With Back-to-School shopping in full swing, we dove into visits to Five Below to see how this fast-growing discount retailer is pulling ahead of the wider dollar & discount store category.

Five Below Still Outperforming Wider Dollar & Discount Store Category

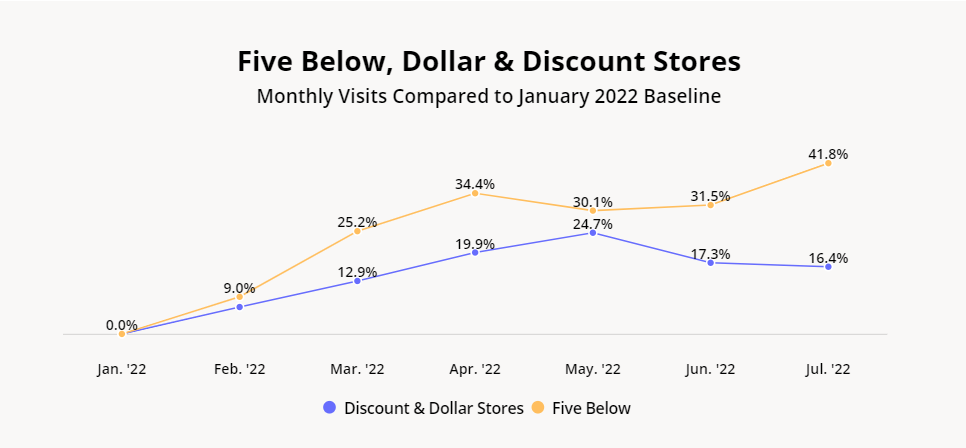

Inflation may be slowing down, but high prices are still impacting shopping habits, with consumers looking to stretch their budgets driving a 16.4% increase in foot traffic to the category relative to January 2022. But despite the strength of the wider category, Five Below continues to outperform the dollar and discount store average. July 2022 foot traffic to Five Below was up 41.8% relative to January 2022 – more than double the wider discount and dollar store increase.

Five Below’s success relative to the already strong discount and dollar store category shows that the company is not just riding the current wave of heightened demand for value-priced merchandise. Instead, Five Below has made some key strategic moves over the past two years that is setting the brand apart within the crowded discount superstore space.

Five Below’s Long-Term Visit Gains

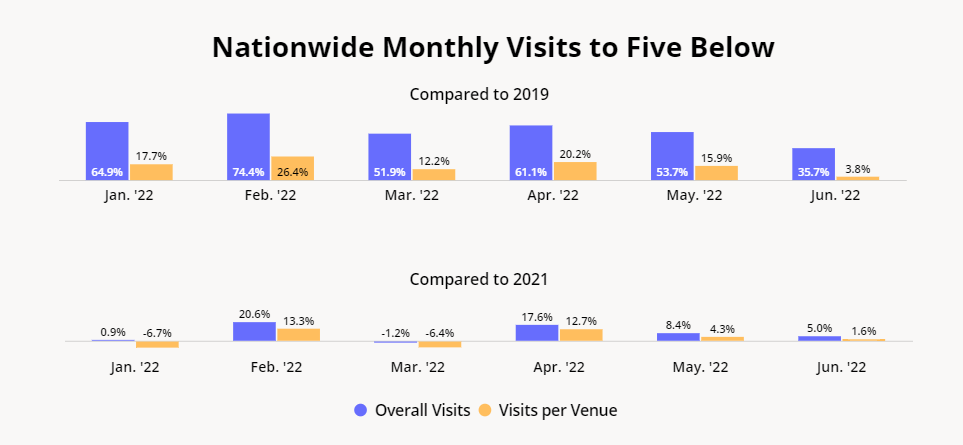

Following an exceptionally strong 2021, foot traffic to Five Below is no longer increasing at the rate it was last year – but visits are remaining above pre-pandemic levels while continuing to trend up. Between January and June (H1) 2022, foot traffic to the brand grew a whopping 55.2% on a year-over-three-year (Yo3Y) basis and increased an average of 8.0% compared to the same period in 2021. And although Five Below is expanding rapidly, the growth is not just due to the company’s larger store fleet – visits per venue in the first half of 2022 were up 15.3% Yo3Y and up 2.8% relative to H1 2021.

Five Below Foot Traffic Boosted by Back to School

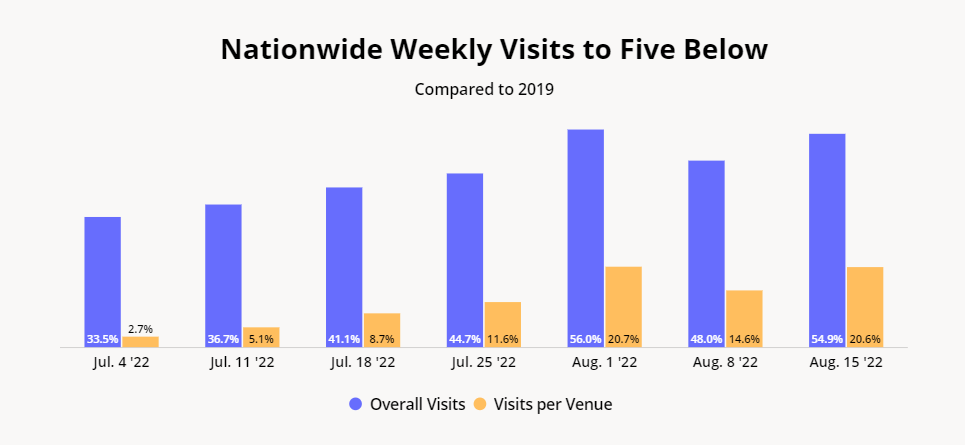

Five Below’s strength is continuing in the second half of 2022, with the weekly Yo3Y foot traffic increase growing progressively larger as the Back-to-School shopping season picks up steam. Overall Yo3Y weekly visits for the week of July 4th, 2022 were up 33.5%, but rose to 54.9% for the week of August 15th, 2022. And while the chainwide increase in foot traffic is impressive in its own right, the growth in visits-per-venue has been truly remarkable – from a 2.7% increase in Yo3Y visits-per-venue for the week of July 4th, 2022 to a 20.6% increase in visits per venue for the week of August 15th, 2022.

Five Below’s success in bringing more consumers to stores can be partially attributed to the brand’s remodeling efforts. The company has been refreshing and optimizing its store format since 2008, and introduced the latest iteration – the “Beyond prototype”, which includes a higher-priced “Five Beyond” section – in 2020. In June 2022, the retailer announced that all new Five Below stores would operate under the new store prototype, and that the company was on track to convert 200 existing Five Below locations to the “Beyond” format by the end of the year.

The “Five Beyond” concept allows the company to sell a wider range of products, especially in the home furnishings and tech categories – including coveted back-to-school items such as scientific calculators. With students and parents in the market for tech gadgets and dorm furniture that won’t break the bank, the new store concept may explain why this year’s August foot traffic is substantially higher than it was in August 2019, before the launch of ”Beyond Five.”

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.