In last week’s earnings report, DIN reported rising sales at Applebee’s and IHOP among High Income shoppers making over $75,000 per year. They hypothesized that this was the result of those shoppers trading down from more expensive dining destinations as year-over-year inflation pressures continue. In today’s Insight Flash, we take advantage of our demographic data to see how high-income individuals have altered their spending in recent months. We look at overall spending by income group, deep dive into the restaurant sector, and examine changes in average ticket across subindustries for high income shoppers.

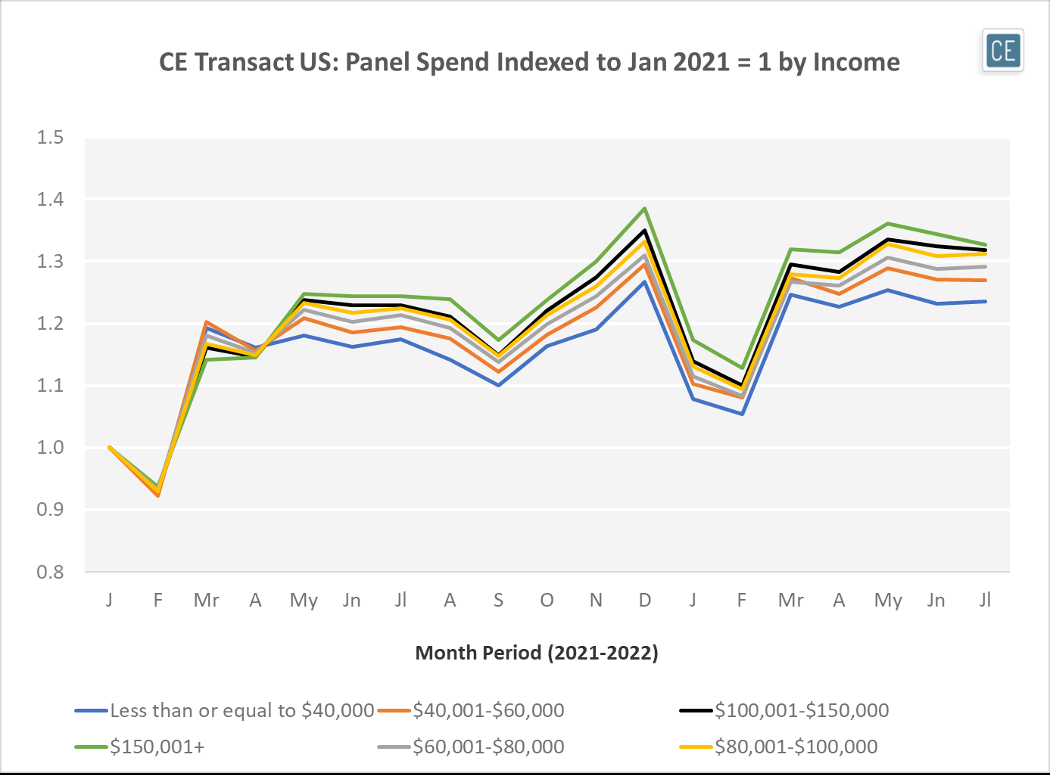

Since January 2021, the highest income groups have increased overall spend at a faster rate than other cohorts. Tracked income cohorts making above $80,000 per year in our data have increased spend more than 30% from that point, while the lowest income group has only seen a 24% spend increase. Interestingly, however, the highest income group making over $150,000 per year has seen spend decelerate almost twice as quickly as any other income group over the last two months. As inflation stabilizes, it will be interesting to see if this deceleration continues into the fall and the holiday shopping season.

Spend Growth

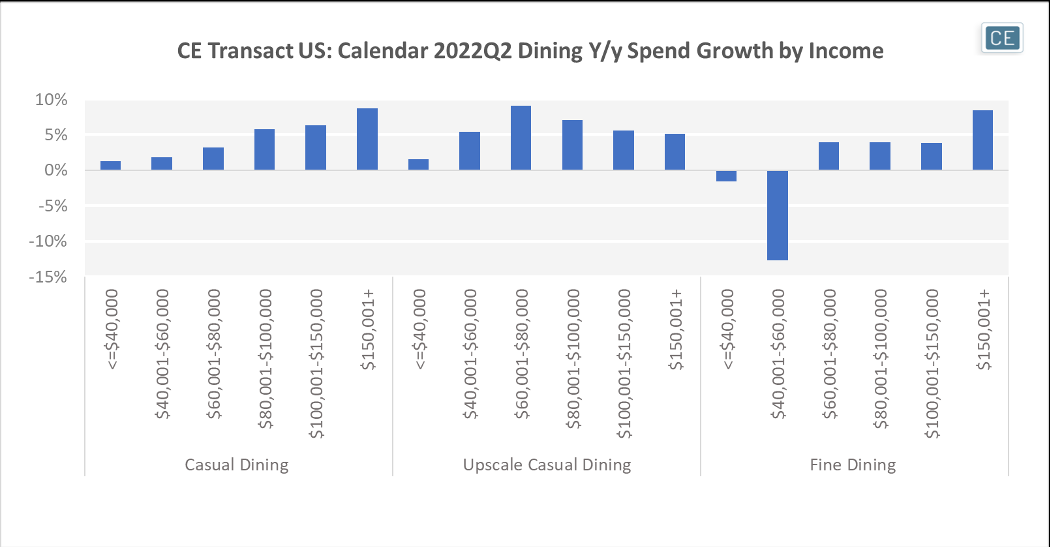

As the DIN call made clear, shifts in spending in the restaurant sector have stood out, especially with food and fuel two of the major inflationary categories. The lowest income groups have cut back on Fine Dining spend y/y, even in a Q2 that is lapping 2021 vaccine rollouts. Those making $40,000-$60,000 per year reduced fine dining spend by -13%. Even increases in Casual Dining spend at restaurants like Applebee’s and IHOP have been less than 2% for those making less than $60,000 per year. Meanwhile, the highest income group making over $150,000 per year has increased spend at Casual Dining restaurants 9%, larger than that group’s increase in Fine Dining spend.

Restaurant Subindustries

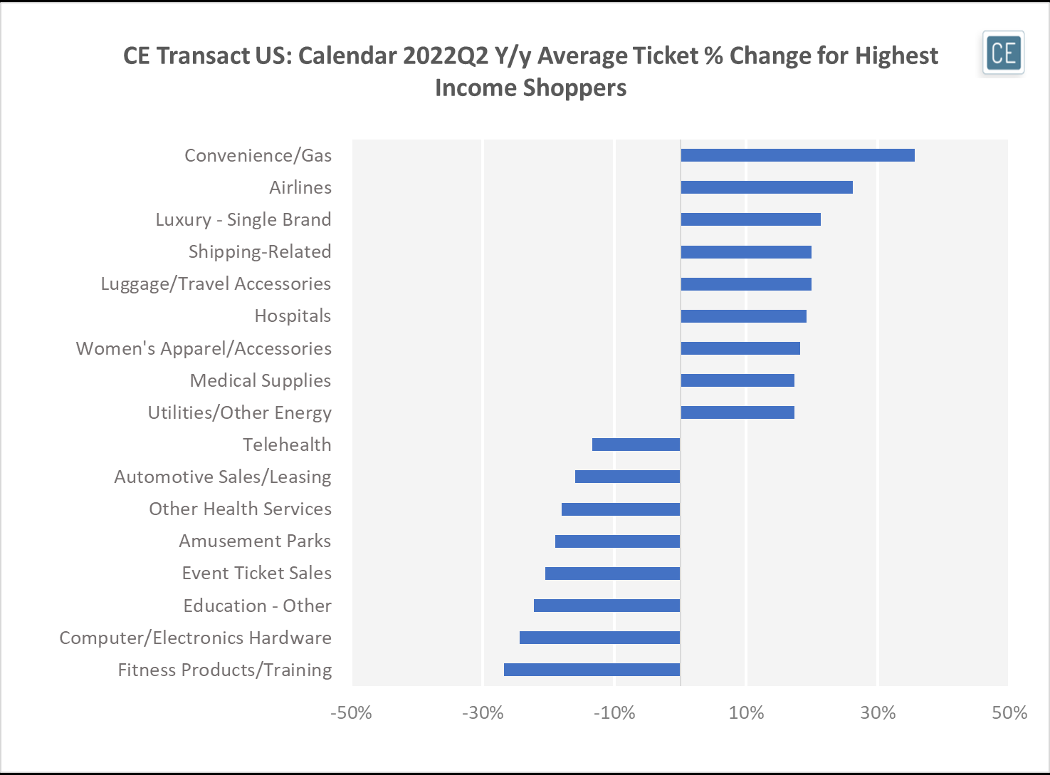

Outside of restaurants, changes in average ticket for the highest income shoppers making over $150,000 per year provide a telling look into how inflation is changing wallet allocation. Average ticket may be more relevant for this group than others as they are less likely to need to split items like a gas tank refill or restock grocery shop into smaller trips. Indeed, the average gas purchase has increased 36% y/y for these shoppers. They are also spending more per purchase on Airline tickets. On the flip side, rising prices in some categories may be putting pressure on this group and leading to the lower spend per transaction seen for Fitness Products, Electronics, and Education.

Average Ticket

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.