With 79% of Americans reporting that their lives are somewhat or completely back to normal following the COVID disruptions, we dove into the data to understand where in-person business events stand as we move deeper into the second half of 2022.

The Return of In-Person Events

With the widespread and enduring increase in remote and hybrid work, the pandemic drove some major shifts in workplace behavior. But COVID didn’t just prevent employees from coming to the office – the pandemic also ruled out business travel and put a halt to almost every form of in-person work event.

And although the shift to hybrid work appears to have been largely successful, online events have garnered a more mixed reception, as even those who favor the accessibility of digital conferences regretted the lack of face-to-face networking opportunities. And despite the proliferation of technological platforms to facilitate remote networking, the vast majority of people still believe that in-person connections are key for successful long-term business relationships.

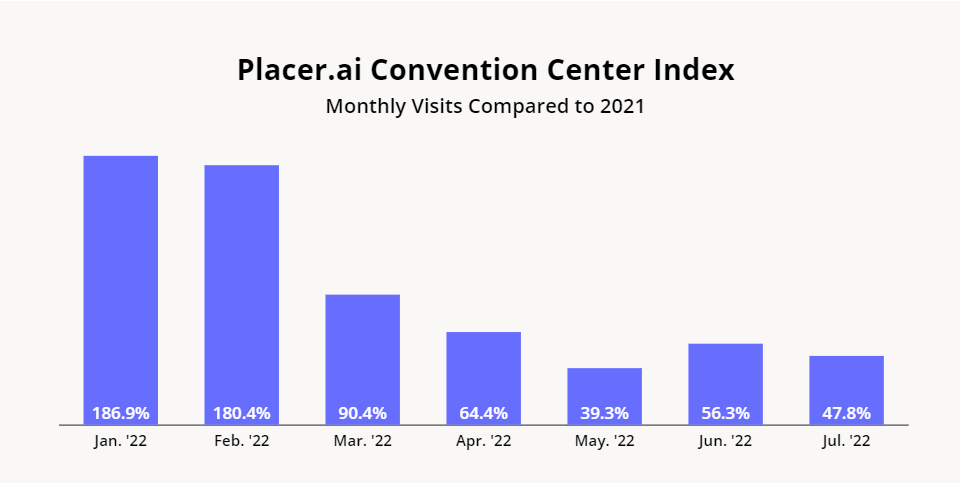

It’s no surprise, then, that in-person events are coming back. Visits to convention centers in January and February 2022 were up 186.9% and 180.4%, respectively, compared to the lows of January and February 2021. And the recovery continued throughout the first seven months of 2021, with year-over-year (YoY) visits in July 2022 up 47.8%.

Convention Center Visits Still Lag Behind Pre-Pandemic Levels

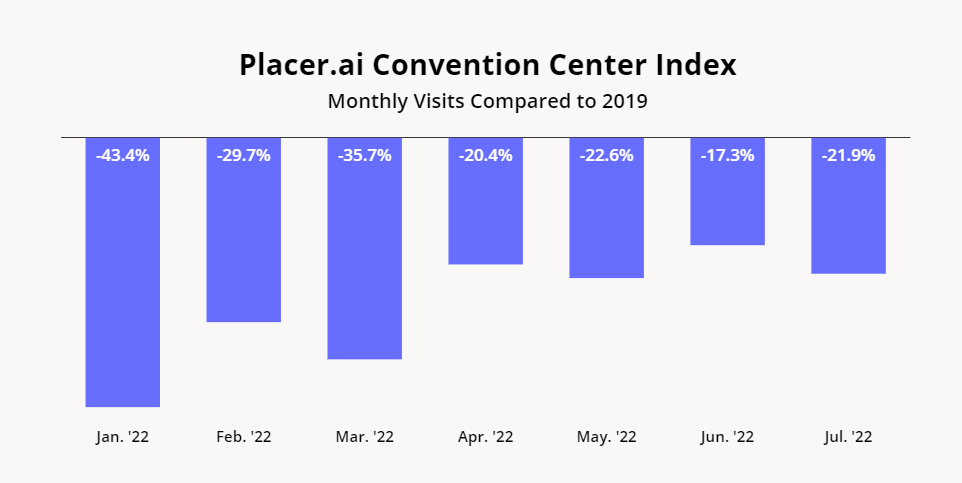

While foot traffic is up relative to 2021, visits to convention centers have not yet reached pre-pandemic levels. Despite the marked improvement since January 2022, the year-over-three-year (Yo3Y) visit gap to convention centers is still hovering at around 20%, with Yo3Y visits down by 17.3% and 21.9% in June and July 2022, respectively.

Much of the lag in visits is likely due to the pandemic aftermath. But some of the decline can also be attributed to companies looking to cut travel expenses in the current economic environment – which means that the recovery may well speed up once the market improves.

What’s Next for the Convention Center Recovery?

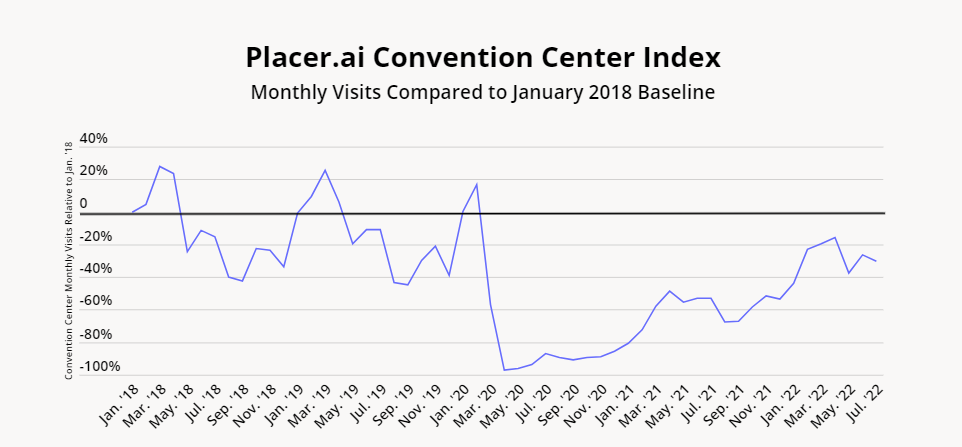

Zooming out and looking at the change in monthly convention centers visits since January 2018 reveals a seasonal pattern. Convention foot traffic seems to be highest during the three months between February and April, with a peak in March. Smaller spikes can be seen in June and July and in October and November. And convention attendance is particularly low in May, August, September, and December – even if some big events, such as ICSC’s RECon Convention in Las Vegas, are held annually in May and still succeed in drawing crowds.

The chart below shows that this seasonality partially returned last year. 2021 convention visits peaked in April – a little later than the usual March peak, as the third COVID wave likely drove many event organizers to schedule their in-person conferences for later in the year. As a result, convention visits stayed relatively steady between April and July before dropping again in August and September 2021, in line with normal seasonality – although the fourth “Delta” wave likely had a significant impact on convention attendance during those months as well.

But even though seasonality began returning last year, this year’s regular seasonal patterns are much more pronounced – another positive indicator for the in-person convention industry. So far, 2022 convention center foot traffic was strongest in February through April, with the peak once again pushed off to April rather than March – likely due to the uncertainty caused by the Omicron wave of December 2021 to January 2022. And visits fell in May, but picked up again in June and July, as had happened in 2018 and 2019.

The return of normal convention center seasonality means that in-person conventions are indeed resuming their regular routine – but it also means that we might need to wait until spring 2023 to experience the full impact of the continuing convention center recovery.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.