This Placer Bytes dives into recent foot traffic trends for Best Buy and GameStop to understand how inflation and rightsizing efforts are impacting visits to these two electronics retail leaders.

Best Buy’s Visit Gap Shrinks in July

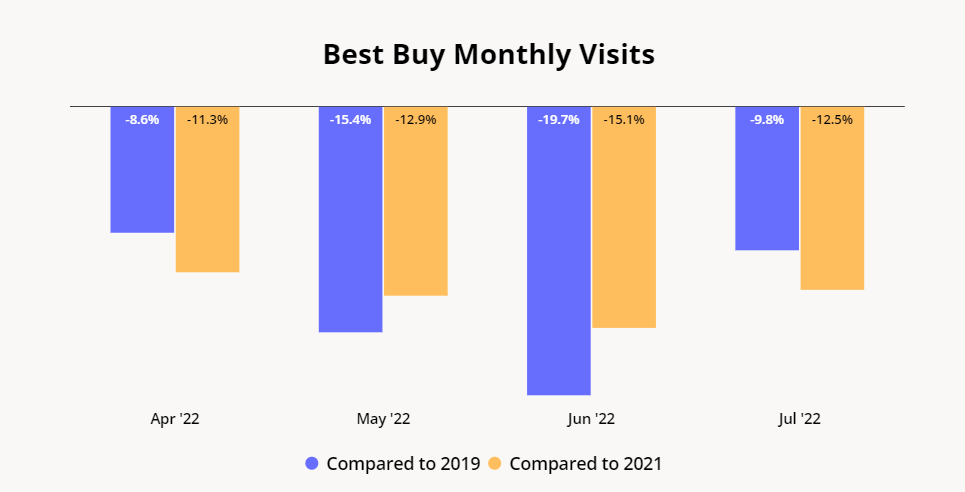

Best Buy’s brick and mortar visits were relatively unaffected by the pandemic, with the brand showing a particularly strong Black Friday performance in 2021. But in recent months, as inflation drove consumers to hold off on larger purchases, including electronics, Best Buy visits have taken a hit. And between April and June 2022, the year-over-year (YoY) and year-over-three-years (Yo3Y) visit gaps increased steadily.

But recent foot traffic data is providing some reasons for optimism, as falling gas prices appear to have freed up some budget for big ticket items. The YoY visit gap narrowed significantly to 12.5% in July 2022, while the Yo3Y visit gap stood at just 9.8% – around half of the previous month’s 19.7% Yo3Y visit gap.

Anniversary Sale Boosts Best Buy Foot Traffic

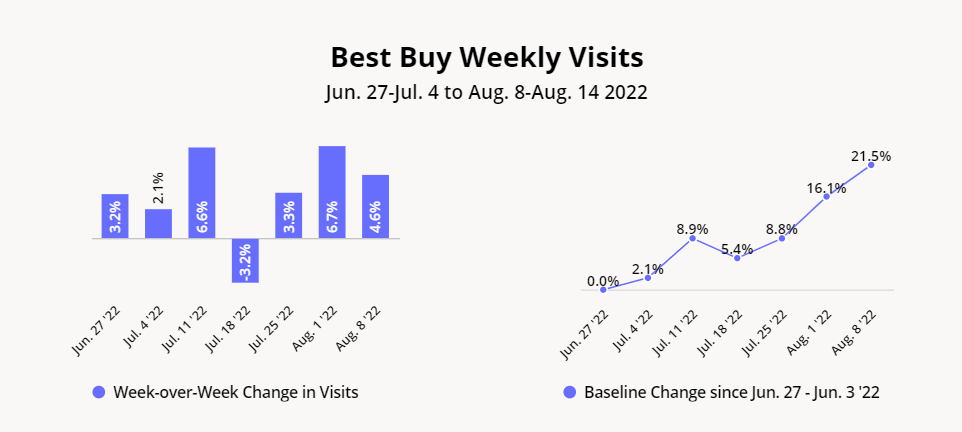

Zooming in on the latest weekly data confirms the upward trend. Since the week of June 27th 2022, week-over-week (WoW) visits to nationwide Best Buy stores have increased almost every week, with foot traffic the week of August 8-14 up 21.5% relative to the week of June 27-July 3 – likely boosted by Best Buy’s anniversary sale. And with the back-to-school shopping season in full swing, the brand is well positioned to end August on a high note.

The company has also been experimenting with ways to optimize its store fleet. After closing select stores in 2020 and 2021, the retailer announced plans to double its outlet store count and add new product categories, including health, outdoor living, and transportation to some of its existing stores. And in late July, Best Buy piloted a new, first of its kind small-format store.

The 5,000 sq. ft. Best Buy store in Monroe, NC is significantly smaller than the brand’s typical 35,000 and 40,000 sq. ft. store, and displays a curated section of “best-in-category” devices and smaller appliances, along with a Geek Squad and consultation services area. Consumers can also purchase any devices from Best Buy’s e-commerce channels and pick up their products in-store for the full omnichannel experience. The new store format will allow Best Buy to continue serving customers in-person while reducing its overhead costs.

With the share of e-commerce sales as percentage of total US retail sales remaining relatively flat over the past year, the benefits of Best Buy’s brick-and-mortar presence should not be underestimated.

GameStop’s Rightsizing Leading to Visits per Venue Growth

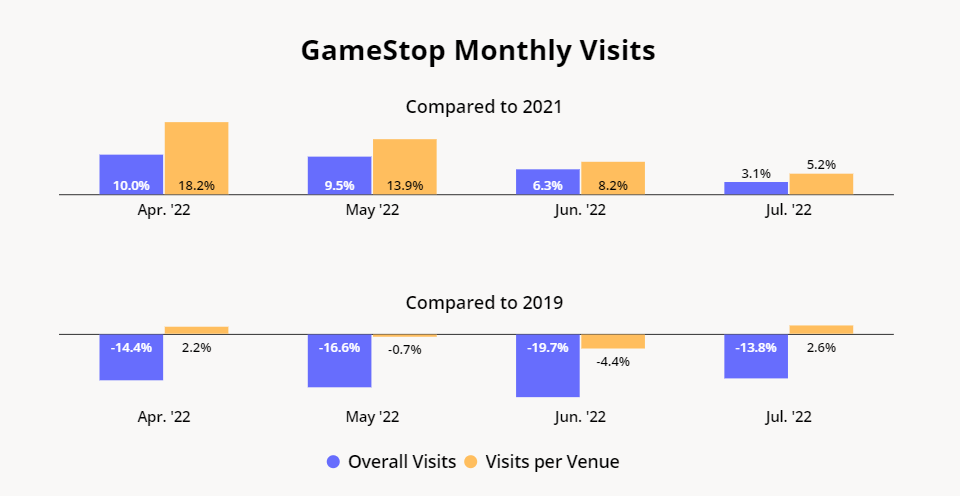

GameStop’s rightsizing efforts are continuing to bear fruit, with recent data indicating that the brand’s store closings are re-distributing visits more efficiently across GameStop’s remaining locations. The company closed over 1,000 stores between April 2019 and February 2021 and continued rightsizing in 2021 and 2022. As a result, overall visits to GameStop are down – but visits-per-venue are creeping up, with July 2022’s visits-per-venue up 5.2% YoY and 2.6%.

GameStop Recovery Gaining Steam

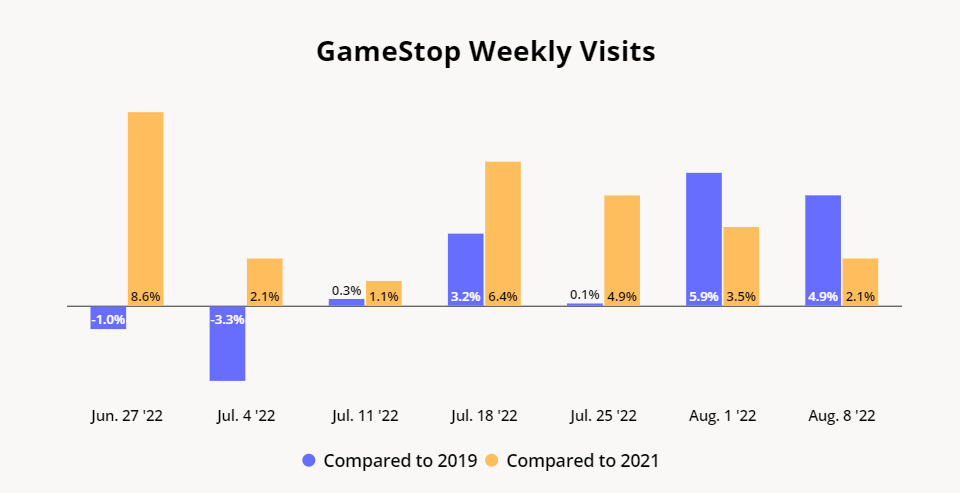

More recent weekly foot traffic data shows that GameStop’s visits-per-venue growth may even be accelerating. For the first two weeks of August, visits-per-venue were up 3.5% and 2.1%, respectively, on a Yo3Y basis, while YoY visits were up 5.9% and 4.9%, respectively, for the weeks of August 1st and August 8th. And the brand’s August 19th restock of the popular PS5 may drive late-August visits up even further for a strong finish to this already impressive month.

As the brand continues to build out its presence in the cryptocurrency and NFT marketplace, GameStop’s brick and mortar comeback indicates that the brand’s store fleet continues to draw consumers and remains a significant asset for the company.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.