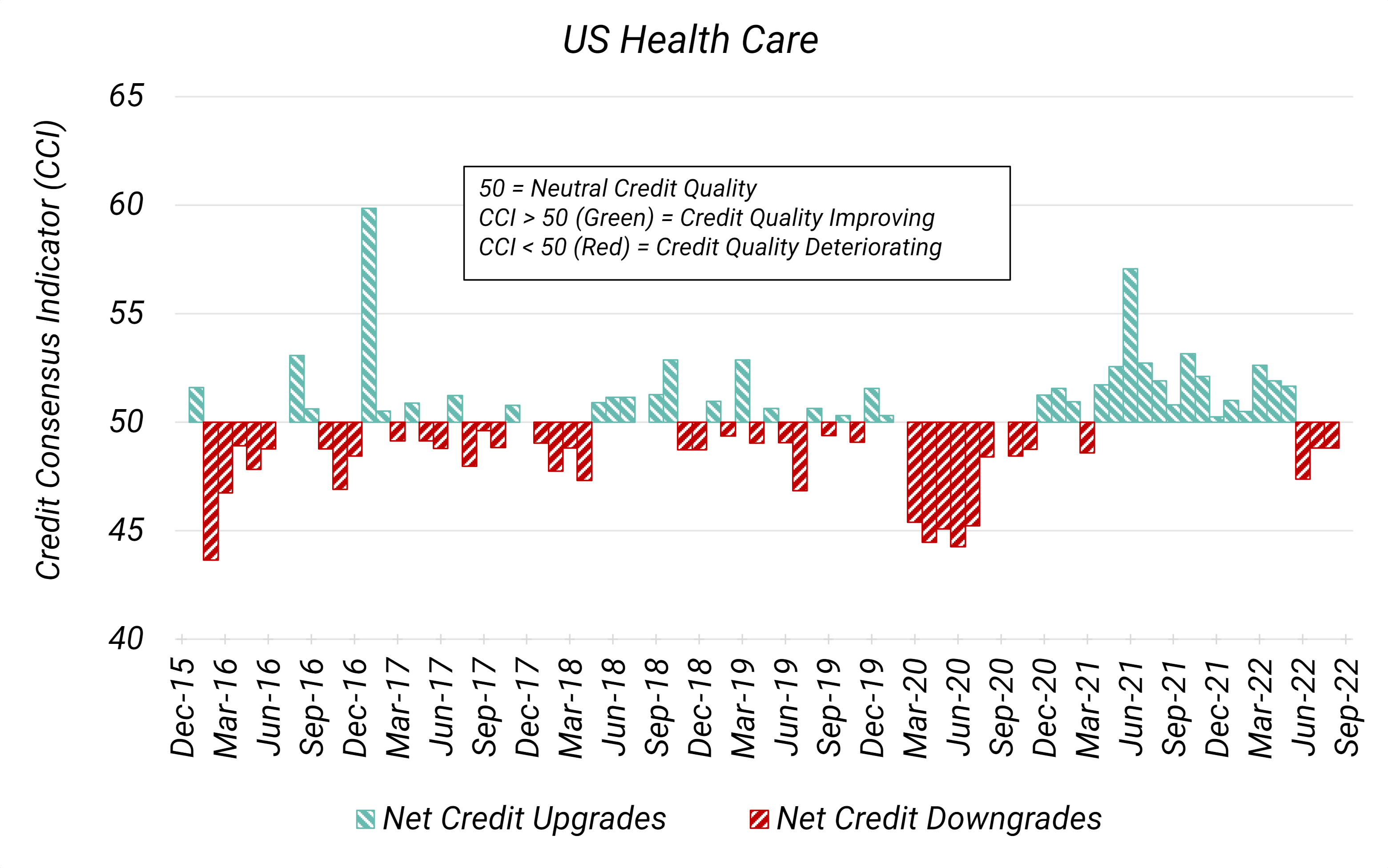

As pandemic-related spending continues to fall, the US Health Care sector is beginning to show credit deterioration. Figure 1 shows the Credit Consensus Indicators1 (CCIs) for US Health Care.

Figure 1: Credit Consensus Indicators (CCIs), US Health Care: Feb-16 to Aug-22

After a record run of 14 months of net improvements, this sample of more than 400 US Health Care companies has recorded three months with a CCI below 50, indicating that downgrades now outnumber upgrades.

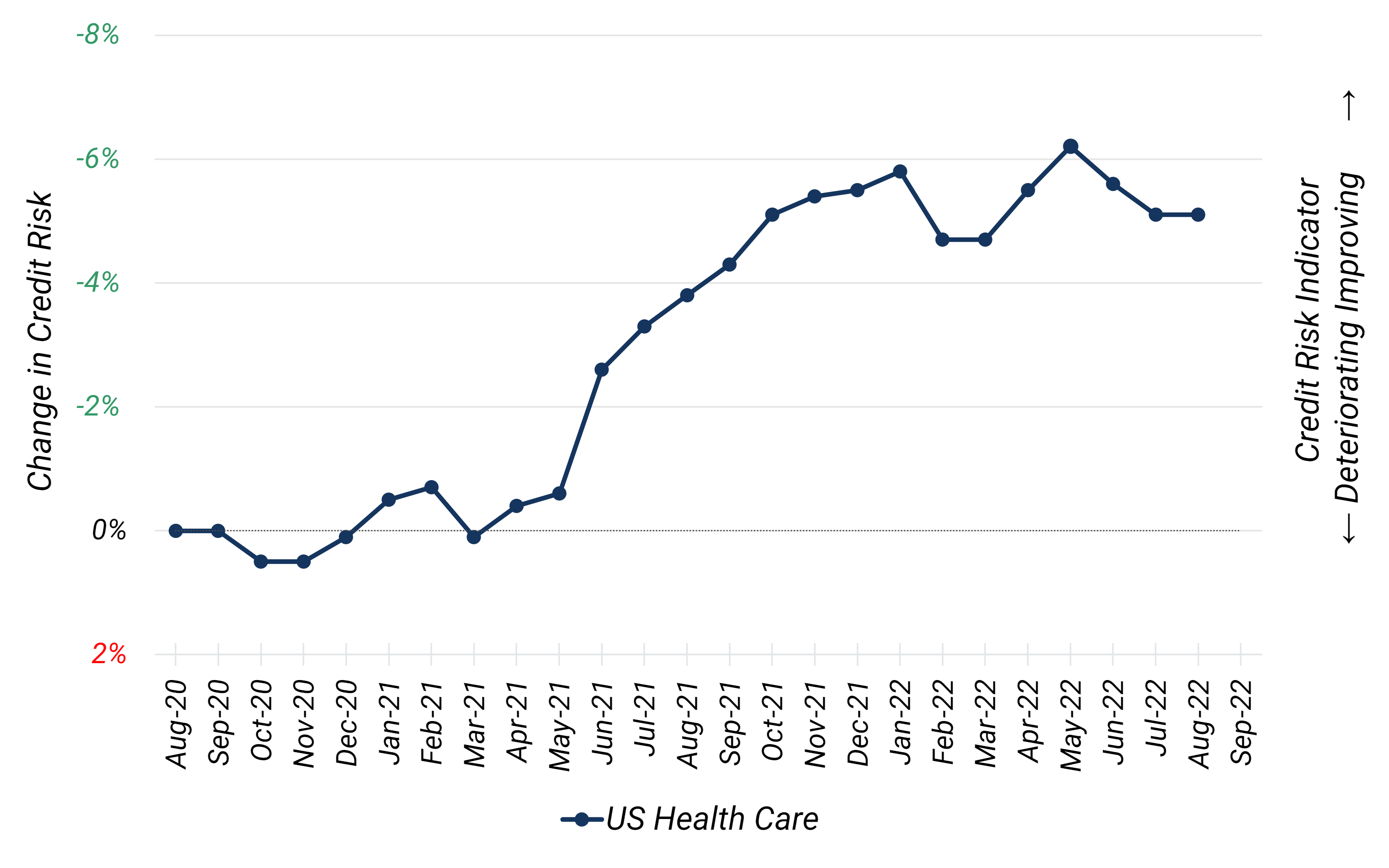

The changing balance between upgrades and downgrades in US Health Care is mirrored in Figure 2, showing that the long decline in average credit risk – measured by default probability (axis inverted) – has been faltering, with recent periods of credit deterioration.

Figure 2: Credit Trend, US Health Care; Aug-20 to Aug-22

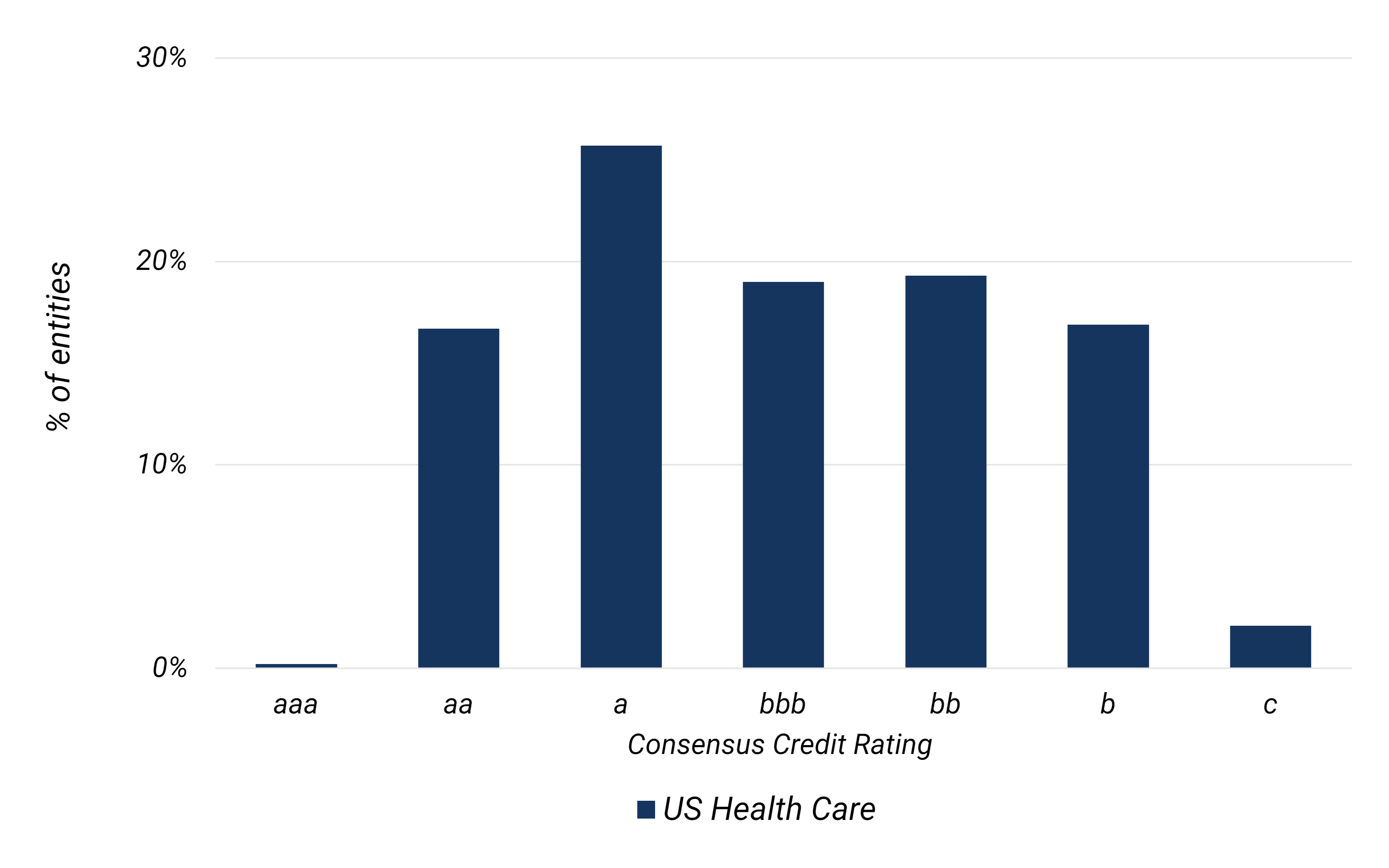

Figure 3 shows the current credit distribution for this sample – the good news is that over 60% are still rated investment grade.

Figure 3: Credit Distribution, US Health Care; Aug-22

While the Inflation Reduction Act (IRA) makes notable strides toward improving the affordability and accessibility of health care in the US, Fitch Ratings believes this act will pressure revenues and margins and have a negative effect on corporate credit, however, the future of US Health Care is still uncertain.

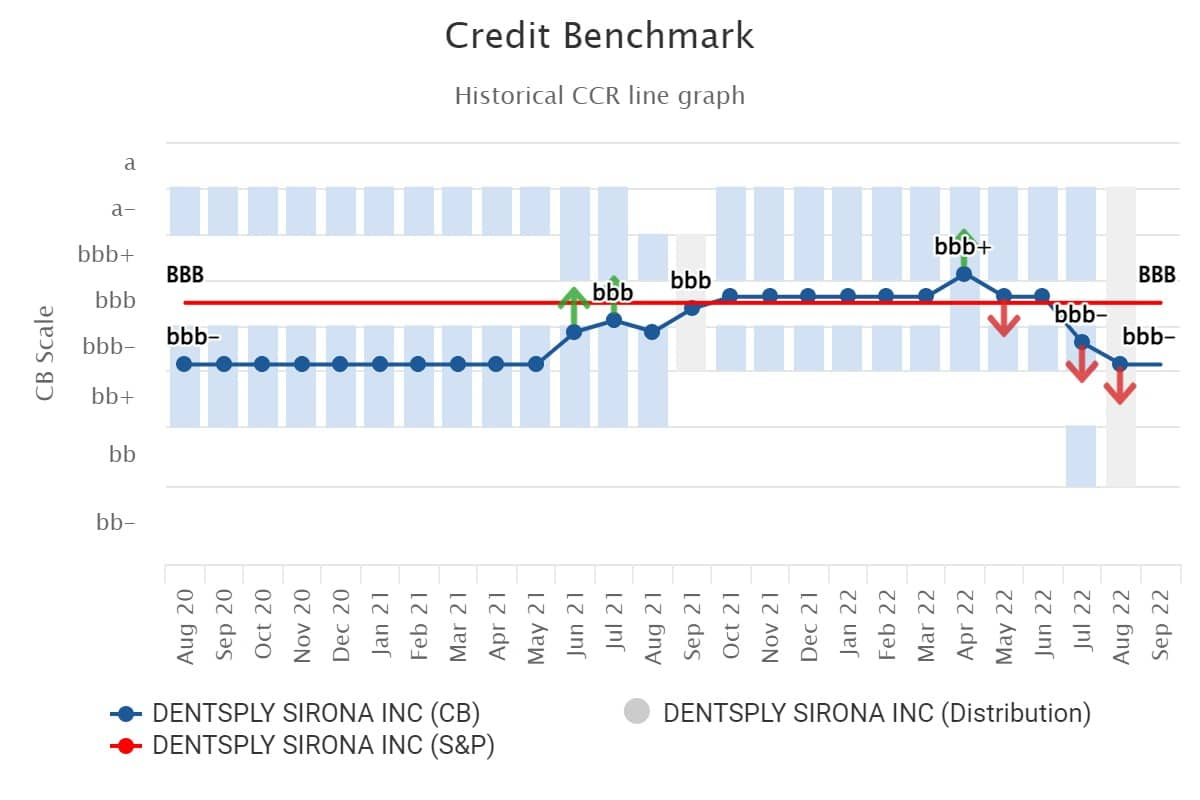

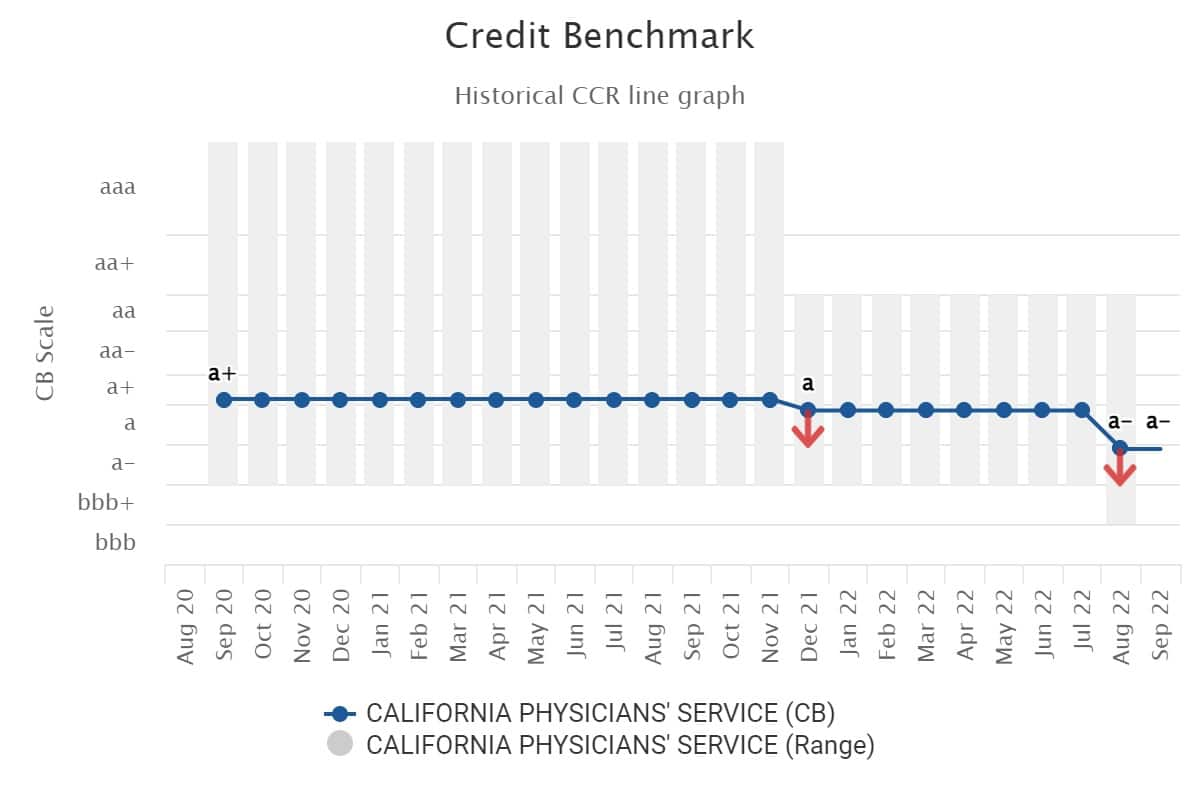

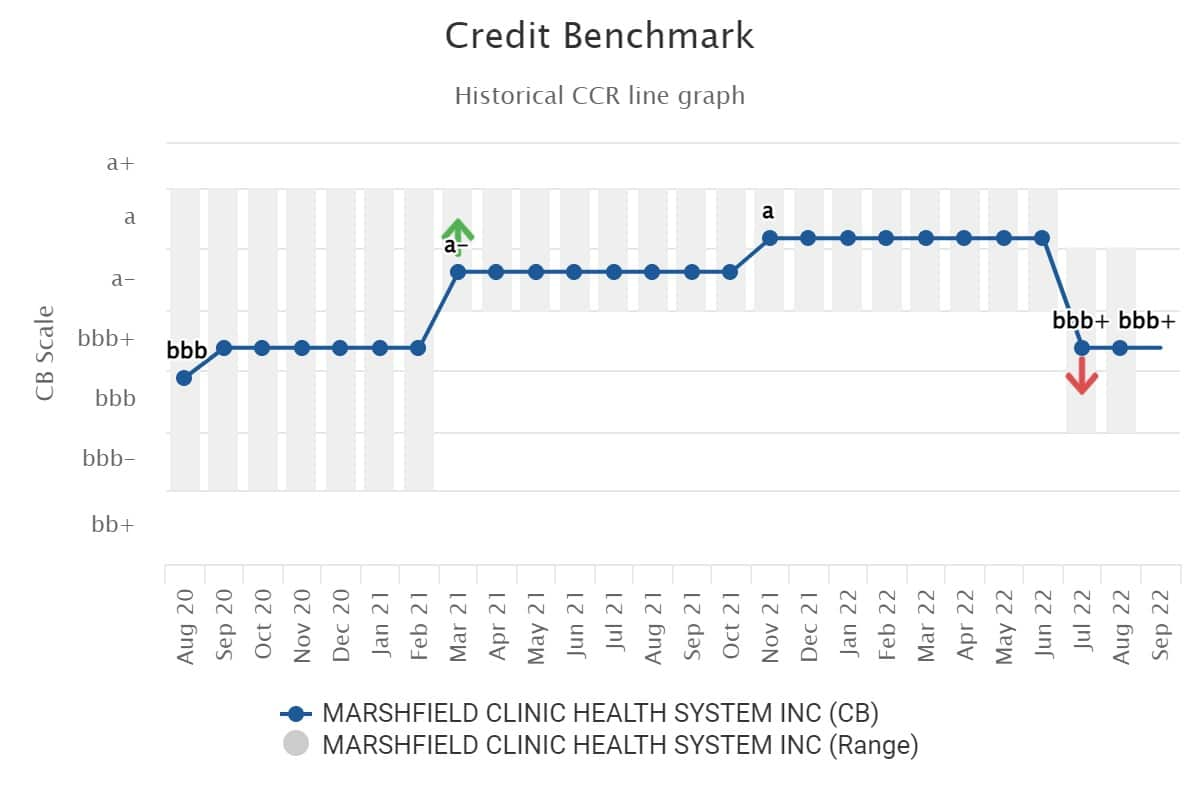

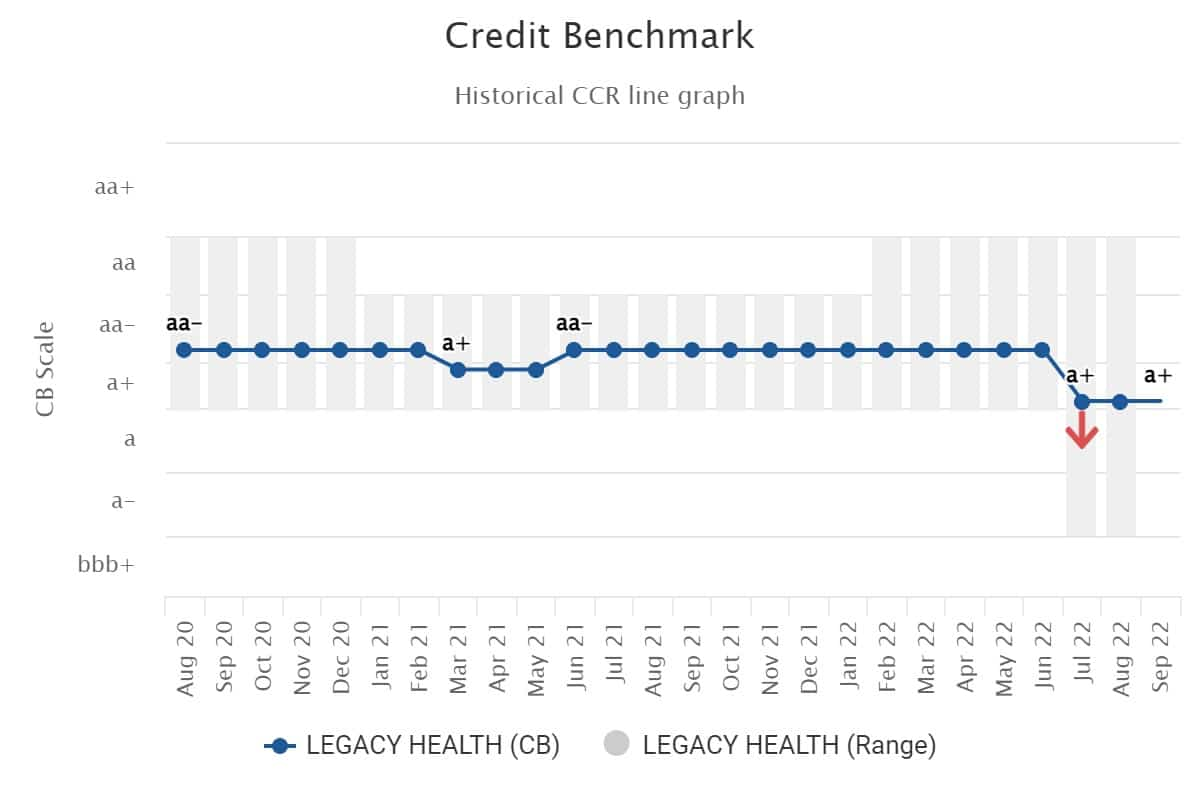

Figures 4-7 show detailed credit trends for some of the US Health Care companies which have experienced credit deterioration recently, majority of which have limited CRA coverage.

Figure 4: Dentsply Sirona Inc

Figure 5: California Physicians’ Service

Figure 6: Marshfield Clinic Health System Inc

Figure 7: Legacy Health

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.