Back to School 2022 brought significant pressure to retail.

There was a real impression that the post-pandemic environment’s first true retail season could provide a needed boost for chains across the sector. Yet, the onslaught of economic headwinds presented a uniquely difficult scenario that proved to be a formidable challenge for brick-and-mortar retail visits.

But the season was not all struggles and, in fact, presented hope that the coming months could already be providing a needed shift.

Back to School 2022

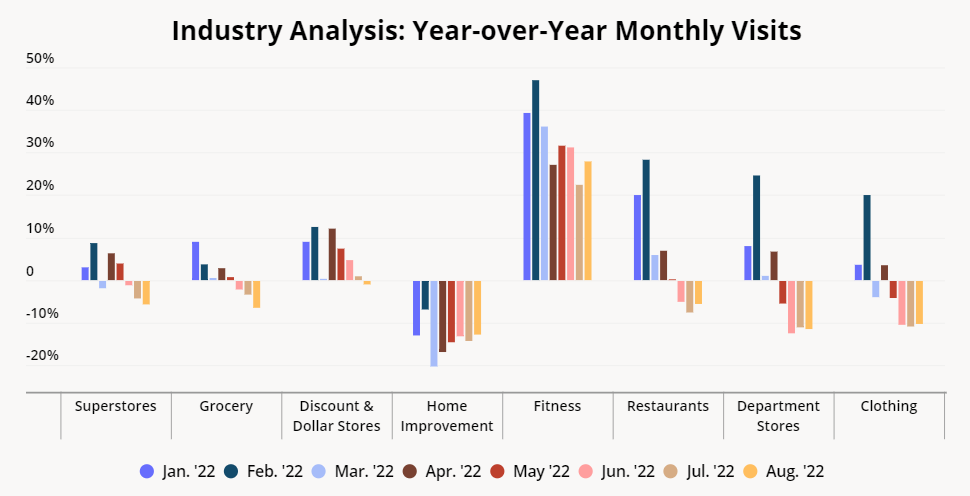

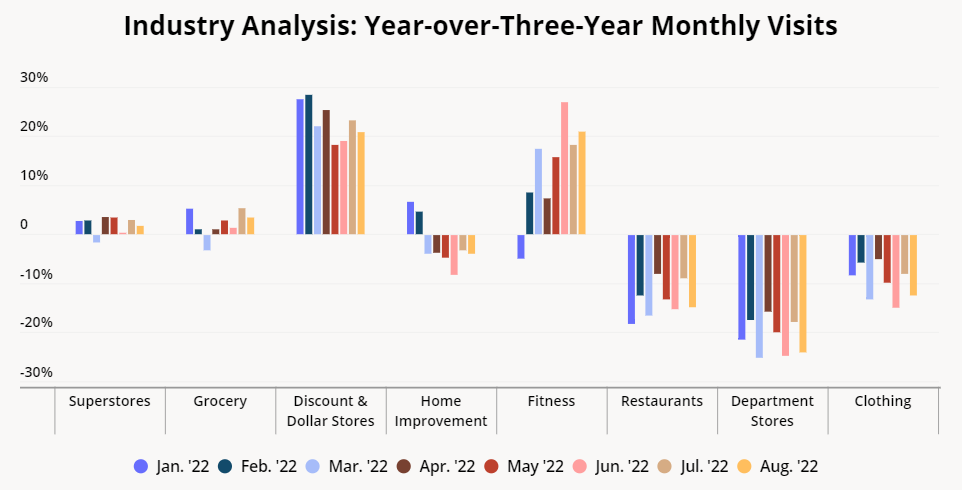

Superstores, grocery, and discount chains were among the strongest performers throughout the pandemic with monthly visits in 2022 regularly higher than both 2021 and a pre-pandemic 2019. However, the unique impact of continued inflation, high gas prices, and a comparison to an especially strong Back-to-School season in 2021 proved to be challenging. Visits for all categories were down year-over-year (YoY) in August with the discount & dollar segment seeing its first such decline in 2022.

Yet, August also showed indications that a turnaround could be en route. While fitness visits continued to outperform, the home improvement, full-service restaurant, and apparel categories all saw important steps forward. The three segments saw their (YoY) visit gaps decline by 1.5%, 2.0%, and 1.7% respectively. Critically, this could be the first sign that discretionary spending – one of the elements of retail most heavily impacted by inflation – could be on the road to recovery.

And even for those segments that were hit hard in August, context is critical. While superstores, grocery, and discount & dollar all saw YoY visit declines, the three categories also saw increases when compared to the same month in 2019. This shows that while economic headwinds limited the ability to match the high standards of the 2021 Back-to-School season, these segments are still benefiting from the pandemic boosts they received. It’s also important to remember that consumer behavior has already shown the ability to adapt to these changing circumstances. As an example, while visit numbers may decline because of the cost of travel increases, the basket size may increase – a return of the mission-driven shopping trend already experienced by Target and Walmart this summer.

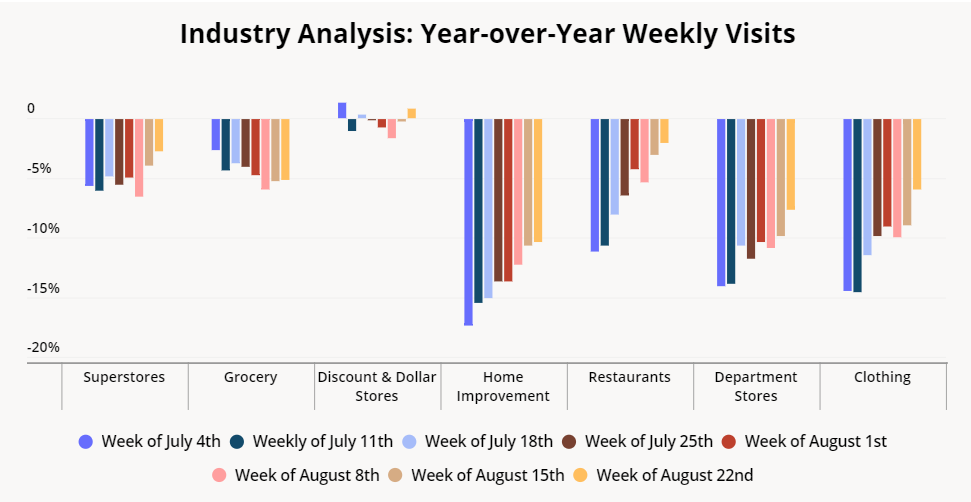

Even more, in many of these cases, analyzing weekly visits shows that the YoY visit gaps already began shrinking towards the end of August. Part of this is attributable to the comparison to the onset of the Delta variant in 2021, but the timing and consistency show that the recovery runs far deeper. The shrinking YoY visit gaps indicate that the lingering impacts of inflation and high gas prices appear to be tailing off.

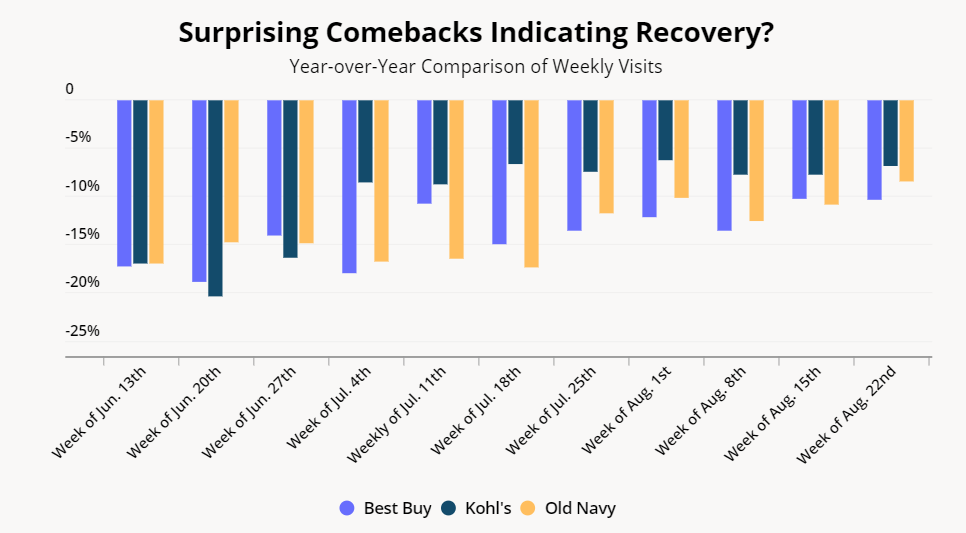

This comes into even greater view when looking at specific retail chains that were heavily impacted by this unique economic environment. Best Buy, Kohl’s and Old Navy were all especially hard hit by the aforementioned economic headwinds, yet all three are seeing a significant recovery. YoY visit gaps shrunk consistently for all three brands, enabling them to end the summer in a far stronger position than they began it.

Should this trend continue, it could time out to provide the wider brick-and-mortar retail landscape, and non-essential retail spending in particular, a needed jolt heading into the holiday season.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.