Although few consider the northeastern states a prime fast-food destination, foot traffic data reveals that QSR visits are skyrocketing in New England and New York, with regional growth significantly outpacing the nationwide average. While the data doesn’t fully capture deliveries, drive-thru visits, or online order pick-ups, the data can still provide a sense of the regional strength of the category.

Fast-Food Foot Traffic is Soaring in the Northeast

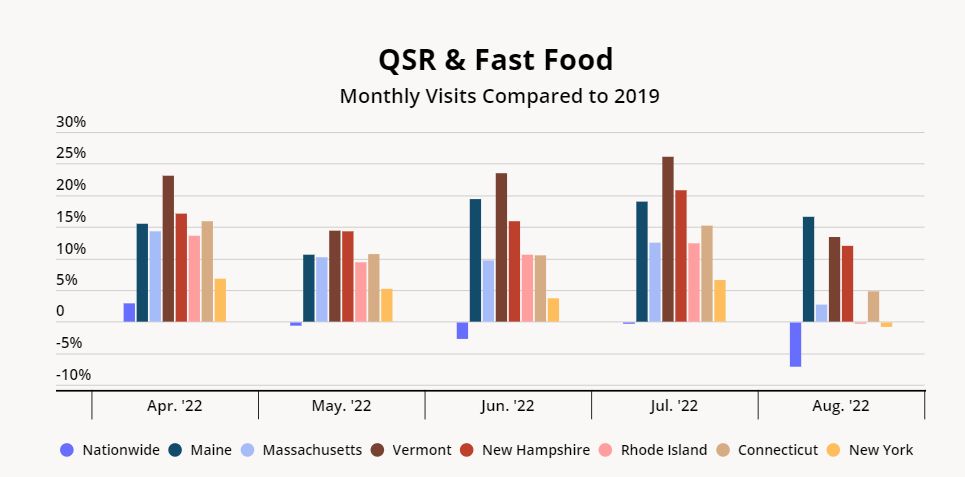

According to several analyses, the Northeast has one of the lowest fast-food restaurant per capita rates in the country. But the relatively low number of QSR franchises and owned locations in the region does not necessarily reflect a lack of local demand. In fact, foot traffic data indicates that visits to QSR and fast food chains in Maine, Massachusetts, Vermont, New Hampshire, Rhode Island, Connecticut, and New York are growing considerably faster than the nationwide average.

In August 2022, year-over-three-year (Yo3Y) visits in most northeastern states were up, while nationwide QSR visits were down by 7.0% relative to August 2019. And diving into the regional performance of leading fast food brands reveals the region’s fast-food strength even more clearly.

McDonald’s

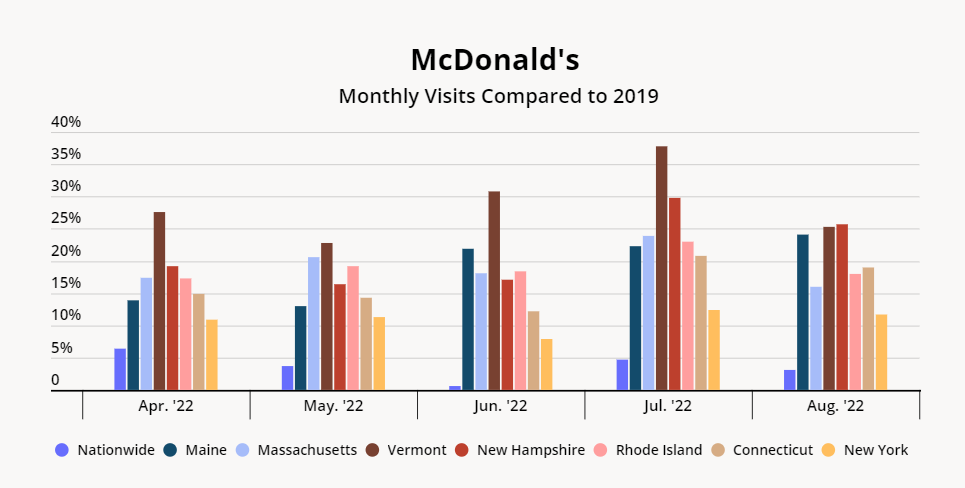

Even though McDonald’s recently closed hundreds of locations across the United States, the company is still the reigning QSR leader, with Yo3Y nationwide visits up every month since April 2022. But while McDonald’s nationwide Yo3Y growth is impressive in its own right, the increase in the brand’s northeast foot traffic is truly remarkable.

In August 2022, McDonald’s nationwide visits were up 3.1% Yo3Y, but grew between 11.7% and 19.0% in New York, Massachusetts, Rhode Island, and Connecticut, and increased between 24.1% and 25.7% in Maine, Vermont, and New Hampshire. As the company plans its first U.S. expansion in nearly a decade, McDonald’s may well consider enhancing its northeast presence to meet the rising demand in the region.

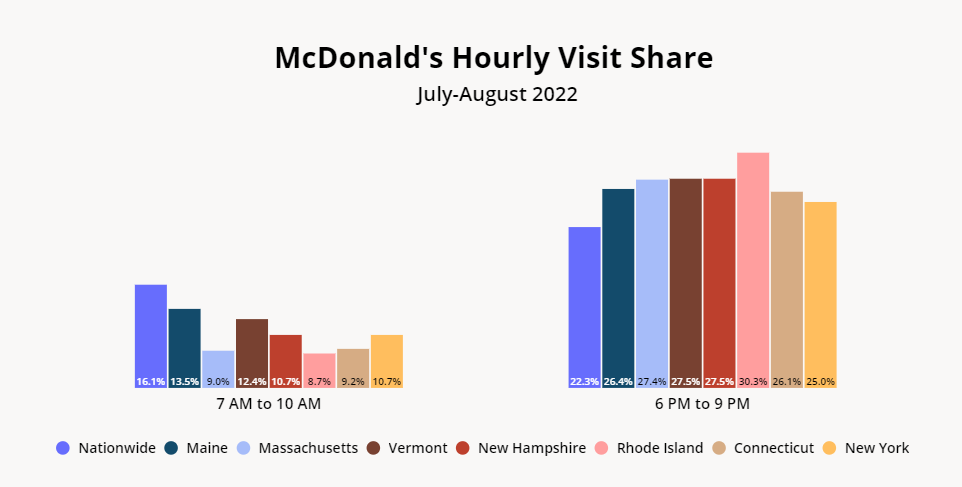

Looking at hourly visits to the brand confirms northeasterners’ appetite for this QSR classic. In all seven states analyzed, the daily share of breakfast visits (between the hours of 7 AM and 10 AM) was lower, and the proportion of dinner visits (between the hours of 6 PM and 9 PM) was higher, when compared to the hourly visit distribution for McDonald’s nationwide.

This means that McDonald’s customers in the northeast are not just visiting the chain to grab a quick breakfast on the go. Instead, many are stopping by the restaurant in the late afternoon and evening for dinner and so might be purchasing more substantial items, which could have a higher price point. This means that visits to McDonald’s in the northeast are not just higher in terms of quantity – many of the visitors may also be spending more at the counter. As the company plans its first U.S. expansion in nearly a decade, McDonald’s may well consider enhancing its northeast presence to meet the rising demand in the region.

Taco Bell

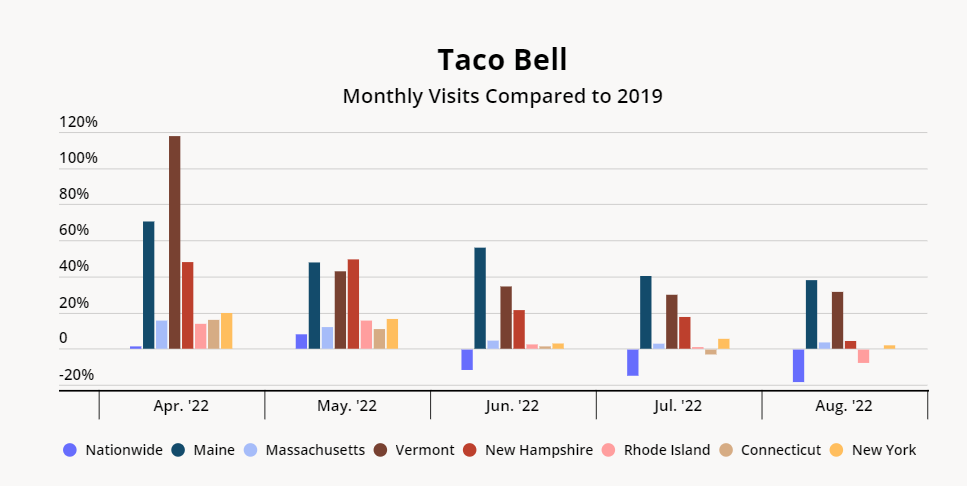

While Taco Bell focuses on international expansion, some of the brand’s domestic markets are undergoing significant organic growth. Like with McDonald’s, Yo3Y visits to Taco Bell in the seven northeastern states analyzed have consistently outpaced the brand’s nationwide average.

Maine – a state with just 20 Taco Bell locations – saw a massive 38.0% Yo3Y growth in August 2022 visits. Vermont and its five branded venues saw a 31.5% foot traffic increase in the same period. And Taco Bell’s success is not just in smaller states – New York has over 200 Taco Bell restaurants, and in August 2022 the state saw an increase of 1.9% in the chain’s venues relative to August 2019.

Small Markets Present Big Opportunities

While many larger companies choose to focus their expansion efforts on more populous cities and states, retailers and dining concepts that focus on small markets can benefit from an eager clientele and a less competitive landscape. The success of McDonald’s and Taco Bell in the northeast – and New England in particular – offers yet another example of small markets’ commercial potential.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.