we took a look at recent foot traffic data to offices to see how the sector is performing.

Uneven Regional Office Recovery Rate

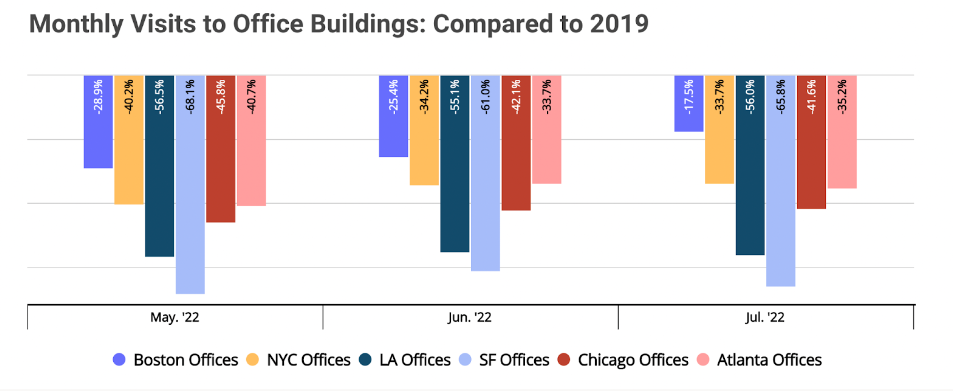

Year-over-three-year (Yo3Y) foot traffic data reveals that the office recovery is unevenly distributed. San Francisco, with its large tech sector, has consistently trailed behind other cities, seeing 61.0% and 65.8% fewer visits to offices in June and July 2022, respectively when compared to 2019. Boston is seeing the quickest recovery of the five cities analyzed, with 25.4% and 17.5% fewer visits in June and July. Meanwhile, office foot traffic in New York City, Los Angeles, Chicago, and Atlanta remained on the middle of the recovery spectrum, with visits in July 2022 down 33.7%, 56.0%, 41.6%, and 35.2% relative to July 2019.

Still, all cities analyzed saw significant year-over-three-year (Yo3Y) foot traffic gaps in July similar to the visit gaps seen in May and June 2022 – which may indicate that many of the workers who will be returning to the office have done so already, and that the office recovery is reaching a plateau.

Year-Over-Year Visits Remain Strong

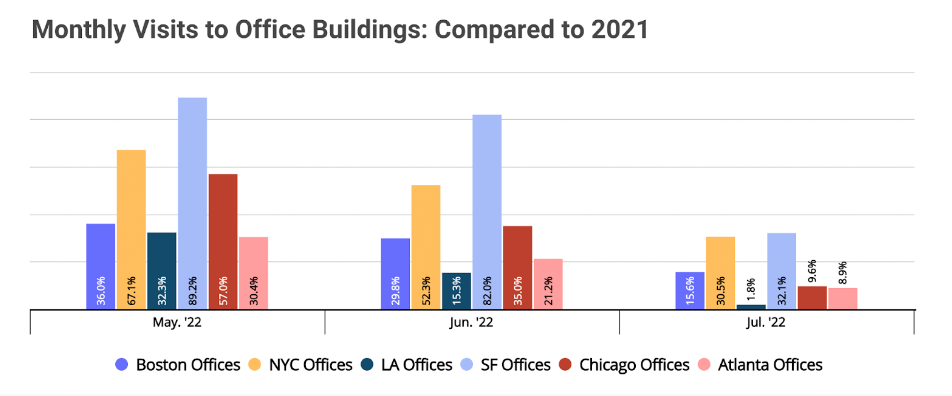

Year-over-year (YoY) visits seem to confirm that the office recovery is entering into a new, more stable phase. YoY visits have been consistently elevated for over a year – but they too have started to stabilize. July 2022 saw the smallest YoY increase since the beginning of the year, reinforcing the idea that many of those workers who plan on returning to the office in some capacity have already done so.

As a significant portion of office workers across the country prefer, and actively seek out, remote or hybrid work opportunities, it may be that foot traffic numbers will show only slight growth for coming months and even years.

Month over Month Visit Growth Softens

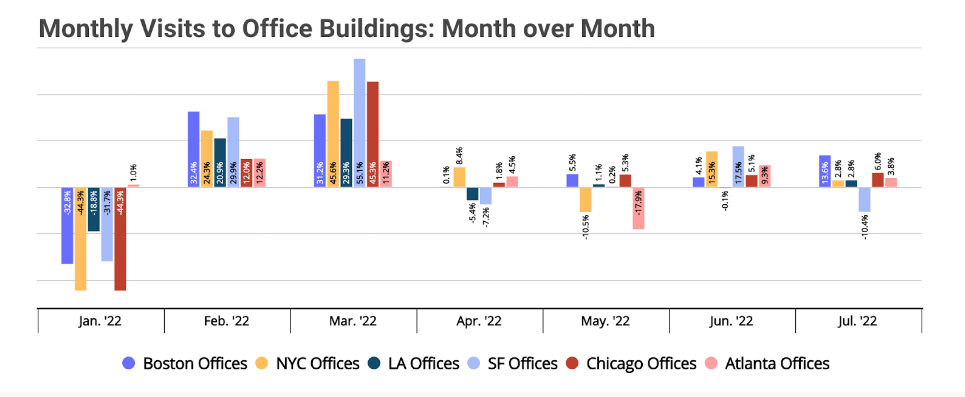

Month-over-month (MoM) visit data seems to confirm that the office recovery is leveling out. The beginning of the year saw fairly dramatic fluctuations in office visits as the Omicron wave kept people at home in January 2022, which explains the massive MoM jumps in February and March 2022. But since April 2022, the MoM change in office foot traffic remained relatively muted, though most cities did see MoM increases (albeit minor ones) in June and July 2022.

The exception is San Francisco, which saw a 10.4% decrease in office occupancy in July 2022 compared to the previous month. San Francisco has the highest percentage of workers who are unwilling to work from the office, and has consistently lagged behind the other cities in Yo3Y office visits. Considering the cancellation of planned tech expansions in the city as well as recent layoffs in the tech sector, the July drop in MoM office visits may indicate that the city will need more time to recover.

Meanwhile, Chicago and Boston saw office visits continually increasing MoM, with July MoM visits up 6.0% and 13.6% for Chicago and Boston, respectively. Both New York and Atlanta saw MoM dips in May 2022, but returned to sustained growth again the following months with July MoM visits up 2.8% and 3.8% for New York City and Atlanta, respectively.

Work from home and hybrid work are still the preferred option for nearly all office workers. And despite many high-profile return-to-office announcements over the past few months, it seems like management is responding in kind. Meta and Amazon, who both announced office expansion plans in New York, have since pulled back on those plans. Whether this becomes the new normal or if the return to office push will win out remains to be seen.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.